Count Dell's pump&dump on Manegement Team!

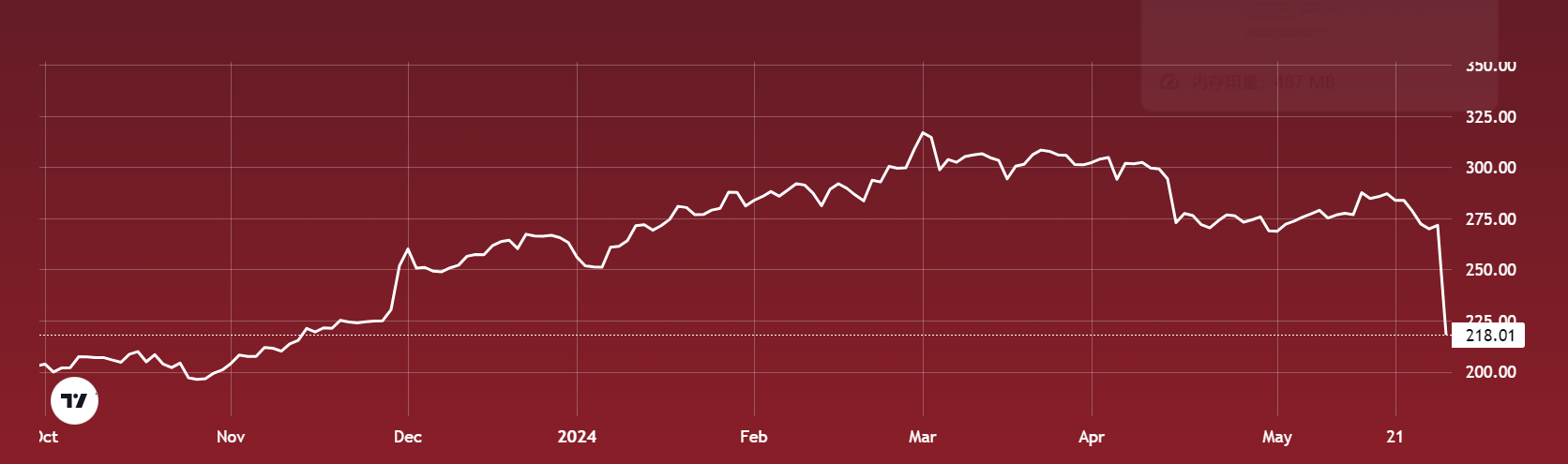

Formerly $Salesforce.com(CRM)$ eighteen years First quarterly Miss, sparking market speculation of AI cloud demand saturation, after-hours on May 30 $Dell Technologies Inc.(DELL)$ also followed the plunge by not quite meeting investors' high expectations.$dell

The same is, both riding the wind of AI, by investors reported great enthusiasm, in just six months have considerable gains, but also therefore was racked on the "high above the cold" expectations.

The difference is that Salesforce is not keeping up on the revenue end, and is properly exceeding expectations on the profit and cash flow end, whereas Dell is strong on revenue as expected, but slightly weaker on earnings than the market expects, and the roots of the two are very different.

The difference is that Salesforce is not keeping up on the revenue end, and is properly exceeding expectations on the profit and cash flow end, whereas Dell is strong on revenue as expected, but slightly weaker on earnings than the market expects, and the roots of the two are very different.

But management has no excuse for this earnings report causing the market to plummet so much.

Dell is full of the "bloat" of an old tech company, with far less operational flexibility than other tech giants. It's Dell that needs an activist investor;

Salesforce is indeed an excellent case study in this regard, with activist investors such as Starboard Value, ValueAct Capital, Third Point, Elliott Investment Management, and others coming into Salesforce in 2022 with a strong push to change it so that its margins and cash flow have since taken a qualitative leap forward.

Poor management of market expectations, Could have announced guidance in the earnings report, but only put it on the call, let the market once think "can not give guidance" and panic.

