The $200 million options trader used all his profits to keep buying Nvidia

Previously: Nvidia earnings preview: Break or the beginning of a big sideways?

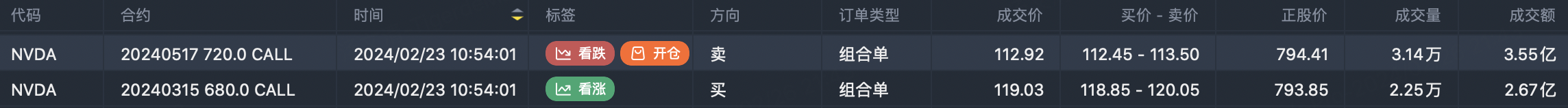

In the above post, I mentioned that a trader liquidated a position of $NVDA 20240315 570.0 CALL$ before Nvidia earnings, made $300 million, and then continued to roll $NVDA 20240315 680.0 CALL$ with 200 million.

Then last Friday, the day after the earnings report, the trader closed 25,000 lots of $NVDA 20240315 680.0 CALL$ , Then use the entire profit of the first two trades of about 350 million (principal 145 million) to continue all IN31,400 lots of CALL options $NVDA 20240517 720.0 CALL$ .

Of course, friends who continue to pay attention may see a problem from the figure, the direction of trading is not quite right. Identifying option buyers and sellers We talked about before, the direction label is only an aid, further confirmation mainly depends on the transaction price bias: the transaction price bias to the buyer is the selling direction, the transaction price bias to the seller is the buying direction. $NVDA 20240315 680.0 CALL$ No doubt a sell close.

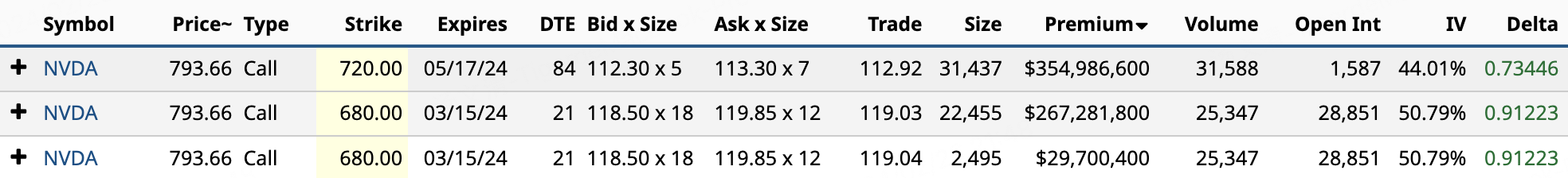

Question is $NVDA 20240517 720.0 CALL$ Buy call or sell call?

There is a difference between the bid-ask range shown by Tiger and barchat, with Tiger biased towards the seller and barchat biased towards the buyer.

Let's sort through our ideas based on maturities and turnover. The first close of 680 proves that the trader has no intention of exercising the option, and the choice of the option 2 months out is consistent with his previous actions: before the first roll, he bought the call option expiring on March 15 on January 22, and then in less than a month Nvidia exploded, turning $145 million into $440 million.

Then the first roll position goal is to bet on the earnings report, so choose the same expiration date with a higher strike price call option 680, but only take out 2/3 of the profit to spindle. And the second roll position he chose to invest the entire profit of 350 million is no doubt continuing to snowball. From the perspective of the exercise price of 680 in the gambling financial report, as a prudent buyer, I do not think he will choose the depth of the price when he is a seller.

So I personally prefer the barchat, or buy view, where this trader chooses to continue to buy the call option. So I chose to sell the weekly put option.

If the trader sells the call option, contrary to what I speculate, it is not a problem, just exercise the call.

I don't know what you think about his trading, please share in the comments section.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

$NVIDIA Corp(NVDA)$