Why is the Fed not cutting rates & talking about hiking them this year?(2)

2."Is US Inflation Making a Comeback?"

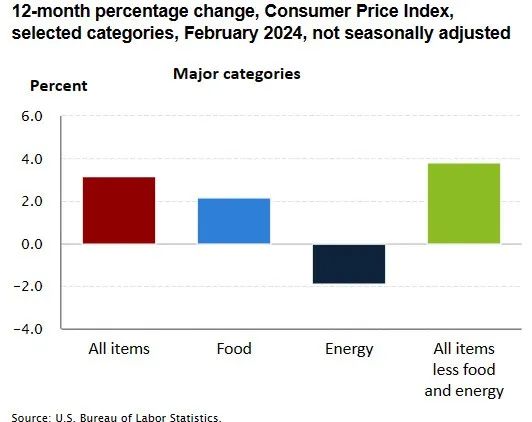

Certainly, the biggest variable regarding interest rate cuts is inflation. This year's inflation data has put the Federal Reserve in a somewhat awkward position.

Firstly, energy prices have been steadily rising. Crude oil prices have reached $86, noticeably impacting Americans at the gas station.

Gold prices have recently surged, breaking the $2300 mark and hitting historic highs, signaling market expectations of further inflation. While the Fed may attribute the rise in oil prices to Middle East tensions, financial markets find this hard to accept.

Looking at the real estate market, the overall US housing market price index has risen by about 4% this year, and rents have increased. Consequently, the equivalent rent weight within the CPI is bound to continue rising.

According to the US Bureau of Labor Statistics' Consumer Price Index, overall prices rose by 3.2% year-on-year in February, slightly higher than January's 3.1%. On a monthly basis, after a 0.3% increase in costs last month, they rose by 0.4% this month. Apart from rent hikes, transportation costs for US residents surged by 9.9% in February, likely due to significant increases in subway, bus, and airfare prices.

3. "US Labor Market Woes"

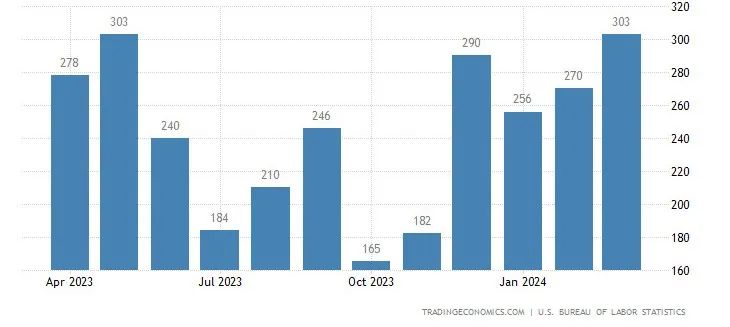

One of the Federal Reserve's three statutory responsibilities is full employment. This means that only when unemployment is high does the Fed cut rates to stimulate the economy, fulfilling its statutory duties. In recent months, US employment data has looked very impressive, especially with March's addition of 300,000 jobs, far exceeding the expected 200,000.

However, as Americans say, "Peel back the onion and see what's inside?"

The real employment situation in the US is far from as simple and optimistic as "adding 300,000." The main additions among the 300,000 are 80,000 jobs in "healthcare and social assistance," 70,000 in "federal, state, and local government" roles, and 40,000 in "construction." These are relatively low-paying sectors. Employment in the high-paying sectors of finance, manufacturing, and technology has all seen net decreases. With artificial intelligence technology being widely deployed in the US, it has already led to mass layoffs in professions such as programming and financial services. It's worth noting that in March, part-time jobs in the US grew by 600,000, while full-time jobs actually decreased by 300,000. This means that as artificial intelligence develops, more and more companies are laying off employees and hiring temporary workers.

For the Fed, the soul-searching question is, "Are Americans working a lot of part-time jobs?" Does this count as full employment? Should interest rates be lowered to increase full-time job positions?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.