BIG TECH WEEKLY | Who's the biggest buyer of AAPL after Buffett?

Big-Tech’s Performance

Tech stocks remained steady for the first four days of the week, rallying continuously following last week's panic sell-off.The market has not given up on further rate cut expectations, despite the scenario that Fed officials are less dovish than the market expects, and rate cut expectations have receded.In addition, cash-flow rich companies still have a large amount of buybacks to support the stock price after the earnings report

Through the close of trading on August 23rd, the big tech companies have had mixed performances over the past week, but all have fluctuated without hitting. $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +1.55% and $NVIDIA Corp(NVDA)$ +0.72% while $Apple(AAPL)$ -0.08%, $Amazon.com(AMZN)$ -0.82%, $Meta Platforms, Inc.(META)$ -1.00%, $Microsoft(MSFT)$ -1.30% and $Tesla Motors(TSLA)$ -1.63%.

Big-Tech’s Key Strategy

Who is Apple’s biggest support after Buffett's Reducing?

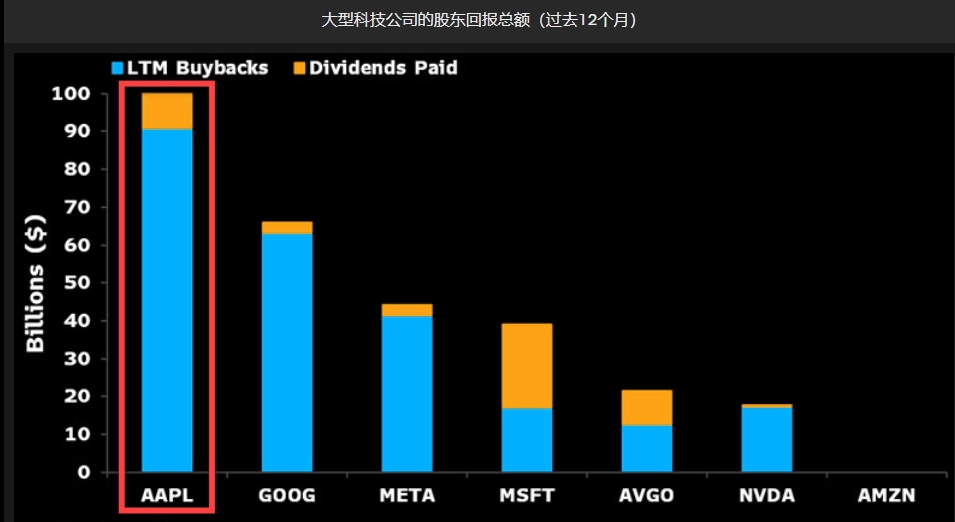

After Buffett's big cut to AAPL following the 13F announcement brought new winds to the market's sails, the biggest buyer of tech stocks right now may be the companies themselves (the buybacks).

