Options Spy | Apple terminated the car plan, the options market feedback positive bullish

Major indexes were mixed as Federal Reserve officials continued to signal they were in no hurry to cut interest rates and markets digested a fresh wave of retailer earnings and economic data. Apple said late in the day that it was abandoning its electric car project and would focus on AI research and development, pushing its shares up more than 0.8%.

U.S. durable goods orders fell by the most in nearly four years in January amid a sharp drop in commercial aircraft bookings, while the outlook for business investment in equipment was mixed. The next key data for investors will be Thursday's release of the Personal consumption Expenditures Index (PCE) for January, the Fed's preferred inflation measure.

$Apple (AAPL)$Apple's latest executive meeting resolution exposed to the outside, the internal official termination of the Project Titan Titan project, that is, the secret promotion of ten years of car building plan, core personnel priority transfer of generative AI project. On Tuesday, the feedback from the large Apple options transaction was positive, mainly by selling put options and buying call options: $AAPL 20240328 185.0 CALL$ $AAPL 20240301 195.0 PUT$

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Apple(AAPL)$ buy call option $AAPL 20240328 185.0 CALL$

$Microsoft(MSFT)$ sell call option $MSFT 20240322 425.0 CALL$

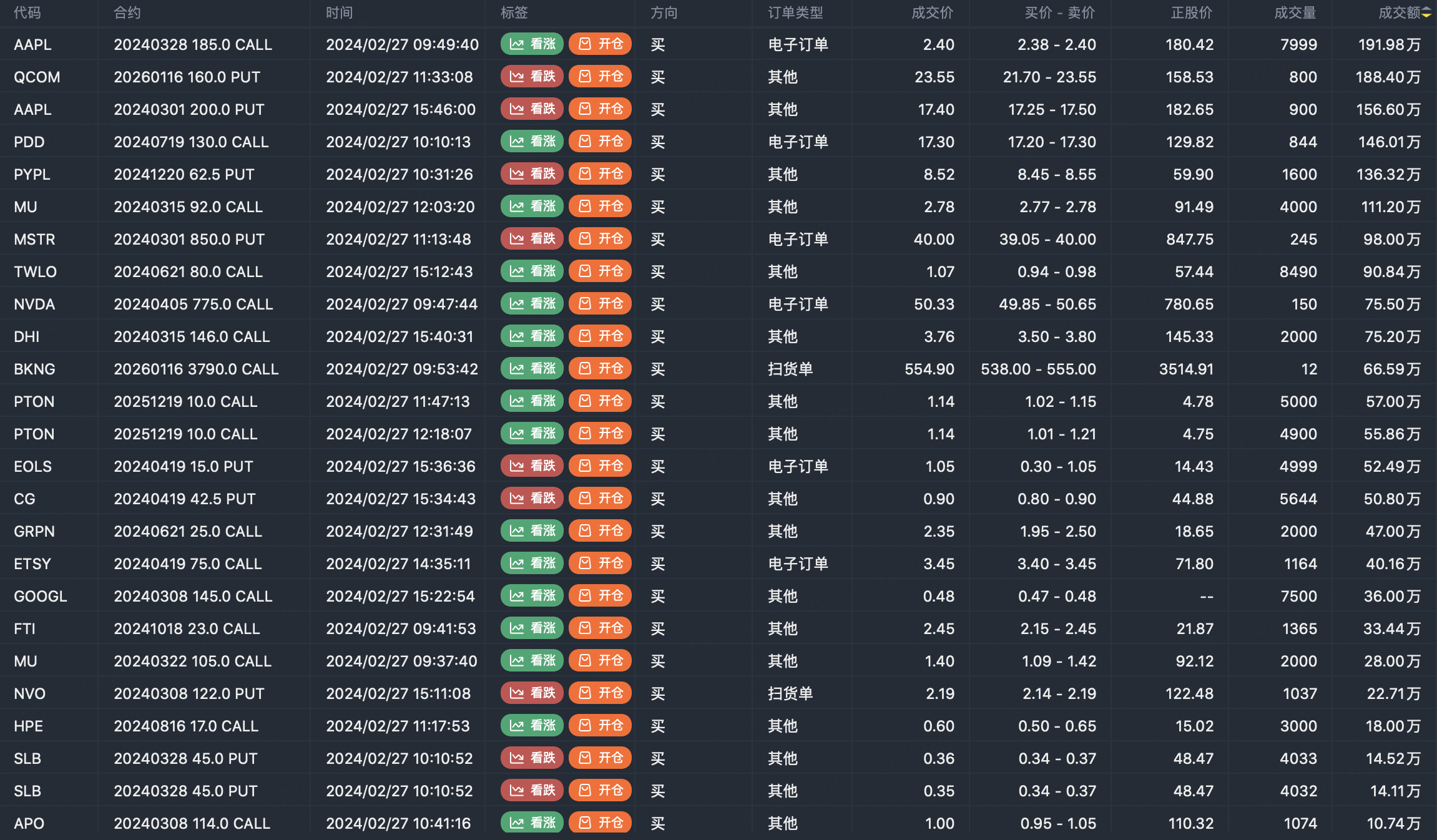

Option buyer open position (Single leg)

Buy TOP T/O:

$AAPL 20240328 185.0 CALL$ $QCOM 20260116 160.0 PUT$

Buy TOP Vol:

