Options Spy | Apple's buy call order is on the list with a 2024 price target of 240

Major U.S. stock indexes rose for a seventh straight week, with the S&P 500 Posting its longest winning streak in six years. The Federal Reserve's admission on Wednesday that its efforts to tame inflation are working, signaling at least three interest rate cuts in 2024, boosted investor sentiment and helped Wall Street rally this week.

In terms of economic data, the latest survey of the Federal Reserve Bank of New York showed that the New York manufacturing index fell to -14.5 in December, a four-month low, reflecting the continued difficulties of the manufacturing industry. The Standard & Poor's purchasing Managers' Index also pointed to weakness in the U.S. manufacturing sector, while service sector activity rose to a five-month high.

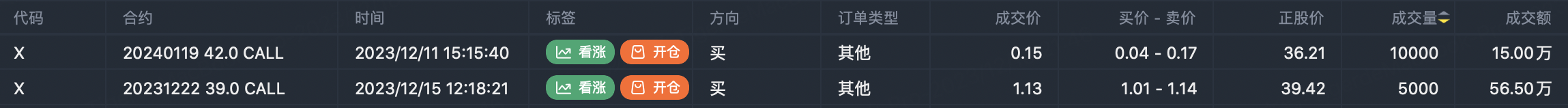

U.S. Steel confirmed that it will be acquired by Japanese steel companies. Under the agreement, Japan Steel will pay $55 per share in an all-cash deal, a 40 percent premium to its closing price on Dec. 15, valuing the company at $14.1 billion, with a stock index of $14.9 billion including debt. Last week's options movement saw large buy call orders$X 20240119 42.0 CALL$ $X 20231222 39.0 CALL$

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

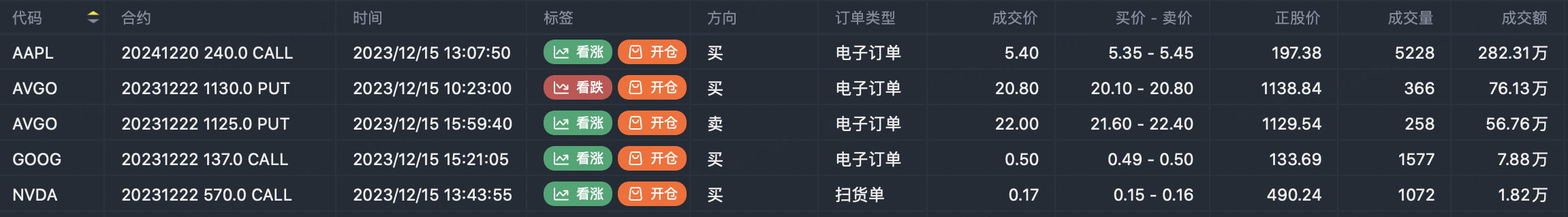

FANNG option active

$Apple(AAPL)$ Buy Long CALL Order $AAPL 20241220 240.0 CALL$ , volume 5228, amount 2.82 million

Option buyer open position (Single leg)

Buy TOP T/O:

$UPS 20250117 155.0 PUT$ volume 4000, amount 4.76million

$AAPL 20241220 240.0 CALL$ volume 5228, amount 2.82million

Buy TOP Vol:

$CCJ 20231229 52.0 CALL$ volume30,000,amount450,000

$NU 20231222 8.0 PUT$ volume15,000,amount89,800

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Sell TOP T/O:

$KO 20240119 65.0 PUT$ volume 1450, amount 950,000

$URI 20240315 480.0 PUT$ volume 1000, amount 950,000

Sell TOP Vol:

