Witnessing history again, bad news for earnings season

Sure enough, 100bps rate hike odds are getting bigger and bigger. Today the cme forecast an 83% chance of a 100bps hike. It is estimated that the FOMC in July, like the last time, Powell pushed forward with the current rate hike of 100bps, the most hawkish words.

Yesterday I said I was writing about the earnings season outlook, but it's already been written, so I'll add a few points.

Why we should be sensitve to Q2 earnings? The article highlighted five aspects of rising costs:

- First, risingraw materials pricesleads to an increase in the cost of goods sold.This has a greater impact on companies that use oil or oil derivatives and commodities as raw materials;

- Second, rising fuel costs lead to rising logistics costs.Mainly due to the increase in fuel prices and logistics labor costs;

- Third, wages rising leasdstohigherlabor costs. Some enterprises overestimate the market demand after the recovery of the epidemic and employ too much labor (retail), while some enterprises are mining high-paying talents, and the overweight is rising (banking)

- Fourth, the tax rate rises. In general, during the Democracy's term, the effective tax rate of enterprises are higher to some extent.

- Fifth, the foreign exchange cost rises Under the influence of a strong US dollar, the overseas revenue of companies with more international business is more susceptible to the influence of exchange rate.

These five factors may be used every quarter to explain why revenue and profit missed expectations, but oil and currency movements make them a big factor. If I were to reorder these five factors, my choices would be 5, 1, 3, 2 and 4.

Foreign exchange influence is number one, oil costs number two, inflation number three, logistics number four and tax rate number five.

Tax rates are easy to explain in fifth place. Because compared with the first four, tax rate is not an uncontrollable factor, and I do not hear that tax rate affects the revenue of enterprises to the extent that they can not meet their revenue expectations.

Tax rates are already factored into revenue forecasts, so it shouldn't be an excuse for not meeting them.