$AAPL 20240328 185.0 CALL$ $TWLO 20240621 80.0 CALL$

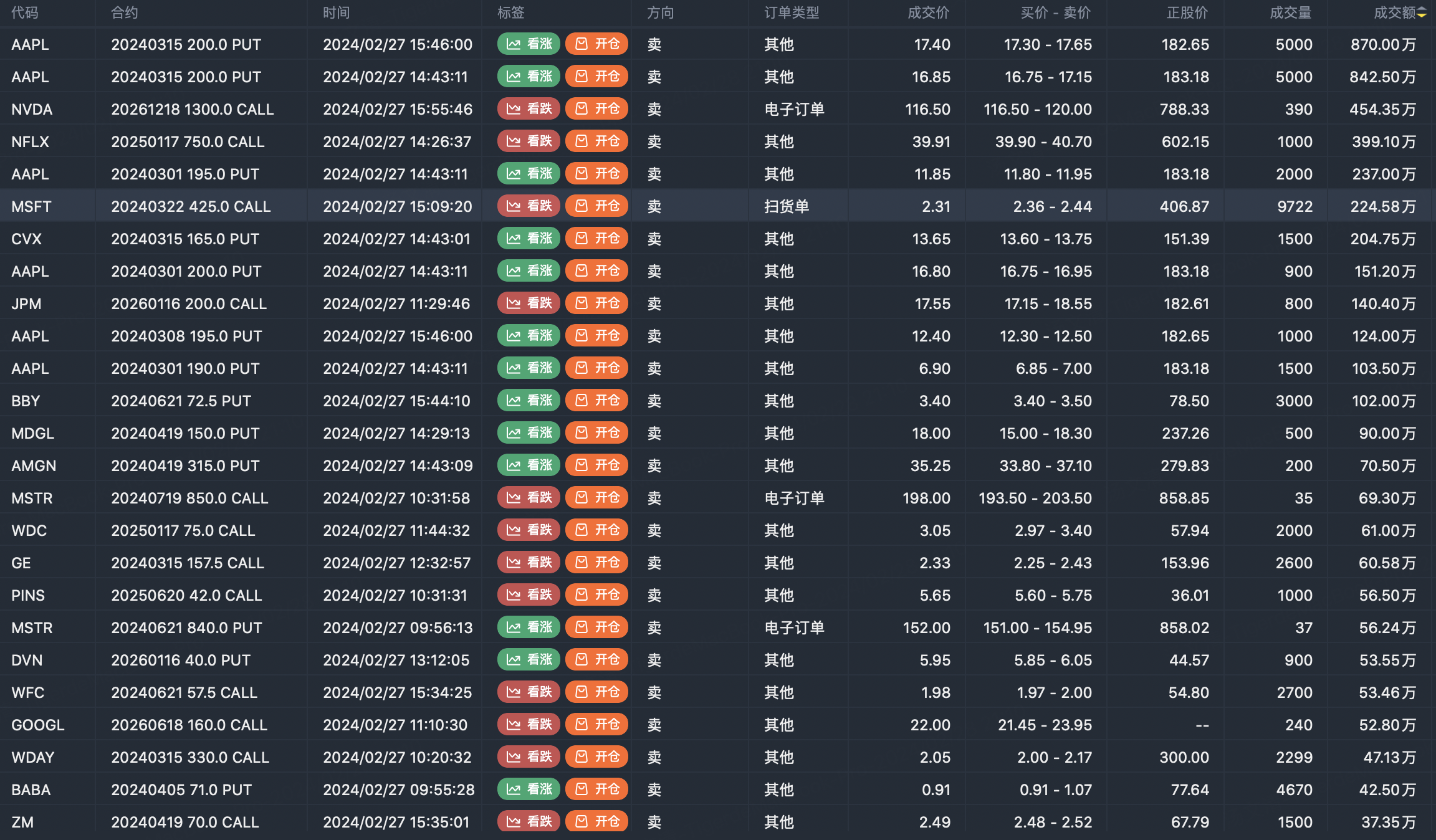

Option seller open position (Single leg)

Sell TOP T/O:

$AAPL 20240315 200.0 PUT$ $NVDA 20261218 1300.0 CALL$

Sell TOP Vol:

$MSFT 20240322 425.0 CALL$ $CVX 20240419 170.0 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