$XP 20231229 19.0 PUT$ volume 20,000, amount 80,000

$HUN 20240119 24.0 PUT$ volume 11,200, amount 220,000

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

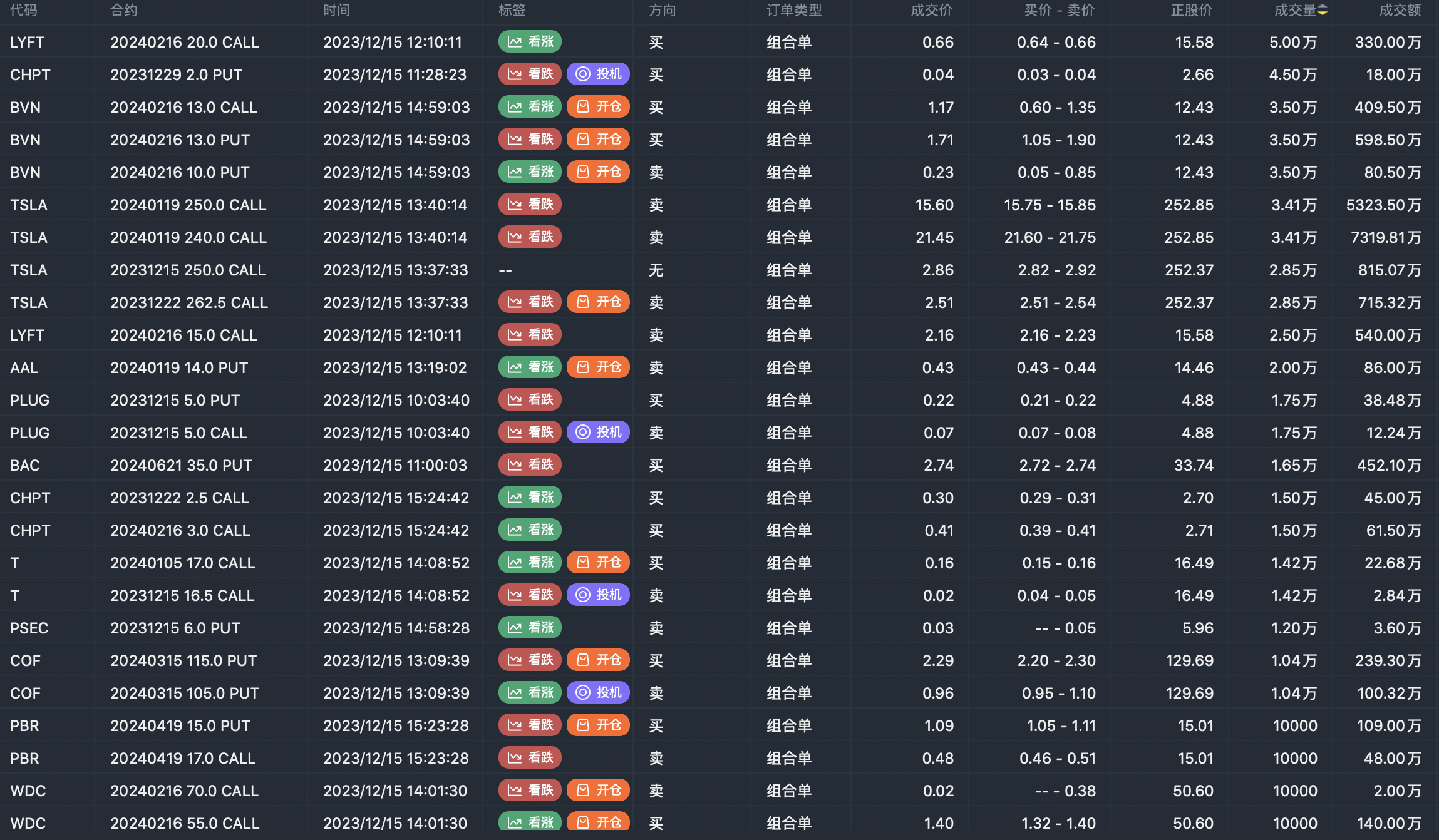

