The Impact of Earthquakes on the Japanese Stock Market

Since Japan launched its rate hike, the Japanese stock market has entered a high sideways consolidation stage, with the Nikkei 225 index rising by less than 3% in October.

Recently, in the 50th House of Representatives election in Japan, the ruling Liberal Democratic Party lost its ruling position for the first time since 2009, and the Japanese stock market and exchange rate fluctuated greatly in the short term, which brought great uncertainty to Japan's monetary and fiscal policies in the future.

There are downside risks to the economy

According to published data, the Japanese government's second-quarter GDP growth rate was lowered from 0.8% to 0.7%, and the annualized quarter-on-quarter growth rate was lowered from 3.1% to 2.9%. Among them, the month-on-month growth rate of private final consumption expenditure, which accounts for more than half of Japan's GDP, was lowered from 1.0% to 0.9%, and the month-on-month growth rate of enterprise equipment investment was lowered from 0.9% to 0.8%.

The latest "World Economic Outlook Report" released by the International Monetary Fund (IMF) lowered Japan's economic growth forecast for 2024 to 0.3%, a decrease of 0.4 percentage points compared with the forecast released in July this year.

In the third quarter, the growth rate of Japanese household consumption continued to slow down, with a negative growth in August. Data show that in August, the year-on-year growth rate of Japanese commercial sales fell to 2.4%, which was not only lower than 7.6% in July, but also lower than the monthly average of 4.2% in the second quarter; It fell sharply by 7.6% month-on-month, the largest drop since February.

Japan's exports also weakened significantly in the third quarter. Data show that Japan's exports in September were 9.04 trillion yen, a year-on-year decrease of 1.7%. Among them, the export value of automobiles, fossil fuels, construction and mining machinery decreased by 9.2%, 49.8% and 33.3% respectively year-on-year.

From the perspective of leading indicators, the Japanese economy got off to a bad start in the fourth quarter. Japan's manufacturing PMI contracted for the fourth consecutive month due to sluggish demand, while the services PMI also contracted for the first time in four months.

Upside risks to inflation remain

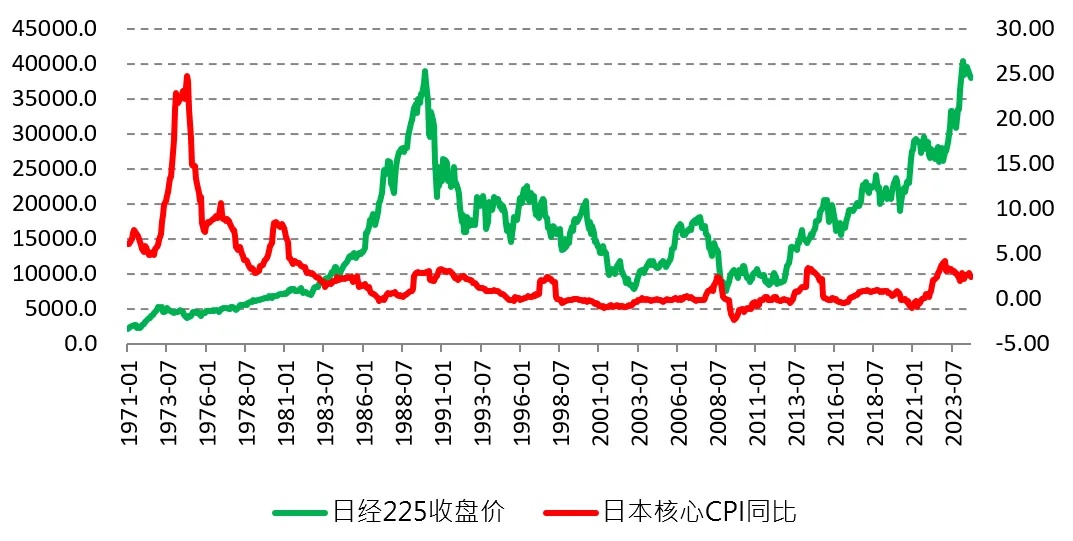

From the perspective of inflation, the pressure of imported inflation caused by the depreciation of the yen still exists, and the Bank of Japan needs to curb inflation and boost the yen exchange rate. In September, Japan's core CPI growth slowed to 2.4% year-on-year, down from 2.8% last month, but still much higher than the level of less than 1% before 2021.

For the stock market, rising inflation is bad. On the one hand, the continued rise in inflation will lead to the shrinkage of private consumption in Japan, resulting in stagnation or even negative economic growth; On the other hand, rising inflation will lead to a decline in the purchasing power of the yen, a depreciation of the exchange rate, and the Japanese stock market will face the pressure of capital outflows.

The picture shows the comparison of the year-on-year trends of the Nikkei 225 Index and Japan's core CPI

Political instability rises

Last weekend, Japan held the 50th House of Representatives election. Among the 465 seats, the Liberal Democratic Party had 191 seats and the Komeito Party had 24 seats (the ruling coalition composed of the two parties had a total of 215 seats, which did not reach the majority of 233 seats); The Constitutional Democratic Party has 148 seats, the Japan Reform Association has 38 seats and the National Democratic Party has 28 seats. The ruling Liberal Democratic Party has lost its ruling position for the first time since 2009.

To sum up, there are downside risks to the Japanese economy and upside risks to inflation, and monetary policy faces a dilemma. The most important thing is that the ruling Liberal Democratic Party has lost its ruling position for the first time since 2009. In the future, the threshold for currency normalization has been raised, and the possibility of fiscal expansion has increased, which makes it necessary for the Bank of Japan to conduct rate hike again. This means that the risk of yen depreciation is rising, and Japanese stocks are under pressure.

But as the Nikkei 225 hit an all-time high, the nominal value of contracts also increased significantly, and the demand for smaller contracts increased with it. In order to make it easier for market participants to obtain Nikkei products, CME Group launched a micro Nikkei futures contract on October 28th, with a multiplier of 1/10 of that of standard Nikkei futures, allowing investors to participate in Nikkei 225 index futures in a more cost-effective way and manage risks more finely. Micro Nikkei futures compliance is small and suitable for small and medium investors, with a contract size of 50 yen denominated in yen and 0.50 USD denominated in US dollars.

$NQ100 Index Main 2412 (NQmain) $$SP500 Index Main 2412 (ESmain) $$Dow Jones Index Main 2412 (YMmain) $$Gold Main 2412 (GCmain) $$WTI Crude Oil Main 2412 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.