Learning the Zen of Chasing Rallies from Option Whales

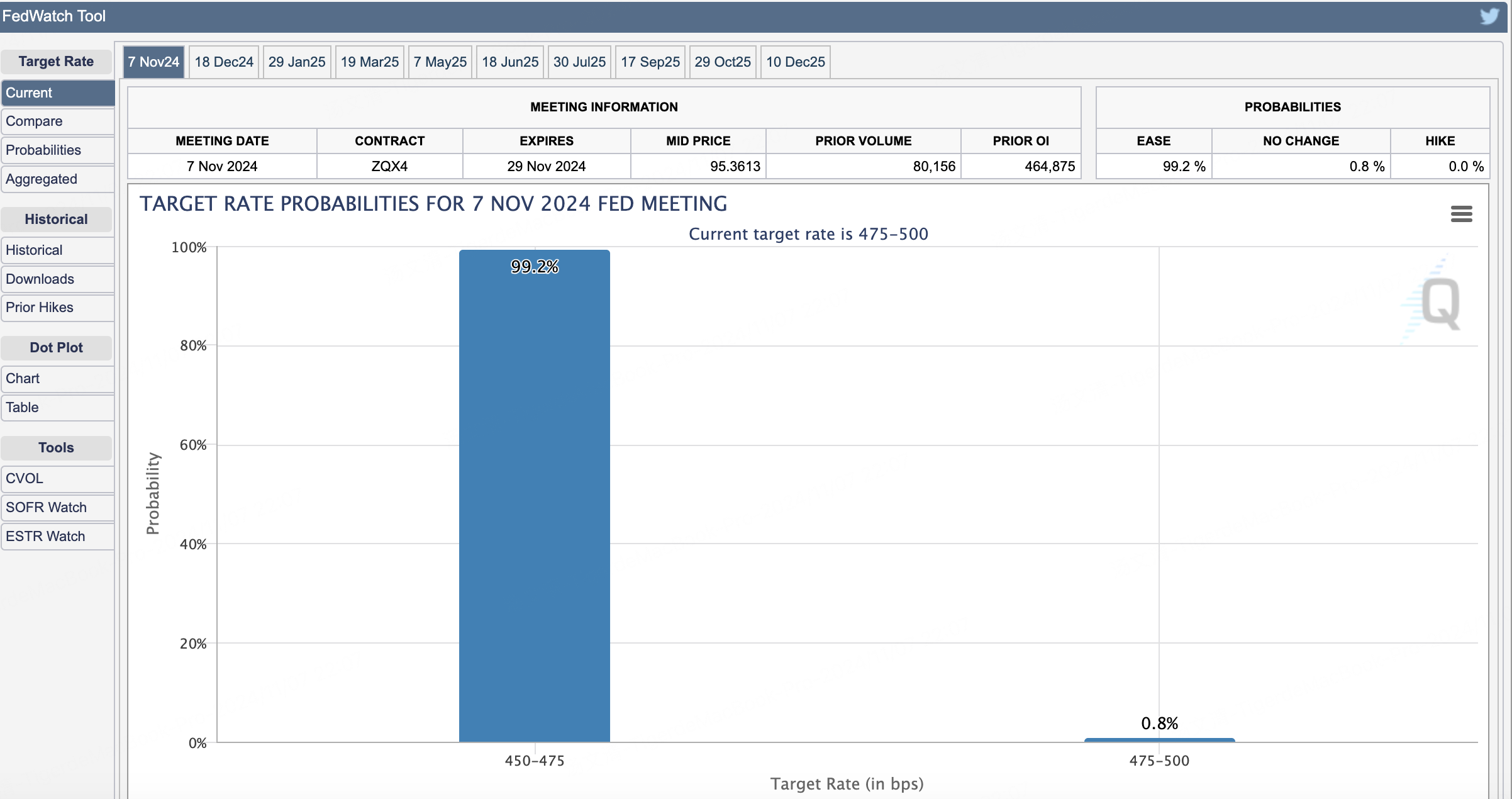

Tonight's FOMC meeting has Powell sweating, as the man representing high inflation is coming back. Looks like next year's rate cut plans need to be re-evaluated.

However, based on CME's FedWatch tool, the most likely outcome tonight is a 25bps rate hike if no surprises.

On Wednesday night, the S&P 500 jumped 2.53% to close at 5,936 - just a stone's throw from 6,000. The burning question on everyone's mind is whether to chase further upside, and how to manage potential pullbacks.

For QQQ, the whales outlined a conservative put spread strategy:

Buy $QQQ 20250117 500.0 PUT$ for 23,000 contracts

Sell $QQQ 20250620 510.0 PUT$ for 23,000 contracts

It's widely accepted that a Trump presidency bodes well for equities over the long run. But near-term, there are fears of a sharp rally followed by an equally brunt pullback. The pain trade in bull markets is not buying the lows.

So buying near-dated puts while selling longer-dated puts perfectly addresses this dual mandate - protecting against short-term drawdowns while maintaining long-term upside exposure. The January $500 puts were bought, funded by selling the June 2025 $510 puts for around a 14% annualized return. A zen-like, bullish risk reversal.

This structure is akin to holding stock and buying protective puts.

However, for those looking to amplify upside exposure in something like Tesla, this put spread may be too conservative. An alternative could be a sell put/buy call risk reversal instead:

Sell $TSLA 20250117 250.0 PUT$

Buy $TSLA 20250117 330.0 CALL$

The main risk here is fear of a pullback, which the put sale largely finances the costly upside call purchase.

Previously, I outlined a $240 median price target for TSLA in Q4. With the recent rally, $260 appears to be robust support. So even if shares pulled back, the $250 short put strike provides a re-entry level with minimal premium erosion.

If the 6-month put sale horizon seems too extended, one could also sell weekly puts instead like the $260 strike expiring next Friday:

Sell $TSLA 20241115 260.0 PUT$

$Nvidia (NVDA)$

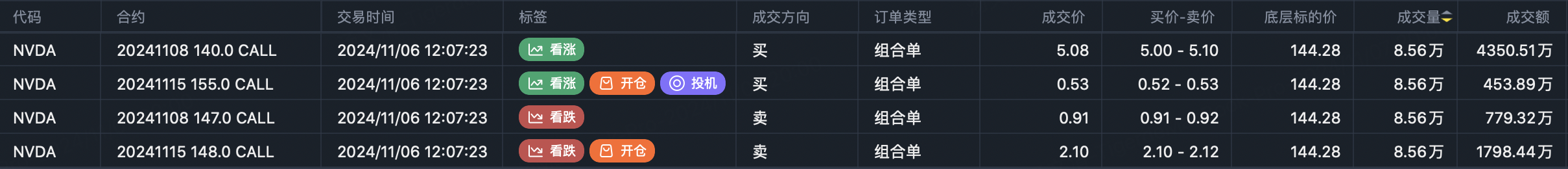

On Wednesday, institutions rolled their NVDA upside call spread higher, now targeting a $148-$155 range into NVDA's November 16th earnings release:

Sell $NVDA 20241115 148.0 CALL$ for 85,600 contracts

Buy $NVDA 20241115 155.0 CALL$ for 85,600 contracts

With earnings unlikely to disappoint, covered call writers could look at $155 or even $160 strike calls as prudent short sale levels. For outright put sales, the $135 strike may make sense given NVDA's momentum:

Sell $NVDA 20241115 135.0 PUT$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.