BIG TECH WEEKLY | ETF Drama: Nvidia flips with Apple

Big-Tech’s Performance

Interest rate cuts officially occurred, and to the surprise of investors. 50 basis points seems to be more than expected, in fact, also contains the July did not cut interest rates "compensation", but also indicates that it will focus on the shift from controlling inflation to promote full employment.

Although the rate cut is regarded as the market's "cardiac needle", the market also opened the early "carnival mode", but Powell mentioned that the neutral interest rate may be higher than the pre-pandemic level, meaning that the future speed of interest rate cuts may be slower than the market expected.

But can not be ignored is that the interest rate inversion is still with the recession between the existence of a positive correlation.Historical data show that since 1954, the inversion of the 10-year and 3-month Treasury rates has usually signaled an impending recession.Nine of the last 10 inversions have accompanied recessions.

Through the close of trading on September 19, Big Tech has been very strong over the past week. $Meta Platforms, Inc.(META)$ +6.37%, $Tesla Motors(TSLA)$ +6.14%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +4.82%, $Microsoft(MSFT)$ +2.74%, $Apple(AAPL)$ +2.74%, $Amazon.com(AMZN)$ +1.53% and $NVIDIA Corp(NVDA)$ -1.07%.

Big-Tech’s Key Strategy

Tech ETF Shifts Positions, Apple the Biggest Winner?

$Technology Select Sector SPDR Fund(XLK)$ is a $68 billion technology sector ETF whose portfolio is "rebalanced" every three months to comply with diversification and weighting caps.

The index adheres to diversification limits, which stipulate that no single company can have a weighting of more than 25%, and that no company greater than 4.8% can have a total weighting of more than 50%;

Once a company has a weight greater than 23%, it is adjusted below 23%; if there are multiple large companies with a total weight greater than 50%, the top two are retained, while the latter are all adjusted back to 4.5%

So, in June 2024, Apple falls to third in market capitalization, with its weighting adjusted downward from 21% to 4.5%, while NVIDIA rises to second, with its weighting adjusted upward from 4.5% to over 20%.That's when the fund passively sold $11 billion of Apple stock and bought over $10 billion of NVDA.

Recent trading data shows that since June, when XLK sold Apple and bought Nvidia, Apple has outperformed Nvidia by 15.1 percentage points (Apple up 7.43%, Nvidia down 7.63%).As a result, Nvidia was again reduced to a 4.5% weighting in this rebalancing, while XLK was expected to sell some of its Nvidia and Microsoft shares to increase its position in Apple.

However, Nvidia's volume is high, averaging $41 billion per day, so a rebalancing cut of $10 billion in Nvidia stock could have a limited direct impact on its share price.

However, Apple's volume is a bit lower relative to NVDA, averaging around $12 billion per day, so this rebalancing buy is close to 100% of its average daily trading volume, providing a positive boost to its stock price.

Big-Tech Weekly Options Watcher

Is the Tesla market here to stay?It's possible that many investors are now "jumping on the bandwagon" to trade the Robotaxi Event Day on October 10th, after all, the market's anticipation has gotten stronger since August, including but not limited to the following:

