How to Trade before a non-trading Non-Farm Payroll day?

March non-farm payroll(NFP)will be released tomorrow April 7th, but the US stock market will not open on that day due to Good Friday. This holiday rarely falls on the first Friday of April, with less than 10 occurrences in the past 1000 years.

Why March NFP report is extremely important?

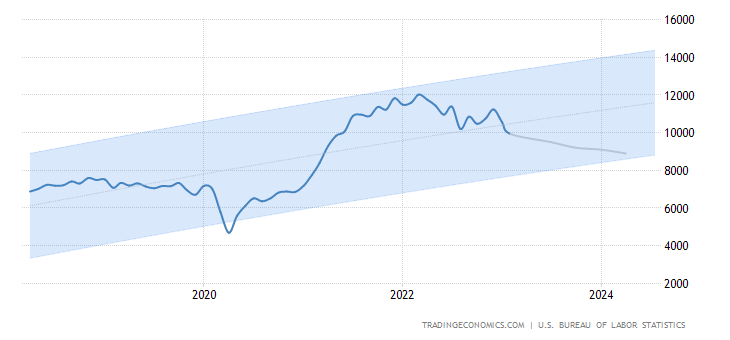

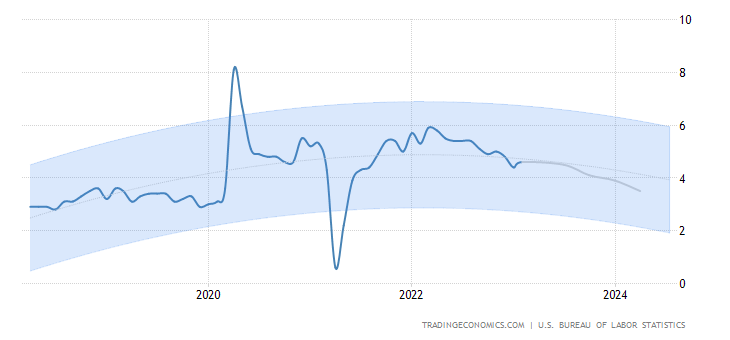

With the expectation of a recession, the unemployment rate in March may be higher than expected. Based on the JOLTS data released on April 4th and ADP employment data released on April 5th, there is a high probability that employment in March will be lower than expected. Although there may be differences between ADP and non-farm payroll data due to statistical methods, when even supply-side indicators such as job offers show a decline below expectations, the problem becomes serious.

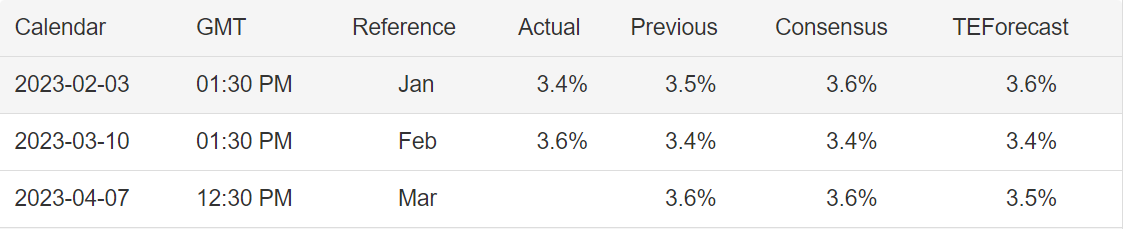

Due to the fact that JOLTS released data for February (and revised down January's data), and the unemployment rate in February exceeded expectations (actual 3.6% vs expected 3.4%), it not only indicates that the balance of employment supply and demand was achieved earlier and faster than market expectations (previously mainly due to some gaps in the service industry), but also layoffs from more industries will be closer in March, which will partially break the previous balance of employment market supply and demand.

Therefore, the ADP employment figures fell far short of expectations, which may not be simply due to statistical methods. In addition, non-farm payrolls are a lagging indicator. If there is such a nonlinear change from "excess demand for employment" to "insufficient demand for employment" in just three months, it indicates that the job market situation is much worse than expected by the market.

