[Options] Is a good time to Sell Put Again? A big signal by unusual option

Hello,tigers,Let's talk about FOMC first.

The Fed raised interest rates by 75bp as scheduled, and the federal funds rate rose to 2.25 ~ 2.5%, equalling the highest level after the last round of interest rate hikes at the end of 2018.

In Powell's press, there are the most important words as follow. He mentioned that it will come appropriate to slow the pace of increases, which is widely interpreted as doves.

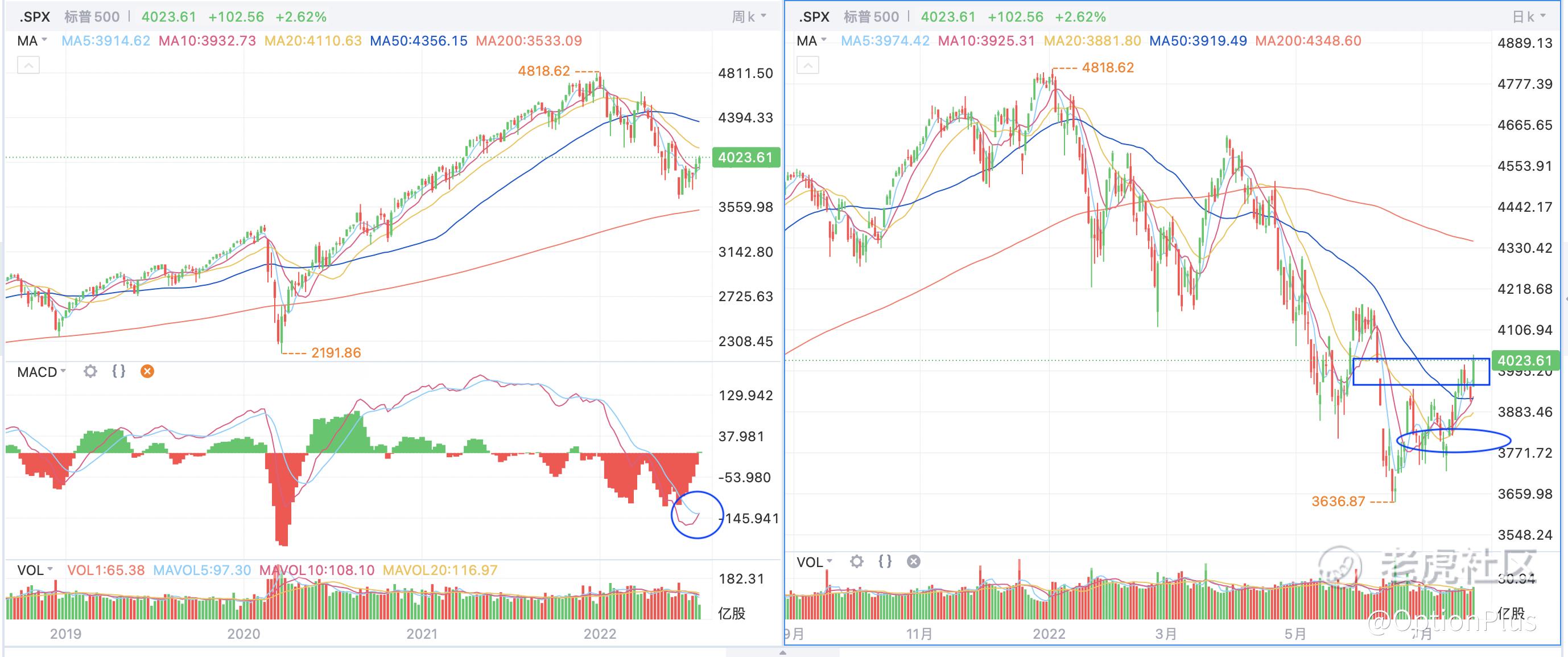

Since last week, the beta stocks saw in a large amount of capital inflow. and QQQ took the lead in making up for the higher gap. In the past two days, big technologies missed the expectations to rise instead. All signal to the market. Nasdaq rose by 4%, and S&P 500 rose by 2.5% last night, the main driver was short squeeze.

In addition, I think the earnings of Microsoft and Google showed that their topline grew slow down, but still far from recession.In addition, I think the earnings of Microsoft and Google showed that their topline grew slow down, but still far from recession.

Although Microsoft and Google miss the consensus, but rose sharply. We will see the second quarter US GDP tonight, and there will be a clearer interpretation about economy. Yellen mentioned before: "recession is broad-based weather in the economy. We are not seeing that now." So is the recession expectation over-interpreted by the market? Tonight deserves attention.

It is worth mentioning that the market seems very enthusiastic after the meetings in May and June, mainly driven by short covering, but reversed the next day. Last night, the Nasdaq rose 4% which was driven by short covering, so it is likely will step back again in the following two trading days.

Look at Nasdaq. From the daily line, the higher one of the two gaps plunged in June has been replenished last week. At the weekly line, MACD showed a golden-cross last week, and confirmed the trend this week. I would think that the weekly signal is usually solid, and the 200-week line has been consolidated for 4-5 weeks, and the bottom is obvious.

I notice unusual options. Last night,$PayPal(PYPL)$'s trading volume was unusual large. And a PUT option traded 10,700 contracts with an exercise price of $250 due to Sep.16th 2022. According to last night's closing price, there was about 200 million US dollars in turnover.

Also,there were about 150 million US dollars traded in the same price of Put contracts due to Jan,2023. PYPL's price between $70 and $80 last two month, but the exercise price of the PUTs was as high as 250 US dollars. I checked that there were only 2,580 contracts left, so most of the transactions were closed last night. I guess someone bought a lot of long-term PUTs when PYPL's share price was still 200-300, and he closed the positions last night, while PYPL's share price rose by 12%.

Not only PYPL, look at the option chain of $Shopify(SHOP)$, the same situation exists in options. There are some other growth stocks in a similar situation.

I think about it. Most of growth stocks prices in a relatively low valuation, which included the expectation that future profits would continue to be lowered. They are hard to decline sharply again.

At present, the overall valuation of S&P 500 index is around 18X, which is not at a historical low point, but it is relatively low. At present, the policy signal will have a more effective impact on the market. And I think the market will be relatively optimistic in the next few weeks. Take your time with me.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Its never a bad timebto sell options only by puts or calls you choose

Sell put.

Probably it is a trap of bullish sign

Good info