Gold, Silver Surge to Year High Level: Best Silver Mines &ETFs to Buy

Key Takeaways:

- Global Demand For Silver Will Grow At A Record Rate

- Global Silver Supply Appears To be Drying Up

- Looking at Physical Silver & Metal ETFs/Funds

Energy and raw materials sectors have seen rapid price increases to near record levels due to the inflationary pressure and the escalating conflict in Ukraine.

As of Feb 24th 2022, Gold, copper, and aluminum futures have all surge to the highest in a year. Brent Oil Futures and WTI Oil Futures all hit over $100, Wheat, Corn, and Beans all saw huge price rises.

Gold marks highest finish in more than a year on Russia-Ukraine strife

Russia-Ukraine crisis: Brent Crude Tops $100 and What's Next?

How a Russia-Ukraine conflict might hit global markets?

The Silver Futures($(SI)$ ) rose 4.4% at $25.57on the pre-market, just surpassing the average silver priceforecast by the Silver Institute of $24.80 in 2022.

What's the Trend of silver next ? Will silver stay bullish in 2022? What other possible investment opportunities are there?

The following article will present a comprehensive consideration of the macro policy environment, the fundamental characteristics of the silver industry, and the supply and demand data of the market to help you understand the logic of silver prices moves.

Silver is an industrial metal, which is needed in the production process of many products. Traditional industrial applications of silver include batteries, bearings, metal brazing and catalysts.

Silver is highly reflective and an excellent electrical conductor, and one of its important uses is to make electrical connections in electric vehicle engines. Remember: every electric car that hits the market, or solar panel nailed to your neighbor's roof needs silver to work.

1. Global Demand For Silver Will Grow At Record Levels

First, from the demand perspective, According to the Silver Institute, the outlook for silver demand is exceptionally promising for 2022 with global demand forecast to rise to a record high of 1.112 billion ounces (Boz) .

Meanwhile physical silver investment demand (consisting of silver bars and bullion coin purchases) is projected to jump 13 percent in 2022, achieving a 7-year high.

Besides that The top 5 countries or regions in terms of industrial silver demand are the United States, Mainland China, Japan, India, and Germany.

In detail, below is the demand forecast for three main industries: electrical and electronic applications, photovoltaics (solar panels) and the jewelry industry.

- Silver demand for electrical and electronic applications is expected to expand.

Despite the prolonged worldwide chip shortage, the outlook for silver demand in automotives remains robust this year. In 2021, 6.5 million electric vehicles were sold worldwide annually with a sales increase of 109% y-o-y, which is higher than the average rate of 65% in previous years .As chip manufacturing bottlenecks ease gradually in 2022 as expected, silver demand for electrical and electronic applications is expected to expand.

According to the London Bullion Market Association, a global authority on precious metals, silver demand in the automotive industry is expected to grow by 246% by 2040 to more than 4,500 tons.

- Photovoltaic Industry demand for silver is expected to reach an all-time high in 2022

Silver also plays an important role in photovoltaics (PV) industry. We have seen photovoltaic installations installed on car roofs to power vehicles, and as for photovoltaic coatings, even photovoltaic pavement seems not too far from real life. The outlook for silver's use in photovoltaics remains bright. Government commitments to carbon neutrality have resulted in a rapid expansion of green energy projects.

Considering that the global photovoltaic market may cross the 200 GW threshold for newly deployed capacity in 2022, The Silver Institute also predicted that silver demand in the solar industry may reach an all-time high in 2022, without providing specific figures.

- Silver Demand in Jewelry Market forecast to expand by 21% in 2022

The Silver Institute forecasts the silver demand in the jewelry industry is set to strengthen by 11% in 2022. India remains the driving force. Even though the Omicron wave affected Indian demand in early 2022, an expected easing of COVID-19 restrictions and efforts by jewelry retailers to increasingly push silver to urban consumers will favor jewelry sales across India.

In the U.S., following a significant rebound in 2021, jewelry sales expansion is expected to continue, albeit at a slower pace. Silver jewelry demand is forecast to expand by 21% in 2022; again, India will account for the bulk of the increase for increased consumption of silver for jewelry.

2. Global Silver Supply Appears To be Drying Up

Then, let's move to take a look at the production and supply side data of silver. According to the U.S. Mint, at least one-third of the silver produced by humans has disappeared from the world due to industrial consumption.

BBlobal silver mining exploration investment peaked in 2012, and has since declined rapidly. In 2016, it fell by 2/3 from the peak value. In 2020, silver production still fell by 4.6% year-over-year.

