Trade NVDA Volatility before November

$NVIDIA Corp(NVDA)$ is once again leading tech stocks and taking the broader market to new highs.There are two main factors that have affected NVIDIA sentiment recently:

Jen-Hsun Huang's reduction in his holdings.But according to a Barron's blurb, he has already completed his share of the previously announced reduction;

Blackwell expectations.According to $Morgan Stanley(MS)$ projections, in Q4 alone, NVIDIA could earn about $10 billion in revenue from Blackwell chips alone.This can be partly understood as incremental revenue with higher margins.

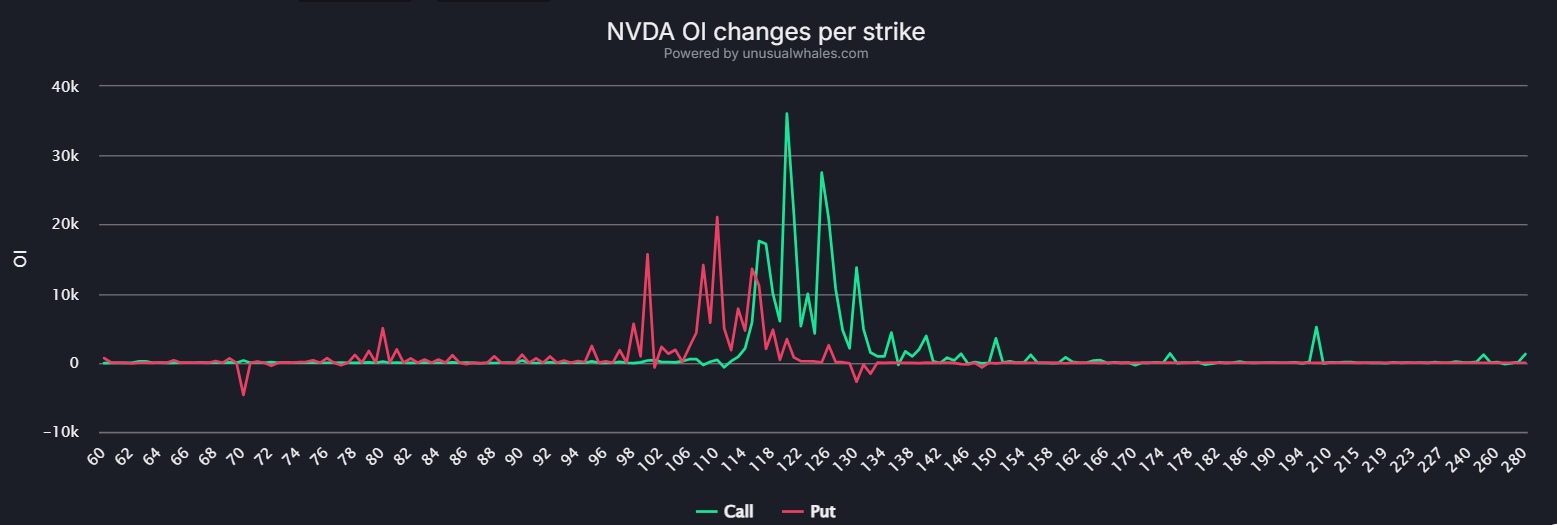

In fact, we can see that since the stock split, NVIDIA stock has gone back and forth for two cycles with gradually decreasing volatility.From a technical point of view, this is a more typical triangle pattern.From a fundamental point of view, in order for the stock price to have a "step" change, or need to be driven by events such as earnings reports (e.g., May, August).

And the end of this trend, also points to the end of November earnings.After all.

November's earnings report contains information not only about the start of Q4 Blackwell volume production and sales, but also market expectations for next year.

Following the Q3 earnings season, it's clearer to see further capitalization from NVIDIA's major A-side tech companies (e.g., $Microsoft(MSFT)$ $Meta Platforms, Inc.(META)$ $Alphabet(GOOG)$ $Tesla Motors(TSLA)$ ) for further capital spending plans.

With November being an election month, it will also be interesting to see what the new president has in store for the chip industry and his administration.

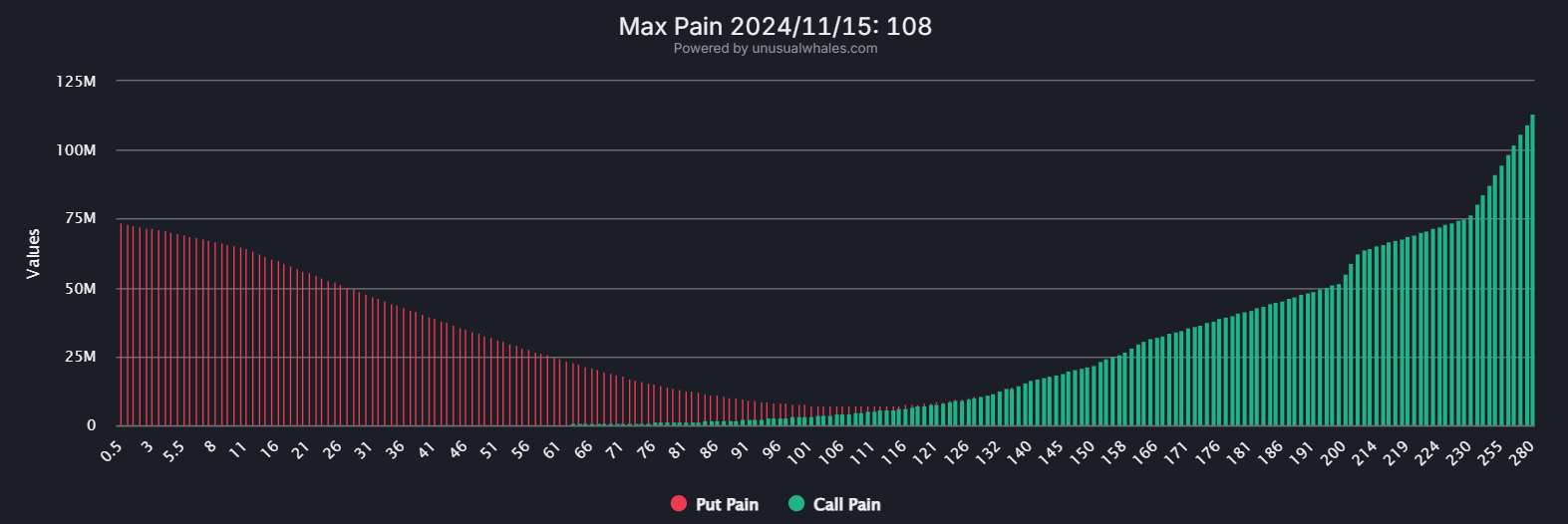

So until then, NVDA's shares will be in the "Blackwell's anticipation trade" and "risk aversion trade" in the balance, the reaction to the market, I think the probability is exactly in line with the expectations of this triangle finishing range.

Because I am not a technical person, I believe it is a coincidence, but the result is consistent.

At the same time, some special events may also bring extreme changes, such as some geopolitics, upstream and downstream supply chain changes, industry M&A big events and so on.

Recent rumors of $Qualcomm(QCOM)$ takeover $Intel(INTC)$ , I also very much agree with Ming-Chi Kuo point of view, belongs to the "outside force majeure" of the impact, meaning thatThe U.S. government is not satisfied with the situation of NVIDIA's dominance.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- henghm·2024-09-27Great article, would you like to share it?LikeReport