💰Fed Cuts & S&P 500 11 Sectors: A Historical Review

[Heart]Hello, Tigers, are you also anxiously waiting for the Fed’s interest rate meeting?

Last week, Tiger community posted 💰5 Charts to Know the Historical Fed Rate Cuts Impact & Strategic Insights,hope it has some help to you to know better about the Rate Cut Cycle.

Today, We have compiled the performance data of the 11 major sectors of the $S&P 500(.SPX)$ index 3 months, 6 months, and 12 months after the 8 rounds of interest rate cuts by the Federal Reserve since 1984.

See the chart below:

Combining the data, we know that the S&P 500 index consists of 11 industries, and each industry has different sensitivity to interest rate fluctuations.

Assuming that the Federal Reserve starts to cut interest rates, the top three sectors of the 11 major sectors of the $S&P 500(.SPX)$ are healthcare, finance, and communications services.

Healthcare sector: Often viewed as a defensive investment, the need for healthcare is persistent regardless of the economy. Interest rate cuts could reduce healthcare companies’ financing costs, boost corporate profits, and so on, thereby boosting industry price expectations.

Related ETFs to watch: $Health Care Select Sector SPDR Fund(XLV)$ $Vanguard Health Care ETF(VHT)$ $iShares Biotechnology ETF(IBB)$.

Financial sector: Interest rate cuts are usually negative for the financial industry, as their profit margins may be compressed. When interest rates fall, banks and other financial institutions may see a reduction in net interest margins. However, if interest rate cuts indicate that the economy is improving, then investments in the financial industry may benefit from expected increased trading activity.

Related ETFs to watch: $Financial ETF(XLF)$, $Vanguard Financials ETF(VFH)$, $Financial Index ETF-iShares Dow Jones(IYF)$. $Financial Select Sector SPDR Fund(XLF)$ , $Vanguard Financials ETF(VFH)$ , $iShares U.S. Financials ETF(IYF)$

Communication services sector: Includes software and hardware companies. Interest rate cuts could reduce borrowing costs for these companies, helping technological innovation and expansion.

Related ETFs to watch: $Communication Services Select Sector SPDR Fund(XLC)$, $Vanguard Communication Services ETF(VOX)$, $Invesco S&P 500 Equal Weight Communication Services ETF(RSPC)$.

Consumer Staples sector: Consumer staples, such as food and beverages, typically perform better when interest rates fall because demand for these companies' products is relatively stable and not affected by economic cycles.

Related ETFs to watch: $Consumer Staples Select Sector SPDR Fund(XLP)$, $Vanguard Consumer Staples ETF(VDC)$ and $iShares Global Consumer Staples ETF(KXI)$ .

Utilities sector: Often viewed as defensive investments because they provide essential services and demand is relatively stable. Lower interest rates could reduce the cost of issuing bonds to raise funds for these companies, but it would also make existing bonds less attractive to invest in.

Related ETFs to watch: $Public Utilities Index ETF-SPDR(XLU)$, $Vanguard Utilities ETF(VPU)$, $iShares U.S. Utilities ETF(IDU)$. $Utilities Select Sector SPDR Fund(XLU)$, $Vanguard Utilities ETF(VPU)$ , $iShares U.S. Utilities ETF(IDU)$.

Industrial sector: includes manufacturing and transportation sectors. Interest rate cuts may stimulate business investment and consumer spending, which will benefit industrial stocks.

Related ETFs to watch: $Industrial Index ETF-SPDR(XLI)$, $Vanguard Industrials ETF(VIS)$, $iShares U.S. Industrials ETF(IYJ)$. $Industrial Select Sector SPDR Fund(XLI)$, $Vanguard Industrials ETF(VIS)$, $iShares U.S. Industrials ETF(IYJ)$.

Real estate sector: Interest rate cuts may reduce mortgage rates, stimulate real estate market activities, and are positive for real estate investment trusts (REITs) and related companies.

Related ETFs to watch: $Real Estate Select Sector SPDR Fund(XLRE)$ $Vanguard Real Estate ETF(VNQ)$.

Energy sector: The performance of the energy sector may be affected by global economic activities and commodity prices. Interest rate cuts may stimulate economic growth and increase demand for energy.

Related ETFs to watch: $SPDR Energy Index ETF (XLE)$ $Vanguard Energy ETF (VDE)$. $Energy Select Sector SPDR Fund(XLE)$ , $Vanguard Energy ETF(VDE)$

Consumer discretionary: Includes retail, media and entertainment. The performance of these companies may be affected by consumer confidence and disposable income.

Related ETFs to watch: $Consumer Discretionary Select Sector SPDR Fund(XLY)$ , $Vanguard Consumer Discretionary ETF(VCR)$.

Technology sector: Technology stocks may be less sensitive to interest rate changes, but a low interest rate environment is generally beneficial to high-growth technology stocks because they can borrow at a lower cost to fund expansion and innovation. However, if the market expects an economic slowdown, technology stocks may be under pressure.

Related ETFs to watch: $Technology Select Sector SPDR Fund(XLK)$, $Vanguard Information Technology ETF(VGT)$, $Invesco QQQ(QQQ)$.

Materials sector: This sector includes chemical, construction and mining companies. Rate cuts ma $Vanguard Materials ETF(VAW)$.

