Posts To Receive Tiger Coins: Will You Trade Oil/Gold?

CaptainTiger Reminds:

This Weekly Topic Event is to reward Tigers who did wonderful contributors to community by sharing wonderful comments or posts.

Let's cheer for them:

Rewards to Comment & Posts Contributors, Week Feb 28th-Mar 6th

🔥Topic for Week Mar 7th~13th 🔥

Date to publish, Gold futures has climbed above $2,000 per ounce.

How do you feel about the trading opportunities for energy and precious metals sectors in the current macro environment?

Possible Reply may cover:

- The rally is coming to an end soon. Please Comment Why?

- The uptrend is not over yet. Please reason why and share related opportunities you believe.

@CaptainTiger will award wonderful comments and posts based on interacted and qualities.

Resources for references:

@Ivan_Gan, @程俊_Dream, @HONGHAO,@Futures_Pro

Sectors Weekly Recap: Bouncing Around, Oil Near All-time Record

🚀🚀Top Investing Opportunities Under War & High Inflation Market

Crude Oil Tops $110/barrel, How Long can Commodities Rise?

How to Invest in Gold? Star Stocks and ETFS

🚀Guess Tickers & Win Tiger Coins | Best Oil&Gas Stocks to Buy in 2022

🔥 WeeklyPosts Period 🔥

Start From Monday to Sunday / Mar 7th~11th.

🔥How to participate 🔥

- Comment on this post replying to whether? Did you? Will you? Or how to trade commodities opportunities? Don't forget to forward the post at the same time.

- Post a new post with the title including"[Commodities Trading]", and the content connect to How/ Why you invest in Oil/ Gold/ Silver and etc opportunities.Title Sample: [Commodities Trading] + Your Title

- Please choose Futures Club as theme if posts and @CaptainTiger in your post for notice.

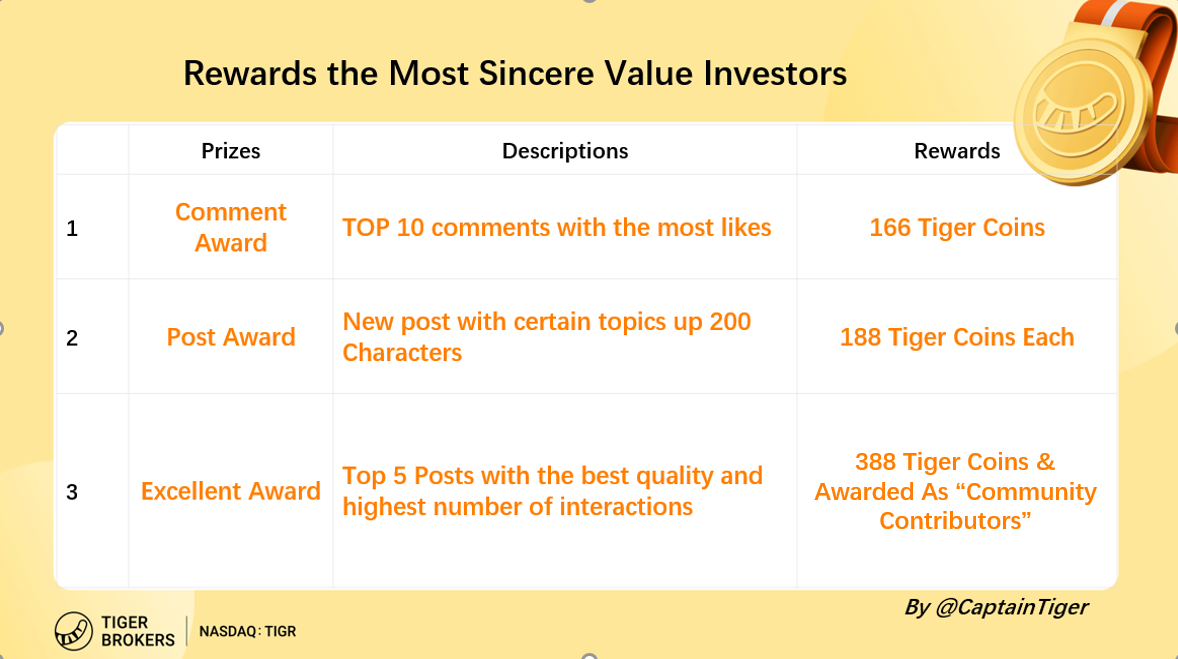

🔥Three Wonderful Awards 🔥

🔥Special Notes 🔥

- The list of users will be published and receive the awards within 5 working days after the end of the event;

- Meaningless posts, duplicate content, advertisements, malicious marketing, etc. are invalid content;

- The subjects mentioned by the users in this event are for reference only, do not constitute investment advice, and the operation is carried out at your own risk accordingly;

- The final interpretation right of the event belongs to the Tiger Community;

- Please follow@CaptainTiger for further announcements.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Gold price took a while, few weeks to rally beyond $1800~1850 and reached over $2000, showing it might have lost some of its lustre as haven and hedge in times of geopolitical crisis. At this level, expect sharp pullback or large % swings up or down.

Will long or short, trading short term in largest gold ETF $SPDR Gold Shares(GLD)$ rather than physical gold or futures, less volatile and risky, to take advantage of large movements. Need to be disciplined and take profit or cut losses when trading idea no longer stand.

Commodities and commodities futures like oil are high capital and high leverage products. For retail investor like me, if not careful, swings in prices could result in massive losses or margin call. So a safer investment option is invest in US oil producers via the S&P Sector ETF $Energy Select Sector SPDR Fund(XLE)$ Otherwise, let Buffett do the investing in oil for you (e.g. he raised stake in OXY), and invest in his $Berkshire Hathaway(BRK.B)$ vehicle instead.

I would buy shares of major oil companies such as $Chevron(CVX)$ and $Exxon Mobil(XOM)$ , rather than trade in crude oil itself, due to my lack of understanding of the latter and fear of having to take delivery of the crude oil.

@CaptainTiger

Not sure if its joe's move to nego with maduro to remove sanction has any impact.

Or people just want to take profit