Market Risks Priced In, May Decline Expected to Narrow to 3%

Fading rate cut hopes and geopolitical uncertainties fueled a sell-off in large tech stocks, leading to a Black Friday for US stocks. The S&P 500 broke below the 4,000 level. The Nasdaq saw its sixth consecutive day of declines, the longest losing streak in over a year. American Express lifted the Dow Jones to close higher.

Options market data showed expectations for a narrowing decline in the S&P 500, with a drop of less than 4.4% expected by May 17th. For QQQ, the expected decline narrowed, with a 2.1% drop projected by May 17th. For small-caps, Russell 2000 options implied a tightening range, with a 1.5% decline and 6.7% upside cap expected for May.

Details:

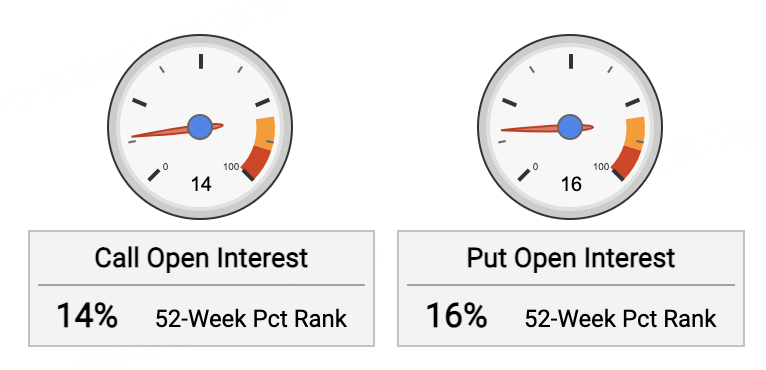

The $SPDR S&P 500 ETF Trust(SPY)$ options overall showed a slightly bullish trading sentiment, with sellers of put options dominating. Open call interest declined -7.1% over the past 5 days. Open put contracts fell -18.1% over 5 days.

For call options, investors bought the most new $SPY 20240503 510.0 CALL$ , with a 510 strike expiring May 3, adding 37,000 contracts, suggesting expectations for SPY to trade above $510 by May 3, a 3% two-week rally.

For put options, investors sold the most $SPY 20240517 473.0 PUT$ while buying the $SPY 20240517 471.0 PUT$ , forming a put spread expecting the S&P 500 ETF to decline less than 4.4% by May 17.

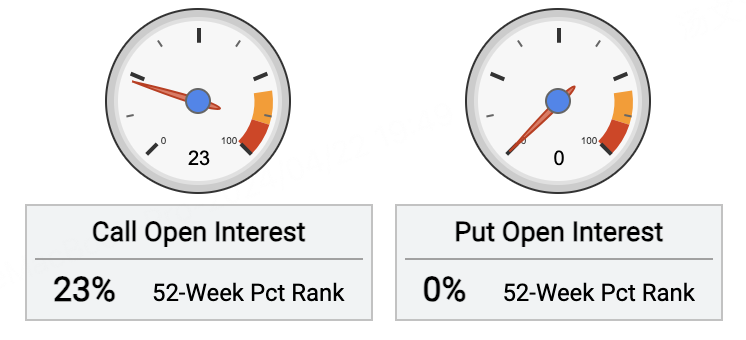

The $Invesco QQQ(QQQ)$ options overall showed a bearish trading sentiment, with buyers of put options dominating. Open call interest declined -0.3% over the past 5 days. Open put contracts fell -10.3% over 5 days.

For call options, investors bought the most new $QQQ 20240426 430.0 CALL$ , with a 430 strike expiring April 26, adding 32,000 contracts, suggesting expectations for QQQ to rally about 3.8% this week.

For put options, investors sold the most new $QQQ 20240426 400.0 PUT$ , with a 400 strike expiring April 26, adding 55,000 contracts, implying expectations for QQQ to fall 3.3% this week. The $QQQ 20240517 405.0 PUT$ expiring May 17 added 32,000 contracts, suggesting QQQ is expected to drop 2.1% by mid-May.

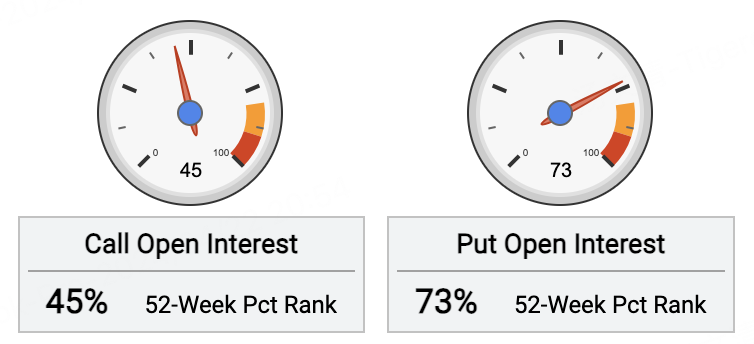

The Russell 2000 ETF (IWM) options overall showed bullish trading sentiment, with buyers of put options dominating. Open call interest declined -15.2% over the past 5 days, while open put contracts fell -6.5% over the same period.

For call options, investors sold the most IWM 20240503 216.0 CALLs combined with $IWM 20240503 206.0 CALL$ , forming a call spread capping potential upside at 6.7% by May 3.

For put options, investors heavily sold the $IWM 20240517 180.0 PUT$ with a 180 strike expiring May 17, adding 51,000 contracts. Combined with $IWM 20240517 190.0 PUT$ , this put spread suggests expectations for IWM to drop 1.5% by mid-May.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?

Great article, would you like to share it?

Great article, would you like to share it?

Great article, would you like to share it?