Options Spy | Bearish Pressure Persists on S&P 500

With markets still cautious about the pace of the Fed's rate cut schedule this year and when it will be able to achieve its 2 percent inflation target, Treasury rates surged on Monday and major U.S. stock indexes were mixed. Trump Media plunged after reporting losses last year. Microsoft snapped a five-game losing streak. Micron is up more than 5%. Alphabet hits record high. Overall, investors remain cautiously bearish on the S&P 500 future market, but individual bullish forces have not completely left the field. There may be profit-taking in technology stocks.

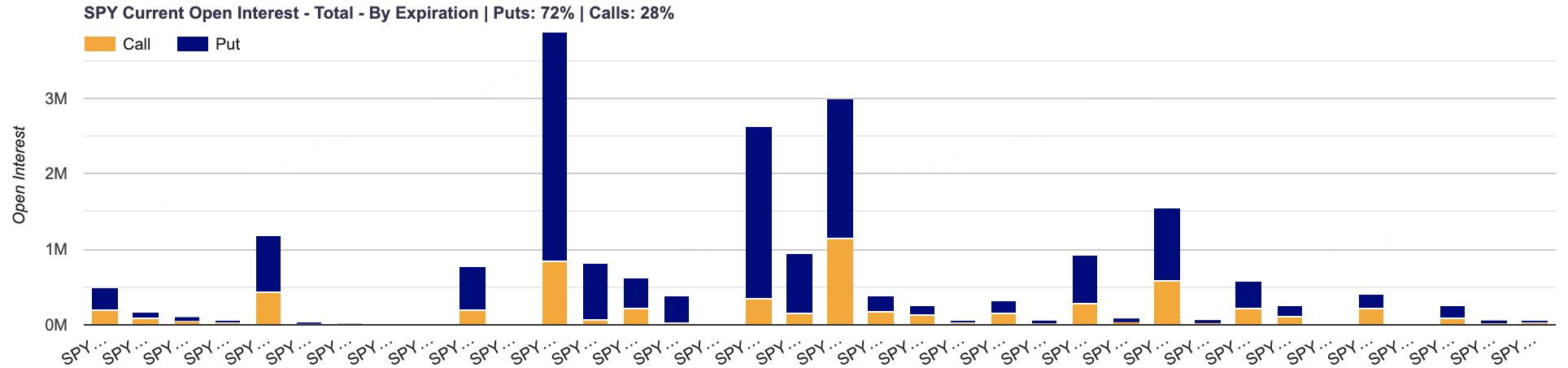

Overall volume of S&P 500 options shows that bearish sentiment prevails. Put open interest continues to grow, far outpacing call options.

The second new call is the April 19 585 forward call, which is mainly a buy open position, suggesting some expectation of a 12 percent rise in the S&P 500 in about three weeks.

However, the important trading direction of the intra-500 call option expiring on April 17 is sell, which forms a combination option with the put option at the same price.

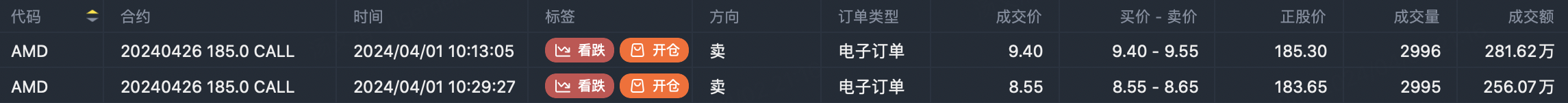

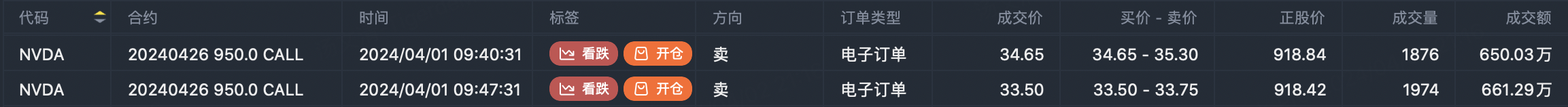

Semiconductor stocks Nvidia and AMD saw large selling calls, 950 and 185 calls expiring on April 26, respectively.

Details:

SPY Option Evaluation Shows Bearish Trading Intentions, Put Open Interest Continues Growing, Far Exceeding Calls

The top new call opener was the deep in-the-money $SPY 20240621 430.0 CALL$ with a 430 strike price expiring on June 21st, seeing 43,000 new openings. The top new put opener was the $SPY 20240621 430.0 PUT$ with the same 430 strike and June 21st expiry, seeing 41,000 new openings. Both were predominantly traded as option combinations.

The second new call opener was the $SPY 20240419 585.0 CALL$ , mainly buy-to-open orders. Calculated from the closing price of 523.07, it implies expectations of a 12% rise in the S&P 500 over the next three weeks. The third new call opener, $SPY 20240419 530.0 CALL$ , was also predominantly buy-to-open.

However, the fourth new call opener, the in-the-money $SPY 20240517 500.0 CALL$ , had a significant sell-to-open direction, together with the second new put opener $SPY 20240517 500.0 PUT$ as an option combination trade. The second put opener was mainly buy-to-open.

Large sell-to-open orders were seen in call options for semiconductor companies AMD and Nvidia : $AMD 20240426 185.0 CALL$ $NVDA 20240426 950.0 CALL$ , both expiring on April 26th.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?

Great article, would you like to share it?

Great article, would you like to share it?

Good