PANW Q4: How AI Change Cyber Security?

$Palo Alto Networks (PANW)$ reported its Q4 FY24 results after the bell on August 19th, and the market feedback was favorable due to more favorable results and guidance for the period.Cybersecurity has also become an important focus for many companies, considering the impact of the previous $CrowdStrike Holdings, Inc.(CRWD)$ large-scale downtime including $Microsoft (MSFT)$ Windows.

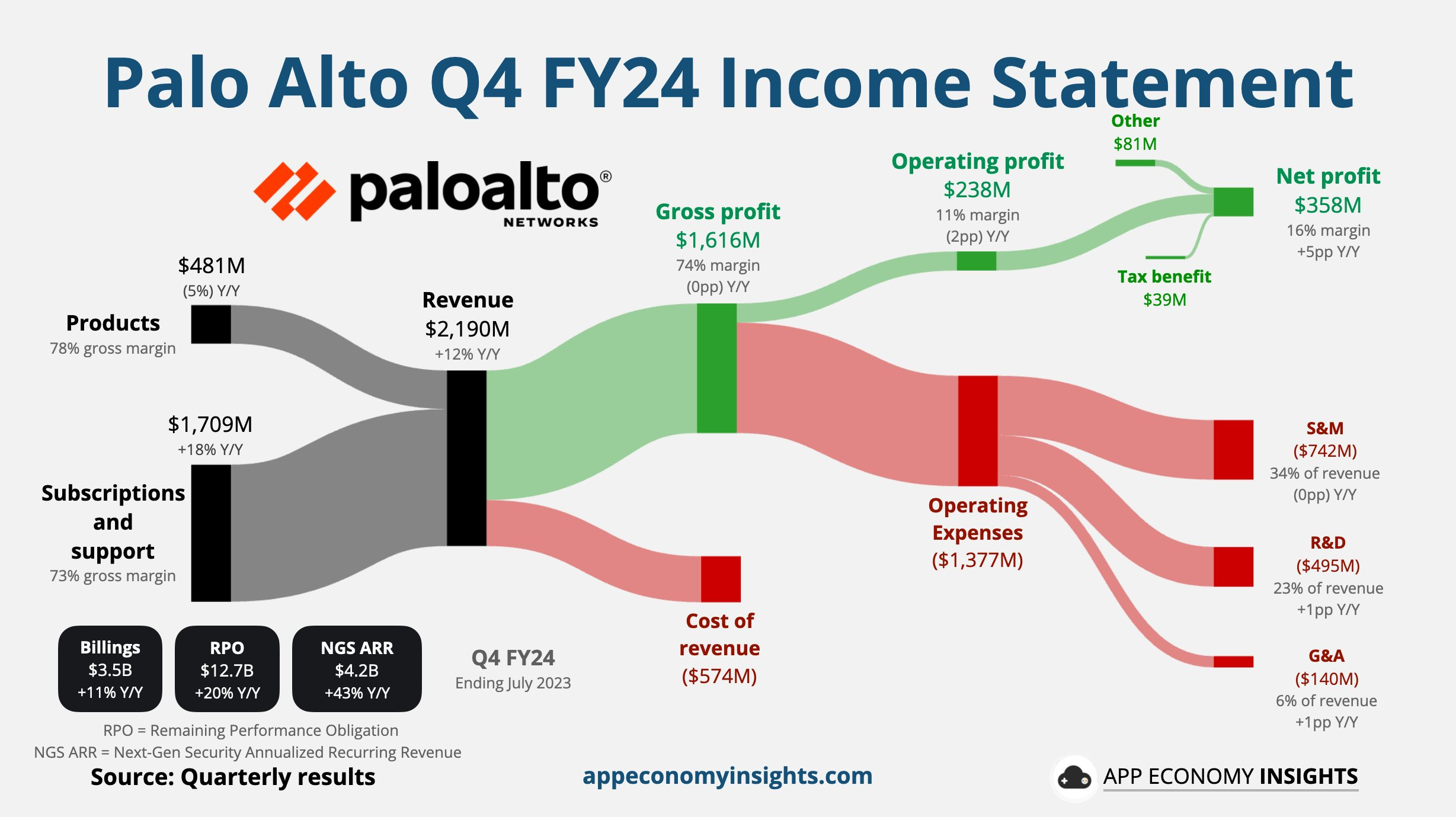

REVENUE GROWTH: Palo Alto's total revenue reached $2.2 billion, an increase of 12% year-over-year.This growth was driven by the popularity of its AI-powered cybersecurity solutions and increased demand in the market, and was slightly higher than Wall Street's expectations of $2.16 billion.

Net Income: Under Non-GAAP guidelines, net income was $522 million, or $1.51 per diluted share, beating market expectations of $1.41 and improving from $1.44 in the year-ago period.

Full-year results: overall revenue for fiscal year 2024 was approximately $8 billion, in line with Wall Street's expectations and up significantly from the prior year.

