Options Spy | Bank stocks are polarized and BAC call orders are exploding

Ahead of major bank earnings, the market was in a wait-and-see mood, and large-cap stocks strengthened. Nvidia hit a record high after TSMC's fourth-quarter revenue beat expectations.

The U.S. Securities and Exchange Commission (SEC) has reportedly approved applications for various Bitcoin spot ETFs. Earlier on Wednesday, CBOE Global Markets released Ark 21Shares Bitcoin ETF (ARKB), Fidelity Wise Origin Bitcoin ETF (FBTC), Invesco Galaxy Bitcoin ETF (BTCO). And new issuance notices for three other funds.

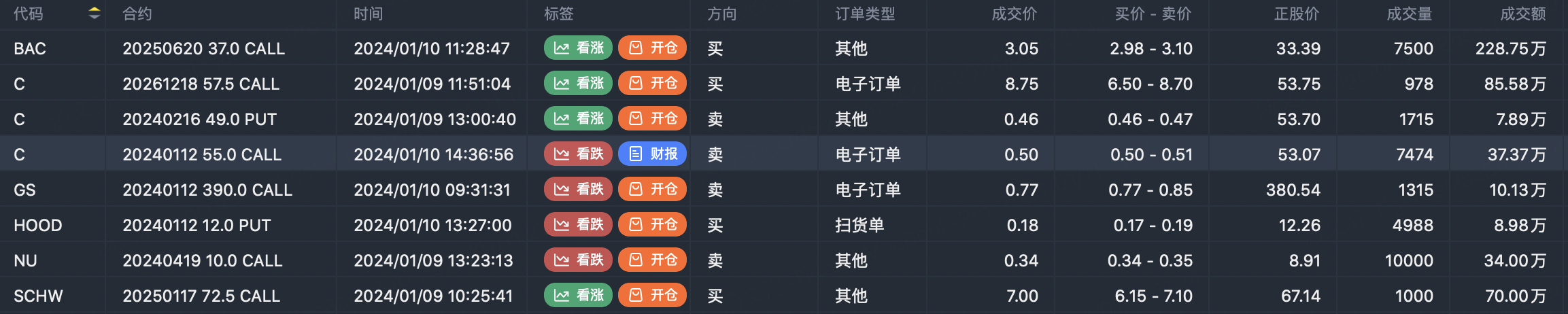

The fourth-quarter earnings season starts with the big banks, with jpmorgan Chase, Citigroup, Wells Fargo and Bank of America due to report on Friday. Option large orders show a buy CALL order for Bank of America: $BAC 20250620 37.0 CALL$ , and a sell call order for this week expiration: $C 20240112 55.0 CALL$