The latest FSD v12.5

Driverless Taxi Cybercab

Wireless charging

More features of AI

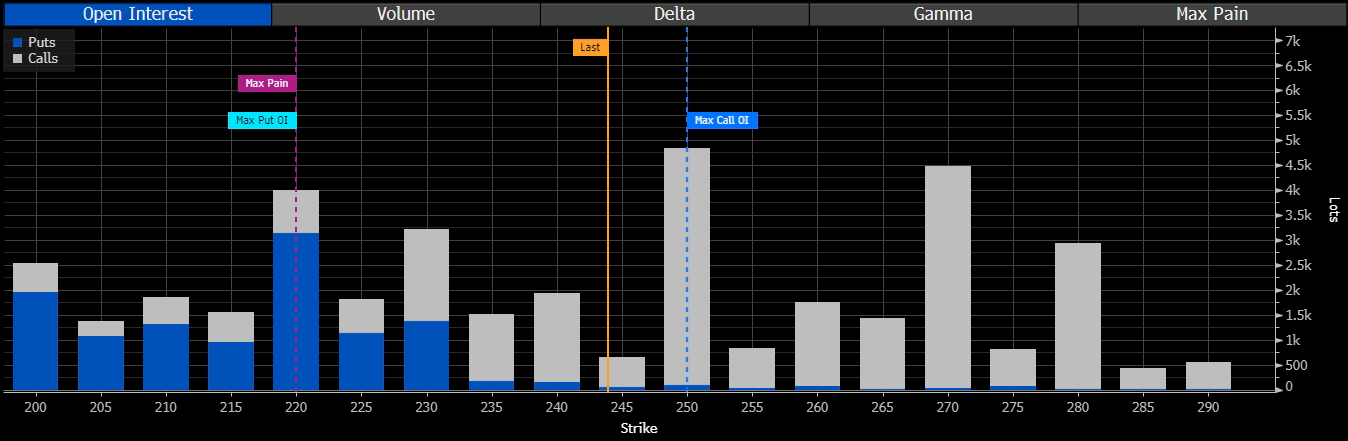

Looking at the options market, activity in options through the week of Oct. 11 is increasing, as is long strength, with Calls expiring Oct. 11 currently having a large number of open orders in the 250-270 range.At the same time, at the current price of $243, there were 220,000, 190,000, and 190,000 "passive buys" on September 27, October 4, and October 11, respectively. In other words, the selling pressure is quite strong, and $250 will require a very large number of buy orders if it is to hold.Unless there is a big surprise on EventDay, the pressure will be high.

Big-Tech Portfolio

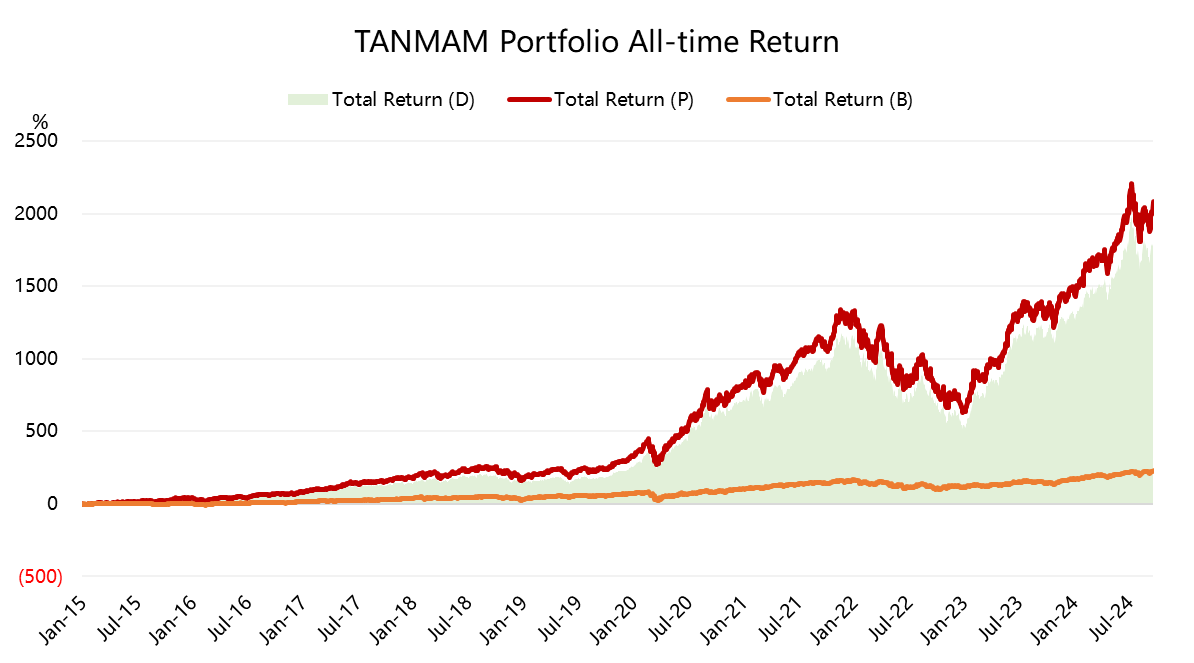

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are far outperforming $S&P 500(.SPX)$ since 2015, with a total return of 2,080%, while $SPDR S&P 500 ETF Trust(SPY)$ has returned 229% over the same period, once again pulling ahead.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.