How The U.S. Election Will Impact The Markets

The final chapter of the annual drama American election will come soon. As a hot spot that was regarded as more important than the Fed's interest rate cut at the beginning of the year, how will the election results affect the short-term, medium-and long-term development of the market?

In terms of short-term fluctuations, we believe that the main difference between Harris and Trump will be the option of controlling the market. Although the risky assets represented by U.S. stocks have maintained a slow bull pattern recently, the continued weakness of oil prices still indicates that the market is currently expensive.

If Trump takes office, it is very likely that he will start smashing the market after officially entering the White House. Or on the day of the general election, it is expected that there will be a similar trend, but the magnitude and sustainability will be weaker.

In the long-term market, no matter who comes to power, the new capital market gameplay and new leading assets will definitely change. Among the troika of the Biden era-gold + US stocks (AI represented by Nvidia) + cryptocurrencies, at least 2 will be replaced, and after 6-7 consecutive months of consolidation, cryptocurrencies are the most likely to become a variable, so that in the next 4 years, it will still play a role that cannot be ignored.

As for U.S. stocks, the two parties will not voluntarily give up, but they will seek a relatively reasonable valuation or support a new leading brother to lead the market and topics.

Referring to the market when Trump took office last time, we guess that there will be a trend market for commodities represented by crude oil, rather than the wide fluctuation pattern in the past two years. And if there are big fluctuations in the financial market or similar to the first trade war or large-scale geopolitical topics, then the foreign exchange market will definitely start a big market. Harris, however, has no history to refer to, so this convenience will be relatively vague at present.

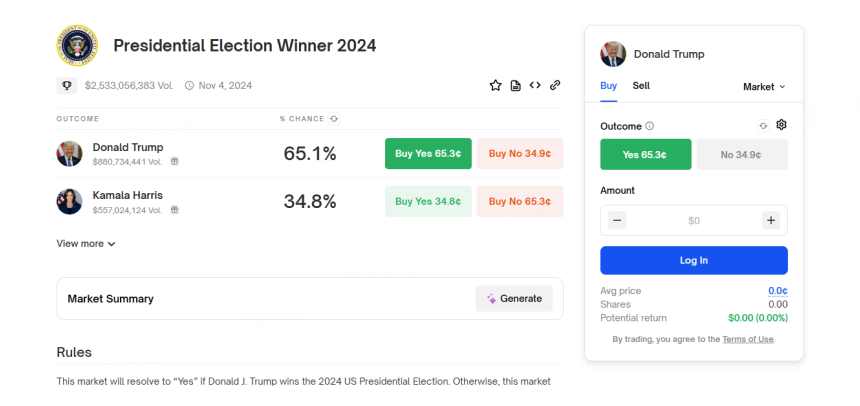

As for who can win successfully, the current polls still lack directivity. Although Trump is far ahead in relative folk data (Polymarket betted with real money), compared with traditional financial media polls, the two are still indistinguishable, and the main variables will still appear in the final results of some swing states. Then, outside the president, there will naturally be some differences in the competition between the Senate and the House of Representatives, but it is a little too early to consider it at present.

To sum up, From the perspective of watching the excitement, Trump has a slight advantage. There may be a roller coaster market on the election day, but it is difficult to continue unilaterally.

Trump's election is not conducive to risky assets and current main trend varieties, but it will drive the trend of volatile varieties such as foreign exchange and commodities; Harris's election will relatively continue the current market style.

From a trading point of view, these days are still the time to take profits for varieties with large profits in the early stage, and for the trend layout of next year or the next four years, it is best to wait for the results to be released before making decisions.

$NQ100 Index Main 2412 (NQmain) $$SP500 Index Main 2412 (ESmain) $$Dow Jones Index Main 2412 (YMmain) $$Gold Main 2412 (GCmain) $$WTI Crude Oil Main 2412 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.