TSMC's Q3 Earnings, should reflect the whole semiconductor industry?

The semiconductor industry suffered in Q3, and the headwinds of supply chain and demand, and irresponsible policy brought this industry unprecedented challenges.

From the financial report released at the end of September which is as of August 31, 2020, $Micron Technology(MU)$ has became the first company to warn the decline in global demand for personal computers and smartphone chips in Q3. According to the management,

Customers in various industries are cutting orders and reducing the chip inventory accumulated before, and the chip industry is in a difficult pricing situation at present.

Yet, MU is not the worst performing in the secondary market.

Coincidentally, TSMC (Asia Pacific) hit the biggest one-day drop in history of 8% on October 11th, its US ADR $Taiwan Semiconductor Manufacturing(TSM)$ also fell 5.92%, and its market value returned to the level in mid-2020. Two days later, TSMC will announced Q3 financial report.

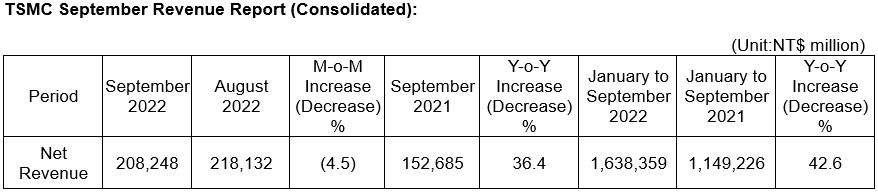

In the September monthly report published on October 7th,TSMC's revenue decreased by 4.5% month-on-month, while year-on-year growth rate decreased from 59% in August to 36%, which was also regarded by the market as a signal of "turning from prosperity to decline".

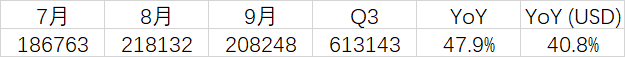

From the performance expectation alone, TSMC's Q3 revenue should reach more than NT $613 billion (according to the monthly report of 789 for three months), with a growth rate of 48%, which is higher than the market expectation of NT $604.5 billion (with a growth rate of 45%). However, considering the strength of the US dollar in Q3,The average depreciation of the NT dollar is 5%, and the growth rate in US dollars is only 40%.

Why taking US dollars?

BecauseMost of TSMC's international investors are based on US dollar, and investors' required return is based on the US dollar. Naturally, we should also consider the exchange rate.

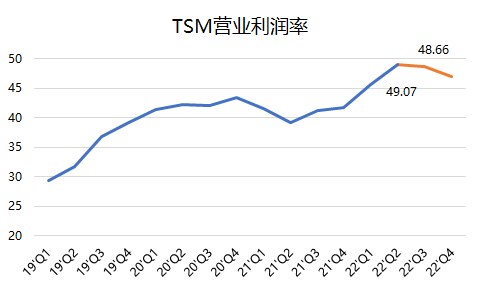

At the same time, the consensus of gross profit margin is 58.87%, which is slightly lower than Q2, but still at a high level in recent years. Operating profit margin is expected to be 48.66%, which is also lower than Q2.

TSMC has a lot of advantages in the upward cycle, One important is marginal effect. If the demand starts to decline and orders start to decrease, it will naturally affect future profit margins.

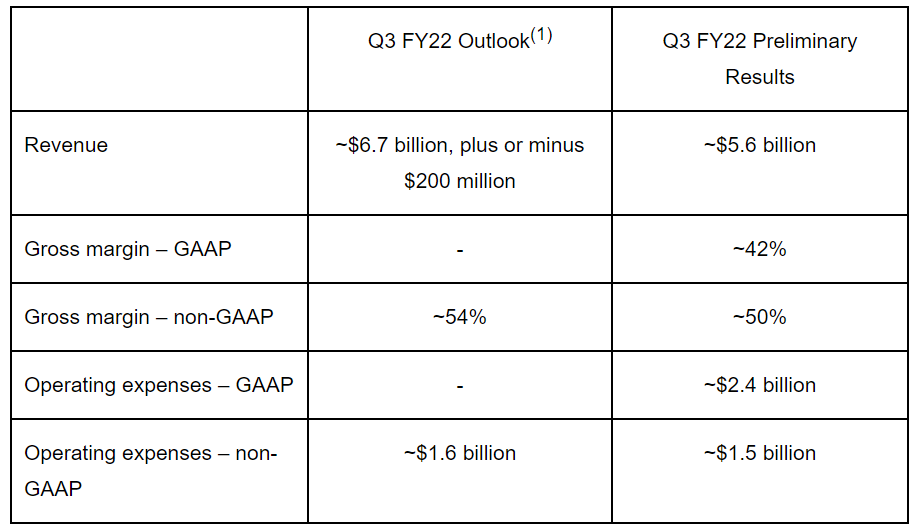

This is an industry problem. Micron predicted that the scale of capital expenditure in fiscal year 2023 will decrease by 30% compared with the previous year, and then$AMD(AMD)$Announced the reduction of Q3 revenue and gross profit margin (guiding 5.6 billion US dollars vs market consensus 6.7 billion US dollars, guiding 50% vs market consensus 54%). The whole chip industry will continue to be shrouded in haze until at least the first half of 2023.

It is no wonder that although the performance of TSMC and other companies continues to rise, the stock price is constantly included in the recession expectation.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

In the current volatile market, TSMC's share price has been on a downward trajectory in the past year. Its current share price of 63.92 almost reaches its 52 week low of 62.32.

While I am bearish on TSMC in the short term, I am bullish in the long term as its growth story is not over by a long shot. With the advent of 5G, Internet of Things, EVs, TSM will continue to grow exponentially in the future.

At 50% discount from its peak, TSMC presents a very attractive buying opportunity.

Thanks @MaverickTiger for your excellent insight on the effects of TSMC's 3Q Earnings and the semiconductor industry as a whole.