Alibaba's Q3 earnings expectations: anyway, don't jump

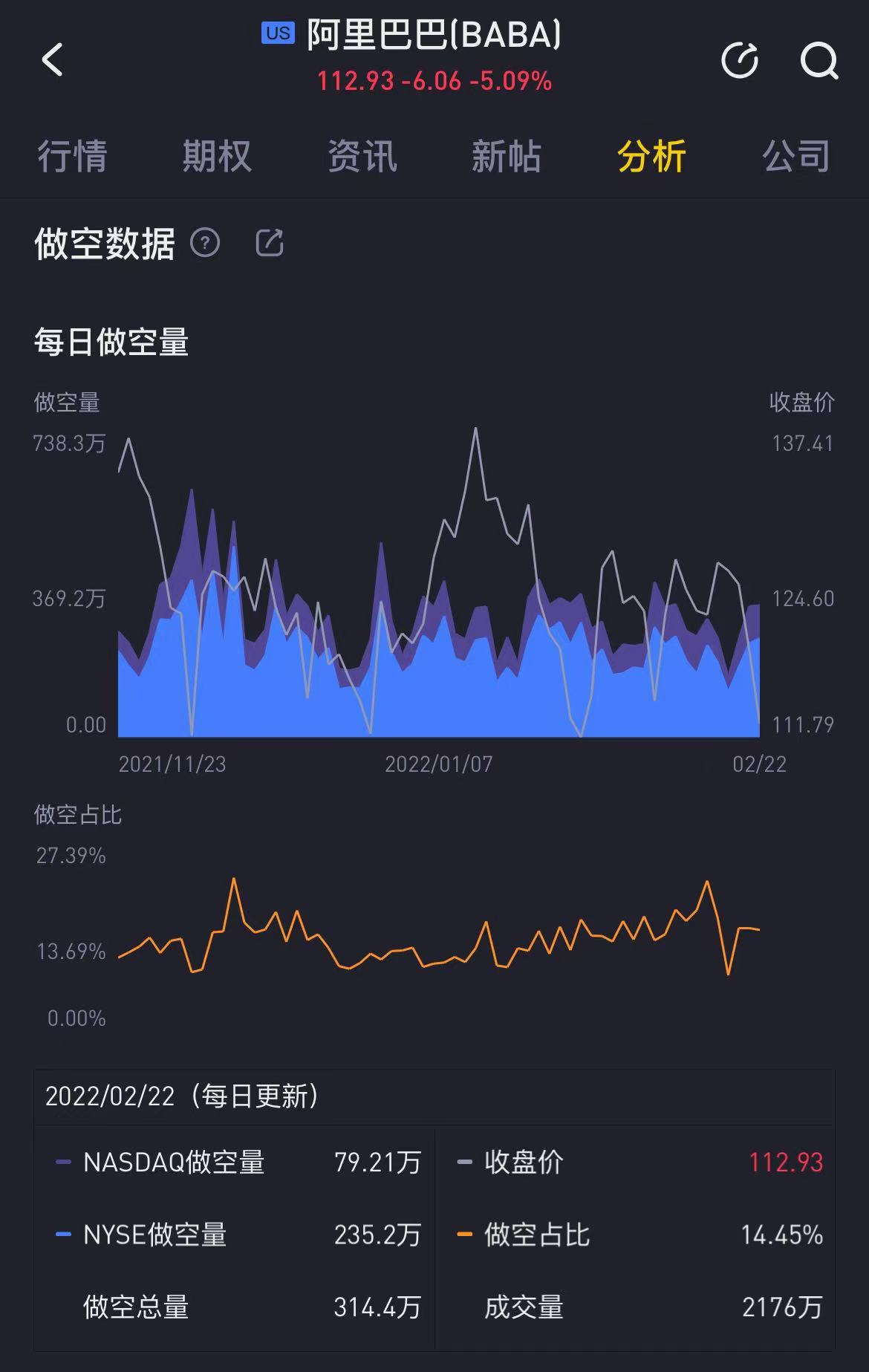

Alibaba's earnings on Thursday,the results from analysts' expectations, Alibaba$Alibaba(BABA)$ is still very pessimistic:

Analysts lowered alibaba's earnings expectations, according to bloomberg consensus, alibaba in the third quarter of fiscal 2022 revenue for 2453.7, year-on-year growth of 11%; Adjusted net income of 44.185 billion yuan, down 27.1% year on year. Adjusted EPS to 16.198 yuan,down 26.4% year on year.

And Q2 quarterly revenue growth of 29%, compared to the combined effects year-on-year growth is 16%.

It's to say that consumer sentiment has been pretty weak this quarter, and we're just a few drops away from single-digit growth.

So will earnings fall this time?

Not necessarily. At present, the call volume is very active in the options outmove list, while from the perspective of large orders, there are straddle, forward call and spread call, all of which are biased to positive fluctuations.

Based on the stock price of 112, an 8% increase in earnings results would result in a loss, while an 8% increase or a decrease would result in a gain of $100.

Of course, a better deal opportunity in Alibaba after the release of earnings.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

将继续长期、伟大的公司和稳定的经济