BIG TECH WEEKLY | Time to bet on META? | Tesla's 260 puzzle

Big-Tech’s Performance

Rate cuts continue to heat up and the broader market continues to hit new highs.U.S. final Q2 GDP maintained its preliminary 3% growth, which was slightly ahead of expectations, and the jobless claims data came in slightly below expectations, so the short-term probability of a soft landing looks higher.Risk assets other than big tech started to rally this week, including stock markets in Japan, India, Singapore, and even China that are counting on the benefits of the Fed's rate cut. $iShares China Large-Cap ETF(FXI)$

Big Tech also continued its upward momentum amidst the shocks due to solid fundamentals, strong buybacks, and the catalyst of events like the Robotaxi Event.

Through the close of trading on September 26, Big Tech has been very strong over the past week. $NVIDIA Corp(NVDA)$ +5.23%, $Tesla Motors(TSLA)$ +4.22%, $Meta Platforms, Inc.(META)$ +1.56%, $Amazon.com(AMZN)$ +0.68%, $Alphabet(GOOG)$ +0.36%, $Apple(AAPL)$ -0.59% and $Microsoft(MSFT)$ -1.68%.

Big-Tech’s Key Strategy

META Connect 2024 Event, teasing the future of VR?

Meta's developer conference this week focused on a number of new product announcements, advances in AI, VR and AR technology.

Among them was the release of the Meta Quest 3S headset, priced at $299.It inherits many of the benefits of the Quest 3, including high resolution, a colorful mixed reality experience, and hand tracking capabilities.

On the AI front, Meta AI with natural language processing is positioned as the most commonly used AI assistant, able to understand images and text and talk to the user's voice, as well as the open-source Llama 3.2 model and Meta AI Studio, which allows creators to make their own AI assistants.

On the VR/AR front, Meta's updates to the Horizon platform include "portals" to easily switch between different virtual worlds, a more realistic avatar and spatial experience called Hyperscape, and a new game, Batman: Arkham Shadows, that enhances the user's interactive experience in mixed reality.

The biggest highlight is the Orion Prototype Mixed Reality Glasses, the "first consumer-grade true holographic augmented reality glasses", the glasses themselves 98g, independent computing unit, myoelectric bracelet, with 7 cameras, custom chips, silicon carbide optical waveguide lenses, Micro LED micro-displays, costing up to 10,000 U.S. dollars, and currentlyOnly 1000 pairs, not on sale.

Of course, the market had certain expectations prior to this, so the stock price change was not significant, but it has remained strong overall for the past two weeks.META's share price support factors so far

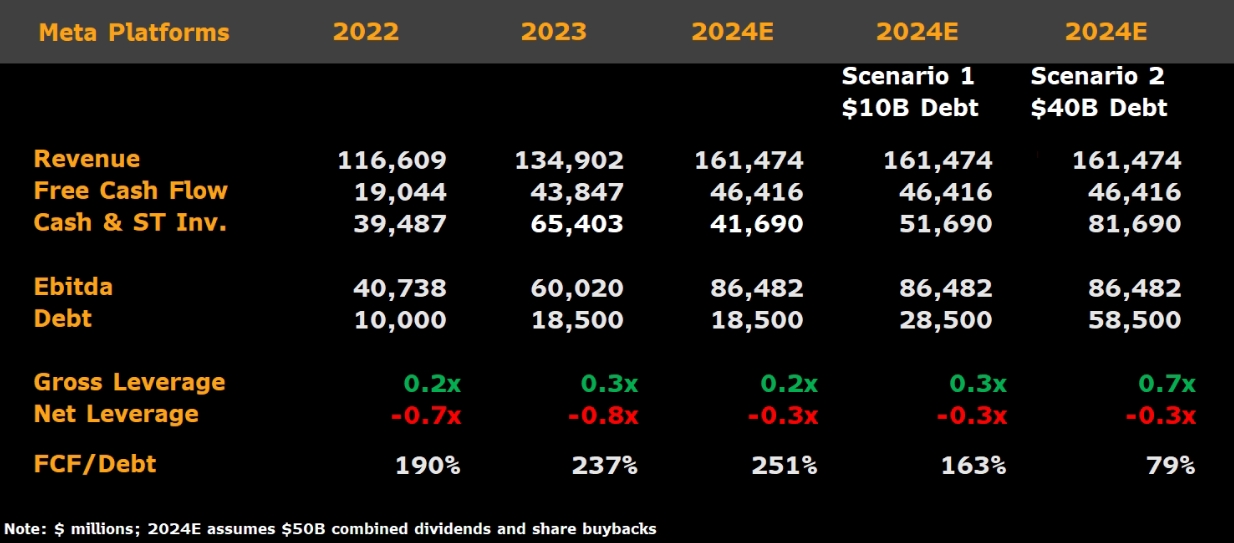

A strong balance sheet is the strongest support for the stock price, with the ability to continue to issue debt to expand under the current buyback program.