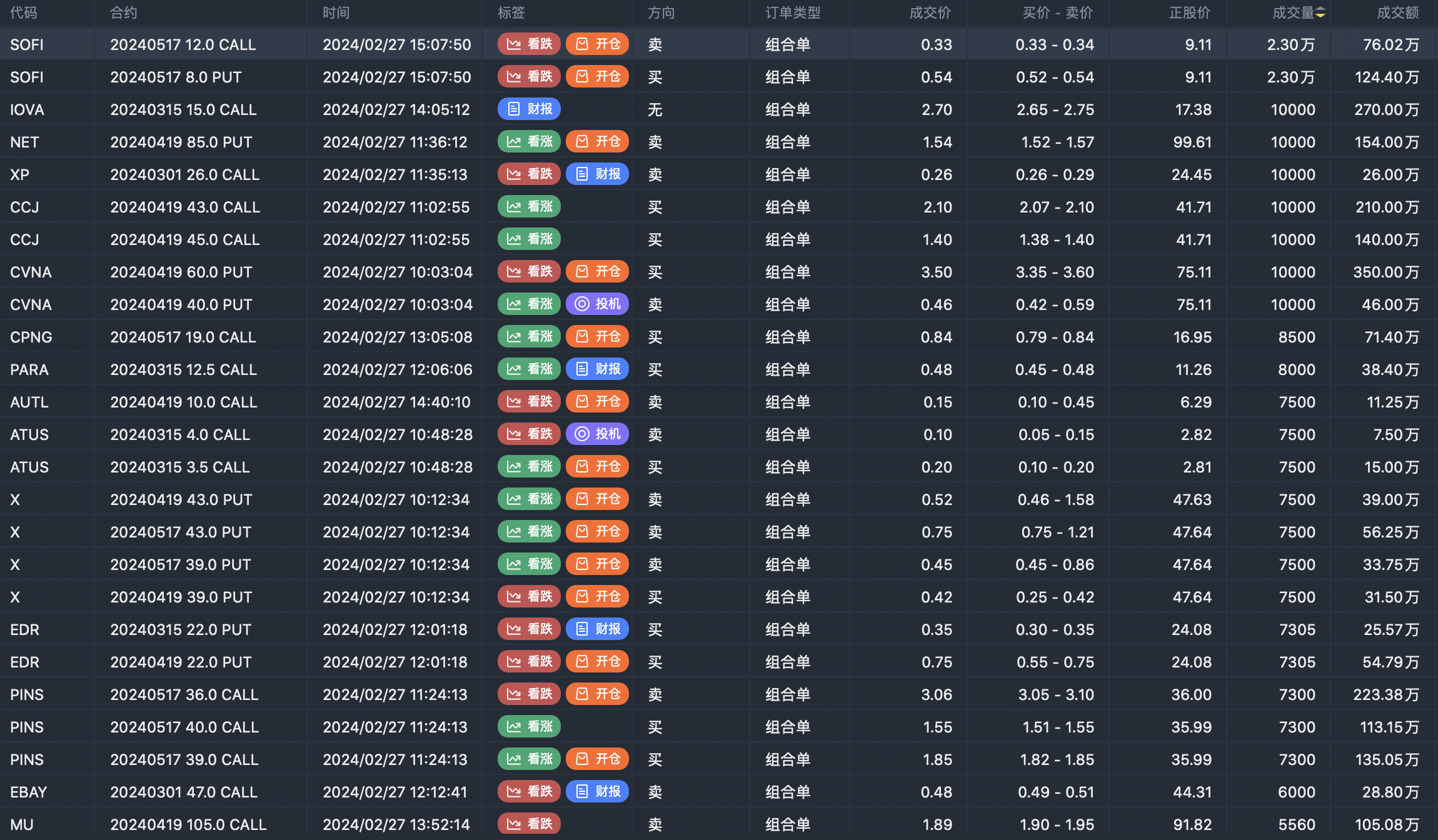

