Powell: higher for longer

The FOMC's focus in June was summed up in one sentence: While the Fed paused for a moment, the US economy and core inflation were simply too strong. Keep raising interest rates. It's impossible to cut interest rates.

According to the dot plot, there is room for 50bps of rate hikes after that. After Powell's hawkish and sustained tone, the market took a symbolic breather and then continued its upward march. This attitude is very interesting, obviously does not take the second part of the sentence seriously. No rate hike is no rate hike, wait until July. What if intermediate core inflation falls? Will the Fed add more?

It's a fluke.

In the final analysis, Powell's confused operation led to another deviation in market expectations, 50bps significantly higher than market expectations. But if inflation is really strong, why not wait until July instead of June? It's not like there were intervals of two or three months before, so one month's inflation data can't do miracles. So this pause made many people confused and felt unnecessary.

To give other central banks a break, of course.

However, at this point in time, there will still be short orders, just not in the bank stocks on the trouble. In this post-meeting press conference, Powell also made it clear that the bank is no longer a systemic risk.

My attitude is the same as before, so just take a look at the list below.

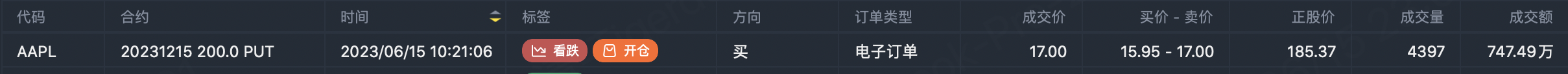

$7 million bearish on Apple, strike price 200, expiration date December 15. To avoid the time loss from the option selection to the maximum, about equal to the positive stock short. I'd rather see when this big order closes.

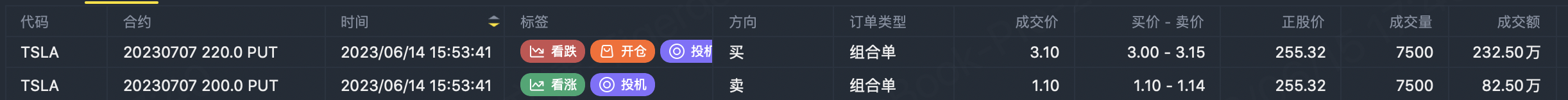

sell $TSLA 20230707 200.0 PUT$

It seems that July 7 is a barrier, and both large orders have chosen this date.

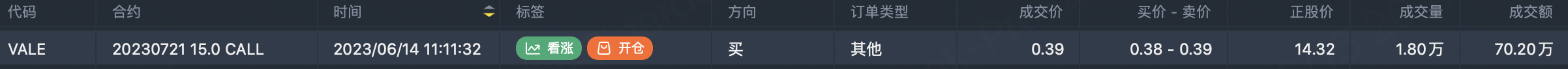

$Vale SA(VALE)$ is slightly similar to $CSI China Internet ETF(KWEB)$ , and the structure of large options orders is also somewhat similar. Recent public opinion is strongly pessimistic about the Chinese economy, so is it about to bottom out?

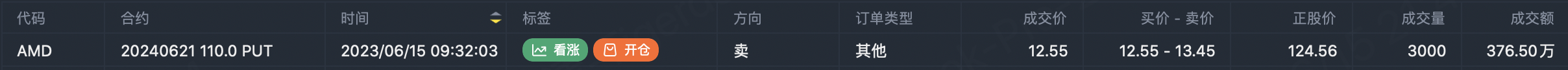

There's nothing to talk about, sell put. The beauty of making money doing nothing.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

I can't help but chuckle at the market's nonchalant attitude towards that second part of the sentence.

Oh, the F,ed's always ready to add more if things go south, they're like a superhero saving the day

The Fe,d's playing a high-stakes game of "wait and see" with rate hikes, it's like a suspenseful movie

The market's like a rollercoaster, taking a breather and then shooting back up, wheee!

Haha, the Fe,d's like a kid in a candy store, can't resist raising those interest rates!

这篇文章不错,转发给大家看看

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?