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

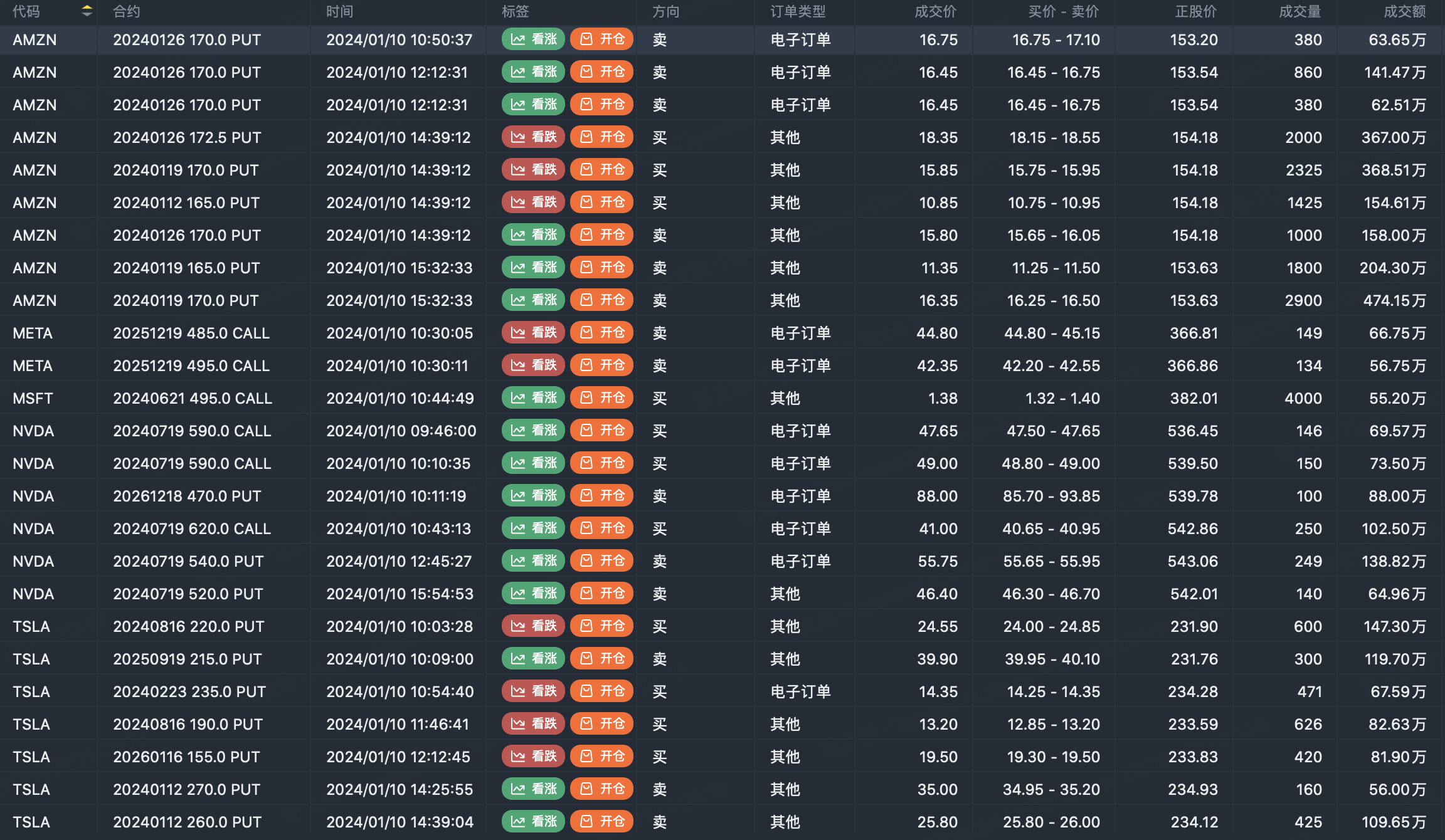

FANNG option active

$Apple(AAPL)$ Buy PUT option $AAPL 20240119 195.0 PUT$

$Microsoft(MSFT)$ Buy CALL option $MSFT 20240621 495.0 CALL$

Option buyer open position (Single leg)

Buy TOP T/O:

$BA 20240119 260.0 PUT$ $AAPL 20240119 195.0 PUT$

Buy TOP Vol:

$AAPL 20240119 195.0 PUT$ $CSCO 20240119 52.5 PUT$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

