Options Spy | PDD once again leads the e-commerce bullish

The U.S. small nonfarm ADP data was in line with expectations of a soft landing, and the 10-year U.S. Treasury rate hit its lowest level in more than three months.

On the data front, the ADP employment report, also known as "small non-farm", was released on Wednesday. Data showed that U.S. private employers added a seasonally adjusted 103,000 jobs in November, well below economists' expectations of 130,000. U.S. companies cut back on hiring in November, another sign that the U.S. labor market is cooling.

The Commerce Department's Census Bureau said the trade deficit rose 5.1 per cent to $64.3bn in October, beating economists' forecasts of $64.2bn and hitting a three-month high. The revised trade deficit fell to $61.2 billion in September, slightly lower than the previously reported $61.5 billion.

On the political and economic front, the market awaits the latest U.S. non-farm payrolls report, and the Fed is currently in a silent period ahead of its interest rate meeting. The market is almost certain that the Fed will hold fire this month and forecast a rate cut as soon as the first quarter of next year.

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

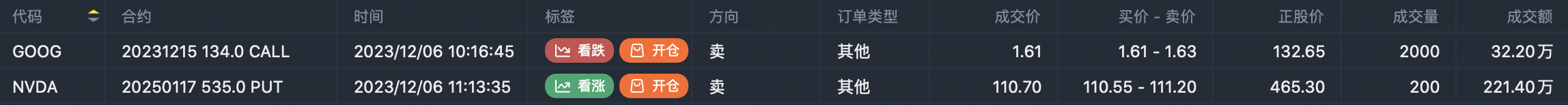

FANNG option active

$Alphabet(GOOG)$ Sell call option $GOOG 20231215 134.0 CALL$

$NVIDIA Corp(NVDA)$ Sell put option $NVDA 20250117 535.0 PUT$

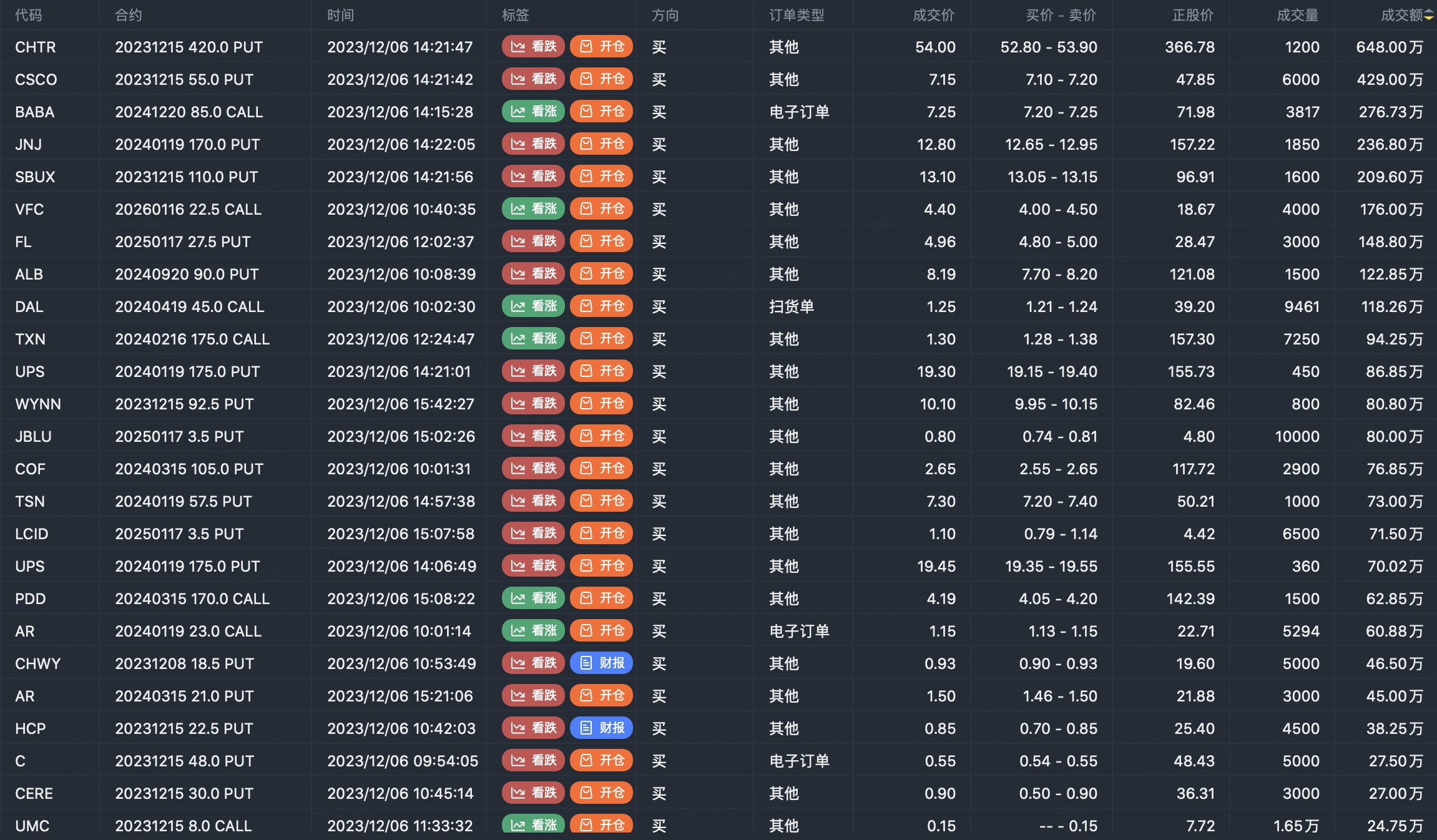

Option buyer open position (Single leg)

Buy TOP T/O:

$CHTR 20231215 420.0 PUT$ $CSCO 20231215 55.0 PUT$

Buy TOP Vol:

$UMC 20231215 8.0 CALL$ $JBLU 20250117 3.5 PUT$

China Concept Stock:

$BABA 20241220 85.0 CALL$ $PDD 20240315 170.0 CALL$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

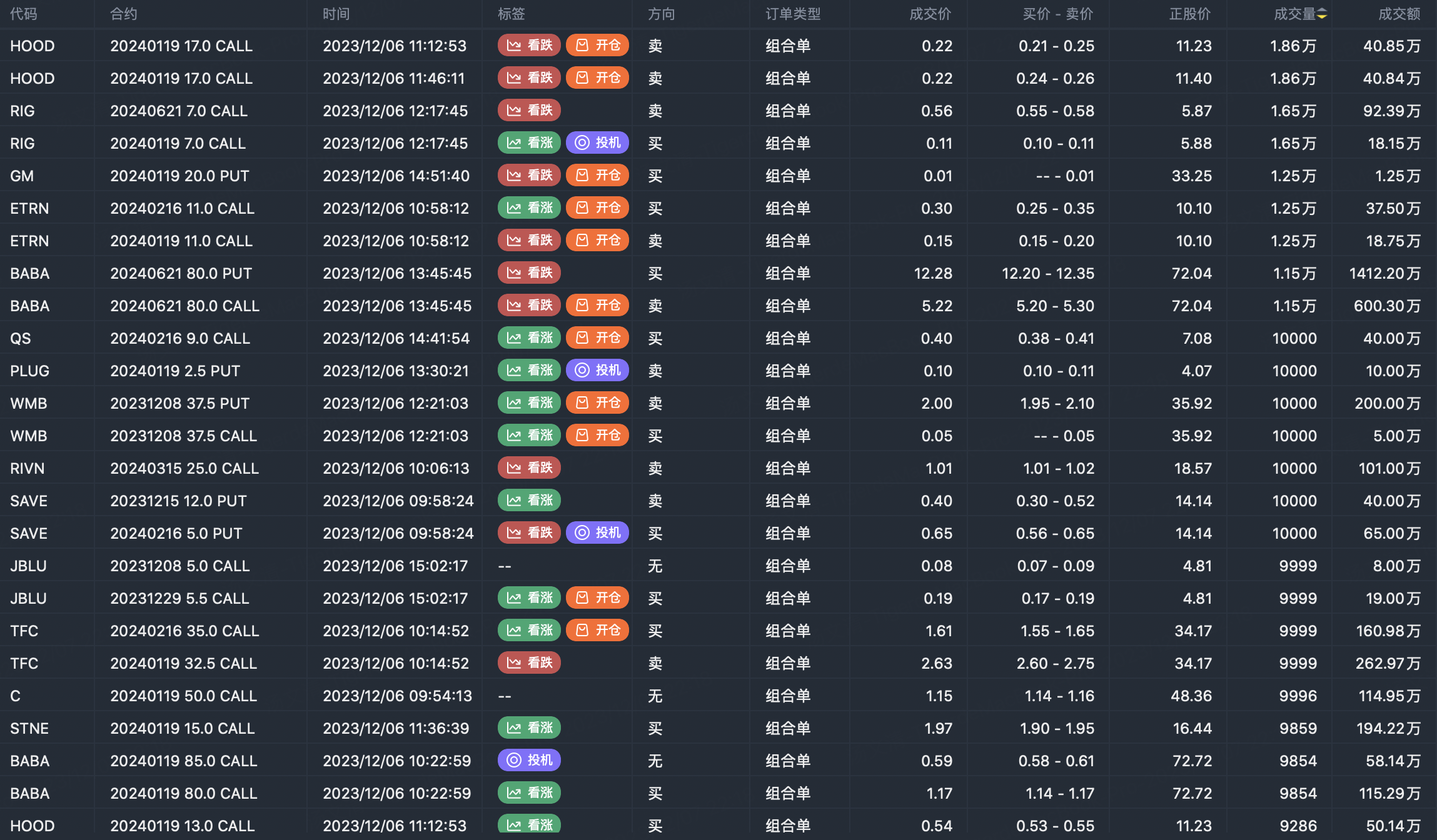

Option seller open position (Single leg)