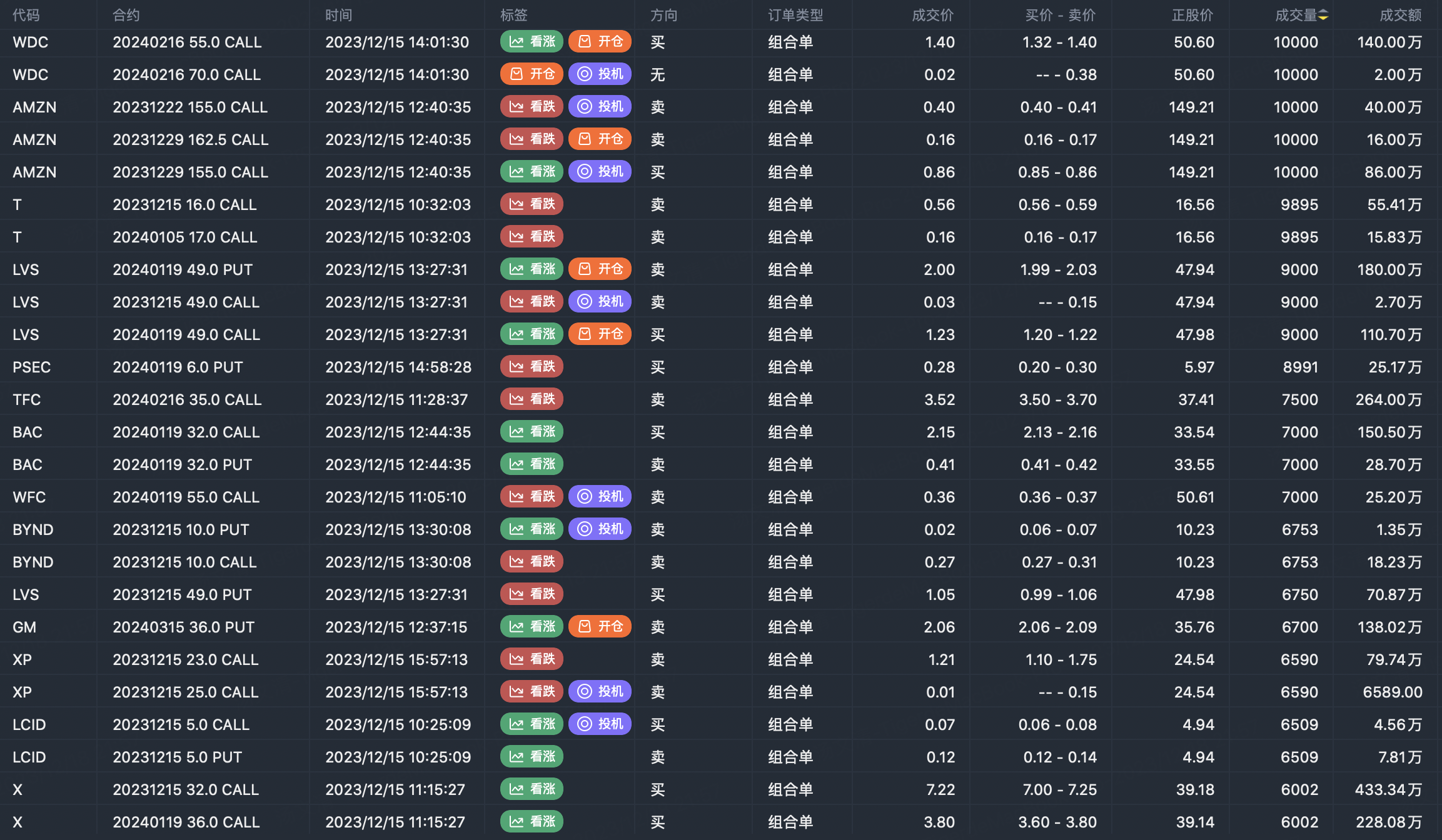

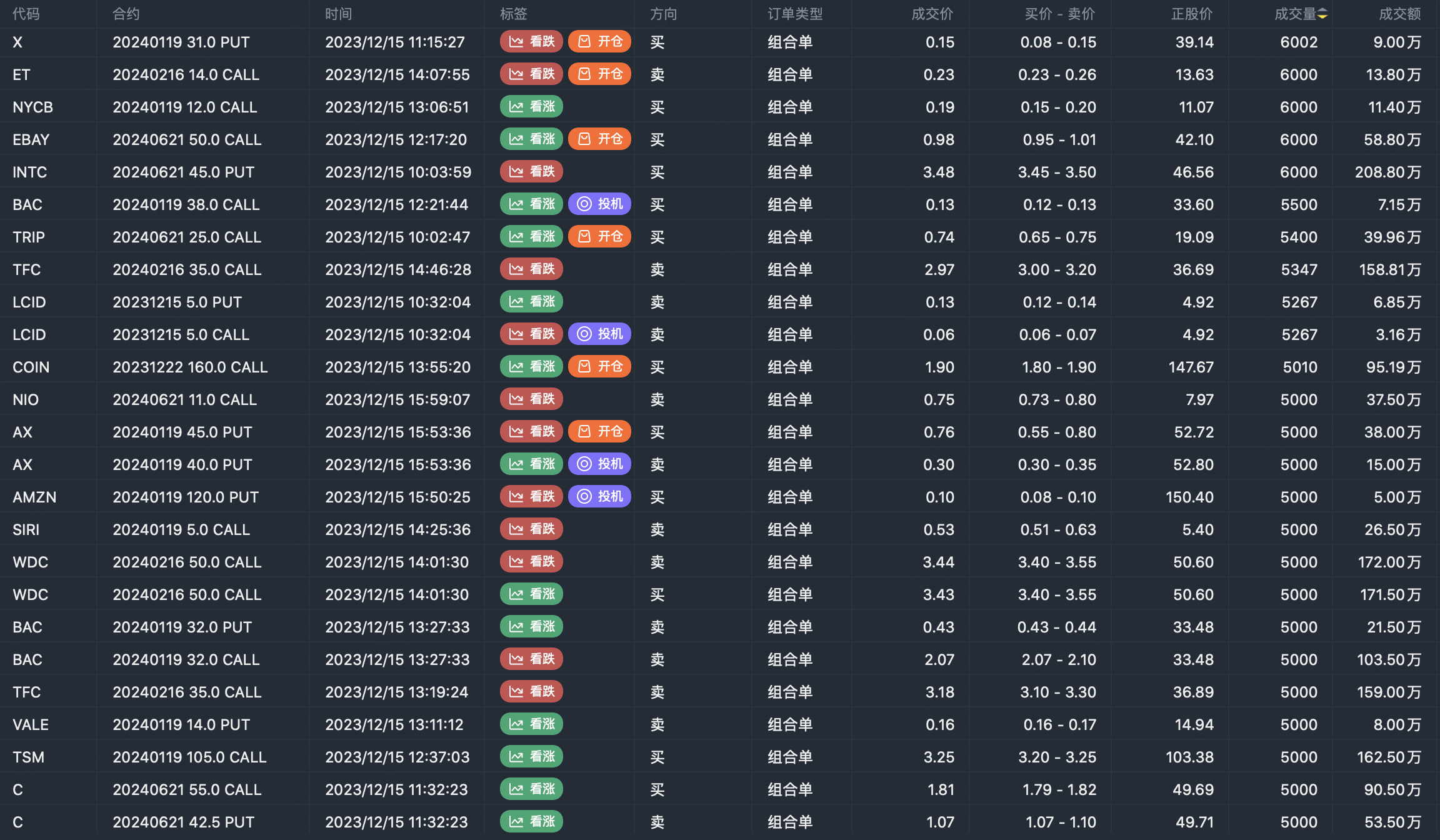

