Options Spy | Institutions sell Micron put options to copy the bottom

After the previous day's sell-off, bargain buying emerged, and economic data raised optimism about the Fed's "pigeon turn." Semiconductor stocks rose strongly after Micron's earnings beat expectations. The fear index, known as the VIX, briefly rose above 14 for the first time since November, and the gauge of stock volatility has been near multi-year lows.

The third quarter gross domestic product (GDP) annual growth rate was revised down to 4.9 percent, below market expectations, and the third quarter personal consumption expenditures (PCE) annual growth rate was revised down to 3.1 percent, below previous and market expectations. Analysts said weak growth and inflation meant the Fed was likely to cut interest rates soon.

Everbright Securities released a research report that the demand for consumer electronics market in 24 years has rebounded, driven by core technology trends such as AI PC and HBM, and the bank judged that 24-year storage prices will grow strongly, driving revenue and profit margins to improve quarter by quarter, and is optimistic about the storage cycle reversal.

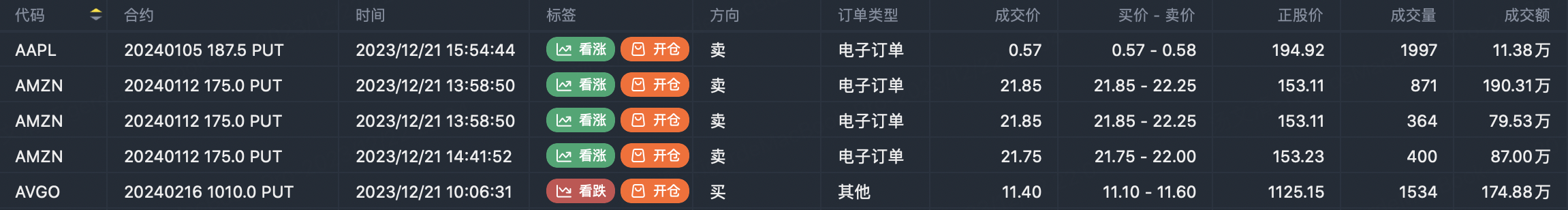

Yesterday's highest opening volume combination of large orders:

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Apple(AAPL)$ Sell PUT option $AAPL 20240105 187.5 PUT$