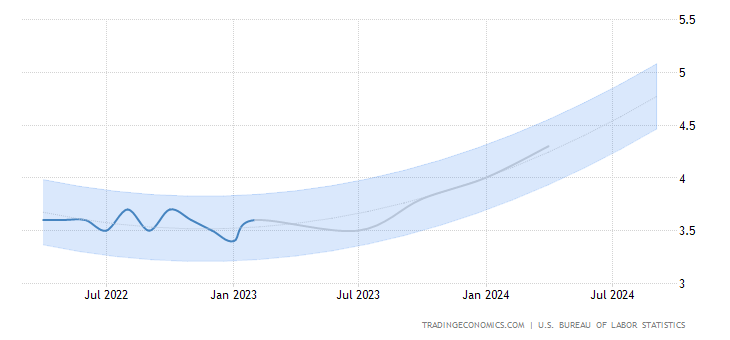

More importantly, the premise that the Federal Reserve is most concerned about in determining inflation indicators, Average Hourly Earnings YoY, may also experience a decline. This will greatly alleviate the pressure for CPI to continue to rise.

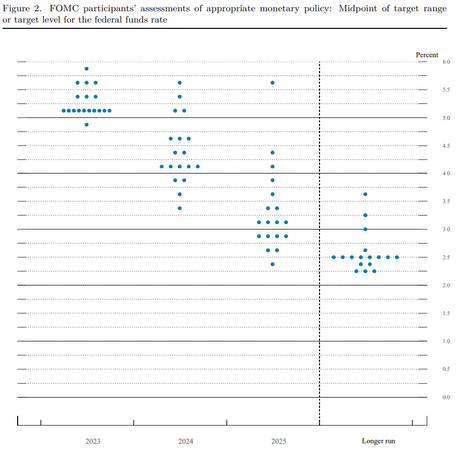

Overall, if any of the indicators such as non-farm employment, unemployment rate, and hourly wage growth show a declining trend, it will greatly reduce the probability of the Fed continuing to raise interest rates this year. This could lead to a revision of the Fed's "dot plot" and even a possible shift in focus from price stability to employment stability. The market's early bet on "rate cuts by the end of 2023" may become a reality.

Market is closed on non-farm payroll days how to trade ahead?

Trading strategies are often set based on one's own risk preferences.

1. Close All Positions. If your risk preference is low, remember to close positions on April 6th, a day before the three-day market closure.

2. Hedge. Stocks held can be protected through derivatives such as covered calls and buying put options. You can also calculate the average beta of the entire asset portfolio and use ETFs related to major indices like Nasdaq 100 ETF (QQQ) or S&P500 ETF (SPY), or directly use options for S&P500 (.SPX) and Nasdaq (.IXIC) indices for corresponding hedging.

When using derivatives, remember to maintain Delta neutrality.

For example, if my $50,000 asset portfolio has a Beta of 1.2 relative to the S&P500 index, then in order to fully hedge this part of the risk I need to short sell futures assets worth $60 million (or its ETF). If SPY Put is used for hedging and its at-the-money option has a delta between 0.45-0.55 within a volatility range of 0-10%, then full hedging would require short selling positions worth $90k-$110k USD. Of course, most of the time you can choose to hedge only part of your position since it's better than liquidating everything.

3. Purchase other inverse correlation targets: If you believe that there will be large fluctuations in the market after Friday's data release, you can prepare ahead by investing in VIX-related products such as Short-term VIX Futures ETN (VXX), ProShares Ultra VIX Short-Term Futures ETF with leverage up to 1.5 times(UVXY), etc., or trade directly with VIX options.

