Interview with TigerOptions | Profited 90% From TQQQ! Why He Adds GOOG Right Now?

Hi Tigers,

Welcome to our Interview with @TigerOptions

Passionate about options trading, he has achieved good returns through various option strategies.

During the bear market in 2022, he bottomed $Nasdaq100 Bull 3X ETF(TQQQ)$ , yielding over a 90% return.

Currently, he is optimistic about $Alphabet(GOOG)$ , believing its search capability remains strong even in the AI-dominated market.

With the current stock price relatively reasonable, he sees it as a good opportunity to add $Alphabet(GOOGL)$ .

1. Can you introduce yourself?

Hello, I'm TigerOptions.

I'm 28 years old and currently working as an import manager, mainly responsible for managing affairs related to supply chain and procurement.

My hobbies include reading, traveling, and outdoor activities. I enjoy challenging myself, such as trying thrilling activities like skydiving from 14,000 ft. (about 4267 meters)

2. Can you share your investment background and stories?

I started investing during the covid when I developed a keen interest in the financial markets. I've been investing for four years, mainly in stocks and options markets.

I consider myself a medium to long-term value investor, focusing more on fundamental company analysis and long-term growth potential.

I prefer options trading because it offers flexibility and potential high returns. Options allow me to seek opportunities in market fluctuations and manage risks and profits through different strategies, leaning more towards arbitrage and hedging.

3. What are your frequently used option strategies?

I frequently use strategies like covered calls, cash-secured puts, straddles, and strangles.

For example, recently, I profited from $Alibaba(BABA)$ using the cash-secured put strategy.

I sold the put option with strike price of $75 and bought it back when the stock price rose to $77, earning income from the option premium.

Another example is the strangle option strategy on $Utilities Select Sector SPDR Fund(XLU)$ .

I sold a combination of $63 strike call and $58 strike put options. I chose this strangle strategy because I anticipated XLU's price to fluctuate within a certain range in the near future. By selling both high strike call and low strike put options simultaneously, I could collect two premiums.

Even if XLU's price fluctuates within a certain range, I can still maintain profitability before the expiration date.

4. You often perform technical analysis on stocks in your articles. What indicators do you frequently use?

I believe technical analysis plays a crucial role in investment decisions, although it's not a panacea. Accuracy often depends on market conditions and selected indicators.

I often focus on monitoring indicators like MA(moving averages), RSI, and MACD. I use technical analysis results to determine whether to close options trades early to optimize investment outcomes. Both trades mentioned earlier were made after careful technical analysis.

