COIN is expected to diverged, with bulls placing 150 bets and bears placing 25 bets

The latest jobs data bolstered expectations of a Fed rate cut as soon as March, the 10-year Treasury yield fell below 4.2 percent and Apple's market value topped $3 trillion for the first time since early August.

On the data front, the number of job openings in the United States fell to 8.733 million in October, the lowest since early 2021, far below market expectations, while the number of hiring in the United States in October fell slightly to 5.9 million, while the number of quits rose slightly to 5.6 million, highlighting that the labor market may be gradually cooling.

In political and economic terms, the last interest rate decision meeting of the year will be on December 12 to 13, the Fed officials are entering the silent period, the market forecasts that the Fed will cut interest rates in the first quarter of next year with a probability of 70%, and expects that the Fed will cut interest rates five times by the end of 2024.

The ECB's shift in thinking is in line with expectations of a shift by the U.S. central bank, with Isabel Schnabel, the ECB's most hawkish official, taking a dovish stance, saying the central bank could do without raising rates given the "significant" decline in inflation and that policymakers should not lead markets to believe rates will remain stable until mid-2024.

According to a new McKinsey report, banks using generative artificial intelligence (AI) tools could increase revenue by up to $340 billion annually through increased productivity, helping the industry adapt to this rapidly evolving field.

$Coinbase Global, Inc.(COIN)$ Bitcoin maintained its bull offensive at $41,795. The bull market has opened, Coinbase, the largest compliant crypto exchange in the United States, has risen more than 300% so far this year, and crypto mining companies such as Marathon Digital and Riot Platforms have also crossed the 300% skyline. Current options call large order cautious bullish, target price 150