VR Labs is entering a "loss mitigation phase" that is expected to have a 200bps impact on the company's overall margins, a change that may not yet be fully priced into the market.

OTHER VIEWS

Bank of America: A broader rollout of AI-powered translation and creator tools can expand the library of engaging content and drive growth in user engagement.Adoption of the Llama language model has also been significant and remains the preferred open source model for building generative AI applications.Over the next few quarters, Meta is focused on driving monetization of messaging and is expected to roll out more business-focused AI chatbot features.

Rosenblatt: Meta highlights that by virtue of being more willing to lose money than any of its competitors and making effective cost/performance choices in VR/AR and the Metaverse, it is uniquely delivering what can be characterized as a category-leading product in terms of consumer adoption.Advances in its AI capabilities are now even more important and are part of an aggressive shift in the company's core advertising business.

JMP: Meta is at the forefront of new computing platforms and has the ability to create new consumer experiences and become the primary computing platform for consumers over time, while Orion represents Meta's evolution from a social media company to a meta-universe company."

TF International's Ming-Chi Kuo: Meta's internal product roadmap suggests that Orion could enter mass production as early as 2027.However, the production timeline could be later as an electronics manufacturing services/new product introduction vendor has yet to be selected and many technical issues remain to be resolved.Meta could launch a lower-spec version of the Orion before it goes into mass production.The Orion is being positioned as a replacement for smartphones and tablets, with the key selling point being the integration of AI and spatial computing.** Meta's internal product roadmap suggests that the Orion could go into mass production as early as 2027.