Dell Investment Highlights

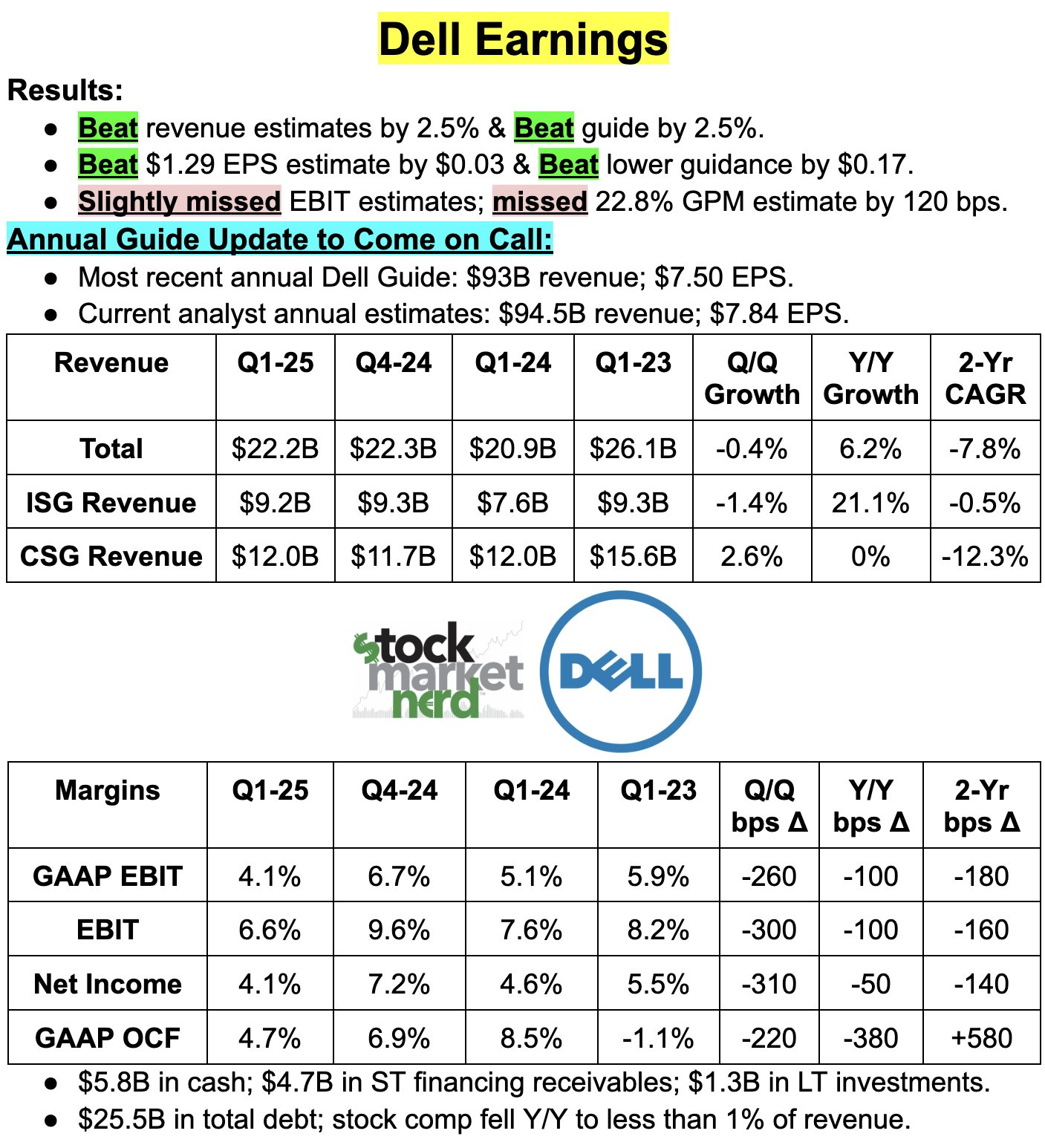

Impeccable on the revenue side. strong momentum in the AI server space with server backlog of $3.8 billion, up 30% QoQ. Overall revenue was up 6% YoY for the first time since 2022 and beat already elevated market expectations;

The pressure on the profit side exceeded market expectations. Increasing revenue without giving away profits includes two aspects: not being able to press upstream and not being able to manage expenses.

Gross margins are starting to fall short of expectations. Inflation starts in 2022, and management is still mentioning rising transportation and logistics costs in 2024, so it's a question of competence. It is also true that memory and storage costs have risen, but the problem is that raw material inventories have not been managed accordingly;

Operating margins were also weaker than expected, the company's labor costs, which were over-invested in employee compensation, and also the strong U.S. dollar caused some pressure on the exchange rate.

In terms of expectations, management did not announce guidance in Earnings, but it was announced on the call.

FY25 full year

Revenues of $93.5 billion-$97.5 billion, median $95.5 billion, were above market expectations of $94.3 billion, with overall growth expected to be 11%.

The ISG business, which is most closely related to AI, is expected to grow 20%, slightly below the market's expected growth rate of 20.3%;

Gross margin is expected to decline by 150bps and operating profit is expected to decline by a single digit year-over-year; EPS is expected to be $7.65 (±0.25), which is below the market's expectation of $7.70.

25Q2

Revenues of $23.5 billion-$24.5 billion, median $24 billion, beat market expectations of $23.2 billion;

ISG business growth is expected to be around 25%, higher than the market expectation of 19%;

Operating profit is expected to be -3% year-on-year, compared to the market's expectation of -3.94

EPS is expected to be $1.65 (±0.1), below market expectations while $1.79.

It's a clear increase in revenue not profit.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- twixzy·2024-05-31#StockAnalysisLikeReport