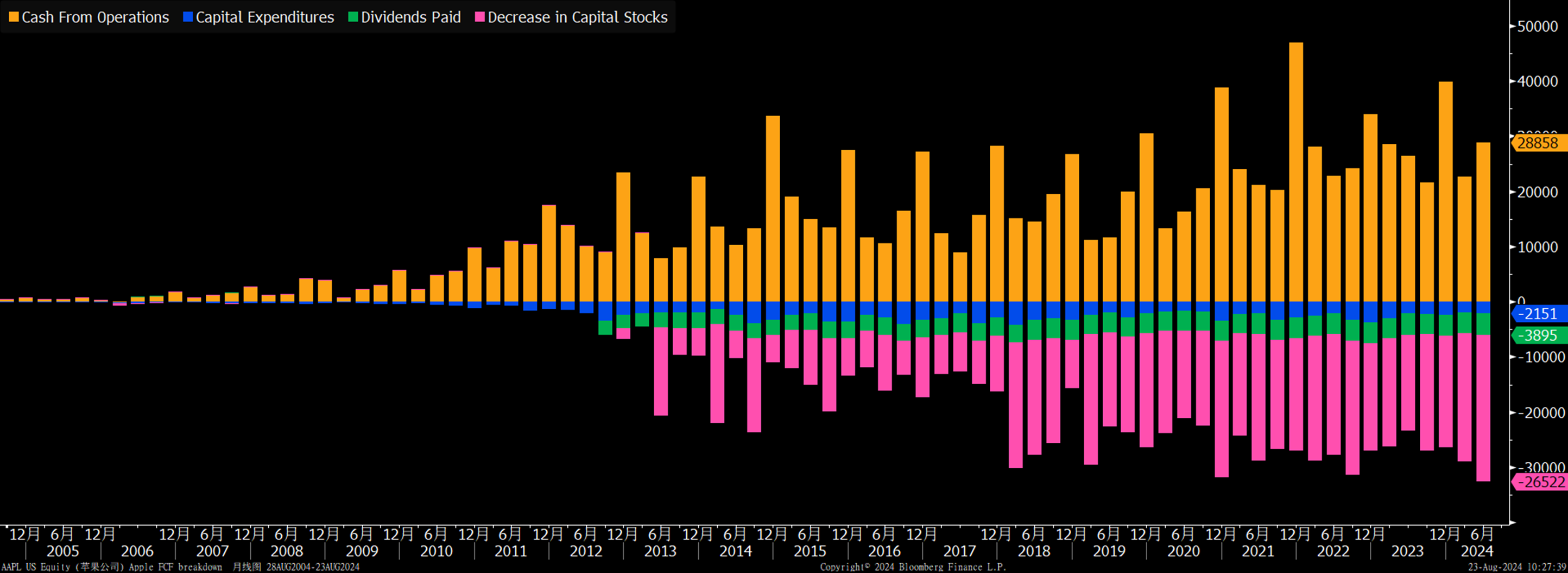

Since Apple boosted its buybacks to a new high of $110 billion, it repurchased $26 billion of stock in its fiscal third quarter alone, equivalent to the market capitalization of an entire Delta Air Lines.But despite that, Apple's EBITDA for the year is still likely to exceed $130 billion, far exceeding the current buyback level combined.While you'll have a corresponding increase in capital expenditures over the two years, free cash flow could still be at record highs.

According to Bloomberg, Apple's annual free cash flow over the next three fiscal years will be close to $400 billion.Unless Apple has a major acquisition project (difficult for its size because of antitrust pressures), the most favorable capital allocation for shareholders will continue to be increased share buybacks and dividend distributions with a cash-neutral target.

In terms of shareholder returns, Apple also far outperforms its tech industry peers, including other Magnificent7.

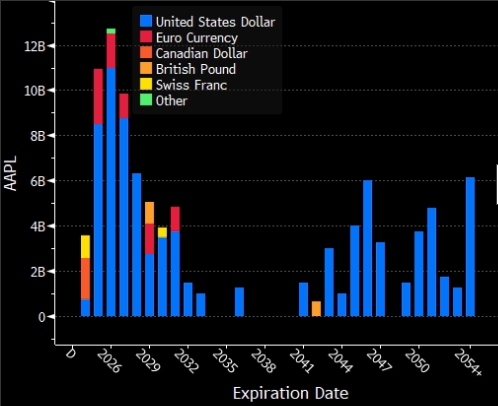

In terms of capital structure, Apple has issued $20.5 billion, $5.5 billion, and $5.25 billion in bonds from 2021-2023, and by the end of 2027 there will be a concentration of $40 billion in bonds maturing.This assumes that Apple could continue to issue similar-sized bonds over the next 2-3 years, and higher cash inflows could cause the company to reallocate its equity-to-bond ratio, which in turn could further increase buybacks.

