What happened in US Market in First week of October

US stock market keeps rolling on $S&P 500(.SPX)$ rebounded by 6% to 3806 points from the lowest point of the year on September 30th, and then down nearly 4% to 3,639 again on October 7th. $Cboe Volatility Index(VIX)$ changes sharply.

No big earnings, no FOMC polices and no Feds' official speeches, why market so sensitive? Why liquidity tightening?

First, the economic data

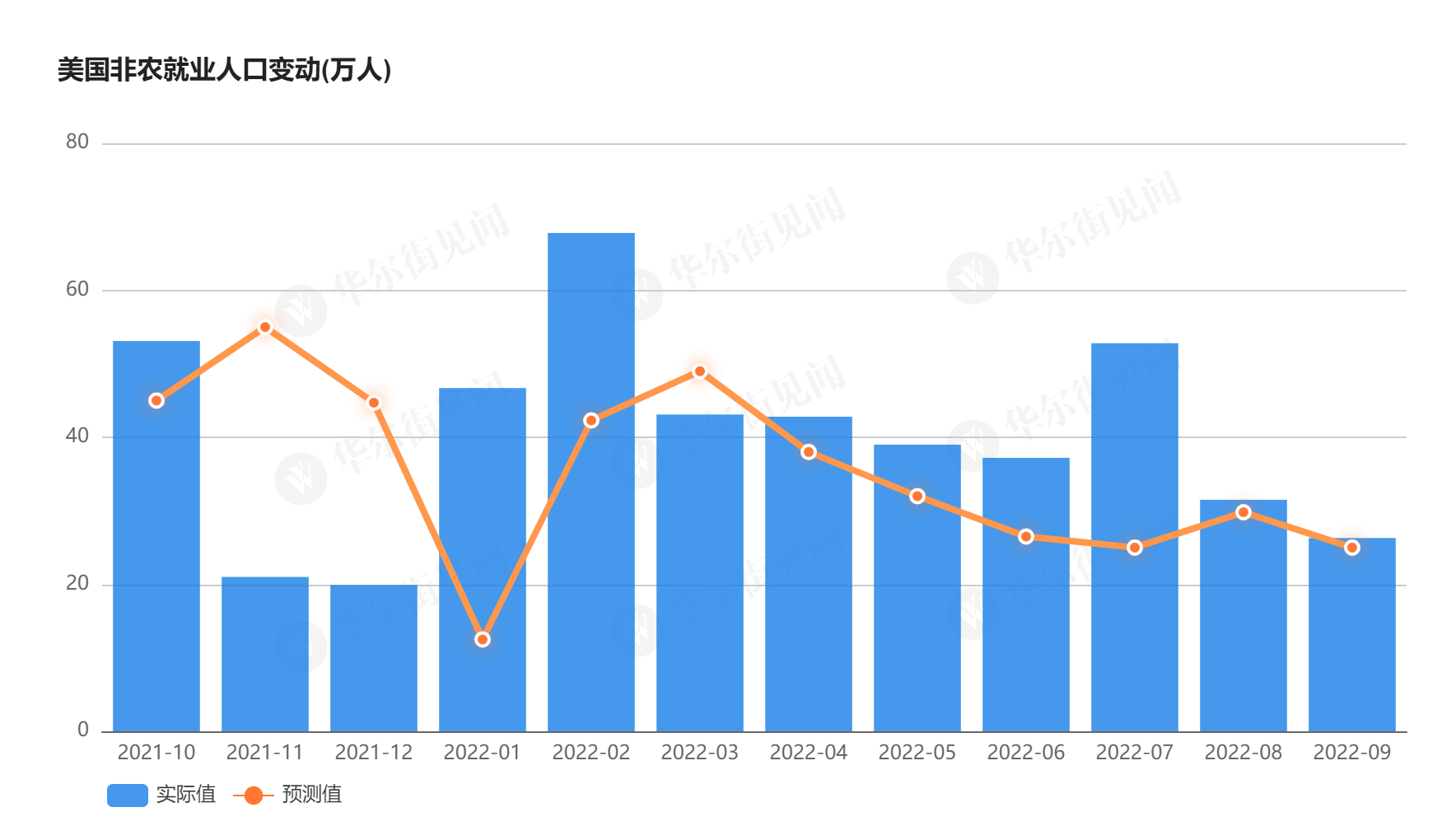

The data released during the period include non-farm, employment rate, jobs vacancies and ISM PMI of September. These data shows a little conflicts, but the uncertainty keeps going up.