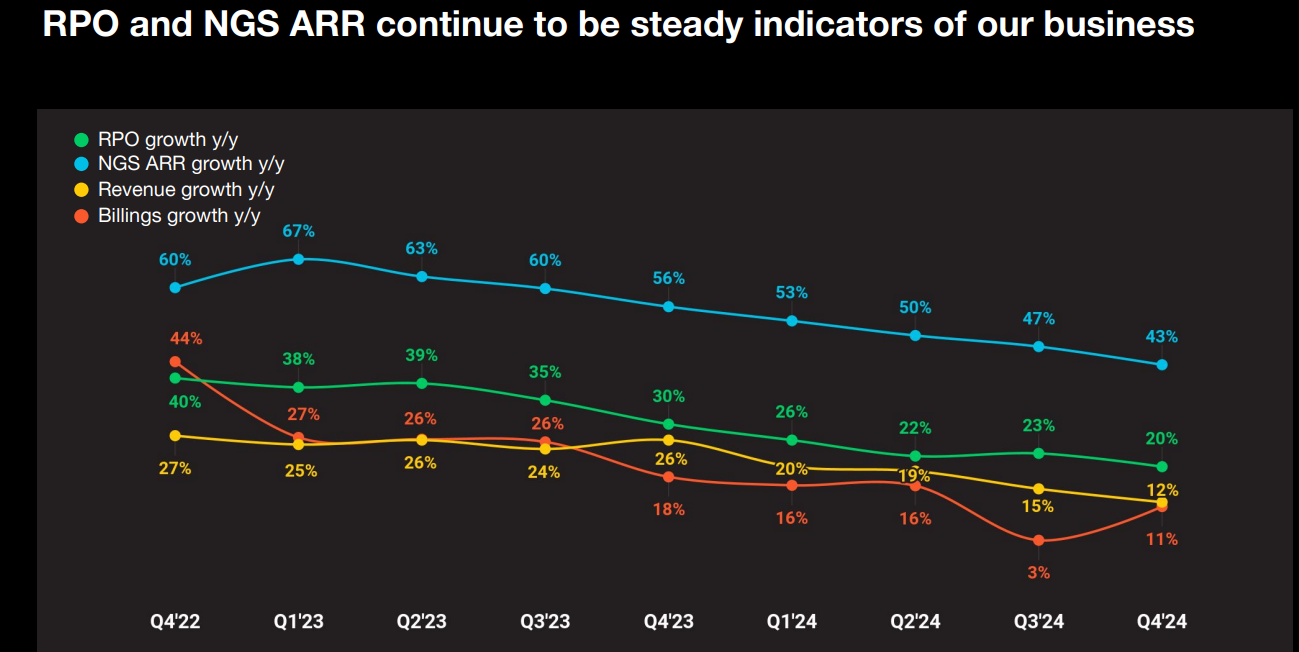

Annual Recurring Revenue (ARR): up 43% year-over-year to $4.2 billion.

Remaining Performance Obligations (RPO): up 20% year-on-year to $12.7 billion.

Performance Outlook

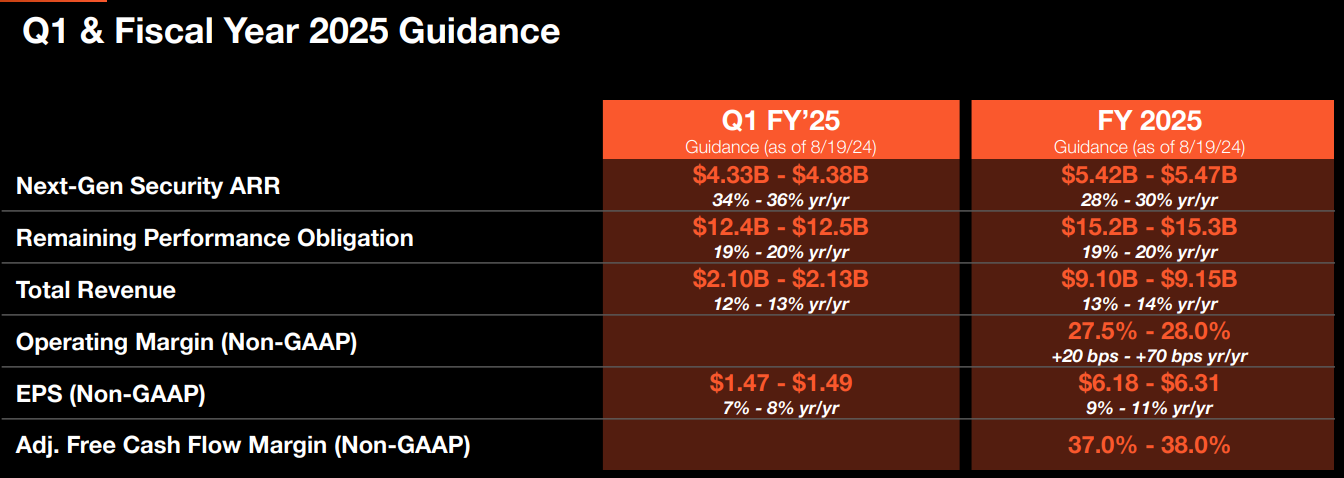

SUSTAINED GROWTH EXPECTATION: Palo Alto expects continued strong growth in FY2025, with total revenue expected to be in the range of $9.1 billion to $9.15 billion, an increase of 13% to 14% year-over-year.This demonstrates the company's confidence in the AI+ cybersecurity space and its competitiveness in future markets.

