Gold Seen Lower Ahead of U.S. PCE Inflation Data,What To Watch Tonight?

According to CME "Federal Reserve Observation", the probability of the Fed keeping interest rates unchanged in the range of 5.25%-5.50% in March is 97.5%, and the probability of cutting interest rates by 25 basis points is 2.5%. By May, the probability of keeping interest rates unchanged is 82.2%, the probability of cutting interest rates by 25 basis points is 17.4%, and the probability of cutting interest rates by 50 basis points is 0.4%.

As can be seen from the above figure, the current price of the futures market has expected that the Fed will stay put in March and May, and the time node when it is more likely to cut interest rates will be postponed until June this year,It is basically consistent with the expectations that the Fed wanted to guide before.

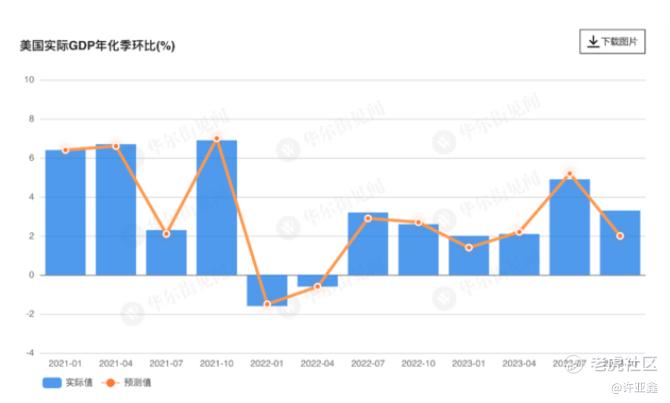

On February 28th, at 21:30 Beijing time, the data released by the US Department of Commerce showed that the annualized quarter-on-quarter revised value of US GDP in the fourth quarter was revised down to 3.2%, which was less than the expected 3.3%.

The above data makes the US economy grow at an annualized rate of 2.5% in 2023,It beat Wall Street's expectations at the beginning of the year and was 1.9% in 2022.

In addition, the price index of personal consumption expenditure in the fourth quarter was revised up to 3% annualized quarter-on-quarter, exceeding the expected 2.7%, with an initial value of 2.8%.

Although GDP data is a lagging indicator of the economy, the above data is still superficial. The resilience of US economic growth and the stubbornness of inflation are actually why the Federal Reserve is not eager to start cutting interest rates in March as expected by the market.

As shown in the above figure, the gold daily line is still in a state of shock. Although the trend is still stable, the high and low points in the past two months are showing a slow decline as a whole.

Volatility began to converge in the last three trading days, which can be seen from the box area, and it is generally within the amplitude range of the K-line on February 23rd.

Tonight at 21:30 Beijing time, the United States will release the core PCE data for January, and gold will soon face an important change window tomorrow. Once the change is successful, it means that the next fluctuating short target will go to refresh the $1984/oz!

-END-

$NQ100 Index Main Connection 2312 (NQmain) $$SP500 Index Main Connection 2312 (ESmain) $$Dow Jones Main Connection 2312 (YMmain) $$Gold Main Connection 2312 (GCmain) $$A50 Index Main Connection 2403 (CNmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.