Institutional Target Prices for Chinese Concept Stocks Exposed

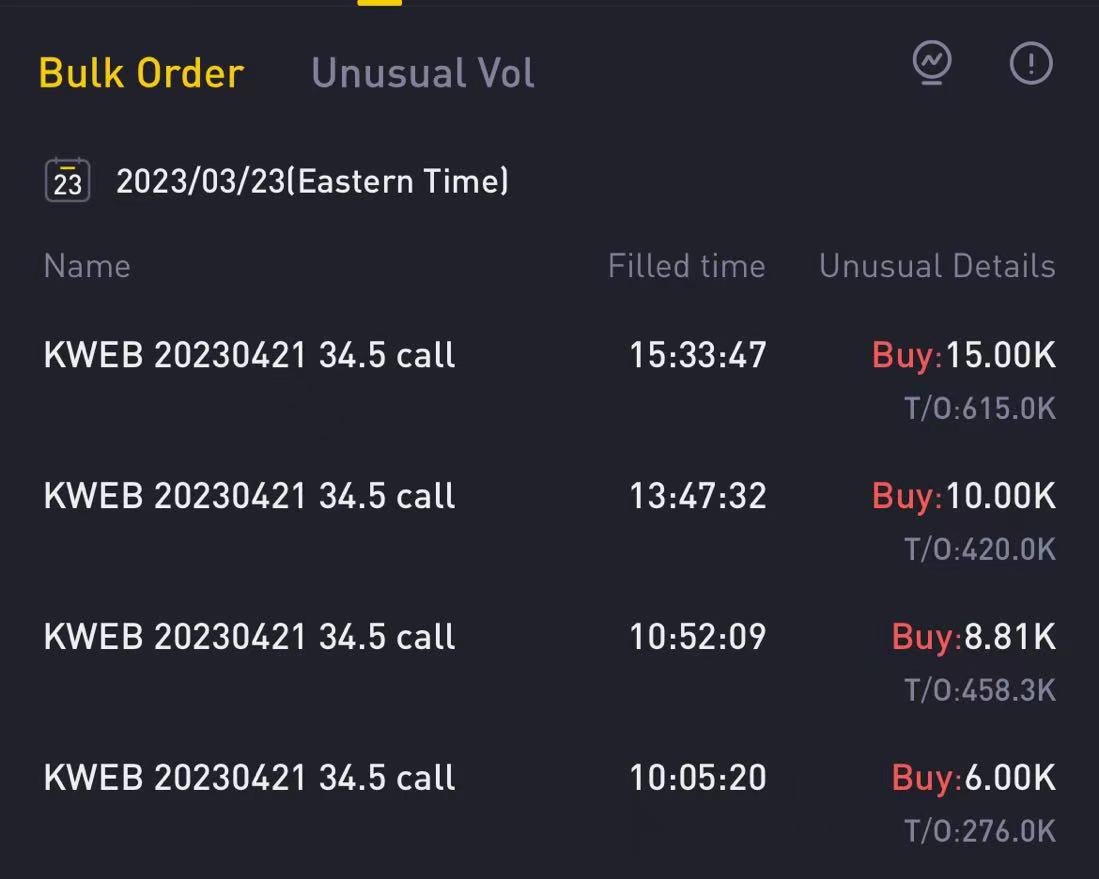

Pinduoduo experienced a sharp drop in stock price yesterday. To confirm the extent of its impact, I reviewed the options activity for the KWEB and FXI ETFs. On March 23rd, I noticed that a trader placed a very aggressive order:

The total transaction amount for the call option is over 1.9 million. It has an expiration date of April 21 and a strike price of 34.5 OTM. There is a high likelihood that there will be a surge in the near future, or the price will rise to 34.5 before April 21.

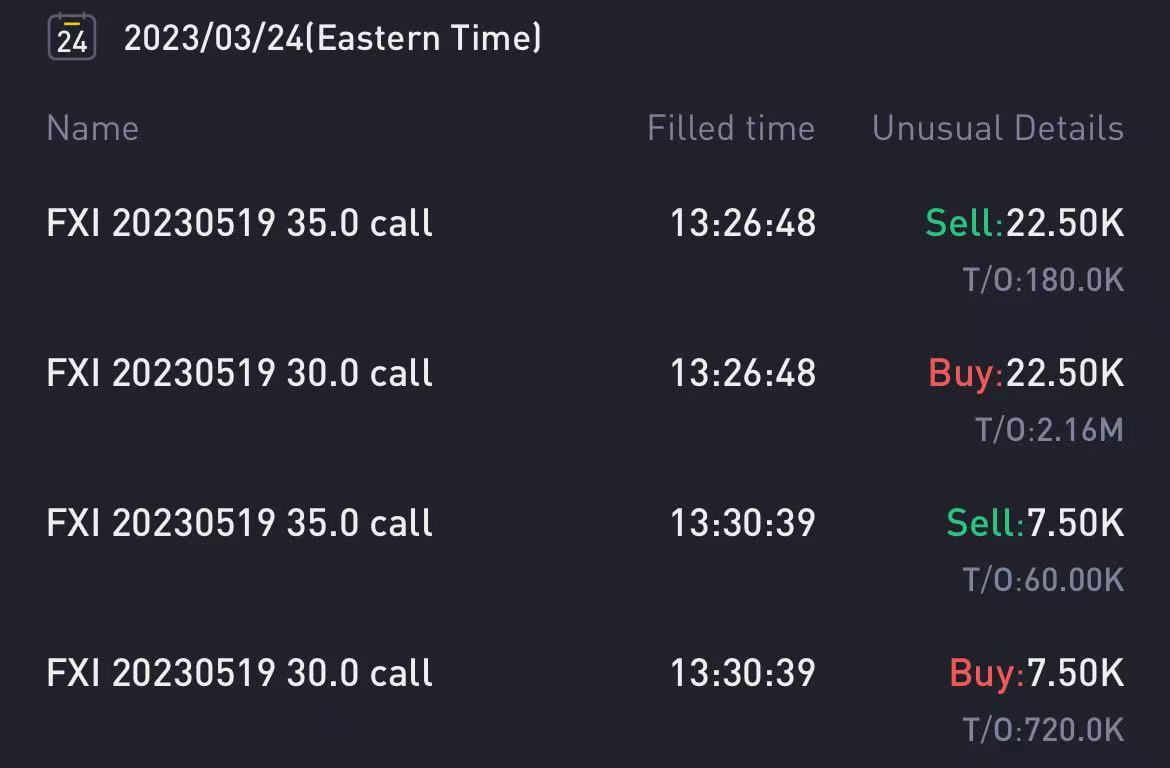

The total transaction amount for the call option is over 2.8 million. It has an expiration date of May 19 and a strike price of 30 OTM. The strike price on the sell side seems to be a weak hedge and appears to be more of a margin reduction than a strong hedging strategy.

If KWEB & FXI are strongly bullish, there's no reason for PDD to remain bearish.

However, it's possible that institutions placing orders after the FOMC are using it as cover, rather than basing trading logic on the event itself. Despite the intermediate volatility causing the option price to fall, good news could still lead to a boom.

The two large orders for Alibaba suggest further government support for the enterprise.

It's unclear whether institutions will wait patiently for the strike price to be reached tonight, or take advantage of a surge to sell directly and make a profit. Please find this information for your reference.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

ok

nice