Mysterious retail whale bets over $100 million on continued Nvidia upside

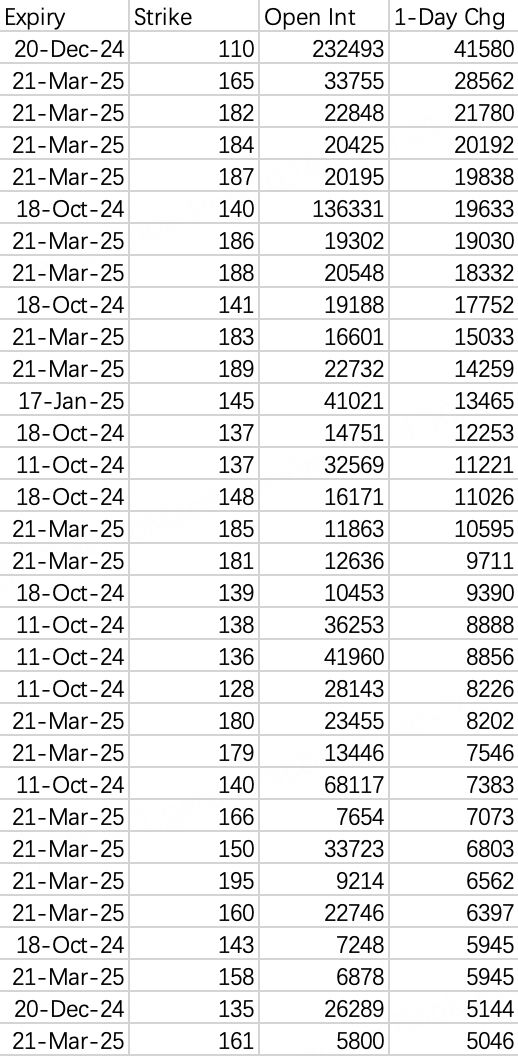

On Thursday, $Nvidia (NVDA)$ call options saw an explosion in opening activity, with 16 different strikes seeing over 10,000 contracts traded.

Two key expirations stood out:

The largest trade was a 41,000 contract opening buy in the December 20th $110 calls, likely an add-on to the "Million Dollar Man's" existing position.

A massive purchase across the March 21, 2025 upside strike chain, focusing on far out-of-the-money calls.

Let's analyze whether these enormous trades signal continued bullishness on Nvidia.

$NVDA 20241220 110.0 CALL$

Regular readers will be familiar with the "Million Dollar Man" who rolled his calls up to the December $120/$110 call spread back on August 30th, opening 120,000 contracts. The reduced size from the prior quarter was attributed to macro factors like the election and rate hikes creating choppiness.

On October 10th, someone else bought over $110 million worth of the $110 calls - a trade befitting of a "large" order.

