Bullish Stance for May, Small Caps See Amplified Volatility

Investors awaited Nvidia's latest earnings report, as well as the release of the Federal Reserve's latest policy meeting minutes later this week, which could test whether last week's record rally in stocks has legs to continue after April's meeting hinted at a hawkish pivot.

Options market data pointed to a bullish view on the S&P 500 for May, with expectations for the index to hold above 520. Upside remained priced in for QQQ, with a 1.7% rally anticipated by May 24 expiration. For small-caps, bullish flows persisted in the Russell 2000, pricing in an 8% rally by July.

Details:

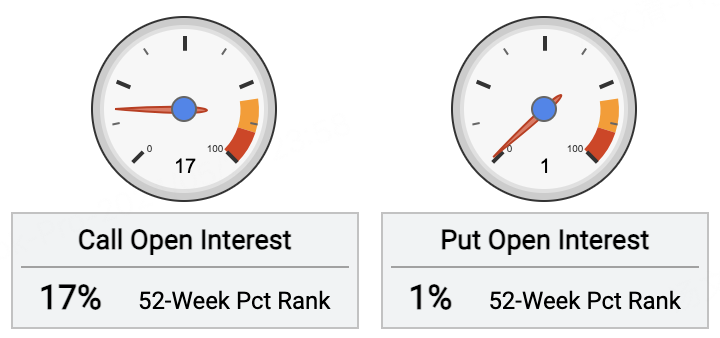

The $SPDR S&P 500 ETF Trust(SPY)$ saw open call interest decline -9.0% over the past 5 days. Open put contracts fell -19.0% over the same period.

For call options, the most actively traded was the $SPY 20240520 531.0 CALL$ with a 531 strike, adding 9,325 contracts.

For put options, investors sold the most $SPY 20240531 520.0 PUT$ with a 520 strike, adding 30,000 contracts. This implies expectations for SPY to hold above 520 by May 31 expiration.

The $Invesco QQQ(QQQ)$ saw open call interest drop -16.3% over the past 5 days. Open put contracts declined -14.9% over the same period.

For call options, investors bought the most $QQQ 20240524 460.0 CALL$ with a 460 strike, adding 21,000 contracts. This suggests expectations for a 1.7% rally in QQQ by May 24 expiration.

For put options, investors sold the most $QQQ 20240621 450.0 PUT$ with a 450 strike, adding 18,000 contracts. This signals expectations for QQQ to remain above 450 by June 21 expiration.

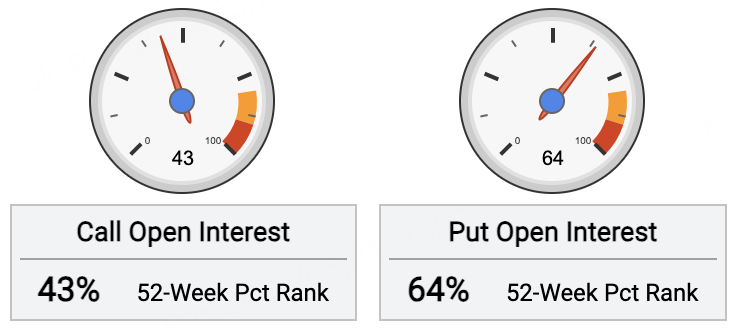

The $iShares Russell 2000 ETF(IWM)$ saw open call interest fall -14.6% over the past 5 days, while open put contracts declined -16.2% over the same period.

For call options, the most actively traded was the $IWM 20250117 260.0 CALL$ with a 260 strike, adding 18,000 contracts.

For put options, investors bought heavily into the $IWM 20240719 198.0 PUT$ with a 198 strike, adding 28,000 contracts. This implies expectations for a 4.8% decline in IWM by July 19 expiration.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?

Great article, would you like to share it?