Crowdstrike Lower Guidance After Global Outage?

$CrowdStrike Holdings, Inc.(CRWD)$ reported its Q2 FY2025 (ended July 31, 2024) results after the bell on August 29th.With the impact of the global downtime on July 16, investors were more concerned about how the company would look ahead to future results.

The company's strong position in the cybersecurity market.

Financial Overview

Results for the quarter remained solid, showing that the company continues to hold a strong position in the cybersecurity market.

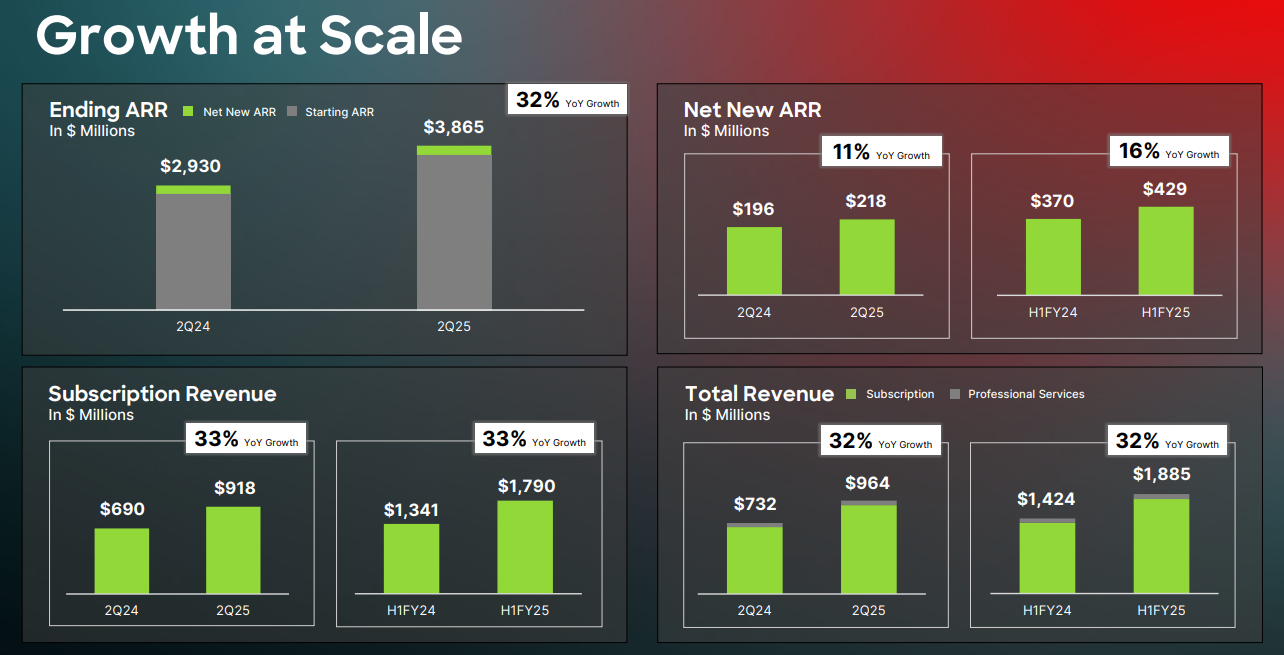

TOTAL REVENUE: CrowdStrike's total revenue was $963.9 million, up 32% year-over-year, compared to $731.6 million in the same period last year.

SUBSCRIPTION REVENUE: Subscription revenue reached $918.3 million, up 33% year-over-year, compared to $690.0 million in the same period last year.

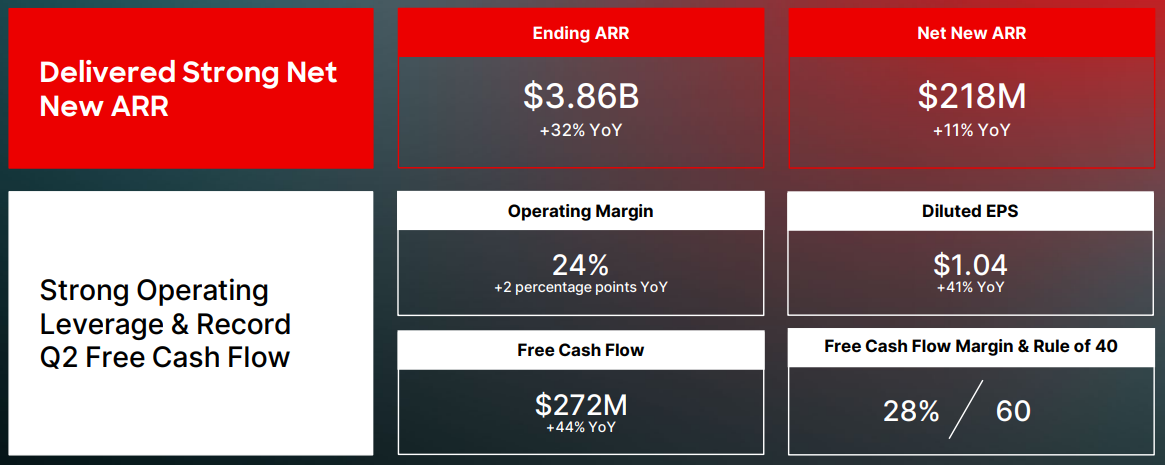

Annual Recurring Revenue (ARR): for the quarter ended July 31, 2024, ARR grew 32% to $3.86 billion, with $217.6 million in new ARR in the quarter.