$Amazon.com(AMZN)$ Sell PUT option $AMZN 20240112 175.0 PUT$

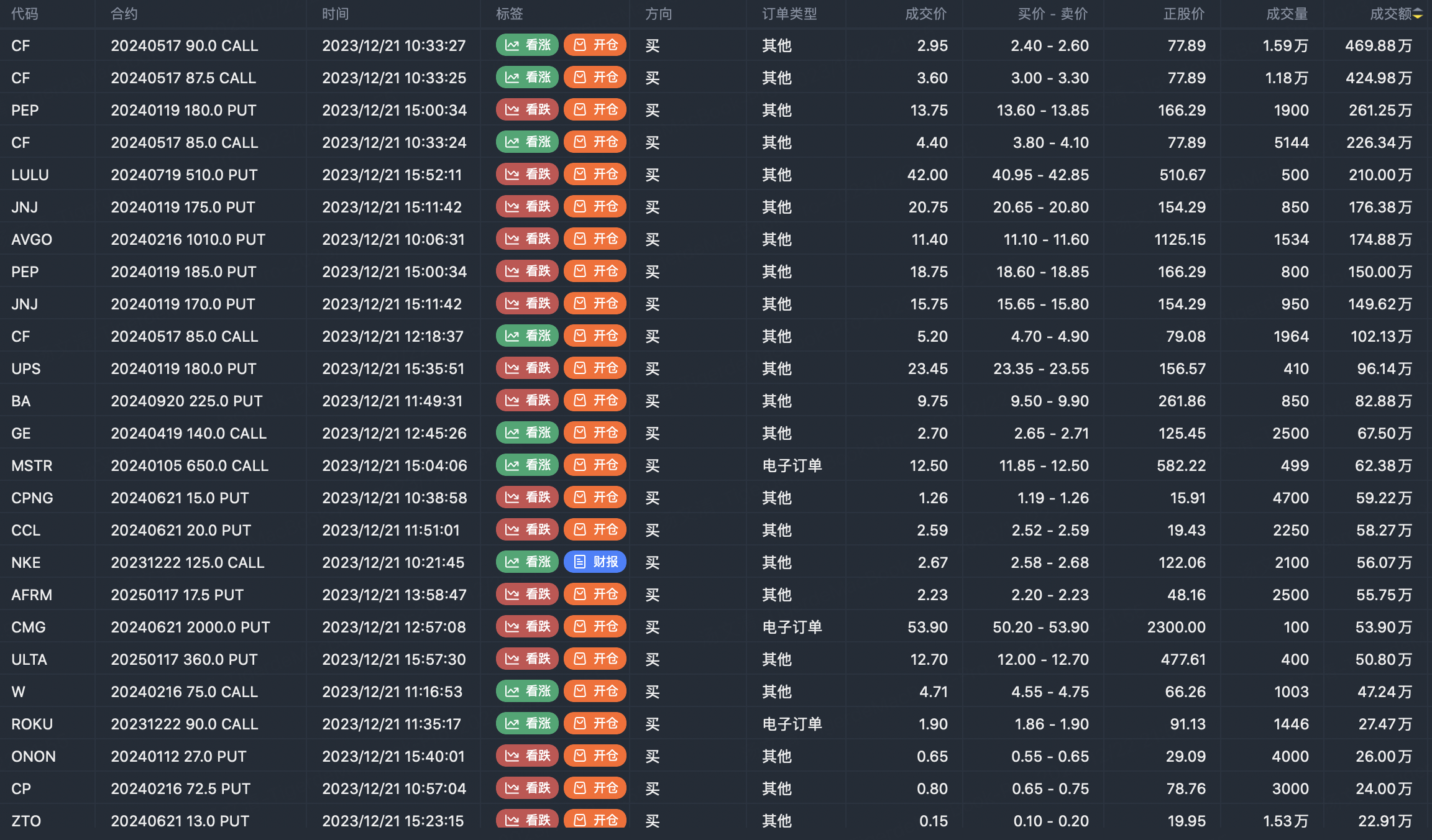

Option buyer open position (Single leg)

Buy TOP T/O:

$CF 20240517 90.0 CALL$ $PEP 20240119 180.0 PUT$

Buy TOP Vol:

$CF 20240517 90.0 CALL$ $ZTO 20240621 13.0 PUT$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

