The Taper is Coming! HOLD OR SELL?

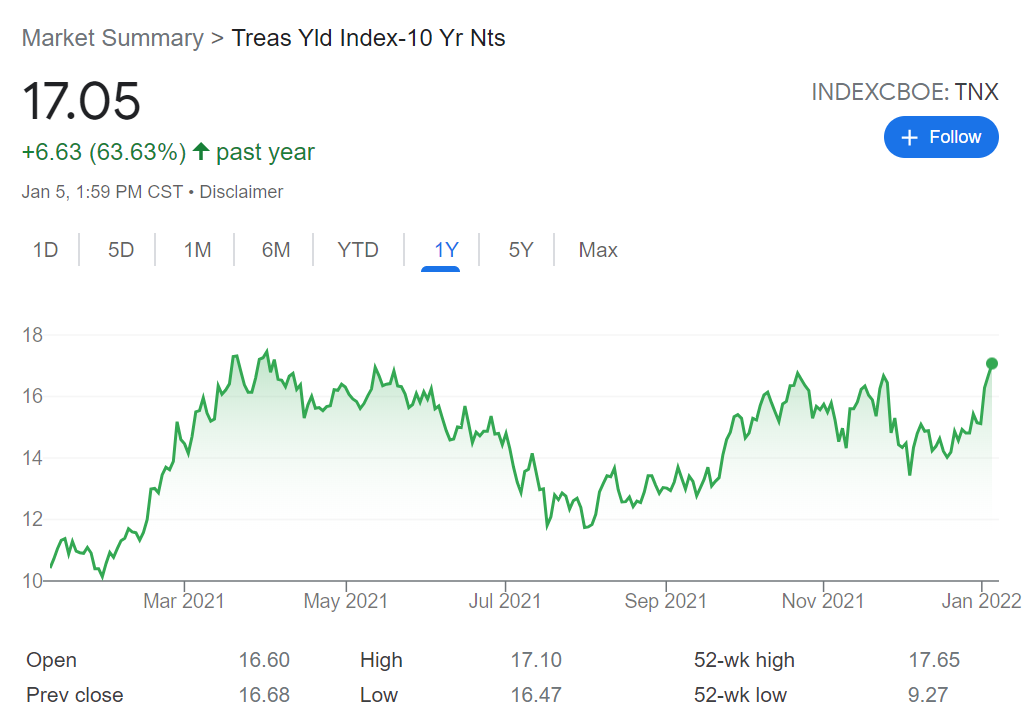

The 10-year Treasury yield tacked on another 1.7% as $TNX$ reached nine-month highs. The Federal Reserve’s latest meeting minutes indicated that the central bank has considered shrinking its balance sheet once it raises rates later in 2022.

The Fed Prepares to Raise Rates

The Federal Reserve is feeling confident about the state of the economy. According to its own Fed Minutes, released today, America’s central bank is looking to accelerate its plans for interest rate hikes and balance sheet reduction. Some officials also thought the Fed should start shrinking its $8.76 trillion portfolio of bonds and other assets relatively soon after beginning to raise rates, the minutes said. Investors would see the move as another way for the Fed to tighten financial conditions to cool the economy.

COVID-19 Cases

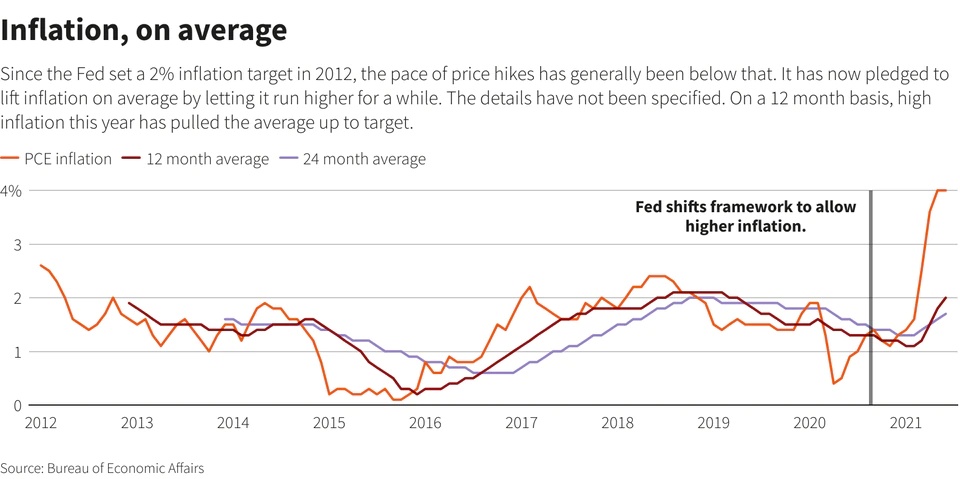

This is fairly unsurprising, given the rampant discourse about inflation. With this signal, the Fed might look to start its rate-raising campaign in March. That comes even amidst a rapid rise in COVID-19 cases in the U.S., which recently cropped up more than a million new cases of the virus in a single reporting day. Meanwhile, the 7-day average is nearing half a million. That makes the first wave, and its economic shutdown, look small by comparison.

Maximum Employment

The Fed isn’t feeling sick, though. Maybe that’s because employment is strong, hospitalizations have been surprisingly low, and a growing sentiment of “who cares about COVID?” is sweeping the economy.

Several officials said last month that higher inflation pressures could force the Fed to raise rates before the employment goal had been met, and some officials thought it had already been met, according to the minutes. The shift is the latest sign of how acceleration and broadening of inflationary pressures, amid a tight labor market, have reshaped officials’ economic outlook and policy planning.

On the other hand, the market is feeling sick to its stomach — and that’s because the words “rate hike” are very scary to investors.

Stocks turned sharply lower after the minutes were released Wednesday afternoon. The blue-chip $DJIA(.DJI)$ fell 1.1%, while the tech-heavy $NASDAQ(.IXIC)$ lost 3.3%.

SHARE YOUR THOUGHTS

How would you rate the Fed's handling of monetary policy? Join the discussion below.

How about your portfolio? HOLD OR SELL?

Follow my bro @Daily_Discussion to win more Tiger Coins! Share your trades today with others >>

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

sell if you are in need of cash flow.

Like pls, thx!