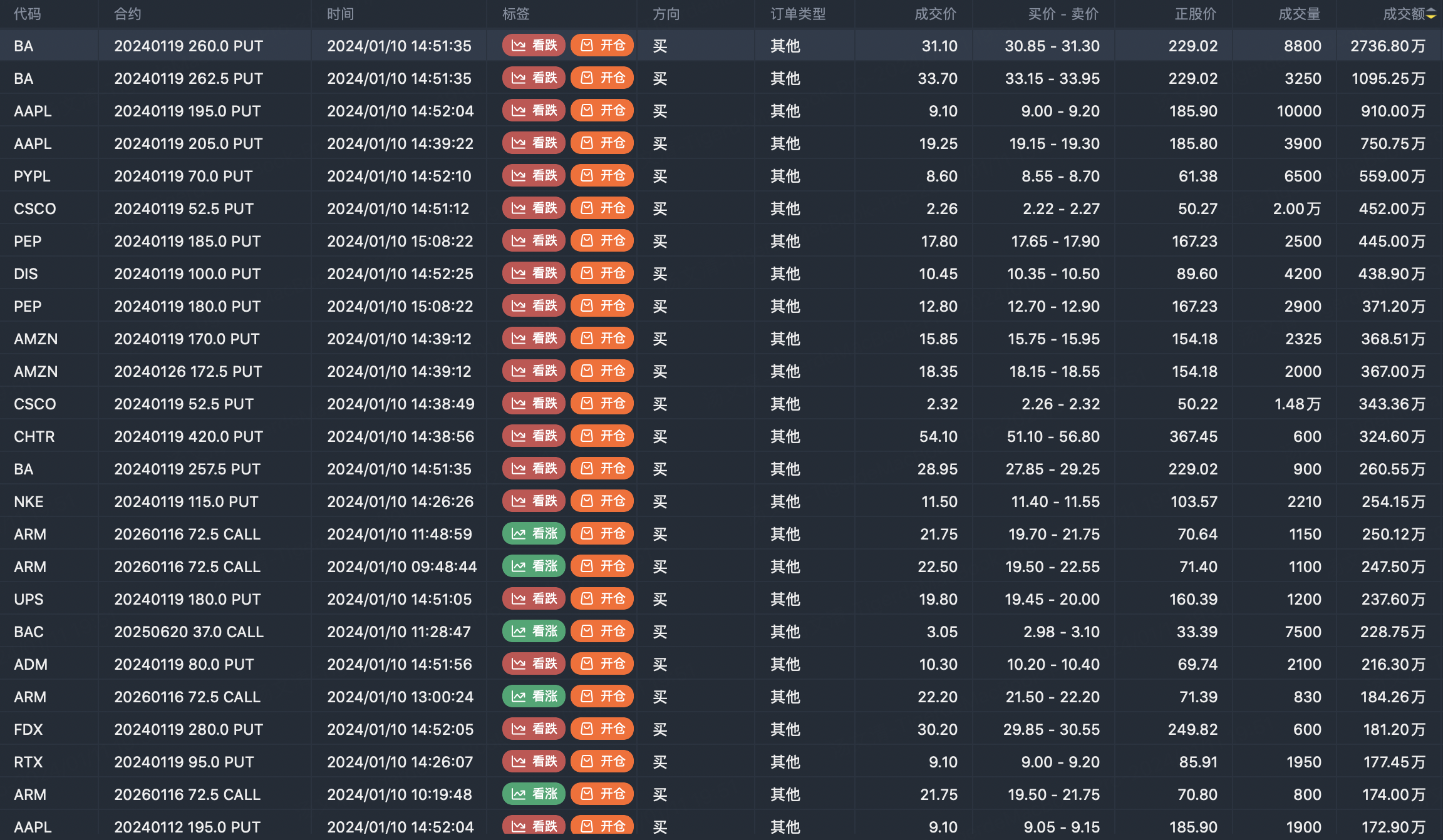

Option seller open position (Single leg)

Sell TOP T/O:

$BABA 20240112 80.0 PUT$ $AAPL 20240112 200.0 PUT$

Sell TOP Vol:

$AAPL 20240112 200.0 PUT$ $CSCO 20240119 55.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