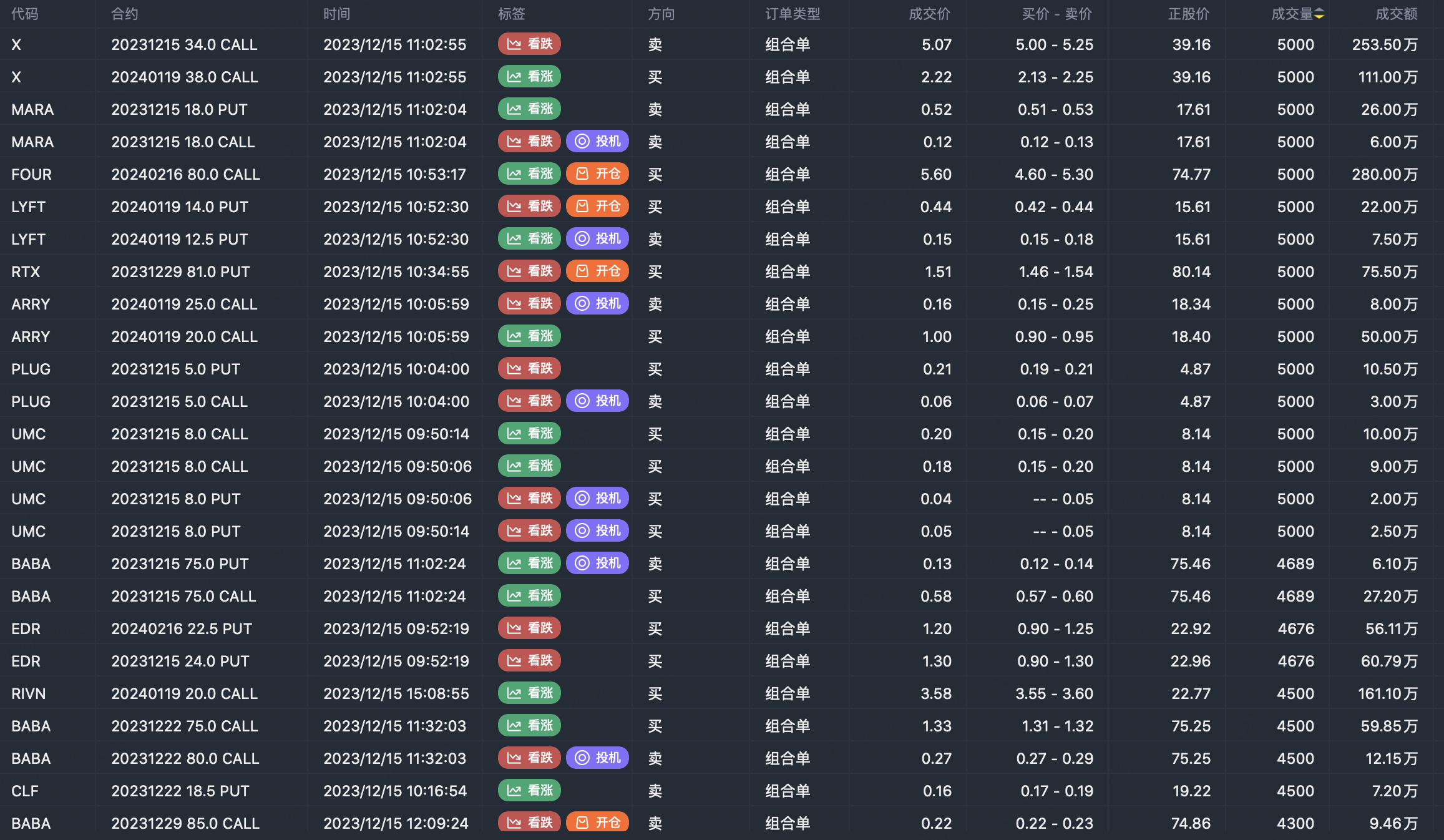

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?