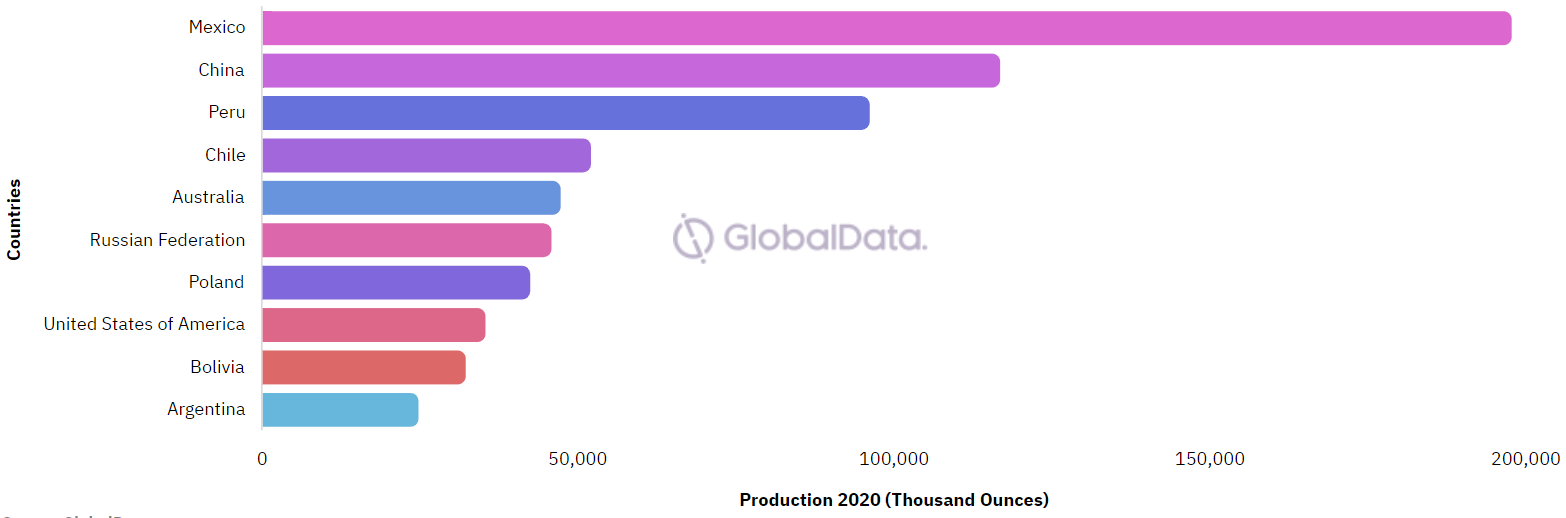

The top 10 producing countries of silver are:Mexico, China, Peru, Chile, Australia, Russia , Poland, United States of America, Bolivia, Argentina.

After shifting to a market deficit (total supply less than total demand) in 2021 for the first time in six years, The silver market is expected to record a shortfall of 20 million ounces in 2022, reported by the Silver Institute. The ten largest silver producing companies in the world together accounted for 33% of global total silver output in 2020.

Industrias Penoles ranked as the biggest among the top silver mining companies by production in 2020, followed by KGHM Polska Miedz and Jiangxi Copper.

Data from the Silver Institute indicates that the total global silver supply is projected to rise by 7 percent to 1.092 Boz in 2022.The main contributor is silver mine production, which is forecast to grow 7 percent to a six-year high this year.

Moreover the increase in silver recycling is expected to be more modestwith 3% growth in 2022. Mining Technology, an industry news site, also listed several major upcoming silver mines in the world by comparing annual production capacities.

The Quebrada Honda I and II Mine in Chile is the biggest upcoming silver mine in the world, with an annual production capacity of 95.64Moz. The Nimbus Silver-Gold-Zinc Mine in Australia and the Rupice Project in Bosnia and Herzegovina are the next major upcoming silver mines with capacities of 72.76Moz and 48.09Moz, respectively.

Before new silver mines start mining, the total supply shortage could lead to a surge in silver prices as global silver supply forecasts aren't in line with demand.

3. Physical Silver & Exchange-Traded Products

In addition to the imbalance between supply and demand. The US central bank has constantly flooded the market in previous years, and the insecurity o thef Dollar's value has prompted investors to turn to gold, silver, and even cryptocurrencies.

Also, when inflation is high, the dollar depreciates, pushing up the value of all hard assets, including silver. Although the Fed's hawkish interest rate hike process may start soon, the dislocation of demand and supply for silver cannot be eased in a short time. Which should encourage retail investors to seek physical silver for wealth preservation.

The US government had proposed to spend trillions of dollars on social, environmental and health issues. The growth of government debt has been parabolic. Some speculate that the dollar is losing its status as the world's reserve currency. Given the rapid increase in the money supply and government debt, silver is still worth looking into.

Although Silver Futures are now price at $25.57, surpassing the Silver Institute‘s expections for 2022, profit-taking is likely to remain muted. If you are new to this industry,below are some items that Futures_Pro shared just for reference only.

Assuming more and more people are buying silver futures or related trusts like SLV or PSLV, ETFs will be forced to enter the market to buy physical silver. Relative to silver miner stocks, physical silver supply is limited, and huge demand will eventually push silver prices higher.

As reported by the Silver Institute, the silver market will build on the strong foundation set last year, and the increase in silver demand will be driven by record silver use in industrial fabrication, as silver’s use expands in both traditional and critical green technologies.

Final Question For you, Under higher inflation, will you hold hard currency like Gold or Silver?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Here is a well written article on the skyrocketing demand for silver. It is worth checking out the best silver mines and ETFs as a hedge and diversification to combat inflation. 🤔

Woow ...try n trusted