Salesforce Q1 earnings, what decides a market leader?

-Will the industry leader rebounce?

$Salesforce.com(CRM)$ released the 23Q1 earning after close of May 31th, with unexpectedly "double beats" again, and raised the profit guidance for the next quarter and the whole year. A 7%+ rose in after hours. Is that mean a rebounce of an industry leader?

Generally, A strong Q1 performance is enough,

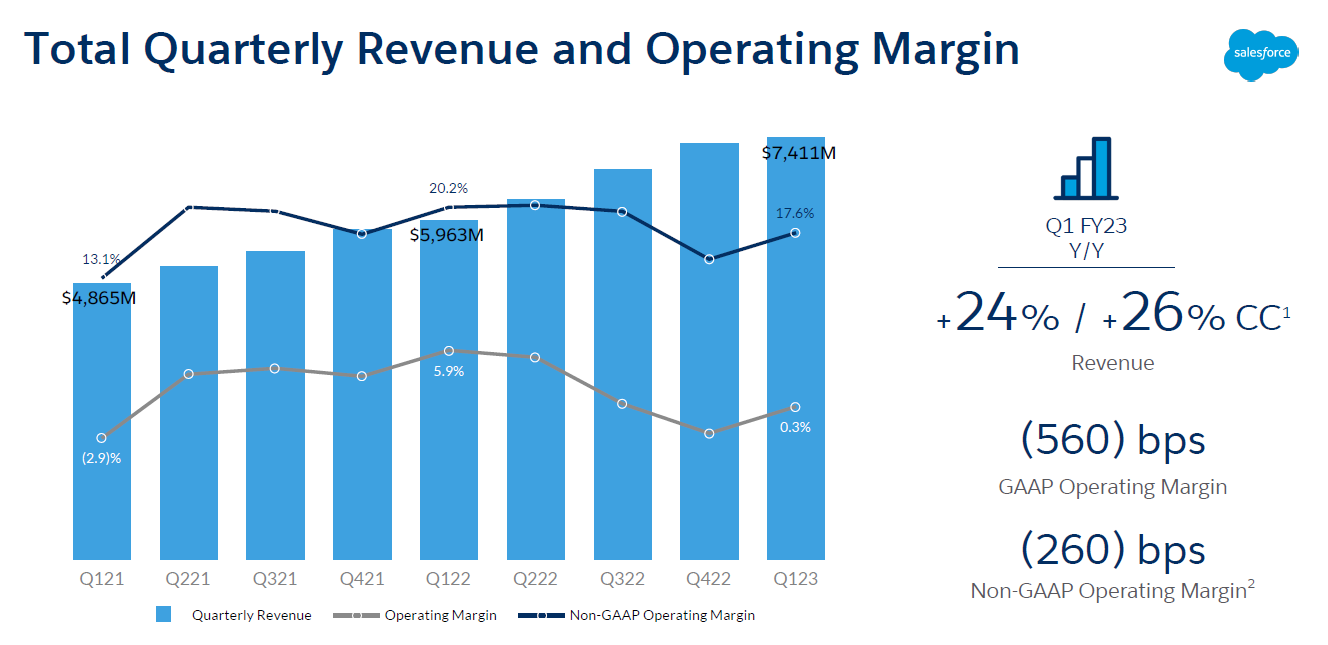

- Revenue was US $7.411 billion, a year-on-year increase of 24%, beat previous market consensus of US $7.38 billion

- Diluted EPS 0.03 US dollars, compared with 0.5 US dollars last year, slightly beat the previous market consensus;

- GAAP's operating profit margin 0.3%, down 560 bps year-on-year and turning losses into profits from the previous quarter.

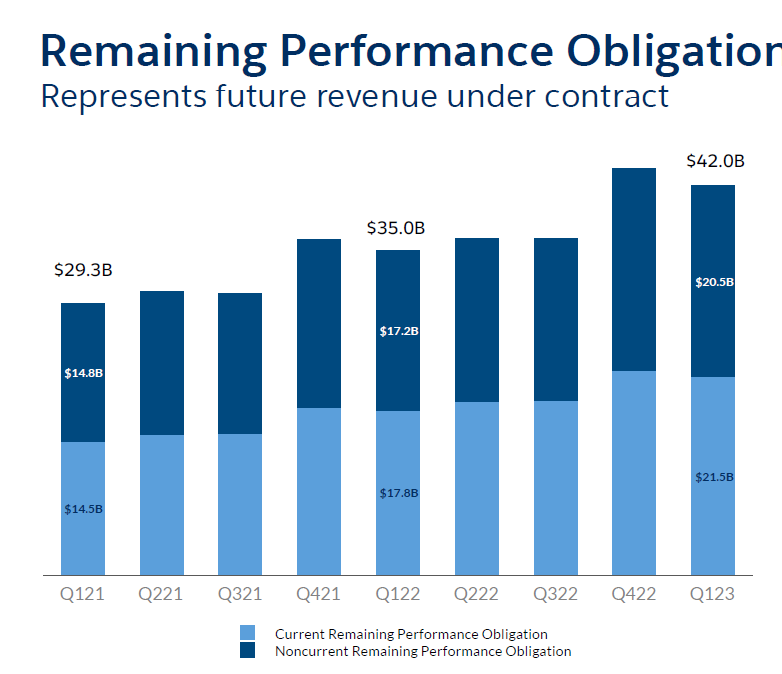

- Performance obligation, which is regarded as a measure of short-term demand, increased by 21% to US $21.5 billion, beat 0.1% consensus