Sell TOP T/O:

$CSCO 20231215 52.5 PUT$ $CVX 20231215 160.0 PUT$

Sell TOP Vol:

$XP 20231215 18.0 PUT$ $CHPT 20240119 2.5 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

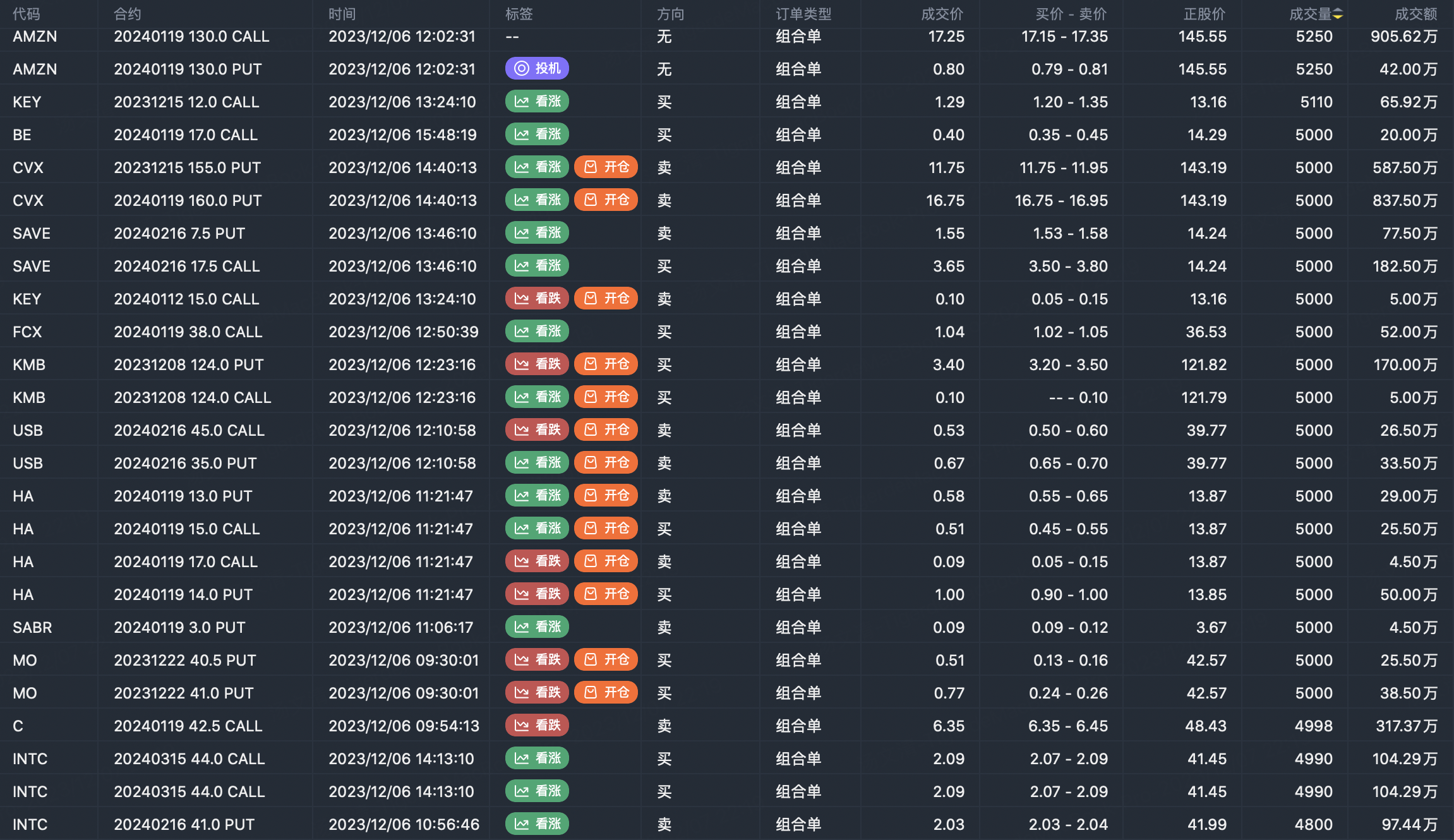

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Newnew·2023-12-08Hi1Report

- Samsonn·2023-12-08nice1Report

- Tom Chow·2023-12-08good1Report

- Tom Chow·2023-12-08good2Report

- Tom Chow·2023-12-08good1Report