Has Airbnb Prepared for the recession?

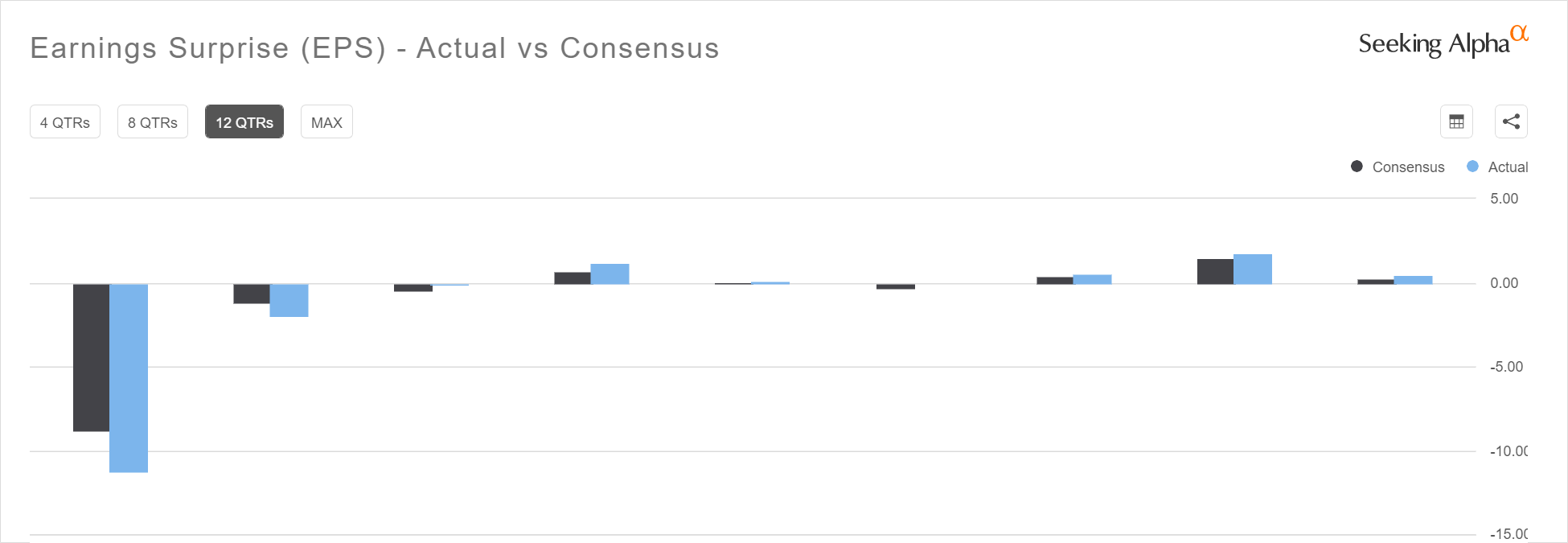

The travel industry began to recover significantly in the second half of 2022. As a leader in the homestay industry, $Airbnb, Inc.(ABNB)$ has also rebounded since the second half of last year. With this comes increasing market expectations for its performance. Of course, since Q4 21, the company's performance has exceeded market expectations every quarter.

The Q1 results announced after trading on May 9 once again exceeded market expectations and met the previously anticipated "Price-in" surprise expectation. However, ABNB's guidance for Q2 is clearly more conservative as it adjusts its outlook for booking volume and revenue more cautiously. Therefore, it fell by over 11% after hours and completely gave back all of its previous two-day overbought status.

