The United States is currently the world's largest producer of natural gas and exporter of liquefied natural gas. Compared with Russia, which ranks second in natural gas production in the United States, the relationship between natural gas production in the United States is 1.45 to 1. (See Figure 1)

Figure 1: The United States and Russia are the two largest natural gas producers in the world

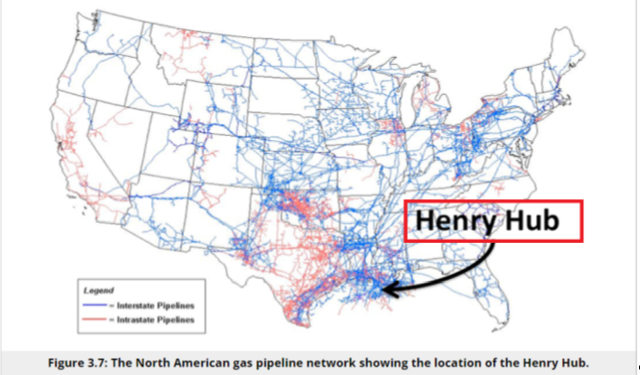

The main natural gas producing areas in the United States are concentrated in the Appalachian Mountains in the east (the birthplace of shale gas) and Texas and the Gulf of Mexico in the southeast (the birthplace of shale oil). Dense natural gas pipelines (the blue line in Figure 2) connect natural gas producing areas with major natural gas consumption centers.

Figure 2: U.S. Gas Pipeline Network and Location of Henry Hub

Where is Henry Hub?

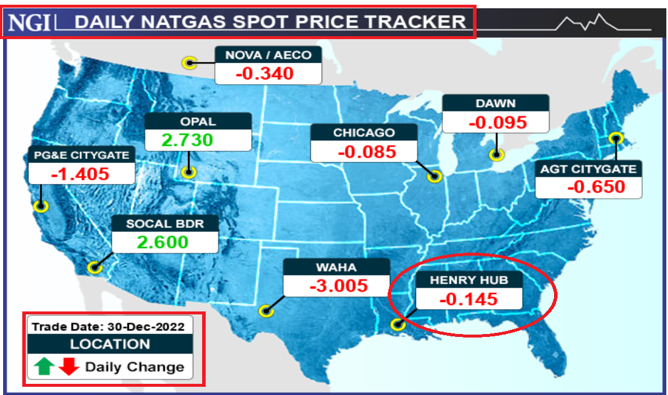

The United States, like China, has a vast territory and complex climate and environment. The demand for natural gas for heating in winter and power generation in summer for air conditioning in the United States is also relatively complex. While Maine in the northeast is frozen for thousands of miles, Florida in the southeast and San Diego in the southwest are as warm as summer. Climate conditions determine that the spot price of natural gas in different places has a very big gap and change. Natural gas spot traders use network connections to display and trade natural gas spot in major cities and regions.

Figure 3 below shows only a few important regional natural gas prices, and there are more local natural gas spot transactions than shown. The Chicago Mercantile Henry Hub natural gas futures (contract code: NG, HH) options we currently trade are based on the natural gas spot handed over at Henry Hub, Louisiana.

Figure 3: Natural gas prices in important areas of the United States

Louisiana is in the U. S. Gulf of Mexico, hot and humid summers, other seasons the climate is relatively mild. Because of its special location and dense pipeline connection, Henry Hub, Louisiana, is the most important natural gas price hub in the United States.

Figure 4: Henry Hub is the most important natural gas price hub in the United States, connecting natural gas pipelines from all over the world

Fluctuating natural gas prices

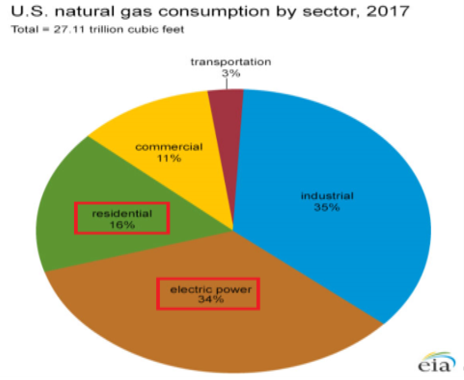

The price of natural gas has obvious seasonality, which is divided into two main seasons, namely, the heating cycle in winter and the natural gas power generation cycle for cooling and air conditioning in summer. Winter in the United States is generally from November to March; Summer is from May to September. Spring and autumn are the time to inject inventory and accumulate inventory.