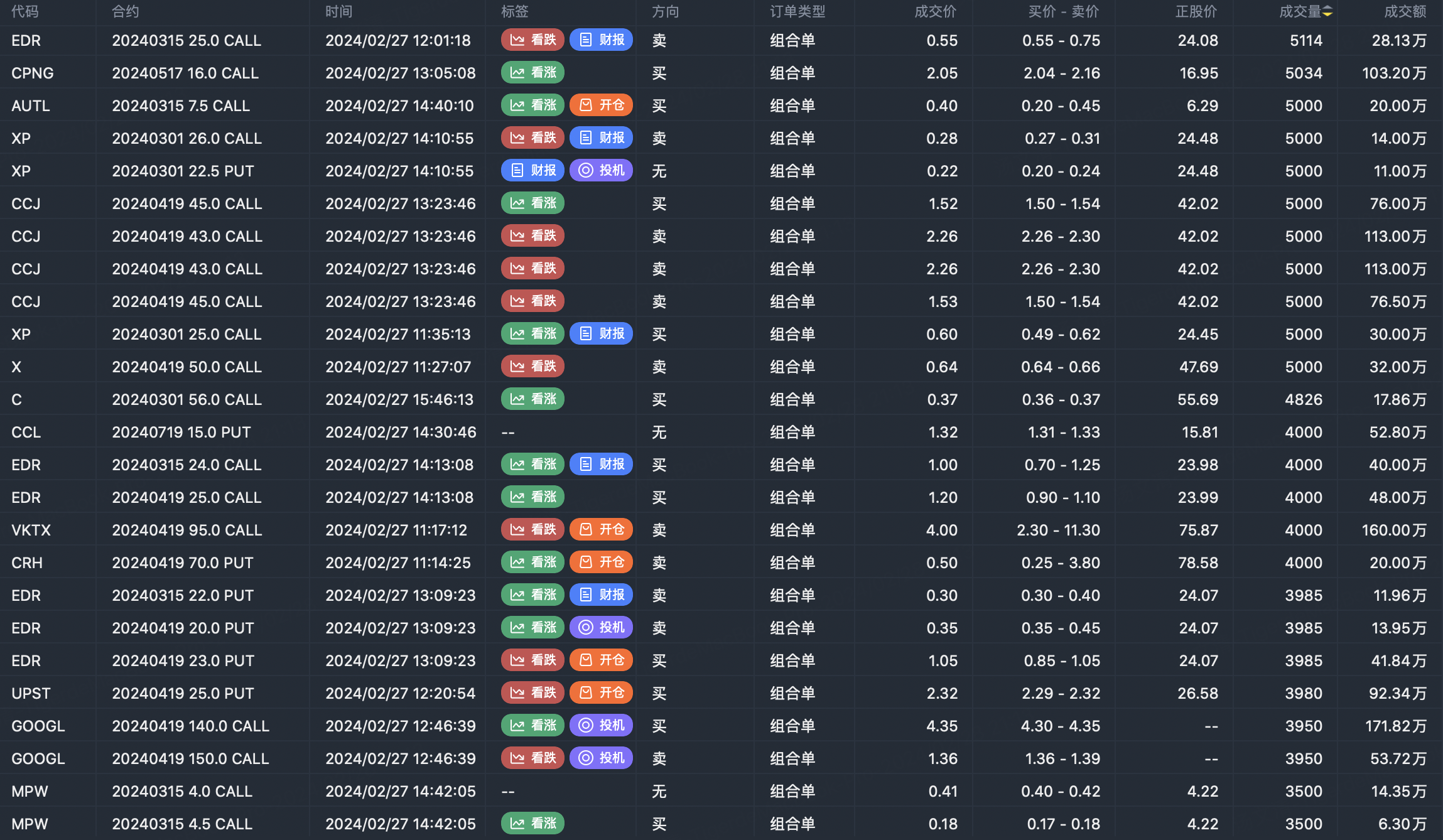

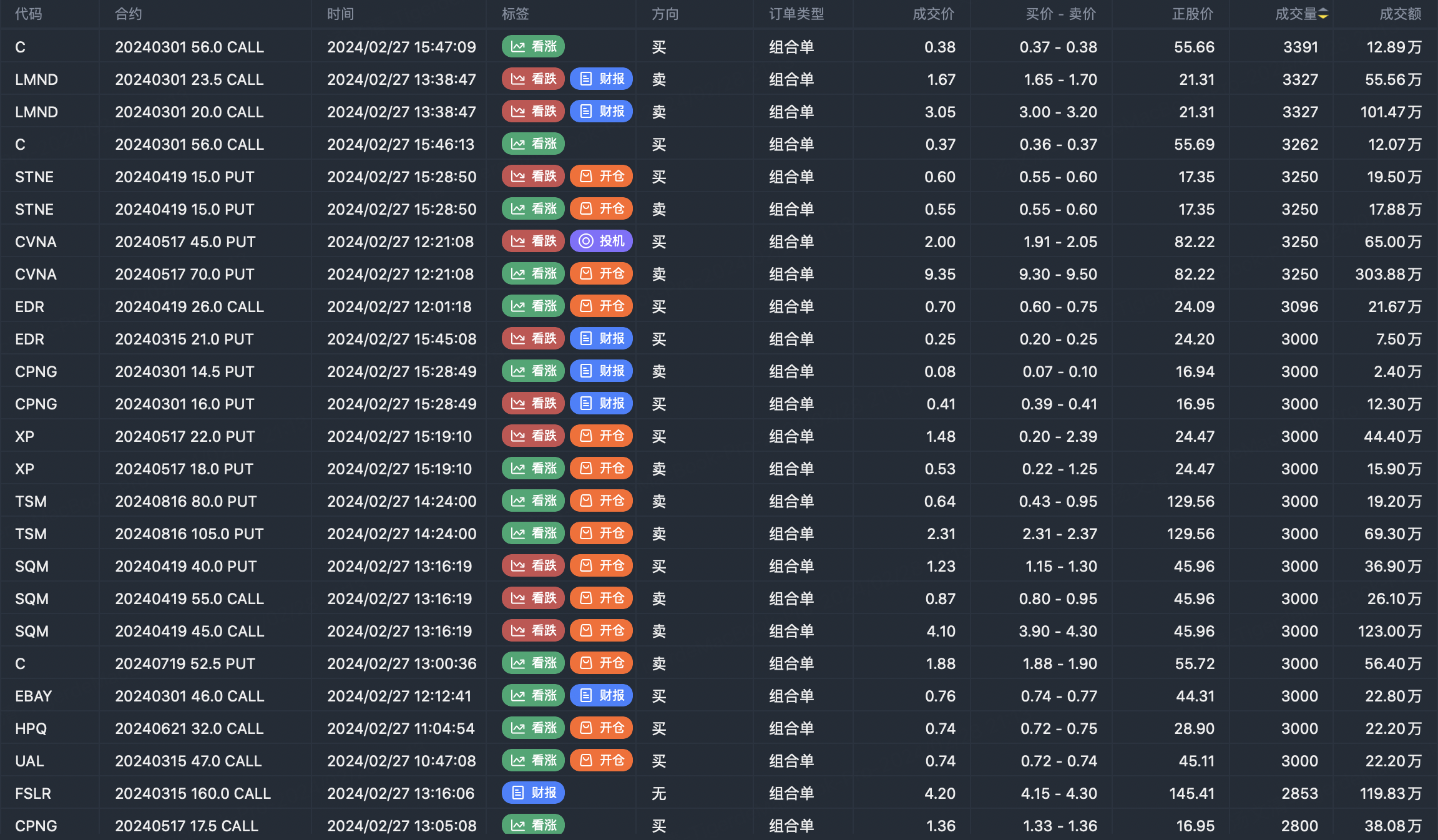

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?