ISM's manufacturing PMI, which has declined compared with August, in which the new orders index has dropped from 51.3% to 47.1%, mainly reflecting two issues, Decline in demand and Inventory growth. This is told by $Nike(NKE)$ on its last earning report. (References Why NIKE plunged? Air Jordon not popular again?)

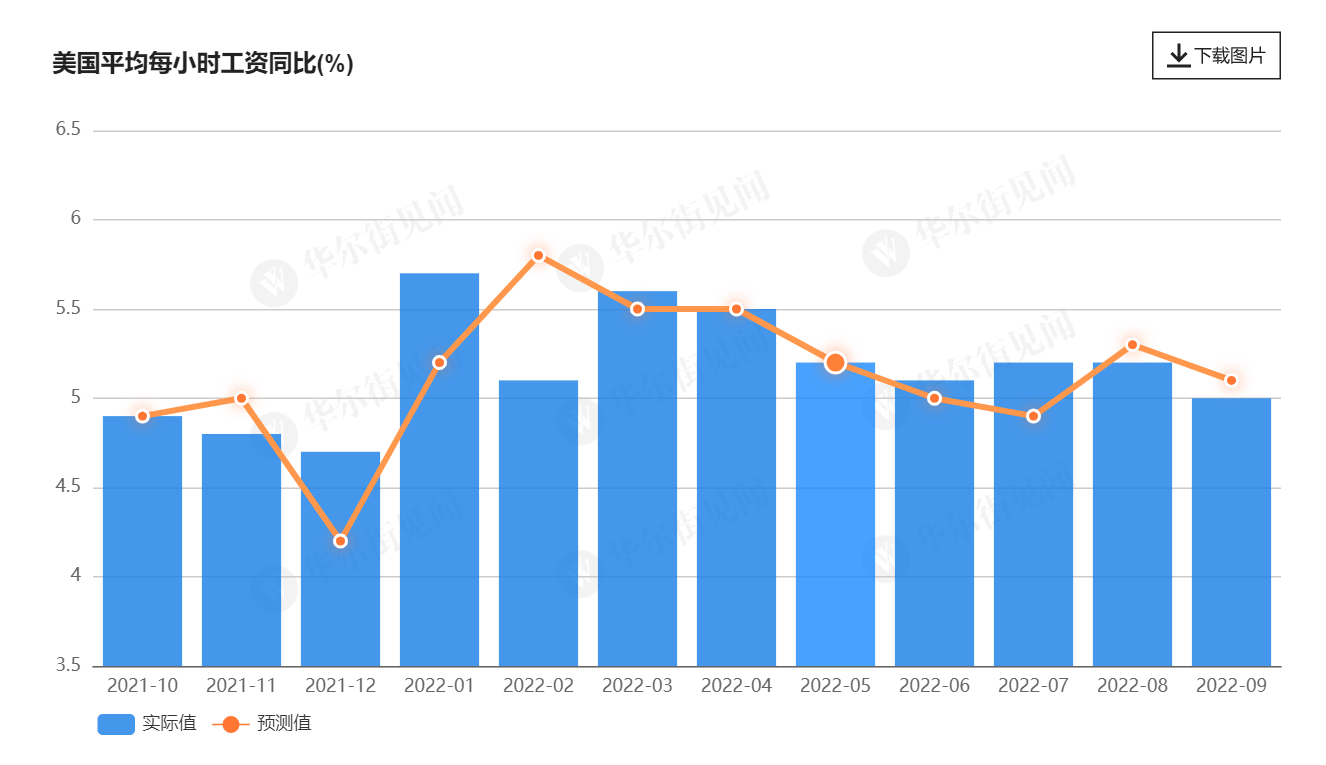

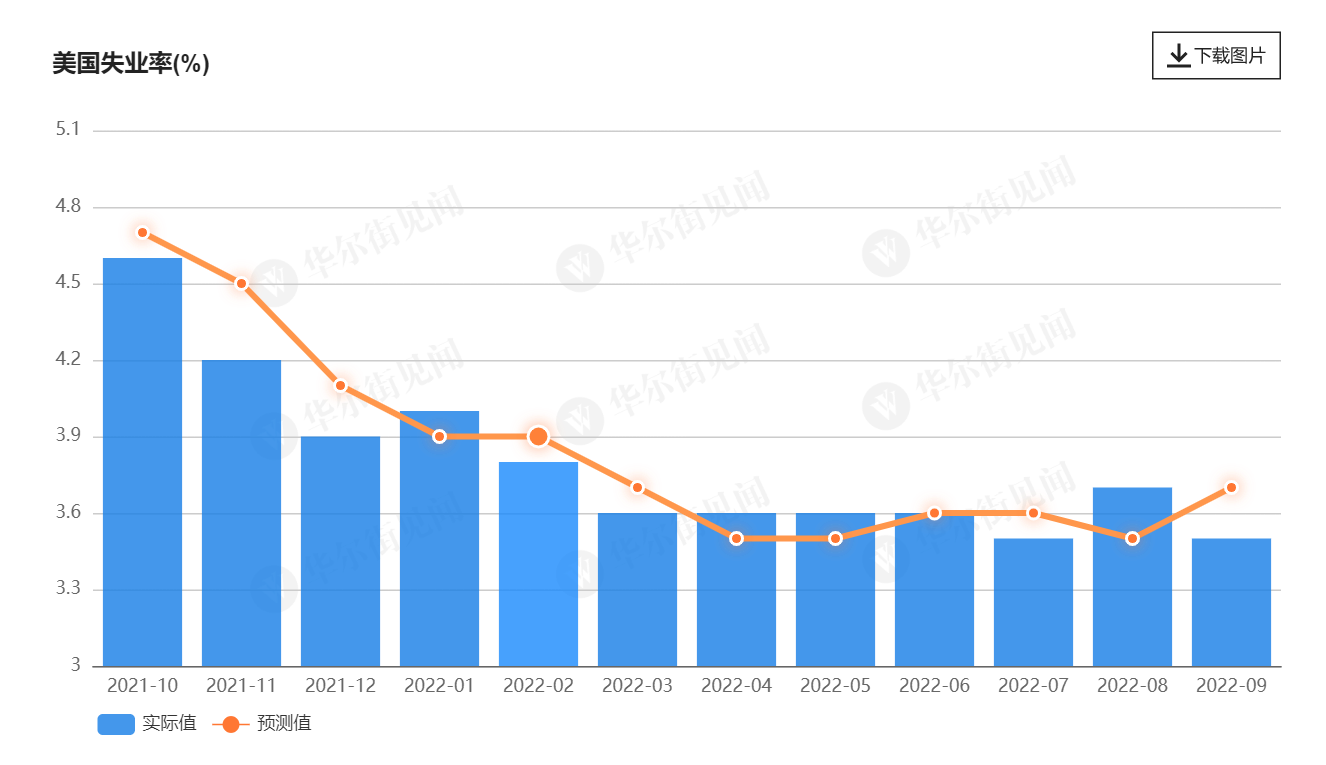

Non-farm payrolls data, with the unemployment rate hit a new low, the previous tight situation in the job market has eased relatively. At the same time, the wage growth rate increased by 5% year-on-year, down from 5.2% in August, and can be compared after the CPI data is released in September. However, the wage rate still cannot keep up with the growth rate of CPI, even the growth rate of core CPI, and the long-term endogenous price stickiness is expected to ease.

However, we also need to think about one thing. After the pandemic, due to expansionary monetary and fiscal policies, more people of the right age chose "not to work", so the unemployment rate rose briefly. What if the higher-than-expected inflation also increase household spending, which makes people pay more attention to "back to work" and hit a new low in unemployment rate?If so, will corporate layoffs cause a catastrophic "unexpected surge in unemployment" when recession expectations are stronger and demand is lower?