ARR for the Cloud Security business exceeded $515 million, up more than 80% year-over-year; ARR for Identity Protection exceeded $350 million, up more than 70% year-over-year; and ARR for LogScale's next-generation SIEM exceeded $220 million, up more than 140% year-over-year.

Profit and cash flow also continued to exceed expectations

GAAP Net Income: GAAP net income for the quarter was $47.0 million, up more than five times from $8.5 million in the same period last year.

Non-GAAP Net Income: Non-GAAP net income was $260.8 million, an increase of 45% year-over-year, and non-GAAP net income per share was $1.04 compared to $0.74 in the same period last year.

Cash Flow: Operating cash flow for the quarter was a record $327 million, from $245 million in the same period last year.Free cash flow was $272.2 million, a significant increase from $188.7 million in the same period last year.

From a business segment perspective, subscription service Gaap gross margin was 78%, unchanged from last year, while non-GAAP gross margin increased slightly to 81% (80% last year).The percentage of customers utilizing five or more modules was 65%, six or more modules was 45%, and seven or more modules was 29%.This is indicative of increasing customer acceptance of and reliance on CrowdStrike's multiple services.

Professional services revenue was $45.615 million, up from $41.654 million in the same period last year.Gross margins, while not specifically disclosed, were good overall, reflecting the company's efficiency in service delivery.

Future Outlook

Although CrowdStrike's outlook for fiscal year 2025 remains optimistic following the July 16 Channel File 291 Incident, guidance remains more conservative than market expectations.

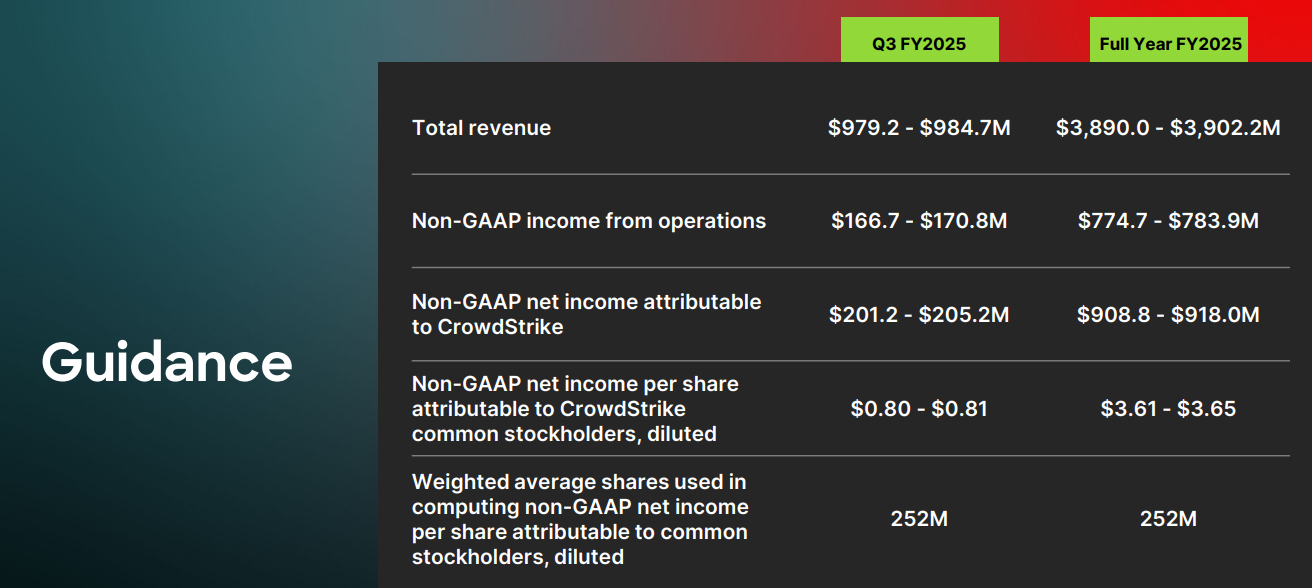

Q3 revenue is expected to be in the range of $979.2 million to $984.7 million, below market expectations of $1.01 billion;

Full year revenue is expected to be between $3.89 billion and $3.902 billion, below market expectations of $3.95 billion;

Q3 EPS expected to be between $0.8 and $0.81, below market expectations of $0.96;

Full-year EPS is expected to be between $3.61 and $3.65, a downward revision from the company's previous estimate of $3.93 to $4.03.

The profit downward revision is more pronounced, and apparently the company has also accrued quite a bit of expenses such as subsequent compensation related to this incident.In addition, incentives due to the Customer Commitment Program are expected to have an impact on subscription revenues in the coming quarters.

Of course, it is also possible that overall industry-wide spending is lower, causing the company to be conservative in its expectations.But overall, Crowdstrike's position and influence in the industry has not been significantly affected.

CrowdStrike has implemented a number of measures to enhance the security and resilience of the Falcon platform, including:

Enhanced content visibility and control: introduced new content control configurations that allow customers to choose when and where to deploy new content.

Content Quality Assurance Enhancements: Improved content validation and interpretation tools to prevent incorrect content from being published.

External review and validation: partnered with two independent third-party software security firms to review the Falcon sensor code and quality control processes.

These measures are designed to enhance the security and reliability of the platform and ensure that similar incidents are not repeated.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- dimpy·08-29Nice revenue growth! Impressive position in cybersecurity market. [Great][Heart]LikeReport