Gold Price Forecast: Will Overbought Conditions Trigger A Correction?

Gold prices have reached record highs recently, and some market participants believe that,A tactical pullback may be on the horizon and see it as an opportunity to add positions.

However, UBS released a report saying that although the overall bullish outlook for gold is solid, the market may need to catch its breath.

UBS analyst JoniTeves pointed out in the report that the consolidation period at this time is beneficial to the market, especially if it allows some weak bulls to exit the market and allows long-term investors to enter the market at a better level.

Generally speaking, September is a relatively low season for gold prices.Because during this month, the dollar tends to perform strongly, yields rise, and the stock market performs weakly.However, this year's situation is different. The Federal Reserve cut interest rates by 50 basis points as scheduled, the US dollar weakened, and real interest rates fell. Various factors have superimposed to support gold prices.

In addition, persistent geopolitical risks, as well as the uncertainty of the upcoming U.S. election, have also increased investors' willingness to use gold as a portfolio diversification tool.

UBS pointed out,Another theme of the gold market this year is the prevalence of the "buy the dip" mentality. Recently, market participants have been more bullish than ever on gold.But that sentiment isn't fully reflected in positions.

Many investors have been waiting for a price pullback to add to their positions, but the market hasn't offered much more attractive entry opportunities. It could also be a key factor in the recent sharp rise in gold prices, as investors are forced to chase higher.

UBS pointed out in the report that the market may need to breathe: "U.S. economic growth has accelerated again, leading to a hawkish Federal Reserve, rising interest rates and a stronger dollar, which will be bad for gold.Official sector gold purchases are much lower than expected, which may mean that expectations for rising prices may need to be lowered, but other things being equal, this is not enough to completely turn bearish. ”

UBS also mentioned that along with the rise in market optimism, investors are also worried about positions. Recently,COMEX gold net long positions surged and were mainly driven by the addition of new long positions rather than short covering.

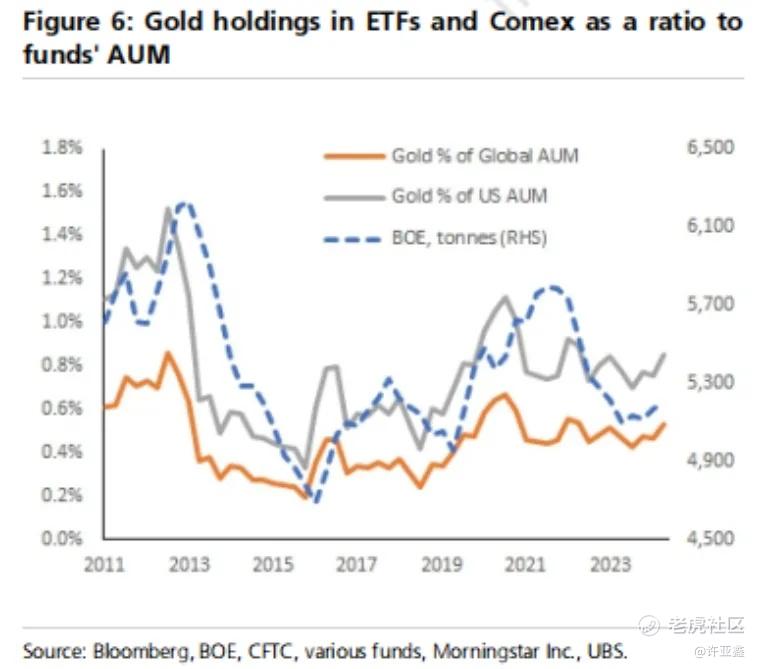

When UBS compared the ETF with Comex's gold holdings and AUM (asset size under management) in its report, it found that the ratio was still below the level seen during the pandemic and the peak of the bull market many years ago in 2012/13.

UBS believes that "although gold has attracted much attention this year and has risen by about 27% year-to-date, the current gold market is not crowded. There is still a lot of room to increase positions.This should continue to push gold higher in the medium to long term ".

Let me summarize it for you in a simple sentence:UBS believes that the traditional off-season trend of gold prices in September is not weak. In the short term, some investors are forced to chase higher and buy, and the price faces the risk of taking a break. However, there is still a lot of room for growth in medium-term positions, and the chance of continuing to hit record highs is still great.

-END-

$NQ100 Index Main 2409 (NQmain) $$Dow Jones Index Main 2409 (YMmain) $$SP500 Index Main 2409 (ESmain) $$Gold Main 2408 (GCmain) $$WTI Crude Oil Main 2408 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.