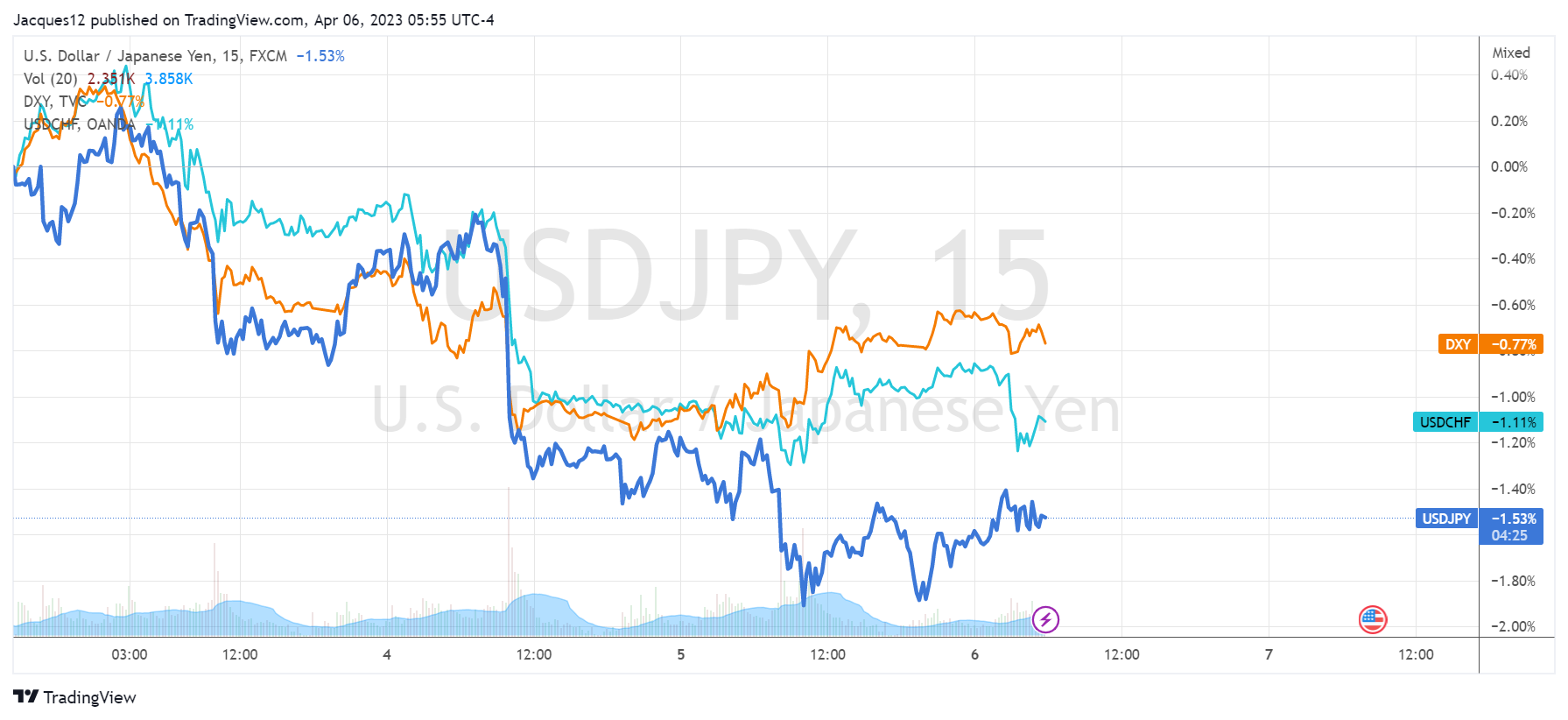

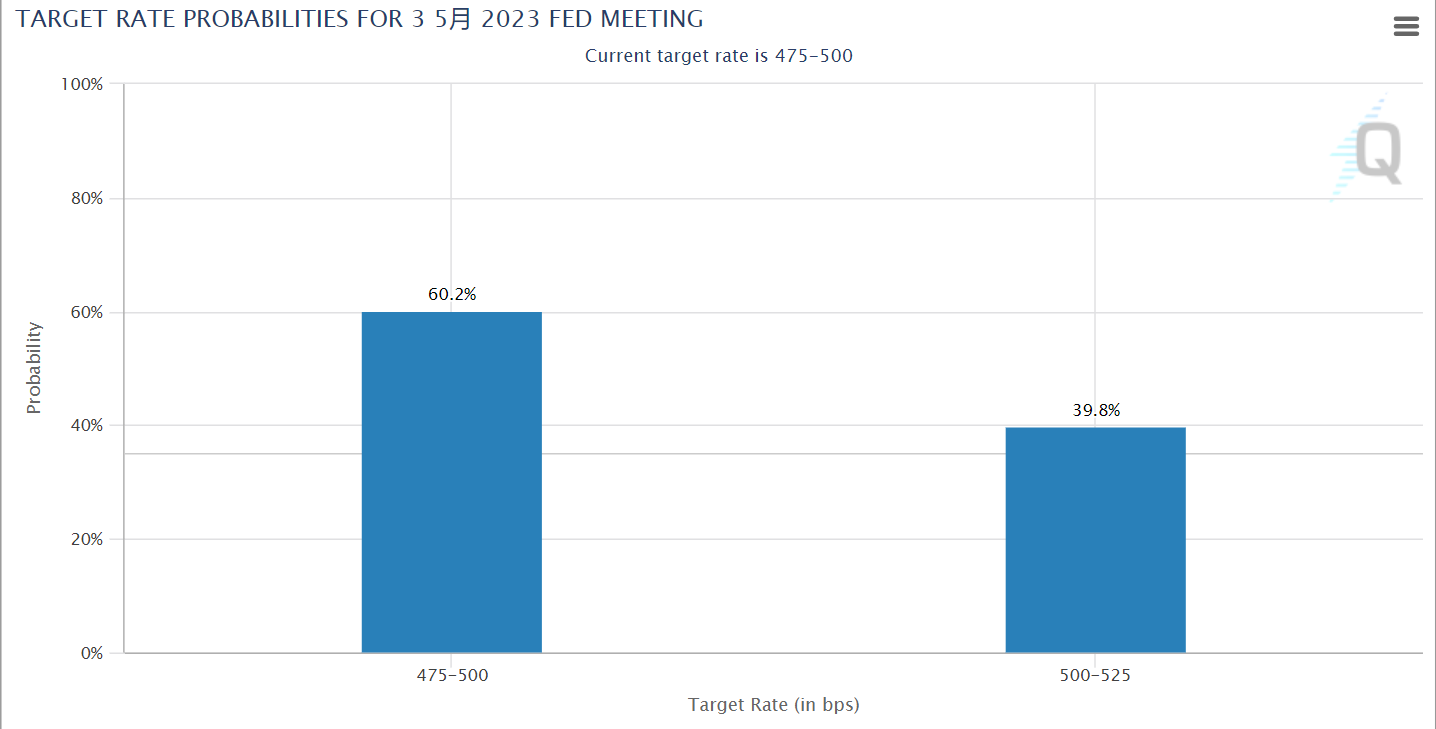

Friendly reminder: Although US stock markets are closed on April 7th, forex and gold trading will continue. Non-farm payroll data has always been the most important indicator affecting the US dollar index. Currently, the probability of a 25 basis point rate hike in May's Fed meeting priced by the market is already below 40%. If March and April employment data released on April 7th and May 5th perform poorly, and CPI shows a significant decline, it is very likely that rate hikes will be temporarily suspended.

The US dollar will continue to be under pressure as a result, and among safe-haven currencies, the Japanese yen $JPYmain 2306$, Swiss franc $CHFmain 2306$, and gold $GCmain 2306$ all have the opportunity to reach new highs this year.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- klarky·2023-04-06can we even believe NFP and CPI data? They are constantly cooking the numbers to manipulate the market and economy.LikeReport

- BillyWilliams·2023-04-07Wow this is so professional! Indeed technical terms are hard to learn.1Report

- WendyDelia·2023-04-07Saudi Arabia Hikes Prices for Asian Oil Sales After OPEC+ CutsLikeReport

- WebbBart·2023-04-07Looking forward to a better economic condition soon.LikeReport

- AlfonsoDex·2023-04-09OkLikeReport

- NANAHO·2023-04-08😀LikeReport

- Cclim·2023-04-08💪LikeReport

- HENRYCSC·2023-04-07ThanksLikeReport

- Jason1616·2023-04-06NiceLikeReport

- Cchan·2023-04-06gLikeReport

- green horse·2023-04-06liked1Report

- JQ62·2023-04-06like1Report

- FinalHope·2023-04-06🤣LikeReport

- yfc838·2023-04-06[微笑]LikeReport

- TWJ84·2023-04-06谢谢LikeReport

- ericbie·2023-04-06[smile]LikeReport

- Louis82·2023-04-06hdhdjfjLikeReport

- 火天大有火天大有·2023-04-06AweLikeReport

- Yh Phoo·2023-04-06OkLikeReport

- Jim LEO·2023-04-06[smile]LikeReport