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

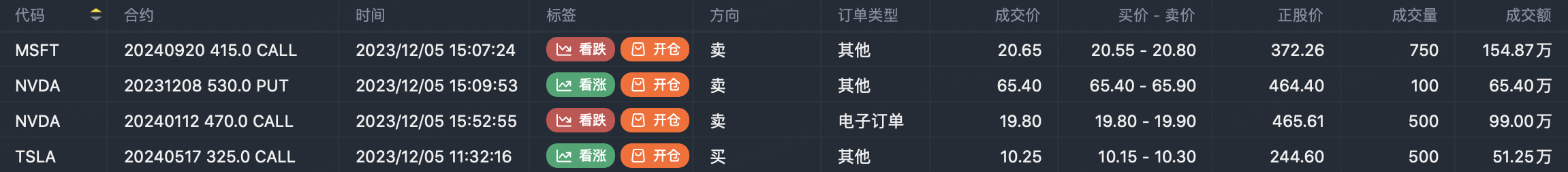

$Microsoft(MSFT)$ Sell call option $MSFT 20240920 415.0 CALL$

$Tesla Motors(TSLA)$ Buy call option $TSLA 20240517 325.0 CALL$

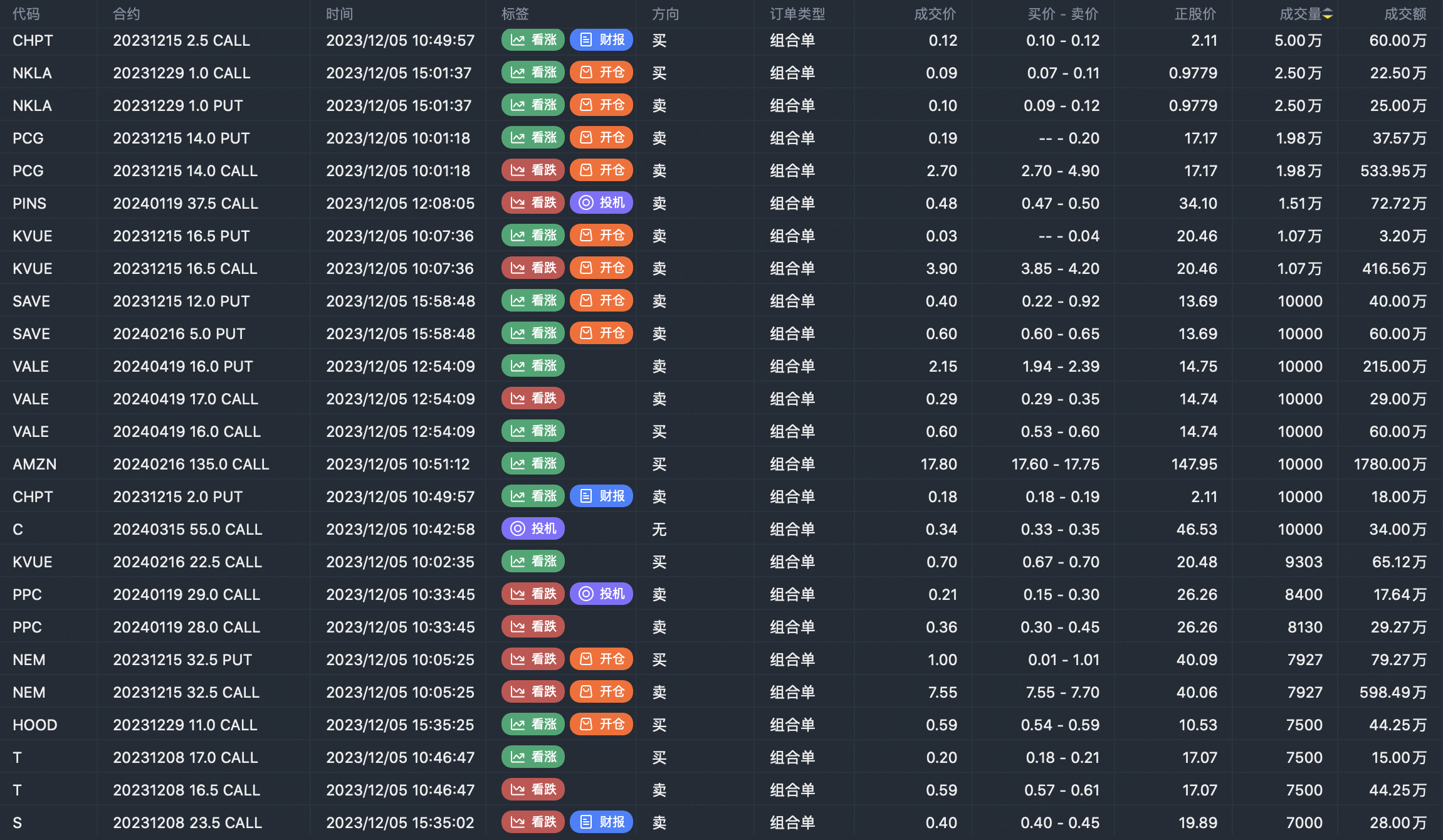

Option buyer open position (Single leg)

Buy TOP T/O:

$CSCO 20231215 55.0 PUT$ $COIN 20240419 150.0 CALL$

Buy TOP Vol:

$CHPT 20231215 2.0 CALL$ $PBR 20231208 15.0 CALL$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Sell TOP T/O:

$MSFT 20240920 415.0 CALL$ $PEP 20240119 185.0 PUT$

Sell TOP Vol:

$ET 20240112 14.5 CALL$ $CHPT 20231215 2.0 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