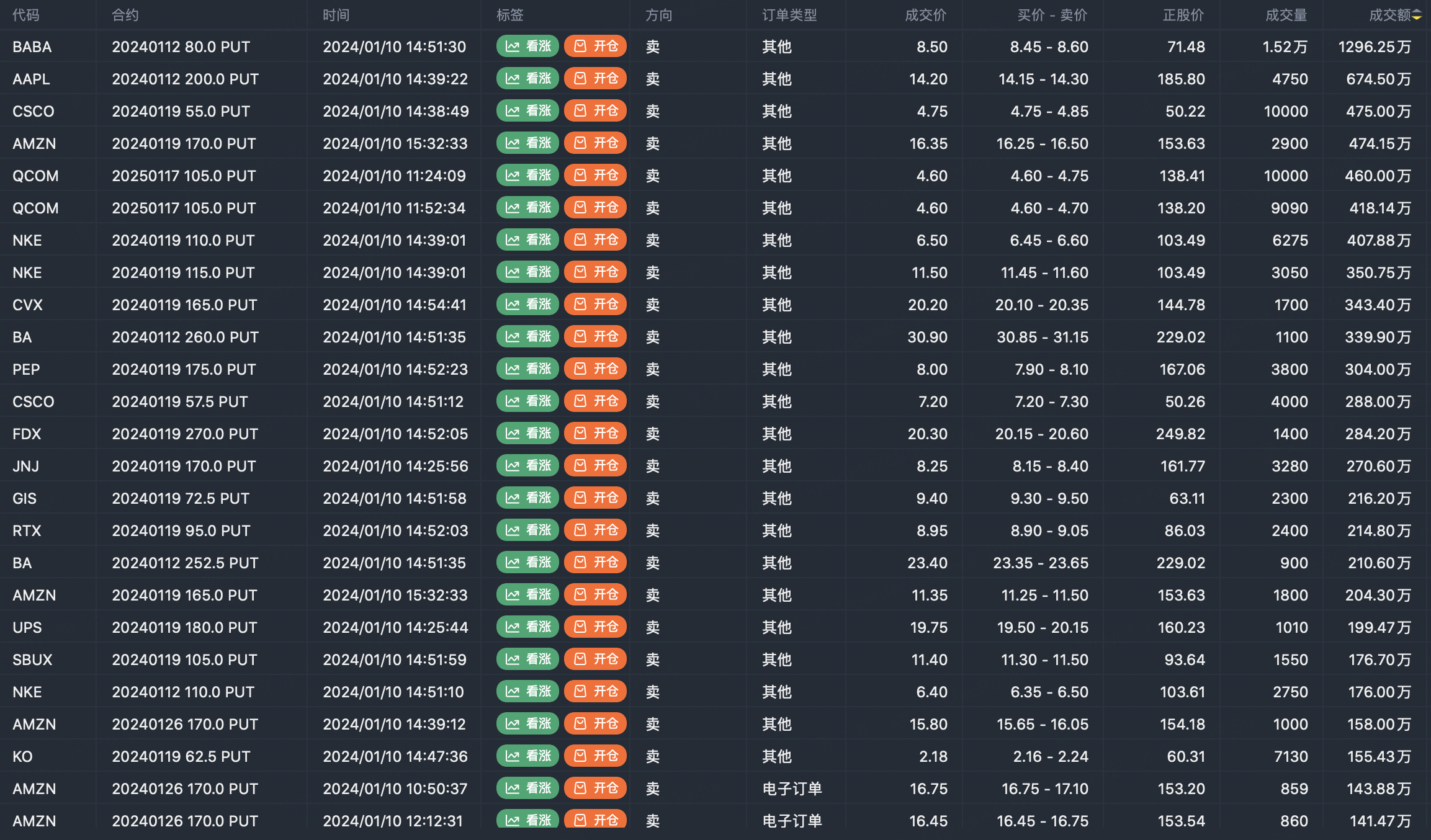

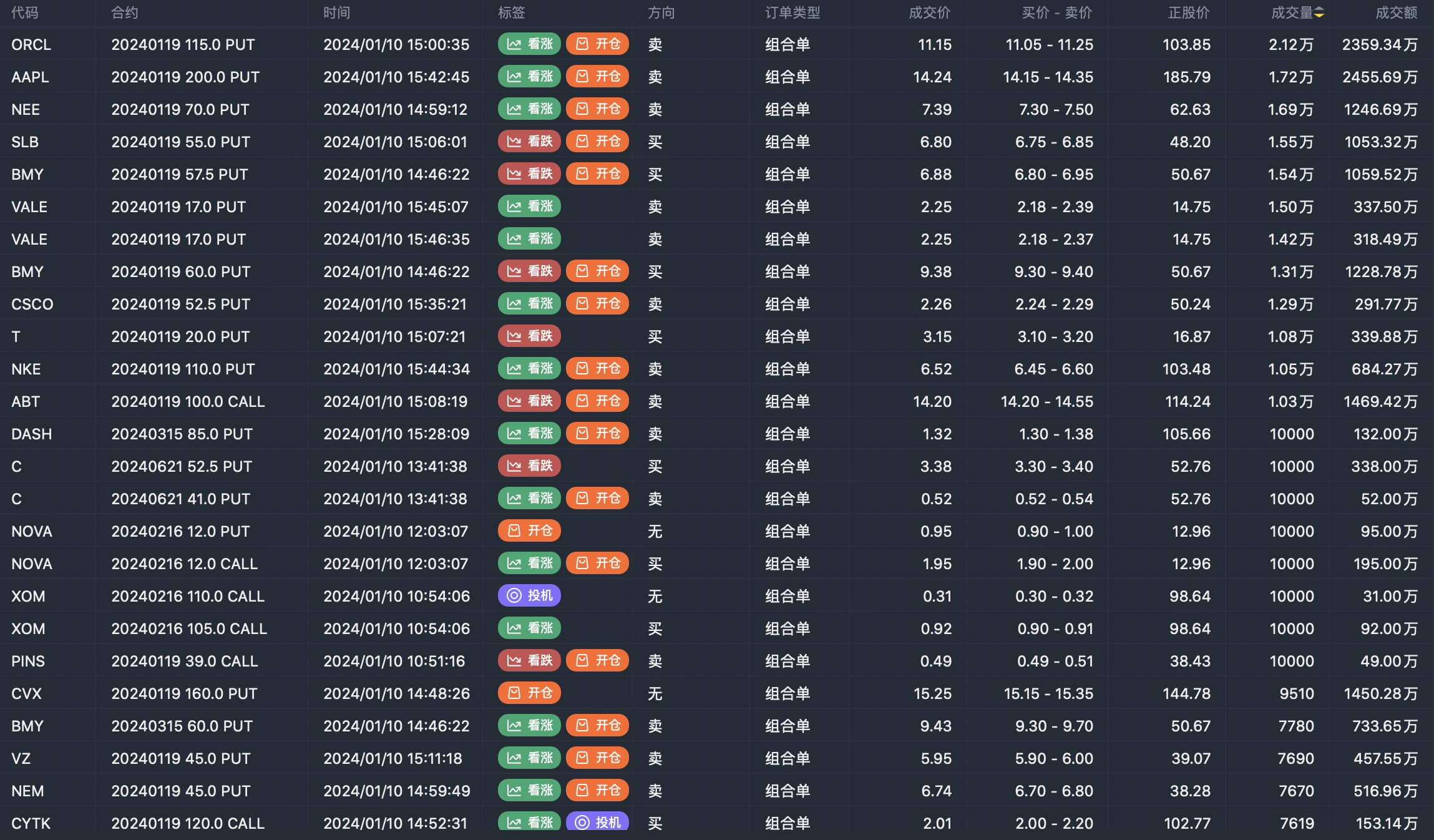

