GDP Is so Bad, When Will the Market Improve?

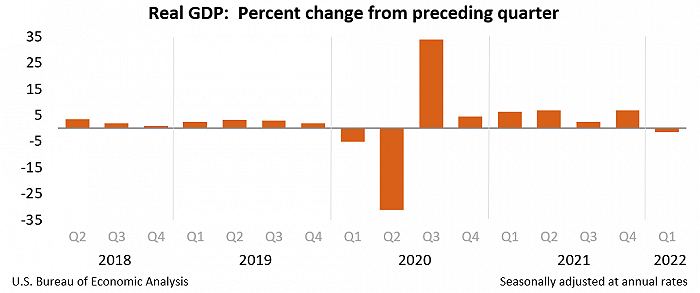

The US Commerce Department released a shock news before the market today, the GDP growth in the first quarter unexpectedly fell 1.4%, expected to grow 1.1% versus 6.9% last. It was also the worst quarter for U.S. GDP in two years.

It also explains why the stock market is so depressed. This data is also the unified feedback of poor financial data.

After all, the economic outlook is tied to our holdings. Four months into a prolonged rout, it's worth talking about the turning point for the market.

Let's start with the root causes. Why is GDP negative? I generalize for two reasons:

1 As shown in the figure, 2021 has a high base. Real GDP growth in the US in 2021 was 5.7%, the highest since 1984 due to the low base in 2020.

2. Supply chain, oil price and interest rate rise. Take a look at the data caliber of the report:

The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending , while imports, which are a subtraction in the calculation of GDP, increased. Personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment increased.

- The decrease in private inventory investment was led by decreases in wholesale trade (mainly motor vehicles) and retail trade (notably, "other" retailers and motor vehicle dealers).

- Within exports, widespread decreases in nondurable goods were partly offset by an increase in "other" business services (mainly financial services). The decrease in federal government spending primarily reflected a decrease in defense spending on intermediate goods and services.

- The increase in imports was led by increases in durable goods (notably, nonfood and nonautomotive consumer goods).

- The increase in PCE reflected an increase in services (led by health care) that was partly offset by a decrease in goods.

- Within goods, a decrease in nondurable goods (led by gasoline and other energy goods) was partly offset by an increase in durable goods (led by motor vehicles and parts).

- The increase in nonresidential fixed investment reflected increases in equipment and intellectual property products.

To explain: Tight manufacturing supply chains and falling inventories of new cars; The dollar's frenzied appreciation is bad for Domestic exports; A decline in government benefits; Spending on health services rose but personal consumption tightened because of inflation; As oil prices rise, used-car prices soar.

These are very realistic issues that we talked about earlier in the article. The impact of higher interest rates may be limited, but several factors add up to today's negative GDP growth.

You can read the original commerce Ministry report if you are interested.

Moving on to the next question: Will GDP growth be this low in the next quarter? When will it get better?

Tackling any one of these three factors would boost GDP.

We can't expect the Fed to compromise on raising rates anytime soon. Powell must have known that GDP was so bad, and he decided to hike 50 basis points ahead of time. But we can expect oil prices and supply chains to improve in the second quarter.

Although I think there will be other problems in the second quarter, I'm afraid the third quarter will be really flat.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

as it linked recession to the drop