Early Rate-Cut Priced-in? Which Asset is the best-performer?

In early Asian trading on Monday, gold surged by $70, breaking through $2100 and approaching $2150, reaching a new all-time high. The underlying logic behind this is that the Federal Reserve's interest rate hike cycle may have ended, and expectations of a rate cut continue to rise.

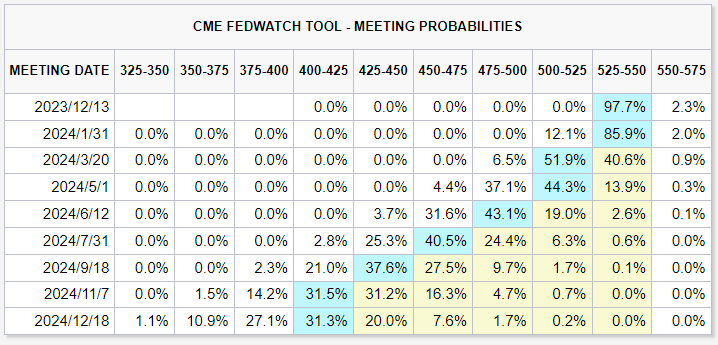

According to CME's Fed watch tools, the market shows that the probability of the end of the Fed's rate hike cycle is almost 100%. The probability of the first rate cut in March 2024 has risen to 52%, and the futures market expects a 125bp rate cut for the whole year of 2024.

Rate-Cut in Advance?

Bill Ackman, a prominent figure in the financial industry, believes that the Federal Reserve may begin cutting interest rates in Q1 due to a faster-than-expected decrease in inflation.

However, over the past two weeks, asset prices have risen significantly, with one important catalyst being Federal Reserve Board member Waller's first mention of interest rate cuts, which sparked market pricing for early cuts.

The slowdown in US inflation is primarily benefiting from supply-side improvements, such as repairs to supply chains, increased labor force participation, and falling energy prices. According to a study by the San Francisco Fed, overall PCE inflation in the US has fallen from 7% in June of last year to 3% in October of this year, a cumulative decline of 4 percentage points.

United States PCE Price Index Annual Change

Supply-side factors contributed 2.2 percentage points, while demand-side factors contributed 1.3 percentage points. From a demand perspective, the current economic situation is relatively good and resilient. The revised real GDP growth rate for Q3 after seasonal adjustment was 5.2%, up 0.3 percentage points from the initial estimate of 4.9%.

In November, risk assets performed strongly, with stocks, cryptocurrencies, gold, and house prices all showing strength, and the wealth effect is expected to support consumption, partially offsetting the suppressive effect of high interest rates on total demand.

United States GDP Growth Rate

How Bonds Outperformed?

In order to prepare for the possibility of the Federal Reserve cutting interest rates earlier than expected, it is important to analyze the performance of different asset classes during the past 14 rate-cutting cycles. Historically, during the six months following the start of a rate-cutting cycle, the median return for overseas assets has been ranked as follows:

US bonds > gold > US stocks > US dollar > commodities.

Bonds have consistently shown absolute advantages during rate-cutting cycles. Stocks have performed weaker than gold, mainly due to economic recessions that have occurred during multiple rate-cutting cycles, which have dragged down stock returns. However, if a soft landing is successfully achieved and there is no economic recession during the rate-cutting process, US stocks may not perform too poorly. This is also why US stocks have remained strong even in the current situation of crowded US bond trading.

The current market may have priced in the effects of rate cuts too far in advance for both US bonds and US stocks, which could be influenced by end-of-year market trends. After entering 2024, if macroeconomic data cannot consistently remain strong, the accumulated risk factors at present may lead to a pullback in risk assets.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

What's next after Microsoft hit another all-time-high? Is it time to take profit or keep holding? At what price will you buy Microsoft?

Youyoyiuyou good good