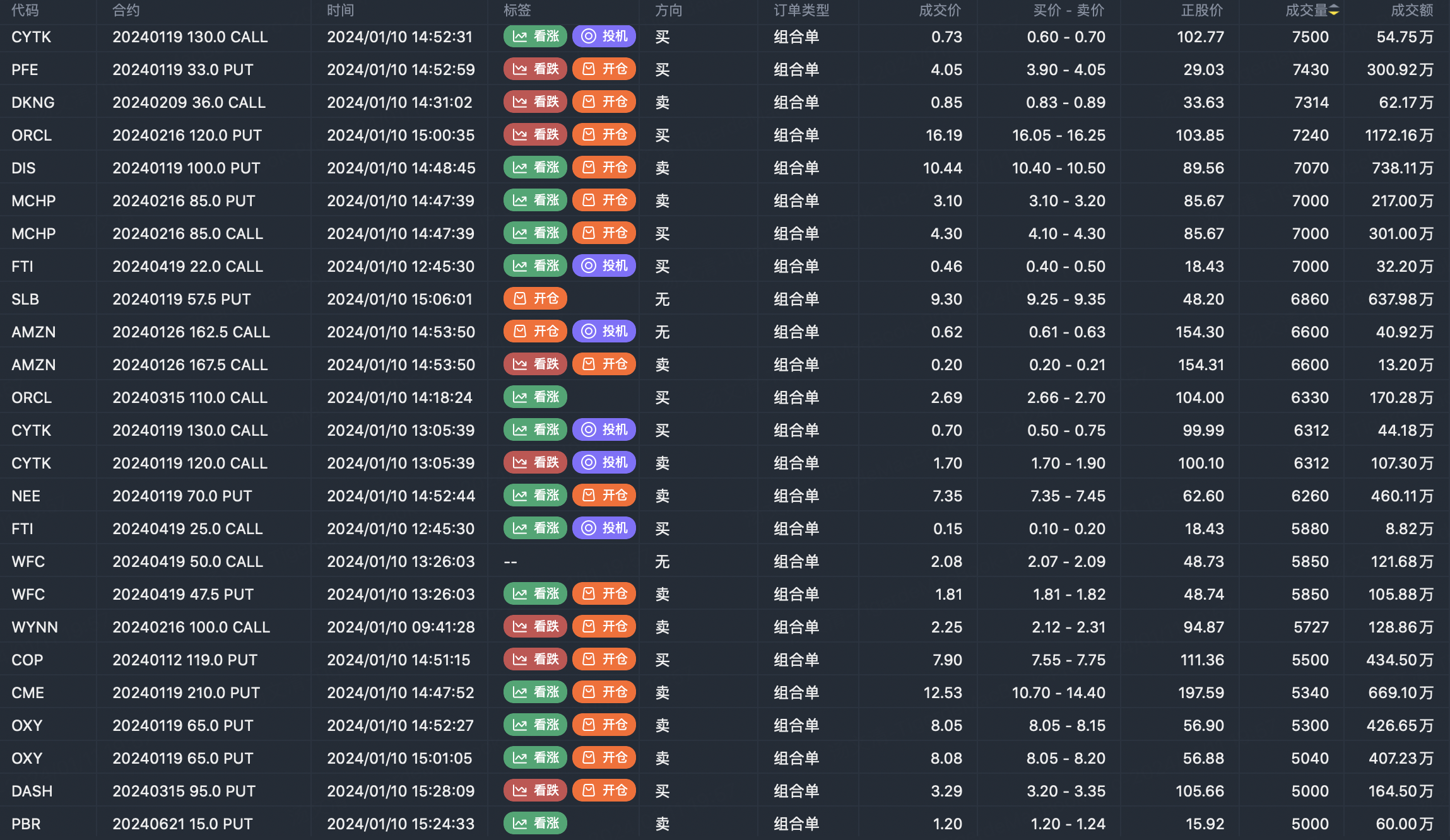

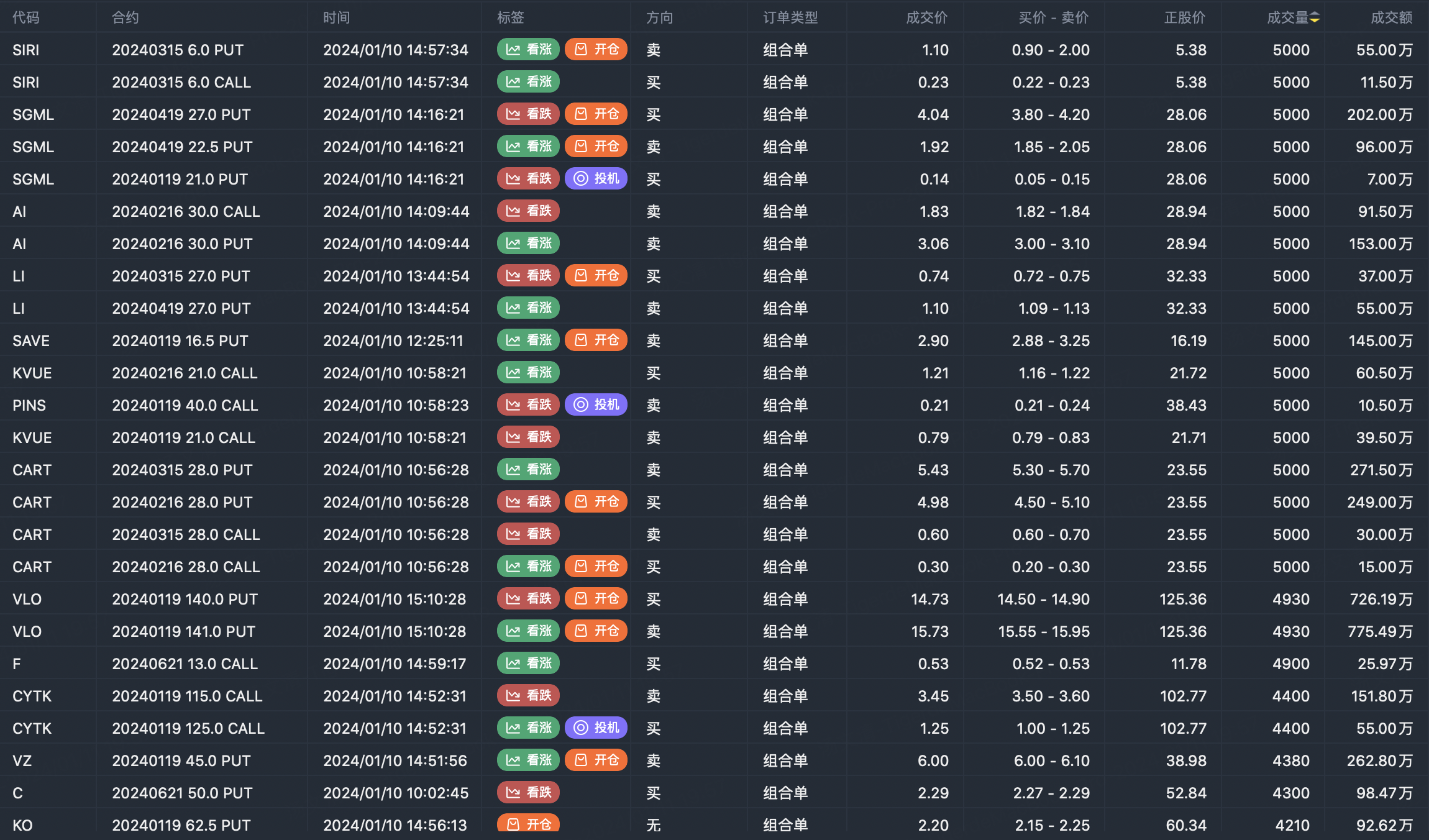

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Thanks for sharing 🙏

好的