Gold soars but be careful when you consider buying gold now

The time node when silver compensated for the increase and the RMB exchange rate triggered the rise of precious metals in the internal market + various news and fundamentals gathered.

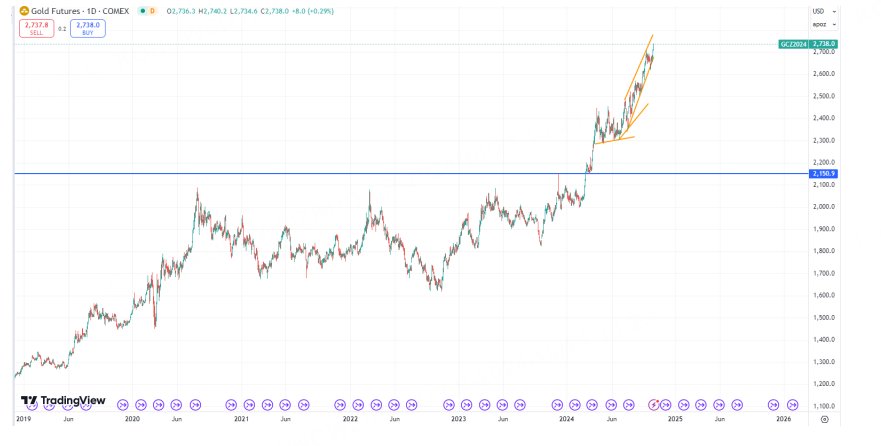

These top features that have been talked about before are emerging one after another. As an old bull who has been bullish on gold for many years, now I am more cautious and waiting for a signal to exit. Always remember that pulling the market is the best way to sell goods. Don't go up or chase high is the only way to avoid deep traps and losing money.

Silver showed a significant upward trend last week, breaking through the high in mid-May, and opening further higher this Monday. Obviously, the recent comparison of gold and silver trends has completely matched the compensatory effect of silver's late-coming first-coming compensatory effect.

Although it is still a long way from the historical high, considering that silver is likely to have no chance to hit a new high, the 100% increase from the low in September 22 is actually not small. At present, it is impossible to judge where the final target point is, but the time period should be relatively certain-before the end of the year, it will be a high probability event to peak. All you need to do is wait for the gold signal to be confirmed, and still choose silver as the main short-selling target.

Going back to gold itself, the ending wedge we previously guessed is still running in the channel, which means that there is still some space and time for gold prices, but it is also difficult to extend more at the point in time. The final result of the US election will clarify the arrival of the top: Trump's election means that at least one or two varieties in the troika will quickly peak and reverse.

On the contrary, if Harris wins, the time will be extended by 3-6 months. However, it should be noted that this extension is likely to be a shock upward trend, or the head construction of a slow bull. In other words, the main rise, we are likely to see and end in October-November.

Considering that there is still more than a month's time difference between the 11.5 election day and the final swearing-in, this time is also likely to become a valued timeline for long and short positions. The most ideal situation is to withdraw while playing near this cycle, and perhaps you can leave some bottom positions, but it is recommended to consider taking profits for most positions.

In addition to the precious metal market itself, you can also pay due attention to changes in the following reference objects. The first is Nvidia. As the leading brother of the US stock market, if NVDA falls, it can basically announce the emergence of new logic. The core support is currently at a weekly low of 100-90.

The second is the change of the yen. USD/JPY suffered a setback around 151, which may imply that the second wave of the yen's rebound is still brewing. The downward breakdown of 139/137 between the United States and Japan is likely to be accompanied by risk aversion. Sentiment and financial market turmoil will also reflect the pressure on US stocks, gold and cryptocurrencies.

The third is the crude oil market. U.S. oil has been suppressed around $70 recently, and its performance lags far behind the U.S. stock index, which deviates from the long-term correlation logic between the two. If the oil price falls further and breaks through 63 in the future, you need to worry about the possibility of risky assets making up for the decline.

In short, we think the current market environment looks comfortable, but there is also the possibility of the last wave. Everyone needs to grasp the last good day and be ready to change direction at any time.

$NQ100 Index Main 2412 (NQmain) $$SP500 Index Main 2412 (ESmain) $$Dow Jones Index Main 2412 (YMmain) $$Gold Main 2412 (GCmain) $$Silver Main 2412 (SImain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.