Big-Tech Weekly Options Watcher

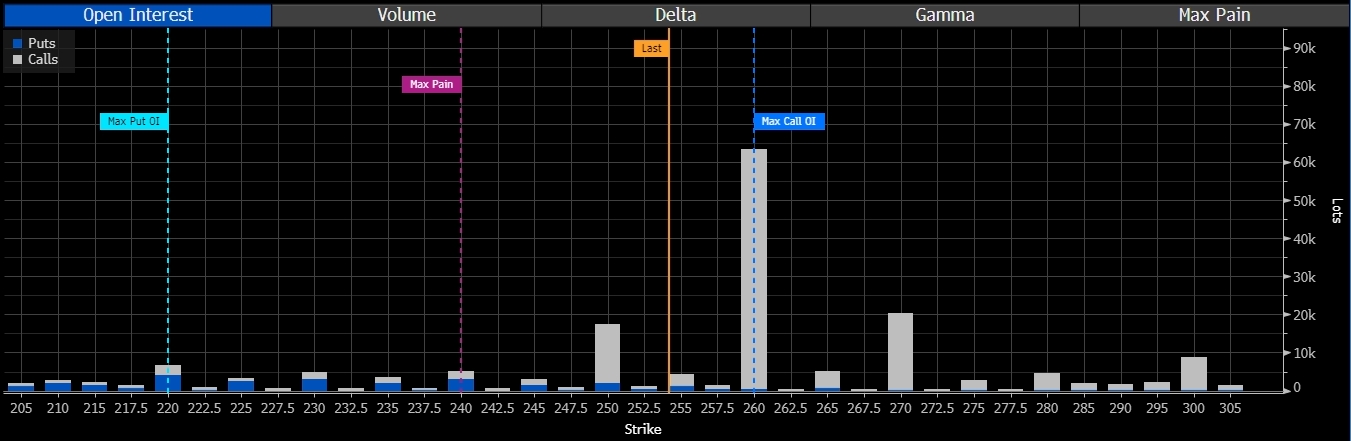

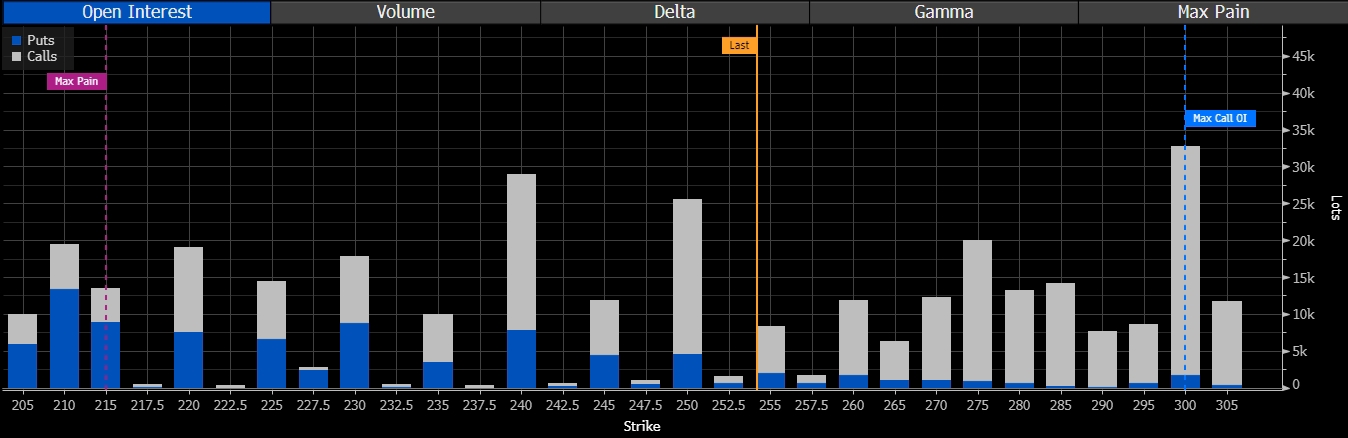

The Tesla Event market continues, with options activity increasing through the week of October 11th starting last week due to the 10.8 day of the event. the October 11th expiration Call currently has a very large open order book at 260, and there seems to be a lot of "Sell in fact" power at the moment, with 270 being a very large open order book.There are also large open orders for 270.

And a week later on October 18, it is very obvious move to 300 CALL, means that the market may be more volatile that week. October 11 if closed above $260, there is a considerable amount of pending buy orders, short-term speculation may be given to sell pressure.

Big-Tech Portfolio

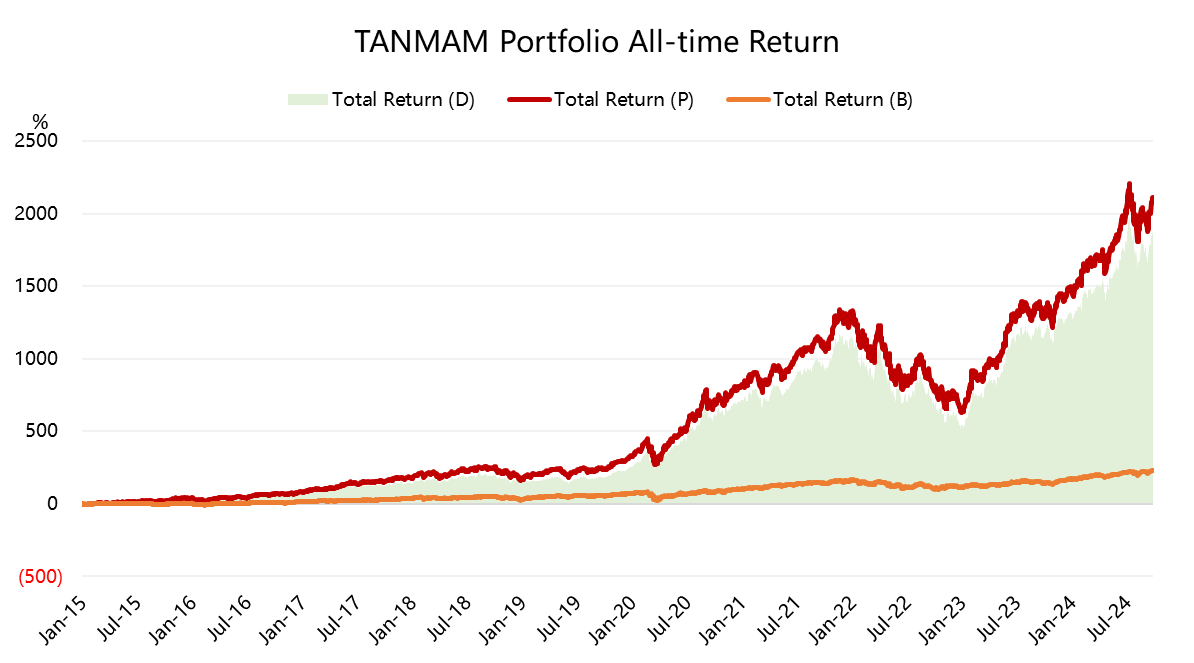

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are far outperforming the $S&P 500(.SPX)$ since 2015, with a total return of 2111.5%, while the $SPDR S&P 500 ETF Trust(SPY)$ returned 230.6% over the same period, again pulling ahead.

Big tech stocks were strong this week, with the portfolio returning 39.8% year-to-date, outperforming the SPY's 21.5%.

The portfolio's Sharpe Ratio over the past year has risen to 2.5, matching the SPY's 2.5, and the portfolio's Information Ratio has risen to 1.4

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- AuntieAaA·2024-09-29GOODLikeReport