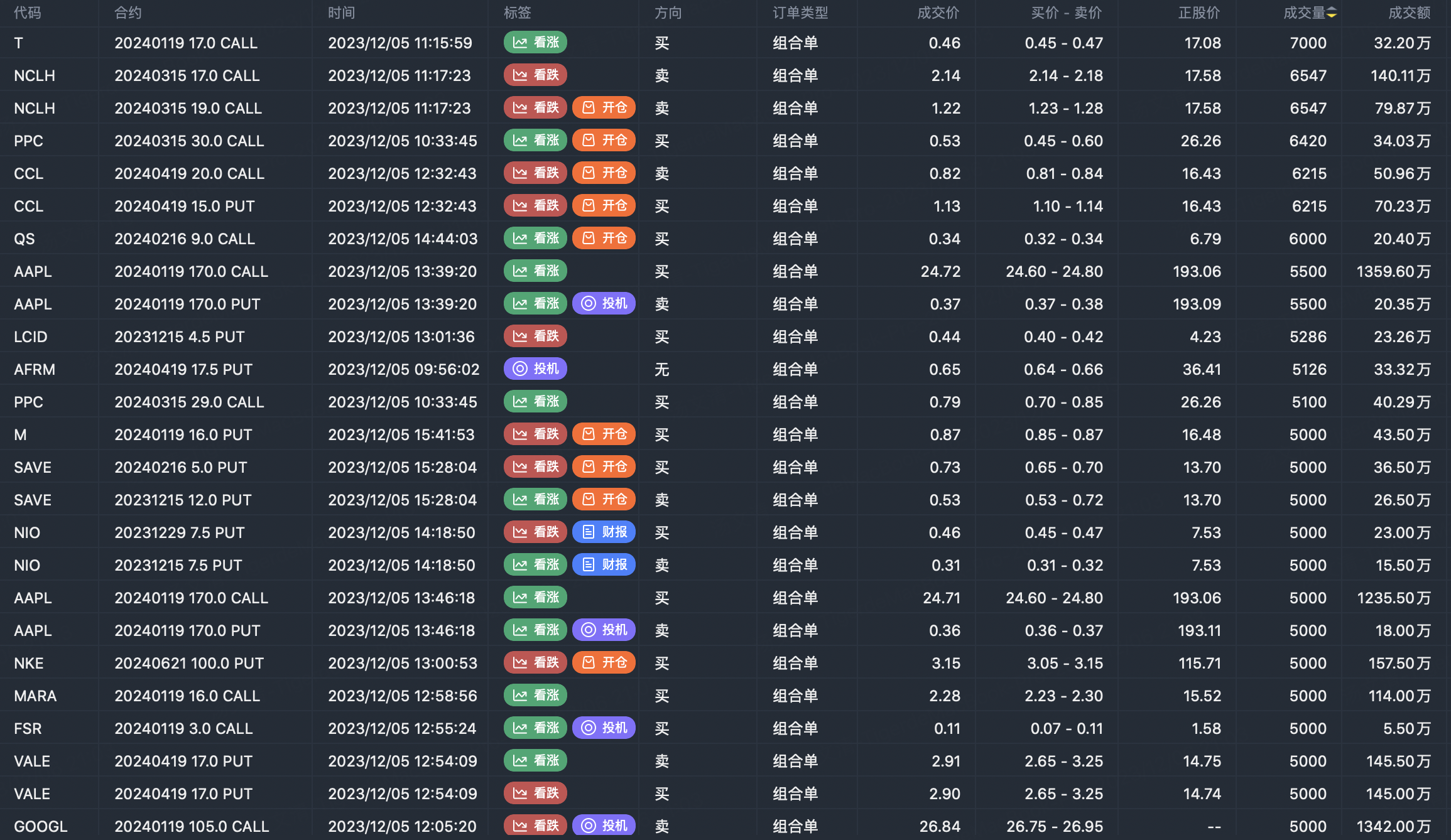

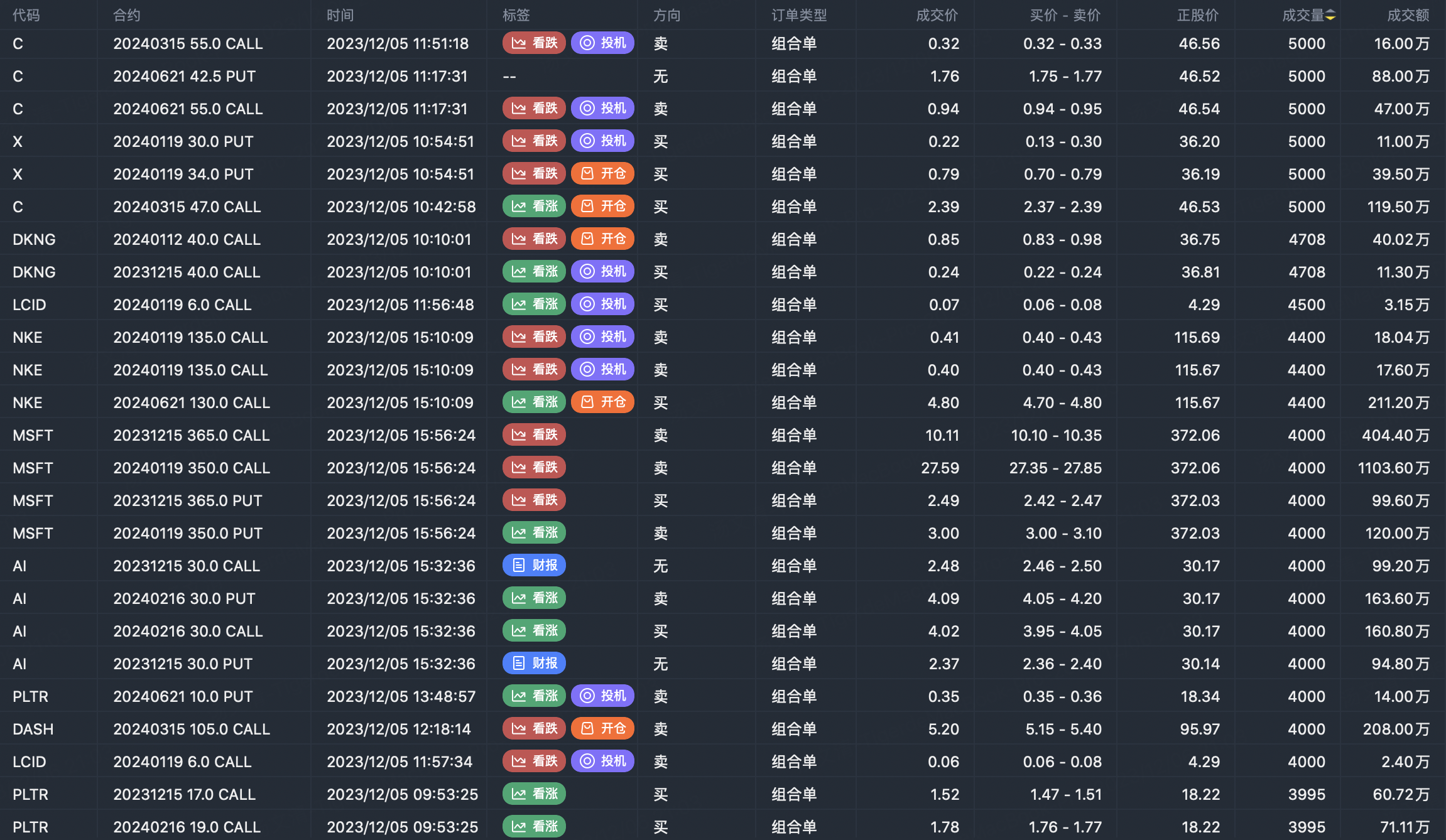

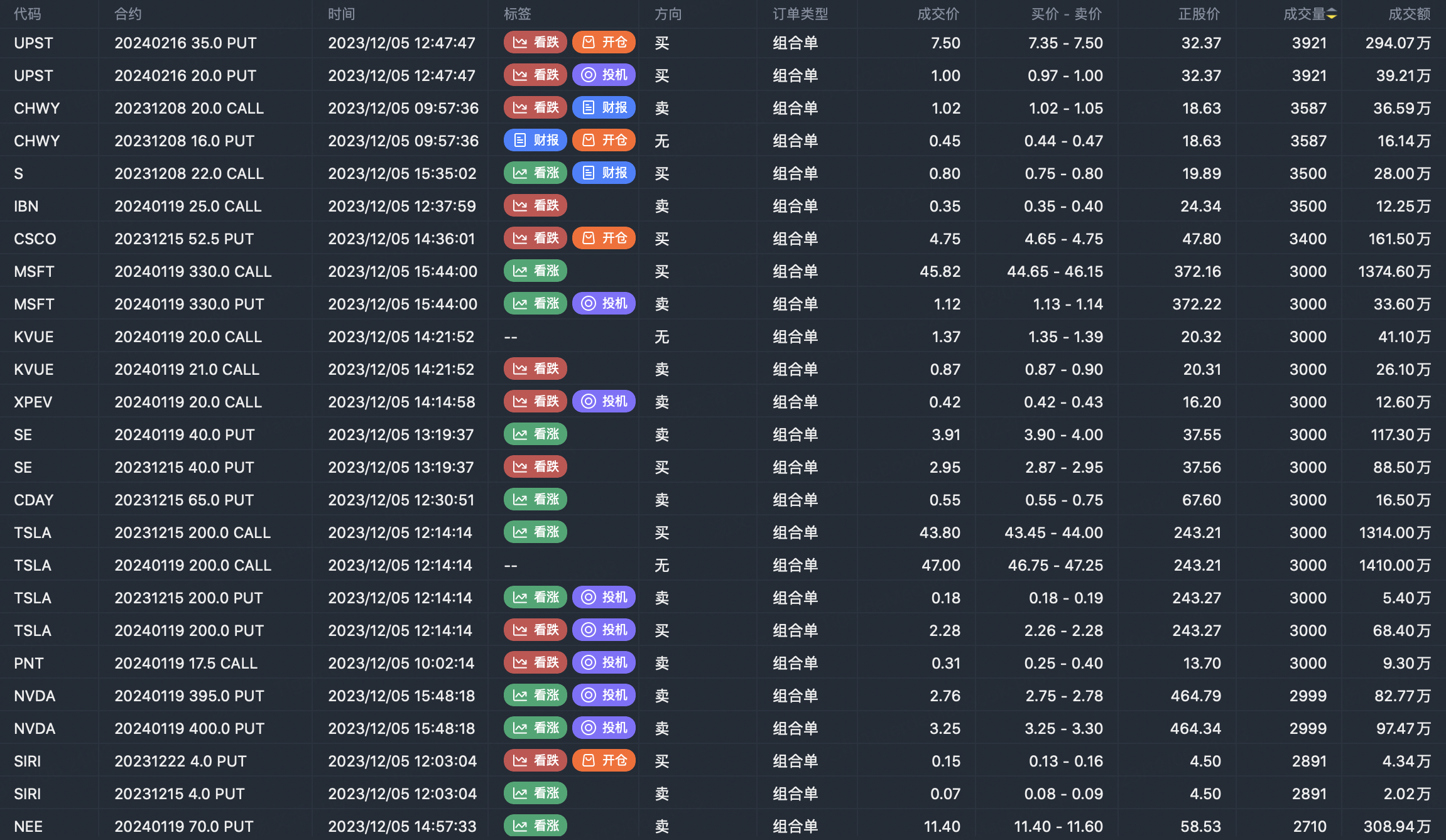

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

你为什么要对微软做出这样的选择?

Employment data really deserves our attention

vTo be honest, they won't cut interest rates so soon.

Now is not a good time to invest in AAPL

Fall in 10-year Treasury yields disappoints