Big-Tech Weekly Options Watcher

The market's view of AAPL has been relatively stable overall, and a number of options traders have made a wave of openings and moves after that big drop last week.While Buffett was cutting his position in half, the market isn't very pessimistic due to the company's buybacks, the expectation of a new AI machine, and the fact that once the market is in turmoil, it will prompt some other positions to come over and hedge their bets.

From the point of view of the never closed options, investors on August 23, August 30 options maximum position have lifted, Call were in 105-115, PUT even to 105, which also implies that the market is optimistic about its expectations.

Big-Tech Portfolio

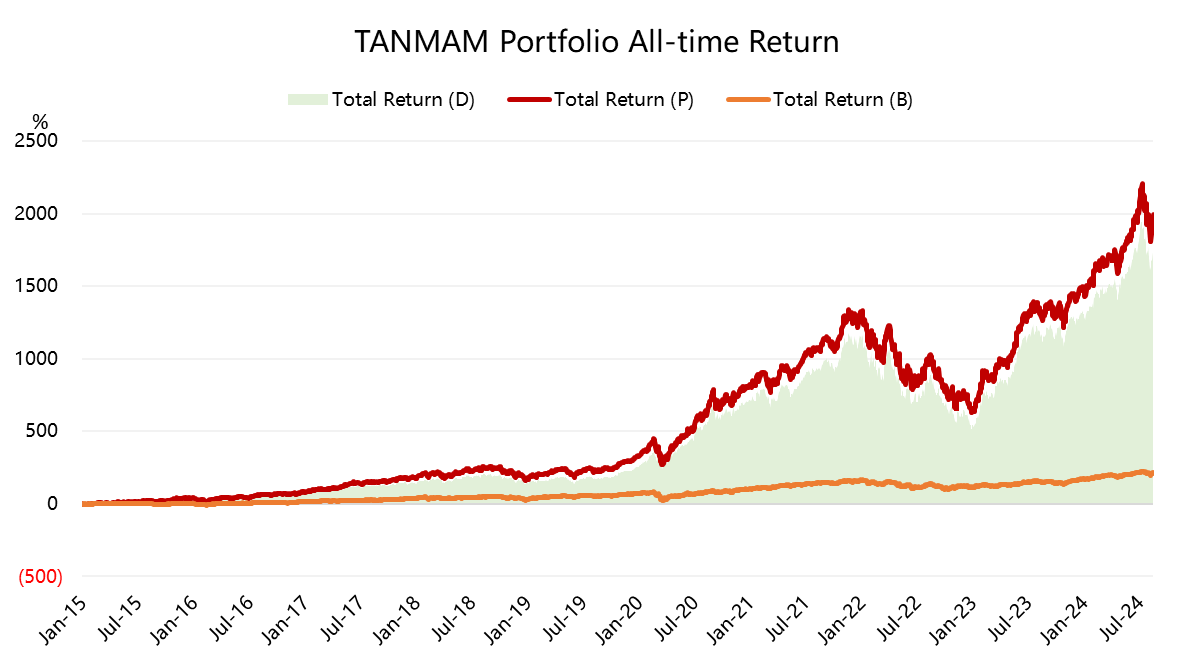

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtesting results are far outperforming the $S&P 500(.SPX)$ since 2015, with a total return of 1988.2%, while the $SPDR S&P 500 ETF Trust(SPY)$ has returned 220.3% over the same period, once again pulling ahead.

With the broader market pulling back this week, the portfolio has returned 32.0% year-to-date, outperforming the SPY by 17.8%.

The portfolio's Sharpe Ratio over the past year has fallen back to 2.0, while the SPY is at 1.8 and the portfolio's Information Ratio is at 1.4.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Big-Tech's mixed bag this week, but Apple’s massive buybacks could still boost its stock. 📈 Will Buffett’s move turn out to be a strategic retreat?

Tech stocks are stabilizing, with AAPL’s buybacks leading the charge. Could this be the start of a new uptrend or just a temporary respite?

The Magnificent Seven outperformance continues! Apple's buybacks and new AI projects could play a big role in maintaining its edge.