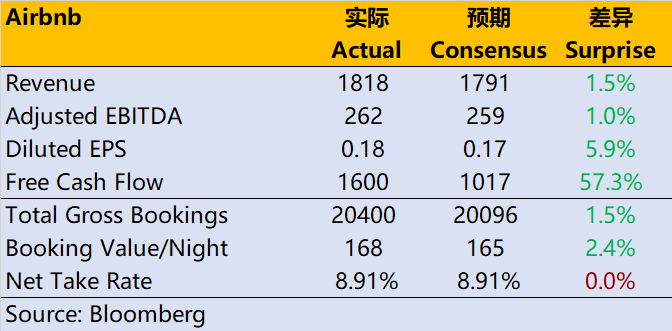

Q1 data:

Revenue was $1.82 billion, a YoY increase of 20.5%, higher than expected $1.79 billion;

Net profit was $117 million compared to a net loss of $19 million in the same period last year, meaning that it turned losses into profits for the first time in Q1;

Adjusted EBITDA was $262 million, up 14% YoY and higher than expected $259.4 million;

EPS was $0.18 per share which is better than expected EPS of $0.10 per share; In contrast with a loss per share of USD$0 .03 during the same period last year;

In terms of bookings: The average daily room rate remained flat at USD$168 compared to last year; slightly higher than market expectations at USD$165.

Total booking value (including host income, service fees,cleaning fees,and taxes) totaled US$20 .4 billion in Q1,a YoY increaseof19%,higherthanmarketexpectationsatUS$20.lbillion.

Regarding their outlook for Q2-2023,the company expects another strong summer tourism season, but the comparison with Q2-2022 will be "difficult."

Specifically, Q2 revenue is expected to reach between $2.35 billion and $2.45 billion, a YoY increase of 12% to 16%. The average value of this revenue outlook is $2.4 billion which did not meet market expectations of $24.2 billion.

In addition, ADR will be lower than the same period last year; adjusted EBITDA will remain flat compared to last year while profit margins are expected to decline YoY; overnight and experience booking growth rates are expected to be lower than revenue growth rates YoY.

The main reason for this is that after experiencing the Omicron wave in the same period last year, there was a large amount of suppressed demand that was released leading to rapid overall performance growth. This explosive demand also raised Q2's base number for comparison.

Of course, this is the company's statement and lowering guidance is also a form of investor expectation management which helps Q2 performance continue exceeding expectations.

We believe that ABNB does face challenges but still has opportunities:

1) Sensitive to economic cycles: Due to travel and entertainment demands being relatively sensitive towards economic cycles, including "recession expectations" into investors' considerations remains their primary concern regarding ABNB's weak performance as a company. If Fed tightening policies persist longer or global central banks follow suit then unemployment rates will inevitably continue rising in the future.This makes consumers carefully consider every penny before spending it.Low-income or unemployed people often do not spend their savings on travel.Statistics show that global tourist numbers fell by 8% during the global financial crisis;

(2) If USD’s strong cycle comes to an end,it would benefit global travel business activities.If USD becomes too strong,the ADR calculated in USDwill maintain low growth or even decrease YoY because price appreciationis offset by factors such as exchange rate and consumer willingness to pay. It will also increase the cost of the company's debt side, increasing interest expenses.

(3) The company is expected to continue improving its profit margin.ABNB achieved profitability for the first time in 2022 while raising its pre-tax profit margin to 23.7%. With the entire internet industry reducing costs and increasing efficiency as well as economies of scale, ABNB's pre-tax profit margin is steadily rising and is expected to reach 28% by 2025.

In terms of valuation, ABNB's current trailing twelve-month dynamic PE ratio is 39 times which is expected to reach30 times by the end of 2024. Although it remains high compared with $Booking Holdings(BKNG)$ and $Expedia(EXPE)$ the two largest companies in this industry,internet companies have higher elasticity and are likelyto receive greater holdings during rate-cutting cycles.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Despite the slight setback, I still have high hopes for Airbnb's future performance. Keep pushing, ABNB

The travel industry is bouncing back, and so is Airbnb! I'm excited about its performance

It's frustrating to see ABNB's stock give back all its gains from the previous two days

The Q1 results were impressive and exceeded market expectations, which is great news for investors

ABNB has been on a steady upward trend since last year, making it a promising investment