It should be noted that the performance of each industry will also be affected by its own specific factors and market sentiment, so the above trends are not absolute. Tigers should consider multiple factors when considering investment decisions and pay close attention to market dynamics.

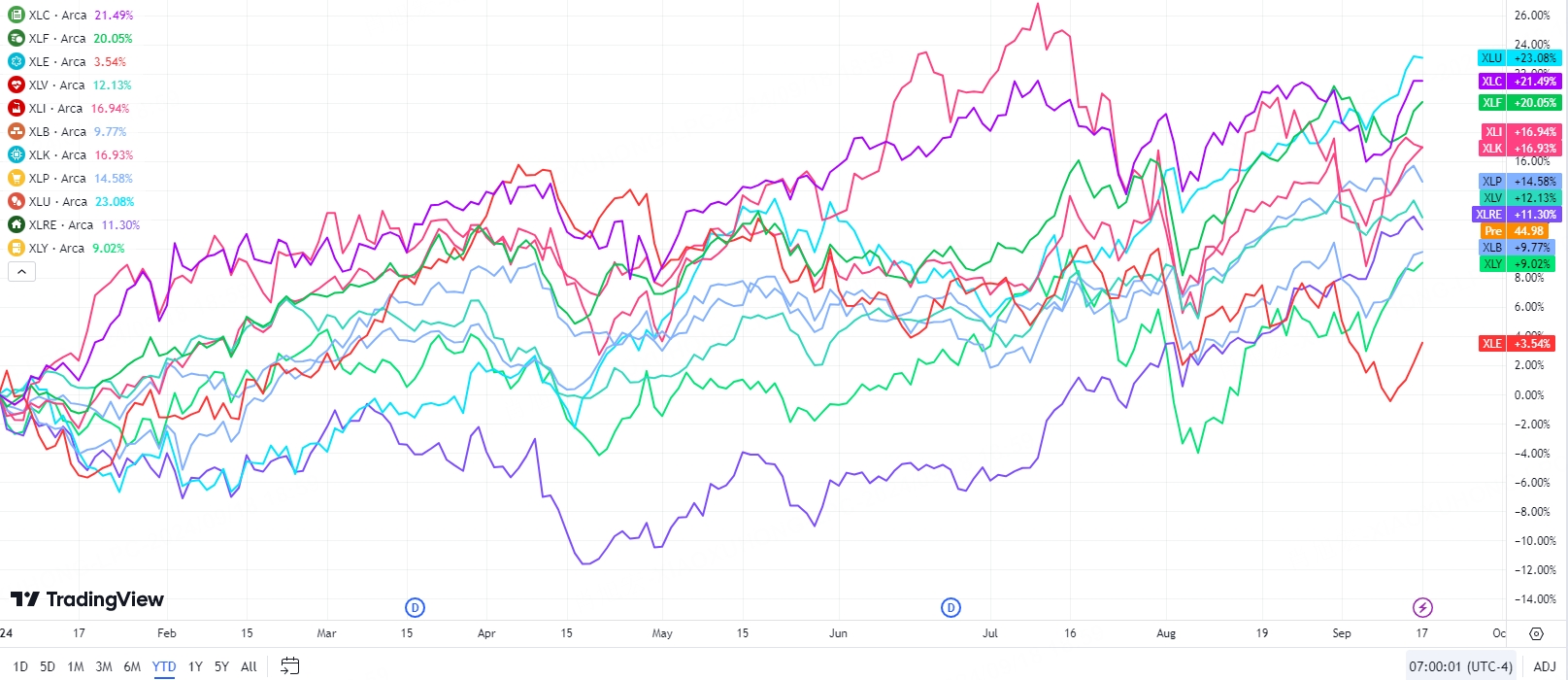

As of September 17, the year-to-date gains and losses of 11 ETFs represented by the 11 sectors of the $S&P 500(.SPX)$ are as follows:

$Utilities Select Sector SPDR Fund(XLU)$ +23.08%;

$Communication Services Select Sector SPDR Fund(XLC)$ +21.49%;

$Financial Select Sector SPDR Fund(XLF)$ +20.05%;

$Industrial Select Sector SPDR Fund(XLI)$ +16.94%;

$Technology Select Sector SPDR Fund(XLK)$ +16.93%;

$Consumer Staples Select Sector SPDR Fund(XLP)$ +14.58%;

$Health Care Select Sector SPDR Fund(XLV)$ +12.13%;

$Real Estate Select Sector SPDR Fund(XLRE)$ +11.3%;

$Materials Select Sector SPDR Fund(XLB)$ +9.77%;

$Consumer Discretionary Select Sector SPDR Fund(XLY)$ +9.02%;

$Energy Select Sector SPDR Fund(XLE)$ +3.54%

Having read this far, welcome to leave your comments in the comment section: After the interest rate cut, which industry will you pay more attention to?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Welcome SG Tigers to open trade with Tiger Cash Boost Account to give wings to your mutiple strategies.

Open a CBA today and Enjoy SGD 20,000 for unlimited and 0 Commision trading upcoming on SGX, HK Stocks, US Equities and ETFS. Find out more here.

Other helpful links:

How to open a CBA: link here.

How to link your CDP account: link here.

Other FAQs on CBA: link here.

Cash Boost Account Website: link here.