This is obviously another thing that the Fed can't control.

Second, global assets changes

Britain's "suicide" tax cuts

A few days before the holiday, Truss, the new Prime Minister of Britain, put forward the policy of "tax cuts", has caused a lot of opposition and controversy. As the UK treasury is an important asset, the Bank of England has to make a sharp turn and implement an emergency policy of unlimited asset purchases for two weeks. Raise interest rates with buyingassets? It also makes the market more afraid of the uncertainty in Britain. (References, Why the UK Makes a Terrible Start?)

Rating agencies such as$S&P Global(SPGI)$And$Moody's(MCO)$ have or are observing whether the UK's rating outlook has been adjusted to negative does not rule out that the volatility of British government bonds will still increase in the future.

Interestingly, Truss's recent interviews demonstrate a terrible understanding of economy, which made people scared. At present, the new prime minister may need to pay more attention to his "political career" after seeing off the Queen.If Britain frequently "changes PM", the "coherence" of its policies will be greatly reduced, increasing uncertainty.

Credit Suisse's concerns

Holidays,$Credit Suisse Group AG(CS)$Concerns about possible capital shortage and liquidity risks have obviously increased, but unlike Lehman in 2008,Credit Suisse's overall capital adequacy ratio (CET1) and liquidity index (Tier 1 leverage ratio) are at a healthy level.Moreover, in the preceding car of the financial crisis in 2008, the legal compliance of various regulators and banks put risk control at an important position.

Because Credit Suisse is more of a "debt legacy" (such as the $5 billion loss of Archegos Fund) and the problems in Europe (higher inflation, energy crisis and higher leverage than in the United States), it is inevitable that the market will worry more about it.

Oil prices have soared

During the holiday, OPEC unexpectedly decided to cut production by 2 million barrels per day from November to December. Affected by this,Oil prices have rebounded by 20% and are now close to the level of $100/barrel.

Biden didn't get a good look when he visited Saudi Arabia before, and then the oil price also dropped from a high level, once falling to a year low of $76. Therefore, Biden did not forget to satirize OPEC-"You don't need to cut production". He thinks oil prices will continue to fall.

In fact, the reason OPEC's actions are relatively unified is that non-American countries will be hit by recession under the extremely strong US dollar. Although it is priced in US dollars,However, the price of commodities also affects the strength of the US dollar to a certain extent.

The recovery of oil prices is more affected by the relationship between supply and demand. At present, natural gas stands out among commodities, and it will be cold in the northern hemisphere in an instant, so the demand for energy will continue to grow.

Third, will Fed's interest rate increase hurt the economy?