The guidance of the next financial is also not bad,

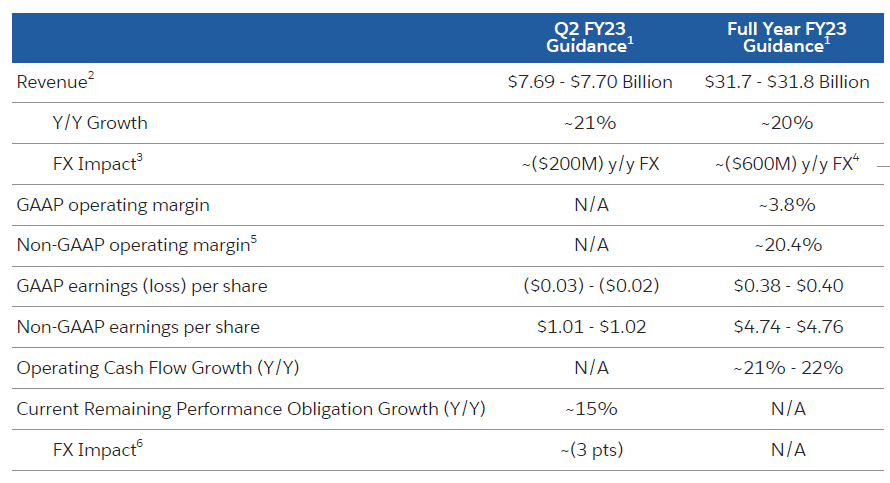

- The company expects Q2 revenue to be between 7.69 billion US dollars and 7.7 billion US dollars, and the market expects consensus to be 7.77 billion US dollars.

- Non-GAAP earned $4.74-$4.76 per share for the whole year, up 12 cents from the previous forecast and exceeding the consensus market expectation of $4.68.

Increasing cost is well known and priced-in by investors. A significant factor this quarter is the impact of the exchange rate. The strength of the US dollar has brought headwinds to the company's overseas revenues in US dollars.

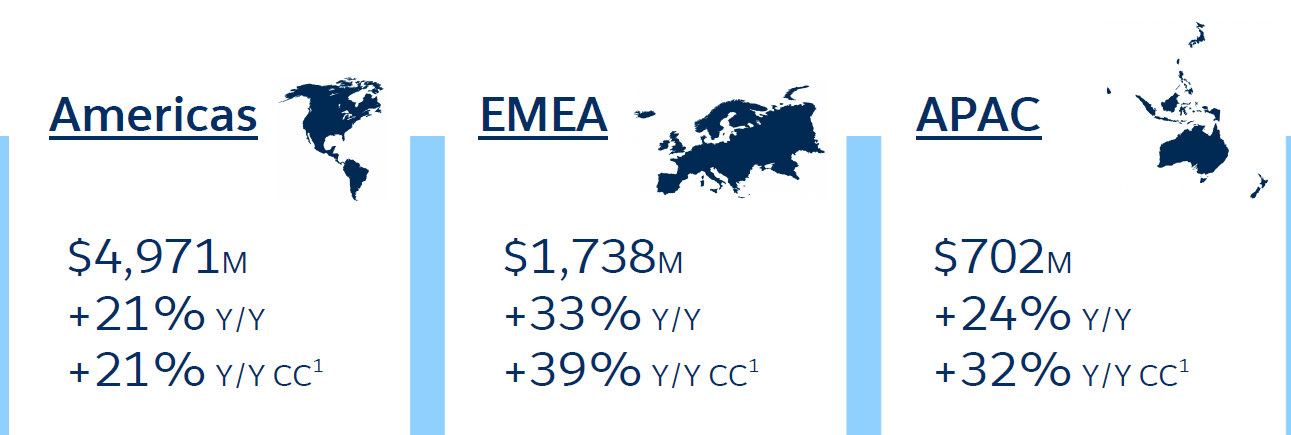

For example, the revenues in EMEA increased by 39% year-on-year in local currencies, while the growth rate in US dollars was only 33% year-on-year. Income in Asia Pacific is 32% (original currency) and 24% (US dollar). the impact on the next quarter may reach 3%.

