Rate Cut Expectations Dial Back, Markets Add Downside Hedges

The surprisingly strong US jobs report led traders to scale back expectations for Fed rate cuts this year. The US dollar index rallied and Treasury yields spiked higher.

Options flows showed an increase in downside put hedging for SPY. For QQQ, there was greater divergence with expectations for further 1.5% upside through July but hedges building for a potential September pullback. Small-caps remained volatile with expectations for a 2.4% rally in IWM by July 17 expiry.

Details:

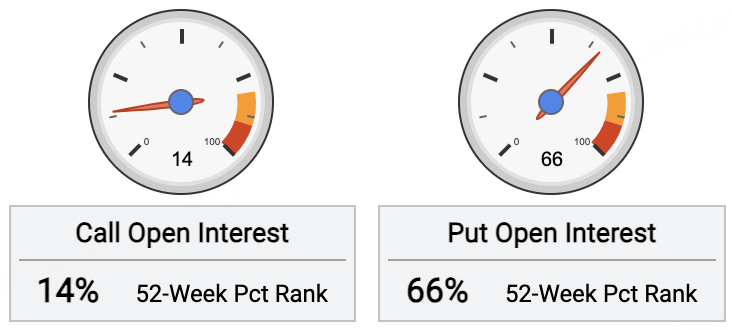

$SPDR S&P 500 ETF Trust(SPY)$ saw open call interest unchanged over the past 5 days. Open put contracts increased 6.0% over the same period.

For call options, the most actively traded was the $SPY 20240610 535.0 CALL$ with a 535 strike, adding 5,066 contracts.

For put options, the most actively traded was the $SPY 20240621 493.0 PUT$ with a 493 strike, adding 8,695 contracts. This implied expectations for a potential 7.6% drawdown in SPY by June 21 expiration.

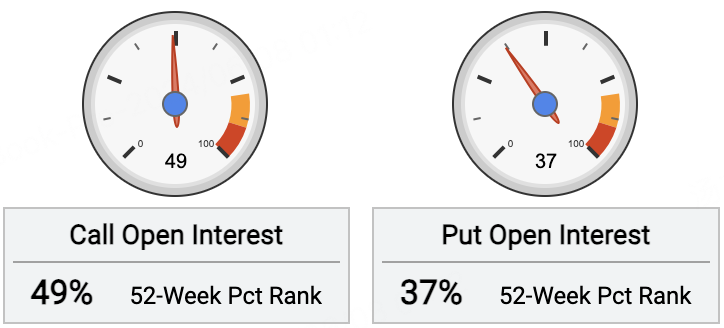

The $Invesco QQQ(QQQ)$ saw open call interest rise 0.2% over the past 5 days. Open put contracts declined 0.7% over the same period.

For call options, investors bought the most $QQQ 20240719 470.0 CALL$ with a 470 strike, adding 6,232 contracts. This priced in around 1.5% further upside for QQQ by July 19 expiration.

For put options, investors bought the most $QQQ 20240920 415.0 PUT$ with a 415 strike, adding 8,331 contracts. This implied expectations for a potential 10% drawdown in QQQ by September 20 expiration.

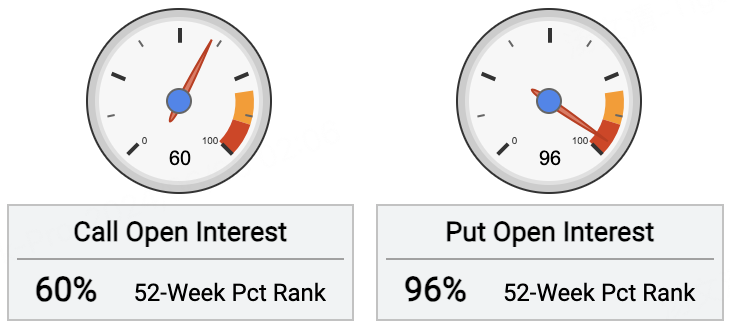

The $iShares Russell 2000 ETF(IWM)$ saw open call interest rise 1.6% over the past 5 days, while open put contracts increased 1.4% over the same period.

For call options, investors bought the most $IWM 20240719 210.0 CALL$ with a 210 strike, adding 7,115 contracts. This priced in around 2.4% further upside for IWM by July 19 expiration.

For put options, there was heavy buying in the $IWM 20240719 193.0 PUT$ with a 193 strike, adding 47,000 contracts. This priced in around 6% downside for IWM by July 19 expiration.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?