In the transaction, individuals found that due to global warming, the natural gas needed for air conditioning in summer is constantly increasing, so the drastic changes in natural gas prices in summer should not be ignored, especially in humid and sultry places like Louisiana.

Figure 4: Residential and power generation demand accounts for half of the natural gas consumption in the United States

Understanding the Natural Gas Derivatives Market

Chicago Mercantile Exchange's natural gas derivatives market is currently the largest natural gas derivatives market in the United States, which is divided into two parts, one is the futures market and the other is the options market.

In the natural gas futures market of Chicago Mercantile Exchange, there are currently three different natural gas futures contracts: spot handover natural gas futures (NG), cash settlement natural gas futures (HH) and small natural gas futures (QG).

The difference between the three major natural gas futures is that the standard natural gas futures contracts for the first spot handover and cash settlement are all priced at 1,000,000 BTU × 10,000 US dollars. Small gas futures settled in cash are $2,500. In other words, four small natural gas futures (QG) contracts are equal to one standard natural gas futures (NG, HH) contract.

The second spot handover standard natural gas futures (NG) will be handed over to Henry Hub natural gas spot in Henry Port on the settlement day. The standard natural gas futures (HH) and small natural gas futures (QG) contracts settled in cash on the last day of the contract.

The above three natural gas futures contracts have enough liquidity to trade every day.

The natural gas options market is divided into standard options and weekly options. Standard options are divided into American options handed over from spot (Transaction code: ON, and the use code of some domestic trading platforms: NG) and cash-settled European options (Transaction code: LNE, and some domestic trading platforms use code: NGE), both of which are very liquid.

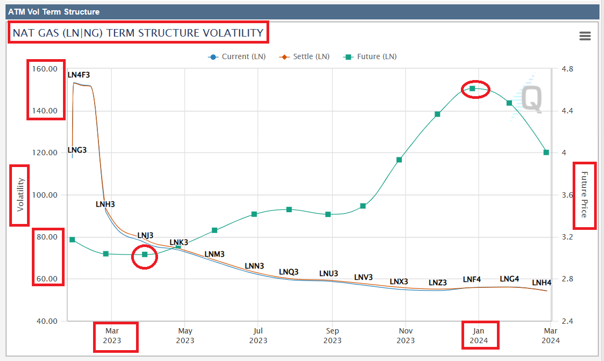

Natural gas option trading has the following two characteristics: the implied volatility of natural gas options in the first winter month is much higher than that in other seasons. Please see the green line in Figure 5 below.

Figure 5: Implied volatility of natural gas options

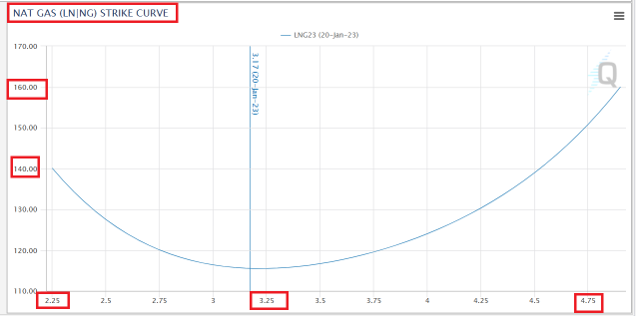

Second, the risk of implied volatility of natural gas options is above the price. The implied volatility of imaginary call options is much higher than that of other agreed price options, as shown in Figure 6 below.

Figure 6: The implied volatility of natural gas imaginary call options is high

At present, the price of natural gas is at the lowest level in the past three years. Due to the warm winter and increasing inventories, the natural gas market has become extremely pessimistic. Personally, I think this is a good opportunity for bulls to open positions, and there are various strategies. Buying bull market spreads or selling imaginary put options should be good choices.

Figure 7: Natural gas prices have fallen to the lowest level in the past three years

$E-mini Nasdaq 100 - main 2303(NQmain)$ $E-mini Nasdaq 100 - main 2303(NQmain)$ $E-mini S&P 500 - main 2303(ESmain)$ $Gold - main 2304(GCmain)$ $Light Crude Oil - main 2303(CLmain)$

Comments