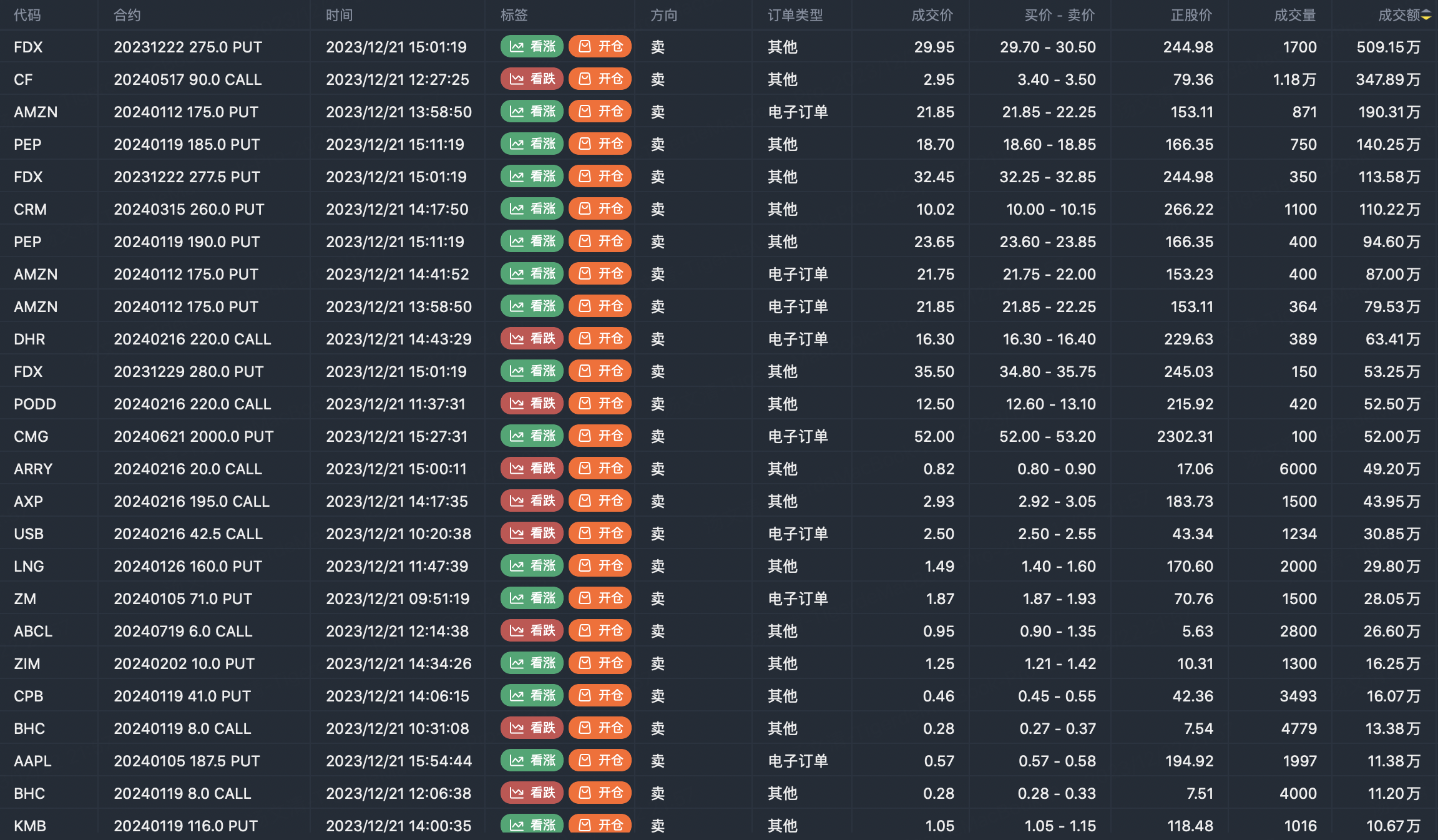

Option seller open position (Single leg)

Sell TOP T/O:

$CF 20240517 90.0 CALL$ $FDX 20231222 275.0 PUT$

Sell TOP Vol:

$CF 20240517 90.0 CALL$ $ARRY 20240216 20.0 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