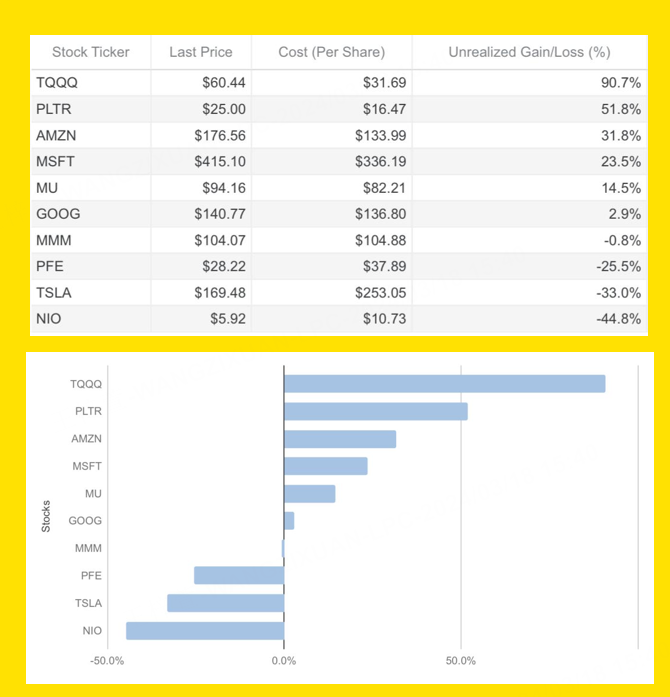

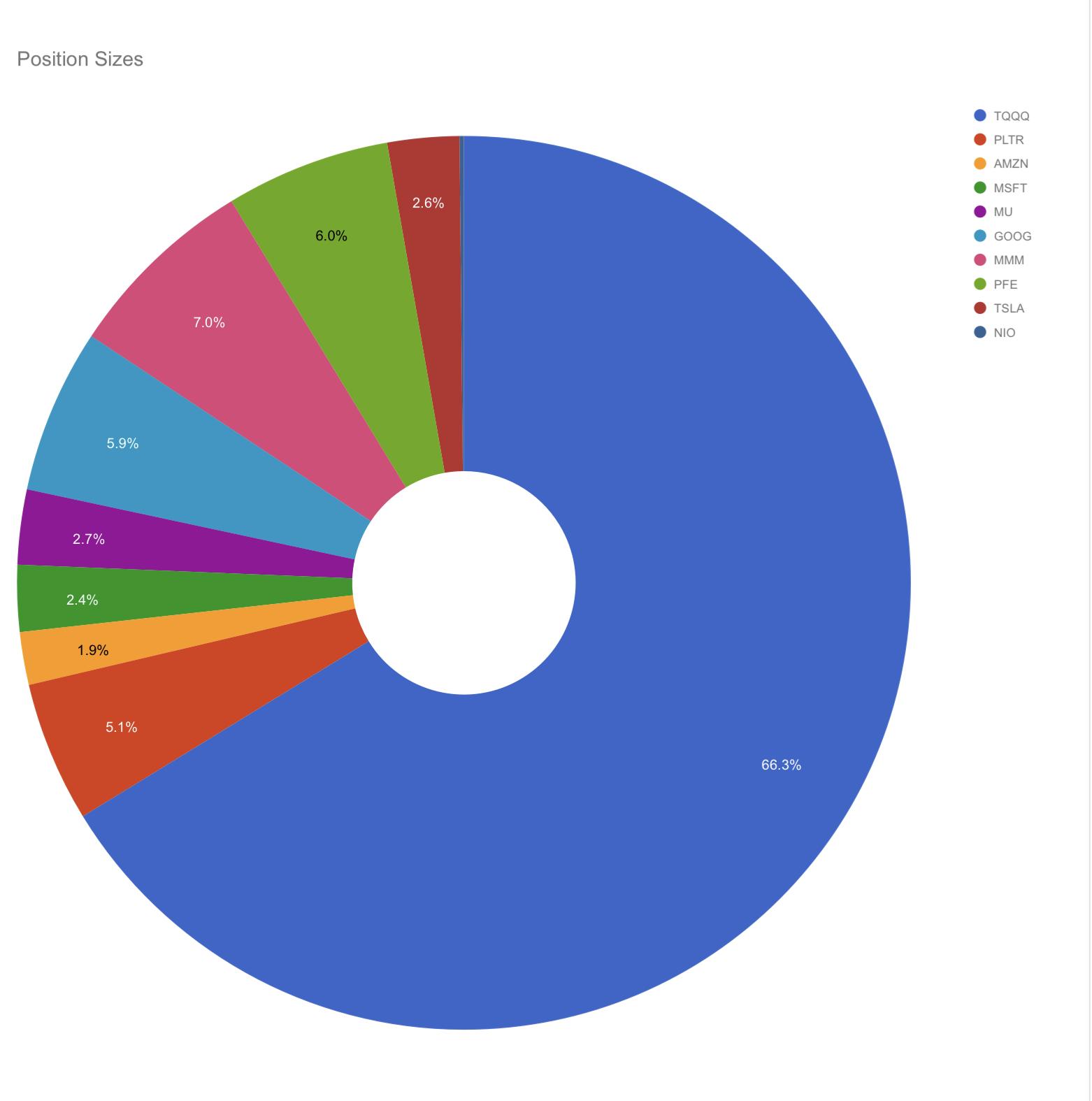

5. What is your current portfolio situation? Which stocks and sectors have you been paying attention to recently?

My current portfolio remains stable, with a year-to-date return of 12.77%.

It mainly consists of high-quality stocks with long-term growth potential, with appropriate trading adjustments when necessary.

Recently, I adjusted my investment portfolio by increasing $Alphabet(GOOG)$ from 2.6% to the current 5.9%. I believe Google still holds a strong market position in the search field despite competitors utilizing AI to seize the market. With the current stock price relatively reasonable, I see it as an appropriate time to increase holdings.

6. What was your most successful trade?

My most successful trade was buying $Nasdaq100 Bull 3X ETF(TQQQ)$ during the 2022 bear market.

Through in-depth market analysis and a solid understanding of TQQQ's potential value, I gradually built up my position in TQQQ, which currently occupies 66% of my investment portfolio. So far, this trade has yielded approximately a 90% return.

7. How do you view the market trends in 2024?

I'm optimistic about the market trends in 2024. I believe global economic recovery and technological innovation will continue to drive stock market growth. However, I also see some uncertainties in the market, such as inflation and geopolitical tensions, which require close monitoring.

8. Any final words for other tigers?

Investing is a journey full of challenges and opportunities.

The key is to stay calm and patient, seek opportunities amidst fluctuations, and continuously learn and grow amidst challenges.

I wish everyone a fruitful year of investment, achieving financial freedom, and I also hope everyone stays healthy, happy, and successful in all endeavors!

Welcome to leave comments and interact in the comment section!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Can you advise a beginner like me how to pick up Technical Analysis skills? Did you take a course or learn from actual trading?

Many thanks @TigerClub for featuring @TigerOptions so that we can all learn from his knowledge and expertise. 😍😍😍

Great article, would you like to share it?

Great article, would you like to share it?