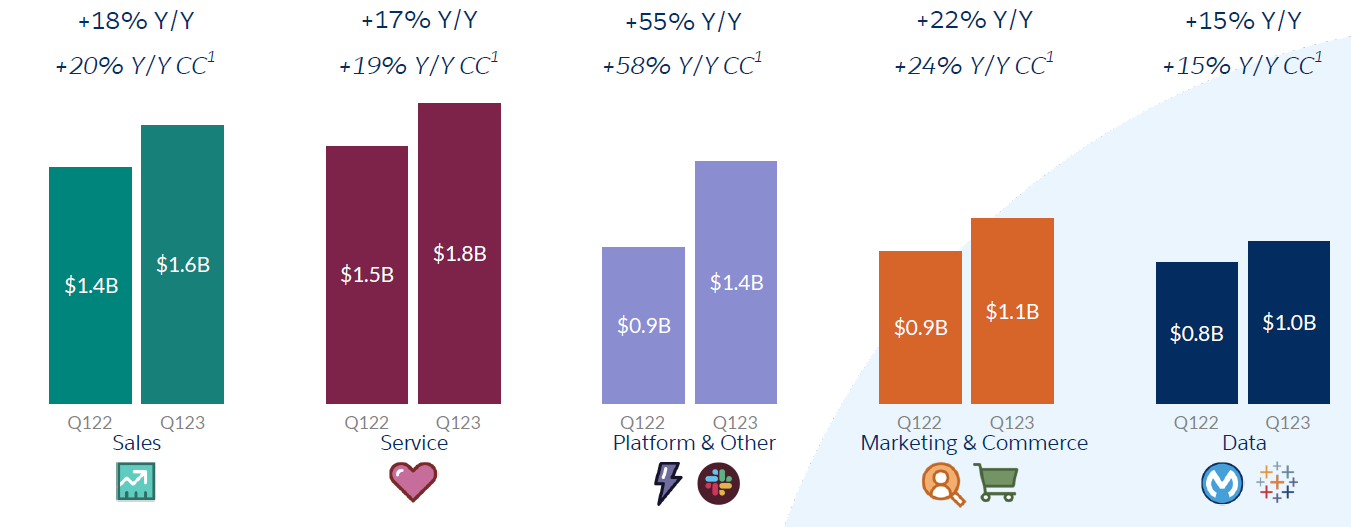

From the perspective of business classification, the growth rate of platforms and other services is as high as 55%, still showing a strong growth momentum. Meanwhile, Sales Cloud continued to accelerate its growth, with an 18% year-on-year increase in this quarter, exceeding $1.6 billion. Slack, acquired by the company, earned $348 million in revenue in the first quarter, exceeding the company's previous forecast of $330 million.

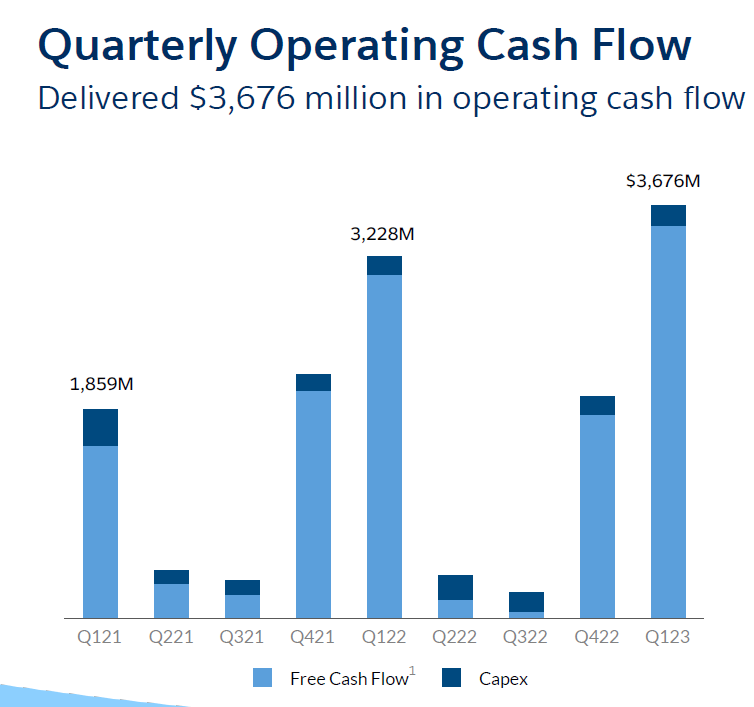

The company's strongest point is cash flow. This quarter's free cash flow growth is as high as 14% year-on-year, which is also 23% higher than the expected consensus.The strength of cash flow is an important factor supporting the company's valuation.

For a leading company in the industry like Salesforce, although its stock price has not been spared from this year's technology stock correction wave, its influence as an industry leader has not weakened. On the contrary,It is the macro environment that determines the stock price of leading companies.For example, the supply chain problems affected by the epidemic in the global economy, the shutdown in some areas, the war between Russia and Ukraine, and the rising inflation in the United States, which affect other companies (that is, Salesforce customers), are more important for Salesforce.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Yeet