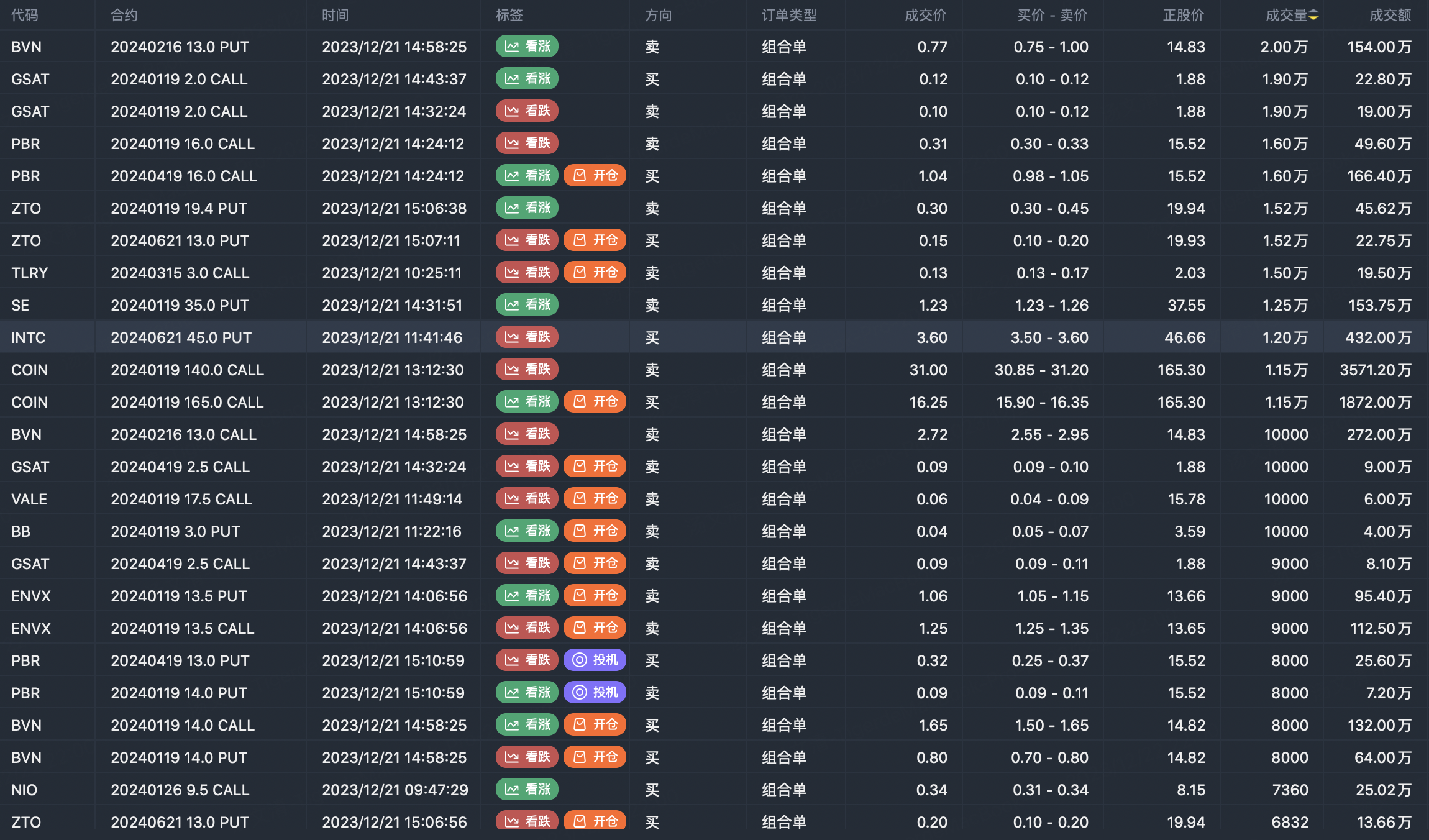

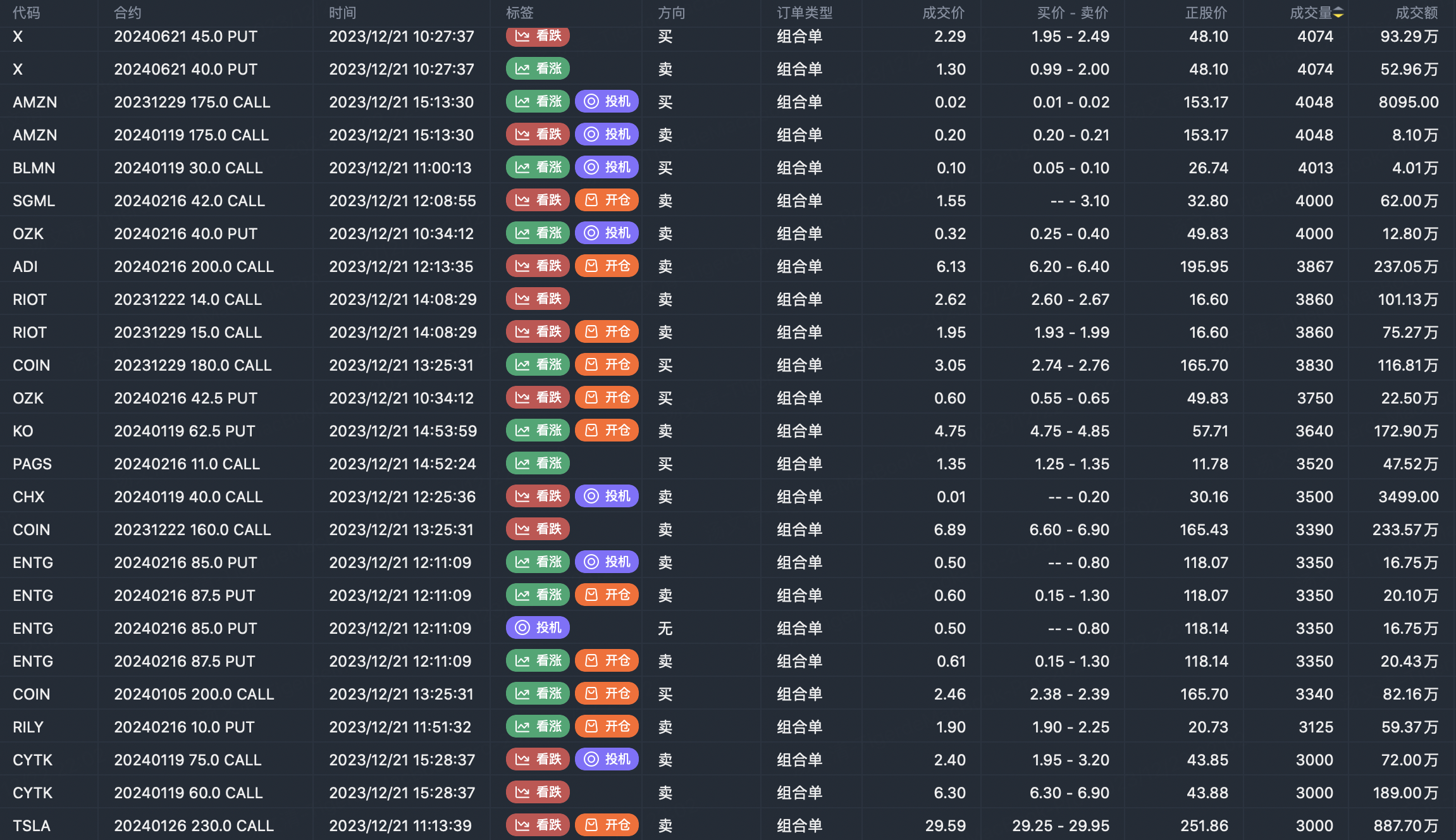

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

👍