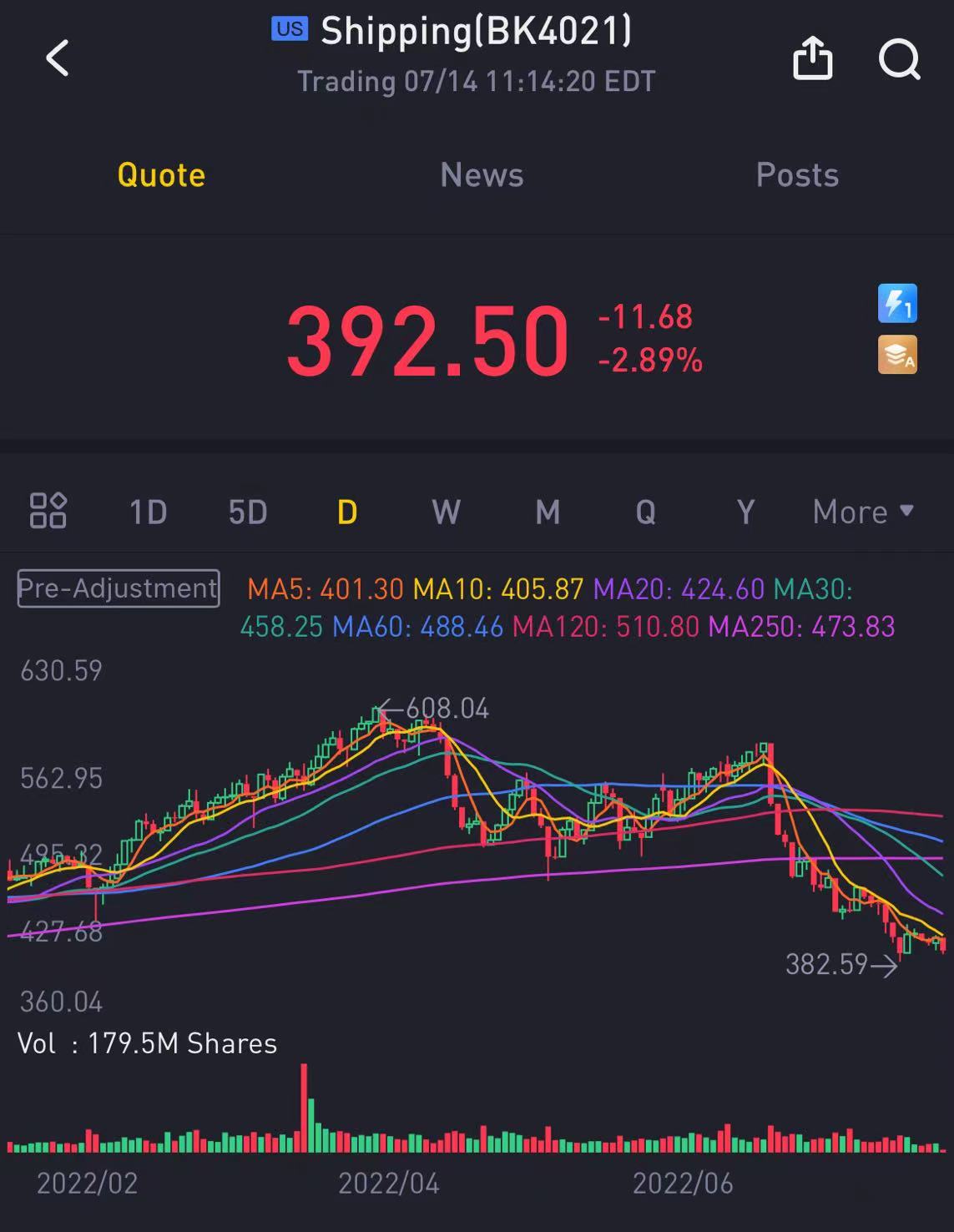

Fourth in logistics. Talking about logistics costs is complicated, but shipping prices are straightforward. Shipping stocks almost halved after Q2. So I think in the second half of the logistics cost will not become a major problem plaguing enterprises, although Q2 will still have a major impact, but the expectation is good.

But what's different from the beginning of Q2 is that the market is shifting back and forth between the inflation and recession narratives because of the current sharp fall in oil prices.

It is hard to argue that inflation's influence on manpower strengthened in the second quarter compared with the first. Consider what you've seen the most in corporate news in the last month -- yes, layoffs. The supermarket has been the industry with the biggest job cuts since the slowdown in consumer spending.

But according to last Friday's NON-farm report, department stores and warehouse stores, while still shedding jobs, were much less than last month (Department stores June -1.9K vs. May -4.7K, warehouse stores June -5.2K vs. May -28.8K).

It's not just traditional industries that are shedding jobs. The tech industry is also cutting costs and boosting profits.

The inflation-induced drop in consumer willingness will have to be addressed by companies themselves, and the resulting drop in revenues is often attributed to a narrower moat.

Now it's time to talk about foreign exchange, the most influential currency. The euro tumbled in the second quarter, briefly falling below $1 on Wednesday, the last time it hit parity against the dollar was in 2002.

For many Internet software companies with global operations, the impact of labor costs and oil costs is far less significant than the impact of foreign exchange, especially for companies with global operations, because the decline in revenue from currency losses is completely inevitable.

Inflation may have peaked, but dollar strength has not.

All told, transportation will ease the supply chain, but oil, inflation and foreign exchange will hit companies' top and bottom lines across the board. Most enterprises began to lock up operating cash, which can be inferred from Zuckerberg's warning, advertising business depression, most technology companies Q2 revenue and profit is certainly not good.

So there's a mystery at the end of the article: Why is Apple's stock so strong?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Big Little·2022-07-15King dollar14Report

- Vikedios·2022-07-15opportunity to grow wealth12Report

- jas68·2022-07-15noted with thanks 👍12Report

- potatochips·2022-07-15thank you10Report

- 闲人老马·2022-07-15为什么苹果如此坚挺?因为他正在壮年4Report

- sotkia·2022-07-15我猜所有的坏消息都会在15个月后停止4Report

- Karma Rider·2022-07-15power啦4Report

- tradelaggard·2022-07-15thx for sharing3Report

- JeremyKok·2022-07-15thank you for sharing.3Report

- 和我一起成长·2022-07-15坚持就是胜利!苦尽甘来!2Report

- SteadyDoesIt·2022-07-16Lots of surprises1Report

- Lakse·2022-07-15thanks for sharing1Report

- ElvisMarner·2022-07-18Thanks for sharing. What you said makes sense.LikeReport

- ElvisMarner·2022-07-18Thanks for sharing. What you said makes sense.LikeReport

- Lakse·2022-07-18thanks for sharingLikeReport

- ps14·2022-07-16历史重演!LikeReport

- JCKL488·2022-07-15In for a tough rideLikeReport

- GerryLoh·2022-07-15很好的分享谢谢LikeReport

- alexj·2022-07-15bads news is good news to investorsLikeReport

- ZenInv·2022-07-15Food for thoughtLikeReport