What is the extraordinary sub-industry in volatile market?

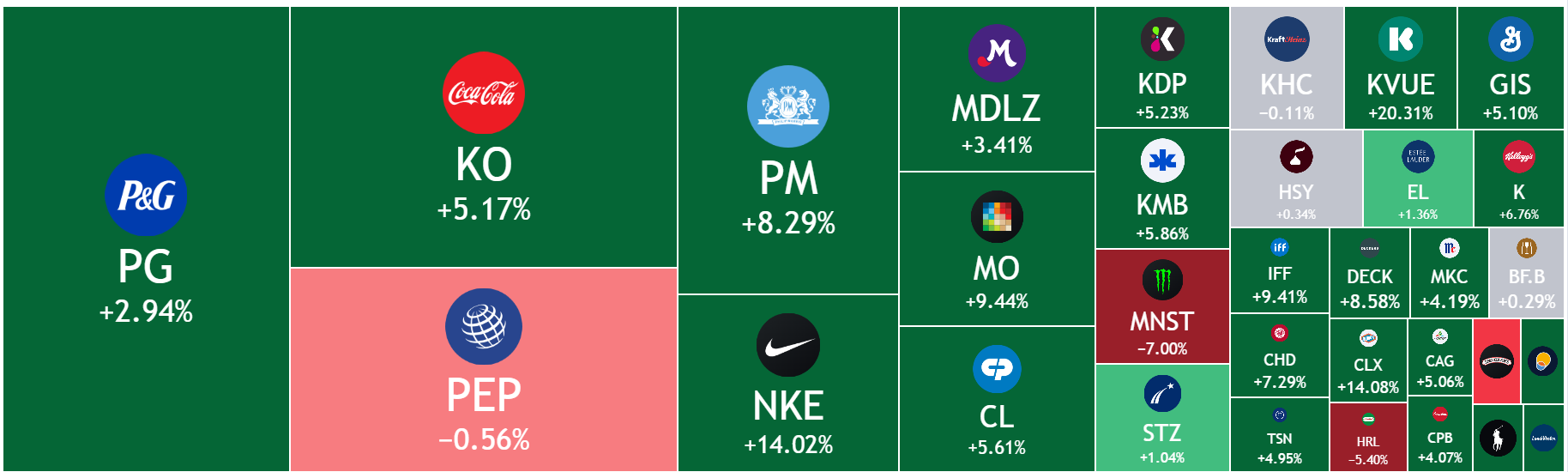

With interest rate cuts on the horizon and increased market volatility ahead of economic data releases, overall volatility of the broader market has increased since August, and the $S&P 500 Volatility Index (VIX)$ has moved up and down and has seen more frequent flows of capital between sectors.

In addition to more inflows into interest rate-sensitive sectors such as REITs, more attention has been paid to defensive sectors, which have long been characterized as "high dividend paying, counter-cyclical" subsectors that are typically resilient to asset volatility.

Tobacco

We believe the tobacco sector's strength has benefited from several reasons:

Stable performance, cash cows, high dividends and buybacks helping companies attract and retain long-term investors.

Smooth transition from traditional tobacco to current tobacco alternatives (including heated non-combustible products, e-cigarettes and nicotine pouches) and increased penetration in higher-margin markets also drove total volume growth

The U.S. election may also affect the direction of relevant legislation.A Republican victory in the White House or Congress could have a positive impact on the tobacco industry, and while Trump may tighten regulations on illicit products, he may lower the ban on menthol cigarettes.

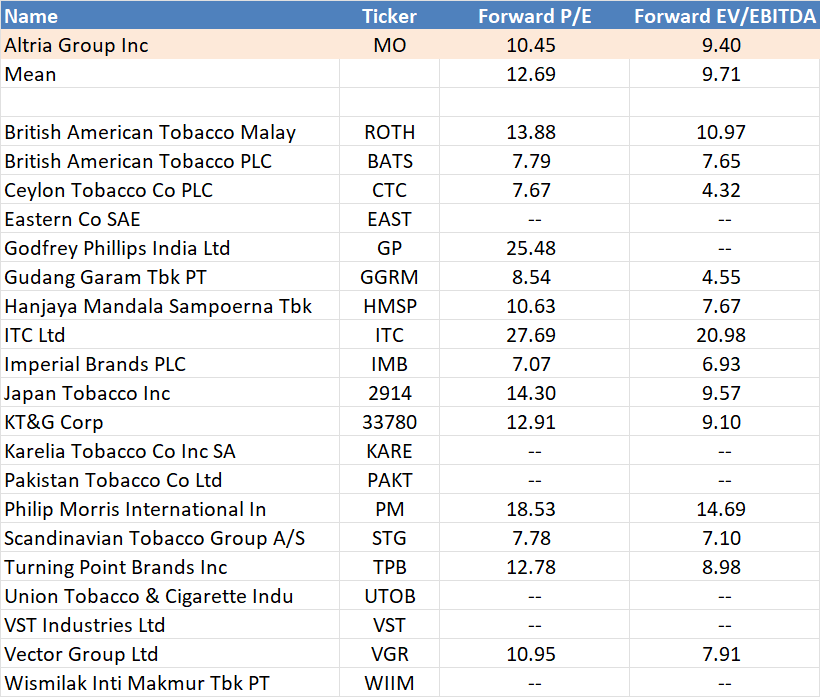

Of these tobacco giants, $Orchard (MO)$ and $Philip Morris (PM)$ are the biggest gainers and their higher valuations relative to the industry averages also represent more market confidence in them at this time.

MO is currently valued at 6bps above its 2-year average, while PM is 12bps above its 2-year average.

MO: Altria Group's key product, the NJOY e-cigarette, is seeking to resolve a patent infringement complaint by JUUL Labs.This lawsuit JUUL's preliminary ruling supports its allegations and recommends that NJOY ACE products be banned from importation into the U.S. The ITC is expected to issue a final decision by December 23, 2024.Since the one-year anniversary of Altria's acquisition of NJOY, the company has strengthened NJOY's supply chain, expanded its retail network, and launched several trial campaigns to boost sales.If finally approved, it will also strongly stimulate sales in the market.

PM: In the past, IQOS had to lower its guidance due to the need for the IQOS business, and the short-term impact of the EU flavor ban on the IQOS business caused market concern, but in the long run, this is only a minor hiccup.The IQOS penetration rate in the Japanese market is expected to exceed 50% next year, making it the first market where the volume of heated non-combustible products exceeds that of cigarettes.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- BerniceCarter·2024-09-05The extraordinary sub-industry in the volatile market seems to be the tobacco sector.LikeReport