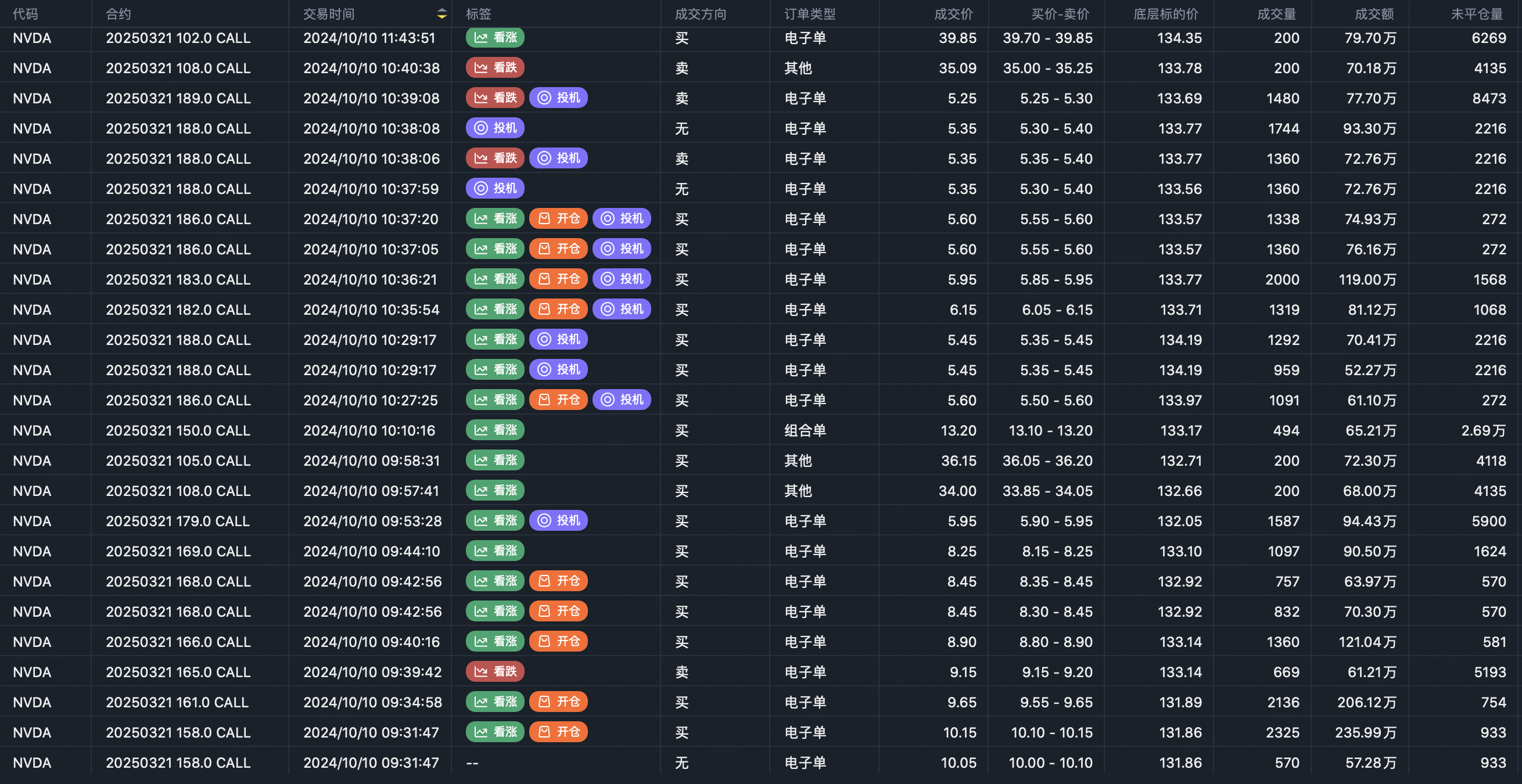

However, this trader is distinct from the Million Dollar Man based on the execution style. As shown, this trade played out over roughly half an hour with prints ranging from 200-500 contracts at a time. For a far-dated option with a $0.10 bid/ask spread, the trades crossed at prices between the market.

So while my filter flagged these as "sells", I believe they were largely buys based on the patterns. If you wish to view them as sells, the analysis changes but you trade at your own risk.

In contrast, the Million Dollar Man trades as an institutional block, likely crossing directly with a counterparty in a single large print - no need to work an order for 30 minutes.

So this recent trade has the hallmarks of a very wealthy retail trader looking to get leveraged upside exposure on Nvidia, perhaps even piggybacking off the larger existing position.

March 2025 Upside Strike Chain

What made this even more bizarre was that the $110 calls were not the only trades on Thursday. The March 2025 upside strike chain also saw significant "accumulation" in block-sized trades.

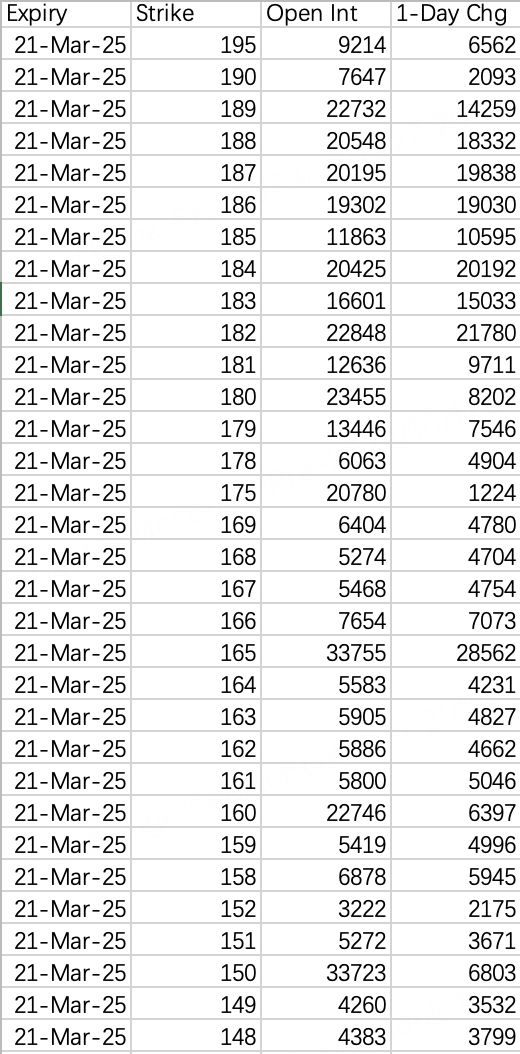

Looking at just the new opens in March 2025, we can see that almost every upside strike was bought from $181 ($NVDA 20250321 181.0 CALL$ ) all the way up to $189 ($NVDA 20250321 189.0 CALL$ ) - not just the largest sizes I had initially flagged.

Similar to the $110 trade, these March prints also crossed the market in a worked order fashion rather than as a clean block trade against a single counterparty.

Digging into more granular data shows these trades were a mix of buys and sells, often straddling the midpoint rather than cleanly hitting the bid or offer. For example, $189 saw more selling, $188 more buying, $187 selling, $186 buying, and so on.

This pattern reminds me of the institution we've seen selling covered calls each week, creating a bullish pinning impact on the stock.

Unfortunately, this flow does not seem to be from that same trader based on the disparate execution style. And there are no multi-leg trades here, just outright long calls in isolation.

I've simply never witnessed such a concentrated volley of trades like this before.

In unfamiliar territory, we can only attempt to analyze what it could represent.

Fundamentally, the option type trumps strike/expiry in terms of implications. Ignoring direction, any large open interest will exert some degree of pinning impact on the stock, the magnitude being the question.

Could this be an outright bearish bet, selling calls in size?

So far, outright put buying remains the more prevalent way to express outright bearish views. And we'd expect any major bearish positioning to also pursue that more straightforward put strategy.

So the conclusion is clear - this flow represents a bullish bet on Nvidia.

However, I remain somewhat reserved on the conviction behind these specific trades. While seemingly a household name "whale", the trading style isn't quite characteristic of a seasoned institutional manager or family office.

One undisputed phenomenon revealed by the recent Chinese equity mania is that there is simply a lot of wealthy cash sitting on the sidelines willing to speculate. Perhaps someone just decided to back up the truck on some lotto upside calls. But if the more professional players remain quiet, it's probably prudent not to blindly follow suit.

For next week, I'll continue with a combined strategy of stock / covered calls / cash-secured puts on Nvidia. Selling the $145 calls and $120 puts, prepared to roll either side while maintaining core equity exposure into this uptrend.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Wow, let see how we can position to benefit from this trend.