BIG TECH WEEKLY | Will ASIC Take Nvidia's Market Share?

Big-Tech’s Performance

Market volatility rose this week, the $.IXIC(.IXIC)$ $NASDAQ 100(NDX)$ hit new highs at the same time, the $.DJI(.DJI)$ recorded the first time since 1974, "ten consecutive losses", while the Federal Reserve's "ultra-hawkish interest rate cuts" to the broader market recorded the largest decline since August.At the same time, the dollar strengthened again, 30-year and 10-year U.S. bond yields exceeded the Federal Reserve's federal funds rate target ceiling of 4.5%.

Individual stock level performance is also more differentiated, meme stocks across the board but volatility is also larger, the overall performance of large technology companies slightly better, Tesla's reflects the risk attributes, up and down volatility, while Nvidia is the ASIC chip from the former Broadcom earnings after the market focus shifted to generate capital outflows.

Next week, Christmas is coming, the year is also down to the end of the year, many investors have chosen to wait for empty positions.The vote on the U.S. government's debt ceiling is also showing the market the contest in next month's transition of power, and U.S. stocks can't rule out more risky events.

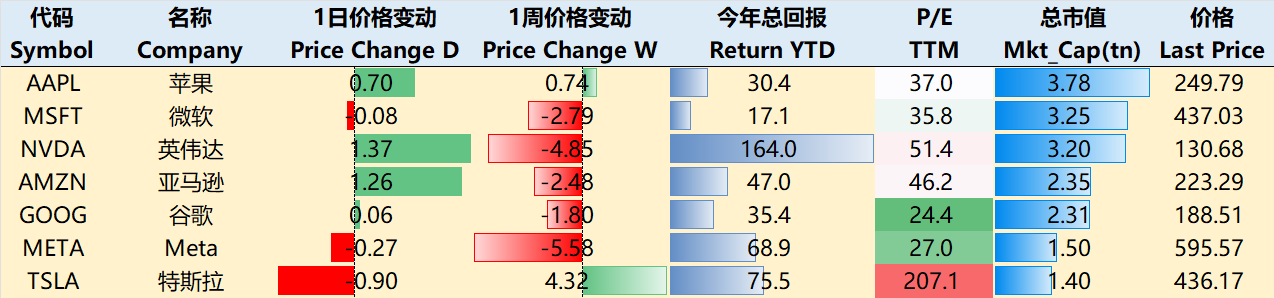

Through the close of trading on Dec. 19, Mag 7 companies as a whole closed lower over the past week. Among them $Apple(AAPL)$ +0.74%, $NVIDIA(NVDA)$ -4.85%, $Microsoft(MSFT)$ -2.79%, $Amazon.com(AMZN)$ -2.48%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -1.80%, $Meta Platforms, Inc.(META)$ -5.58%, $Tesla Motors(TSLA)$ +4.32%.

Big-Tech’s Key Strategy

How much did ASIC affect Nvidia?

Ignoring the Fed's hammer, one of the worst performers this week was NVIDIA.The underlying reason is that after $Broadcom(AVGO)$ earnings report a few days ago, investors suddenly became interested in ASIC chip manufacturing and started pricing it to "capture some of NVIDIA's GPU market", so the other side of the coin, NVDA's money began to flow out.

This is not the AVGO CEO's outlook on the ASIC market, but what is really happening.

The market for ASICs (Application Specific Integrated Circuits) continues to expand on the basis of, among other things:

Lower prices;

It doesn't need to be as all-encompassing as a GPU, but it can be customized in one way or another to meet your needs.

As a result, ASICs are being adopted including Amazon AWS' 3nm Trainium project, Google's 3nm TPU project, Microsoft's 3nm Maia200 project, and Meta's 3nm AI Networking project.As a result, AVGO's own expectation is that by 2027 in the three major cloud service providers/hyperscale data centerThe AI market opportunity for customers will accelerate from $15-20 billion in 2024 to $60-90 billion.

$JPMorgan Chase(JPM)$ 's view is that the TPUv6 3nm training chip is expected to enter volume production in the second half of the next fiscal year, and this single product could generate $8bn+ in revenues for AVGO in FY2025.Together with the cyclical semiconductor business, fundamentals are stabilizing in most businesses, except Industrial, and are expected to recover in fiscal 2025.

$Barclays PLC(BCS)$ also said: can now see the addition of 2 new custom ASIC large customers, META also has signs of new training ASIC, business expansion is active, 2025 fiscal year is expected to revenue of 61.5 billion U.S. dollars, year-on-year +19.3%, the growth rate of profits will be more pronounced.

But there are different views.

First, AVGO's company's XPU business is likely to see a slowdown in growth in the first half of FY25 due to process issues, and is not expected to grow strongly until the second half of FY25 after the launch of next-generation 3nm products;

In addition, GPUs are not superior across the board; software reprogrammability via CUDA is irreplaceable by ASICs, which allows them to adapt to a wide range of workloads, and this flexibility is seen as a key differentiator.

As a result, $Citigroup(C)$ believes that the TAM for AI gas pedals will reach $380 billion by 2028, but GPUs will still dominate with a 75% market share, while ASICs are expected to take the remaining 25%.

A major factor in the low market share is the higher average selling price (ASP) of GPUs.

So there would be a game for software companies -

It's going to cost cheaper ex-custom ASICs, but lacks flexibility;

Either more expensive GPU and reprogrammable, but with enough output?

Ultimately it will come down to the one with the higher ROI in terms of ASIC/GPU pricing.

Big-Tech Options Watcher

This week we're watching: Tesla's Strangle

Compared to the ambitious 500 hit at the beginning of the week, Tesla's high volatility is also reflected after the Fed meeting this week, the nature of risky assets is still similar, especially with BTC's risky money is similar, then the current Tesla is also faced with the choice of whether to continue the uptrend or pullback.From the perspective of next week's chip distribution, the PUT/CALL ratio has been relatively high, and too many Calls chasing the rally in the 400-450 range may be in the floating phase.And above 500 is more of a Sell CALL disaster area.

So much so that the Reverse Strangle strategy of double selling has become one of the preferred options for shorting volatility.

Big-Tech Portfolio

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are far outperforming the $.SPX(.SPX)$ since 2015, with a total return of 2,499.86% and a $SPDR S&P 500 ETF Trust(SPY)$ return of 249.11% over the same period, for an excess return of 2,297.48%.

The big tech stocks had a pullback this week, but year-to-date returns are still there to 64.35%, outperforming the SPY by 24.48%, with a record high excess return of 39.88%.

The portfolio's Sharpe Ratio over the past year has rebounded to 2.26, the SPY is 2.4, and the portfolio's Information Ratio is 1.23.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- zubee·12-20 17:39Interesting analysis1Report