Investment Highlights

Customer Growth and Market Expansion

The company has excelled in acquiring new customers, with significant deals with large government agencies and financial services firms that have boosted its customer base and strengthened its market share in specific industries.

Q4th added more than 1,200 new customers, totaling more than 93,000 customers;

Average annual customer contract value (DBNER) reached 119%, remaining above 110% for the 12th consecutive quarter;

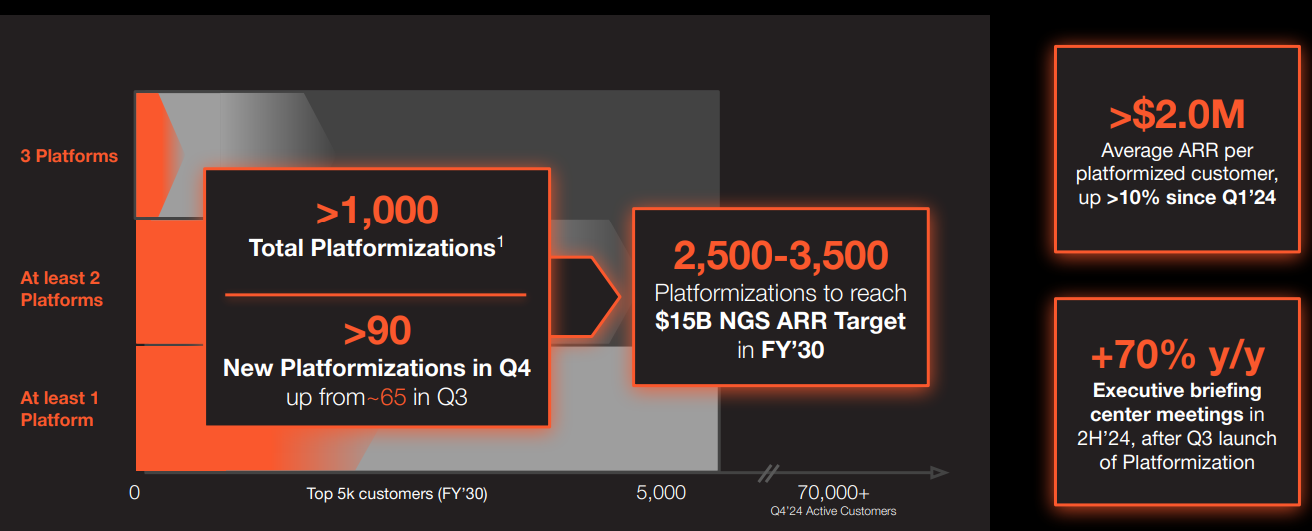

Added 90 new platform-enabled customers, with a cumulative total of over 1,000 customers platform-enabled.

Integration of AI and Cybersecurity

Significant progress has been made in the application of AI technology, which has improved the threat detection and response capabilities of its products through the integration of AI and machine learning technologies, enabling the company to analyze a large amount of threat intelligence data, from which it can identify potential attack patterns and correlations, so as to respond quickly to new types of threats.

Product Innovations

The Company launched several new products and upgraded existing products with AI features during the quarter, particularly solutions such as Cortex XDR and Prisma Cloud, which further strengthened its competitiveness in the cybersecurity market.

Some of the company's problems

1. Overvalued

Current Valuation Levels:Palo Alto's stock currently trades at a future P/E of 55x, which seems unreasonable in the current context of slowing revenue growth and declining earnings expectations.Analysts note that the current high valuation is not in line with the company's actual financial position, despite an expected rebound in revenue and earnings in fiscal 2025.

2. Slower revenue growth

Declining Growth: in the fourth quarter of fiscal 2024, Palo Alto expects revenue growth of just 11%, while normalized earnings per share (EPS) is expected to decline by 2%.This slowdown in growth contrasts with the company's previous performance and suggests that the company faces challenges in the near term.

3. Poor Earnings Expectations

Declining EPS: While the market generally expects Palo Alto to realize a re-acceleration of revenues in the future, analysts are cautious about its profitability in the near term.EPS is expected to decline in FY2024, which is at odds with the market's expectations for a high-growth company.

4. Vulnerability to market reaction

Sensitivity to negative news: Analysts have warned that any negative earnings results, especially guidance for FY2025, could lead to significant share price volatility and even a valuation reset.This vulnerability makes the current high valuation seem even more dangerous.

5. Long-term growth potential versus short-term performance

Impact of platformization strategy: While Palo Alto is implementing an "accelerated platformization" strategy that is expected to lay the groundwork for future growth, the short-term impact of this strategy on revenue is negative.Analysts believe that while the long-term outlook is positive, the short-term performance may cause investors to question its valuation.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- EvelynHoover·08-20InterestingLikeReport