GME: Posturing Exposed, Time for Shorts to Enter Orderly

TL;DR: Tonight Kittey will stream and pump GME. Recommend selling once it hits $60.

On Thursday June 6th, during trading hours, Roaring Kittey announced a YouTube stream for Friday, causing GME to spike 49% and close at $47, reaching $66.98 after-hours.

Regarding the stream topic, Kittey claimed he's betting everyone will join in. Undoubtedly, GME's price must rise during the broadcast.

A Bucket of Cold Water

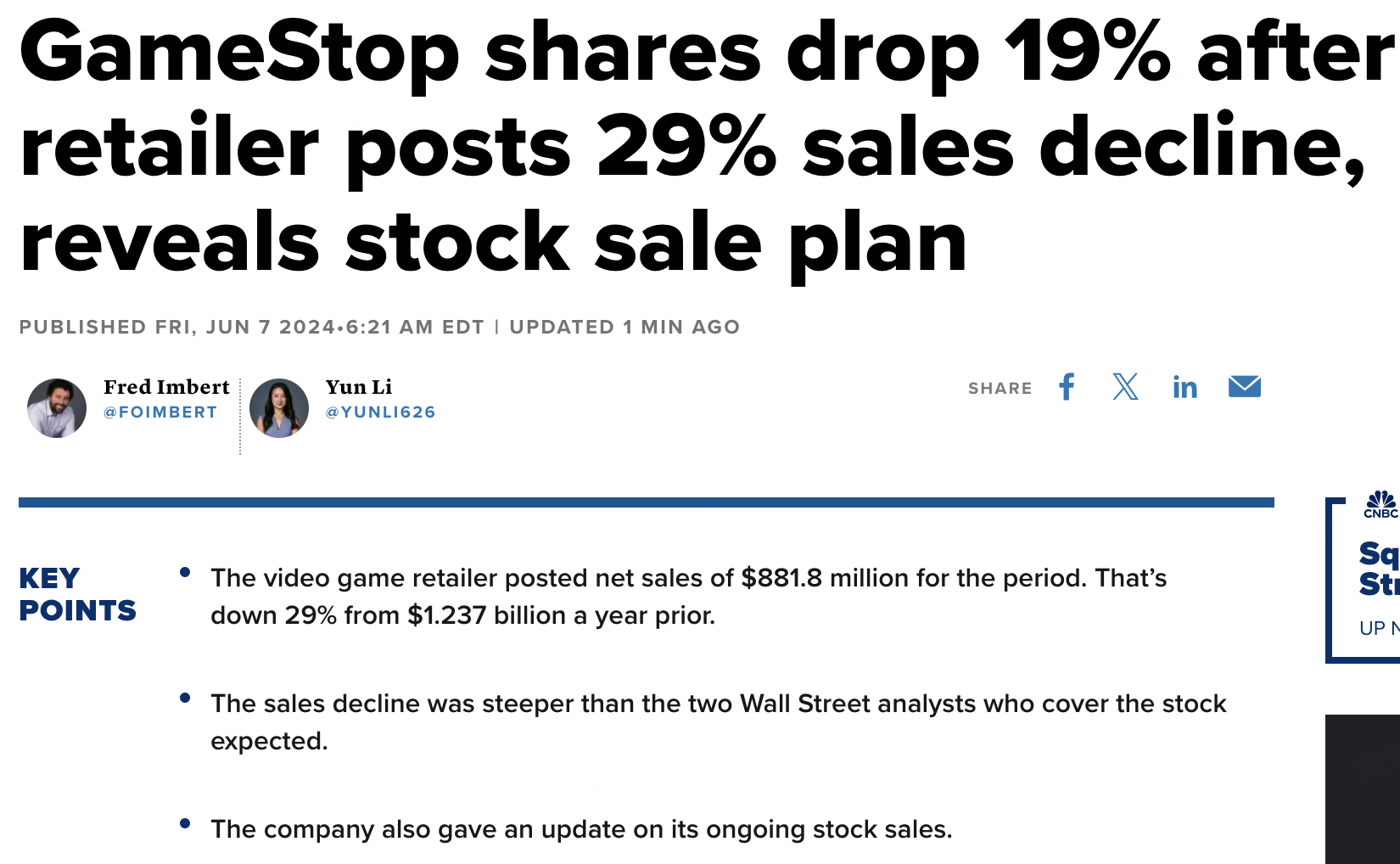

Just as retail was gearing up for a rip-roaring open, the unthinkable happened - GME preannounced disappointing earnings and plans for a $300 million share offering, which was originally scheduled for June 11th after market close.

$GameStop(GME)$ The news tanked the stock from $63 to $35.

Meanwhile, the company stated there would be no earnings call on Friday night. Indeed no need, because Kittey is streaming tonight.

When Something's Amiss, There Must Be a Catch

Kittey emphatically stated the stream will satisfy chasers, implying the price will rip. So why would GME sabotage him by preannouncing poor earnings and an offering?

The selloff was justified by fundamentals. Could GME's relationship with Kittey be strained?

Unlikely, it's clear they are in cahoots. In fact, Kittey is essential for pumping GME's price.

So ponder this: how is a guaranteed pump related to the premarket drop?

stock fell from $63 to $35 premarket, then Kittey promised a satisfying stream.

Recall $63 was the May 14th high, held for just 1 day.

The ramp starting May 13th was too violent for new bagholders to keep up - many didn't FOMO in until the 15th. That entire week was the extent of what the ringleaders could muster.

Above $60, Kittey can't sustain upwards momentum anymore. His personal high-water mark was $64.8 on May 25th. Beyond that requires stars aligning.

The earnings preannouncement was deliberate to facilitate the sell-off.

At $60+, Kittey loses control of the ramp. $64.8 was his masterpiece limit.

Last Chance to Escape

If they're willing to wield an earnings bomb, you think Kittey won't bail?

Friday is the ideal day to close out, but also the last opportunity to play 0dte options. My guess is Kittey unwinds options on Monday, while trying to blow up Friday's call sellers.

However, his personal limit was $60. Anything higher is a gamble even for him.

A ramp to $100 on Monday can't be ruled out. But most bulls lack the capital to gamble.

If Friday's after-hours doesn't nuke the shorts, even if Kittey delays closing options, just selling shares alone would net massive profits. No need to worry about Monday's flood.

My advice to bulls: exit tonight.

My advice to bears: prepare to enter.

Of course, is $60 merely a headfake to lure in shorts? Possible, but are you willing to bet on it?

Disclaimer: If you have a long position and are angry, please don't mind, I'm just telling a story.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.