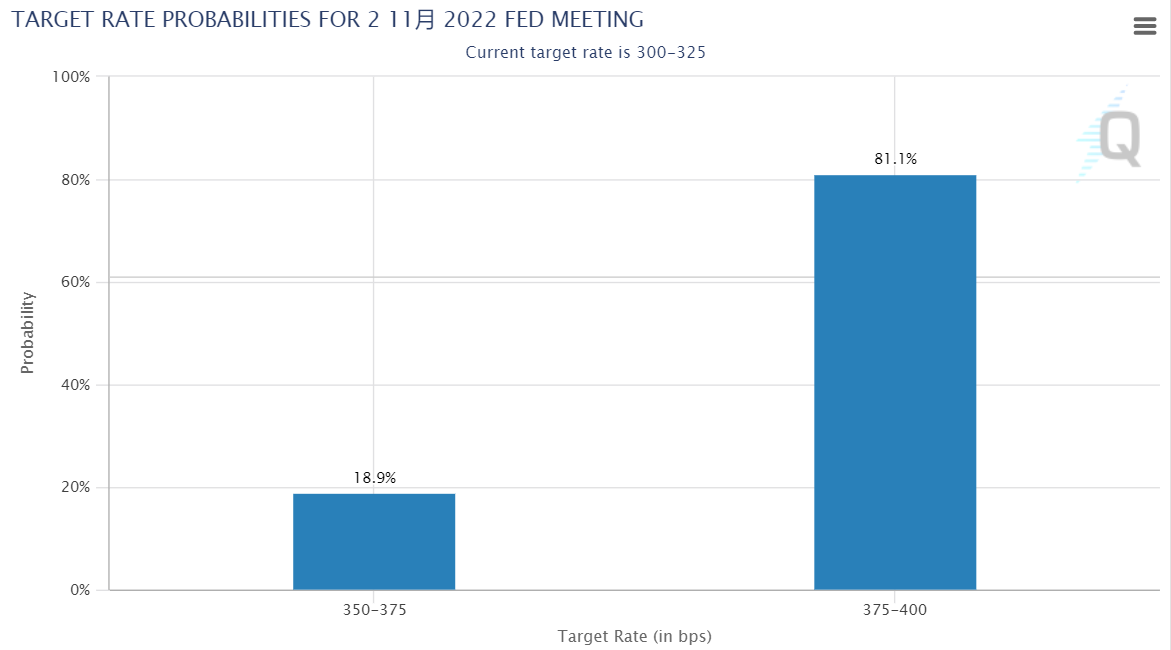

As the unemployment rate decreases, the wage growth rate continues to remain high (although it is not comparable to the CPI growth rate), and the market expects the CPI in September to remain high. The market kept a high expectation for FOMC to raise interest rates by 75 basis points in early November.

According to Powell's statement in September, the end point of raising interest rates may be 4.4-4.6%, and it is expected that the Fed meeting will be completed at a faster pace:75 basis points in November, 50 basis points in December and 25 basis points in February, 150bps in totaling. Now US stocks and gold have already priced this expectation.

However, even at about 4.5%, raising interest rates is still not the focus of the Fed. After that, how to retreat from high interest rate and how to deal with the subsequent recession needs to be handled more carefully.The market is also concerned about how long the strong US dollar will last due to interest rate hikes.

With 30-year mortgage rates nearing a 16-year high of 7%, housing demand is falling sharply, which is the straight line for the Fed to raise interest ratesReceive the result.

Excessive and too little austerity will bring great risks, which is not a completely unilateral thing. At present,Fed officials, led by Powell, have sent a strong signal that they would rather make mistakes in raising interest rates excessively becauseThey don't want to repeat the mistakes of the early 1970s.

Compared with the post-inflation recession in 1970s, the market environment this time is better, but the policy makers of the central bank will still encounter an unprecedented situation, and their every action will be judged by future generations.

As Paul Volcker said

It is one thing to understand the benefits of monetary discipline, especially in the case of long-term lack of monetary discipline during the Great Moderation, and another to persist in working to reshape monetary discipline and prevent the stagflation of the global economy from heading for crisis.

Raising interest rates is simple. How to avoid recession, especially the economic crisis, is even more difficult.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- xWoo·2022-10-10unstable market14Report

- JonLucky·2022-10-10like what used to happen13Report

- chan tow·2022-10-10thank you14Report

- 紫南·2022-10-10CPI Friday, interesting 🤔12Report

- x2espresso·2022-10-10continue to go down. economic data has no impact play on stocks sometimwsLikeReport

- tamira·2022-10-09Thanks for sharing1Report

- YesMdm·2022-10-11Good readLikeReport

- uynujeel·2022-10-10niceartigblLikeReport

- ValuInvestor·2022-10-10Hope things get betterLikeReport

- MichT·2022-10-10All shares are droppingLikeReport

- Michelle Ong·2022-10-10Like back thanksLikeReport

- Chloe Goh·2022-10-10Thanks for sharingLikeReport

- Blackrosez·2022-10-10great informationLikeReport

- KendrickTan·2022-10-10[微笑]1Report

- FunnyFun·2022-10-10NiceLikeReport

- StreetCat·2022-10-10🙏1Report

- PYing·2022-10-10👌LikeReport

- Deposit·2022-10-10okLikeReport

- AhLun·2022-10-10👍LikeReport

- DarylNg·2022-10-10😯LikeReport