Middle East Turmoil, Retail Data Weigh on U.S. Stocks, Call Options Poised for Rebound

The Middle East unrest and stronger-than-expected retail sales data weakened expectations for Fed rate cuts, causing the VIX fear gauge to surge, and stocks continued to fall on Monday (15th). The Dow Jones fell for the sixth consecutive trading day, with the S&P 500 index and Nasdaq both closing below their 50-day moving averages.

The S&P 500 index options market overall had a slightly bullish sentiment. The number of call options held increased rapidly, but put option open interest remained above the one-year average level. The most favored new call options were the September expiry 600 strike calls, reflecting investors' expectations that the S&P 500 index will rise nearly 19%. For put options, investors used a spread strategy, expecting the S&P 500 index to fall no more than 4.3% by May 17th.

The Nasdaq 100 index options market was slightly bearish, with the number of call options held increasing but still below the one-year average. The most popular new call options were the June expiry 530 strike calls, reflecting optimism for a 22% rise in the Nasdaq. For put options, investors adopted a combo strategy, expecting the Nasdaq to fall no more than 2.5% by April 19th.

Details:

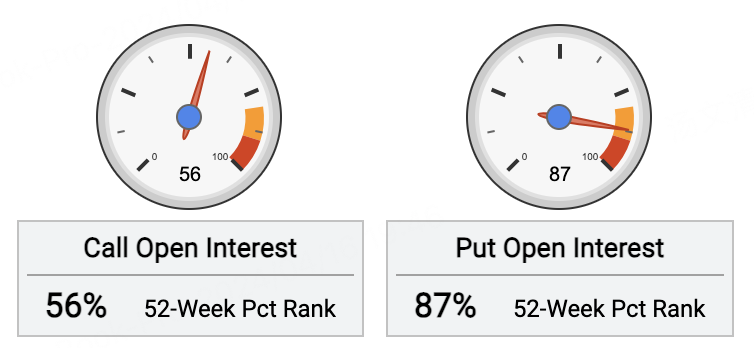

The $SPDR S&P 500 ETF Trust(SPY)$ options overall showed a slightly bullish trading sentiment, with sellers of put options dominating. Open interest in call options grew rapidly, while open put contracts remained above the 52-week average.

SPY Call Open Interest: The open interest in SPY call options increased by 2.9% to 6.9 million contracts. Furthermore, call open interest is up 10.8% in the last 5 days. Compared to its 52-week average of 6.8 million contracts, the current call open interest for SPY is stronger than usual.

SPY Put Open Interest: The open interest in SPY put options has grown by 0.7% to 15.2 million contracts. Furthermore, put open interest has risen 0.5% in the last 5 days. Compared to its 52-week average of 13.9 million contracts, the current put open interest for SPY is higher than usual.

For call options, investors bought the most new $SPY 20240920 600.0 CALL$ s, with the 600 strike price expiring on September 20th, adding 34,000 contracts, indicating that major buyers expect the S&P 500 index to rise about 19% by September 20th.

The most newly bought put option was the $SPY 20240517 480.0 PUT$ , with a 480 strike expiring May 17th, adding 30,000 contracts. However, at the same time, some investors also sold the 482 strike put option, which is a spread strategy, implying an expectation that the S&P 500 index will fall no more than 4.3% by May 17th.

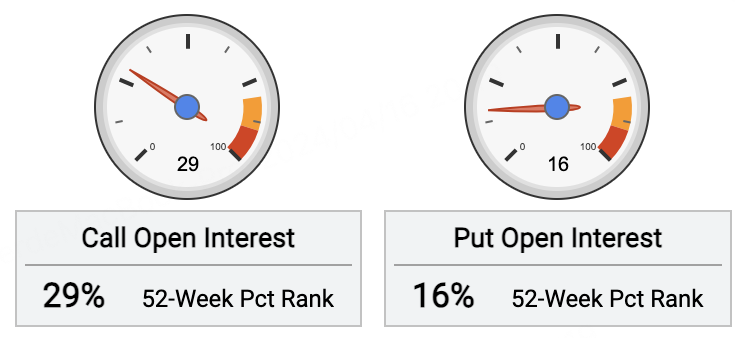

The $Invesco QQQ Trust-ETF(QQQ)$ options overall showed a slightly bearish trading sentiment, with sellers of put options dominating. Open interest in call options grew rapidly.

QQQ Call Open Interest: The open interest in QQQ call options increased by 4.4% to 4.0 million contracts. Furthermore, call open interest is up 10.6% in the last 5 days. Compared to its 52-week average of 4.3 million contracts, the current call open interest for QQQ is weaker than usual.

QQQ Put Open Interest: The open interest in QQQ put options has grown by 3.1% to 6.8 million contracts. Furthermore, put open interest has risen 2.4% in the last 5 days. Compared to its 52-week average of 8.2 million contracts, the current put open interest for QQQ is lower than usual.

For call options, investors bought the most new $QQQ 20240621 530.0 CALL$ , with the 530 strike expiring June 21st, adding 9,880 contracts, indicating expectations for the Nasdaq to rise about 22% by June 21st.

For put options, investors bought the most new $QQQ 20240426 415.0 PUT$ , with the 415 strike expiring April 26th, adding 51,000 contracts, but at the same time, some investors also bought the $QQQ 20240419 420.0 PUT$ with a 420 strike expiring April 19th, which is a combo strategy, implying an expectation that the Nasdaq will fall no more than 2.5% by April 19th.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- feelond·04-16👍LikeReport