Introduce some aggressive options strategies: VIX TSLA

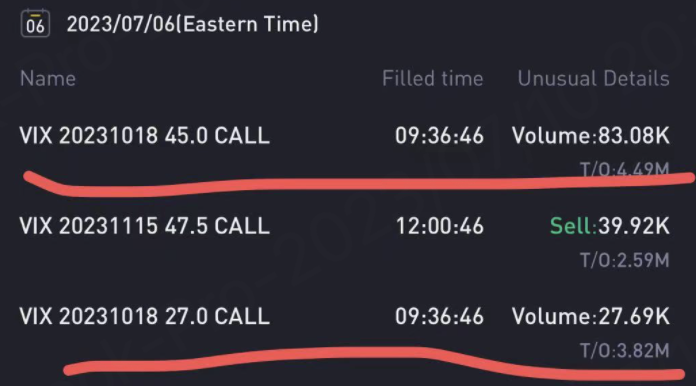

In May we profiled a VIX player with a very aggressive trading style. He hedged his bets by selling low strike options and buying high strike options, betting that a big crash could happen this year (VIX>90). Someone made a similar move on Thursday, trading the exact same strategy before the June non-farm release, but with a less aggressive strike price:

The trader bought 83,000 calls with an October 18 expiration date with a strike price of 45 for a total turnover of 4.49 million and sold 27,000 calls with the same expiration date with a strike price of 27 for a total turnover of 3.82 million.

The break-even point is calculated to be 54, and compared with the last break-even point of 70, VIX54 is not an unattainable target: the market can lose more than 6% in a week.

But compared to the big target, the strike price of the sell call is more noteworthy. The strike price option for the sell call is 27. The VIX has exceeded 30 only once this year, on March 13, the fifth day of the banking crisis. Even so, only the banking sector fell sharply that day, while the technology sector was calm.

Overall, the market is down 4 to 5%, and the VIX will hit 30. The sell call's strike price option 27 means that either there is no decent pullback (weekly pullback <4%) by October 18, or there will be a sharp decline (weekly pullback >6%). The former is a high probability event, the latter is a low probability event, and this combination is to hedge the tail risk of low probability events.

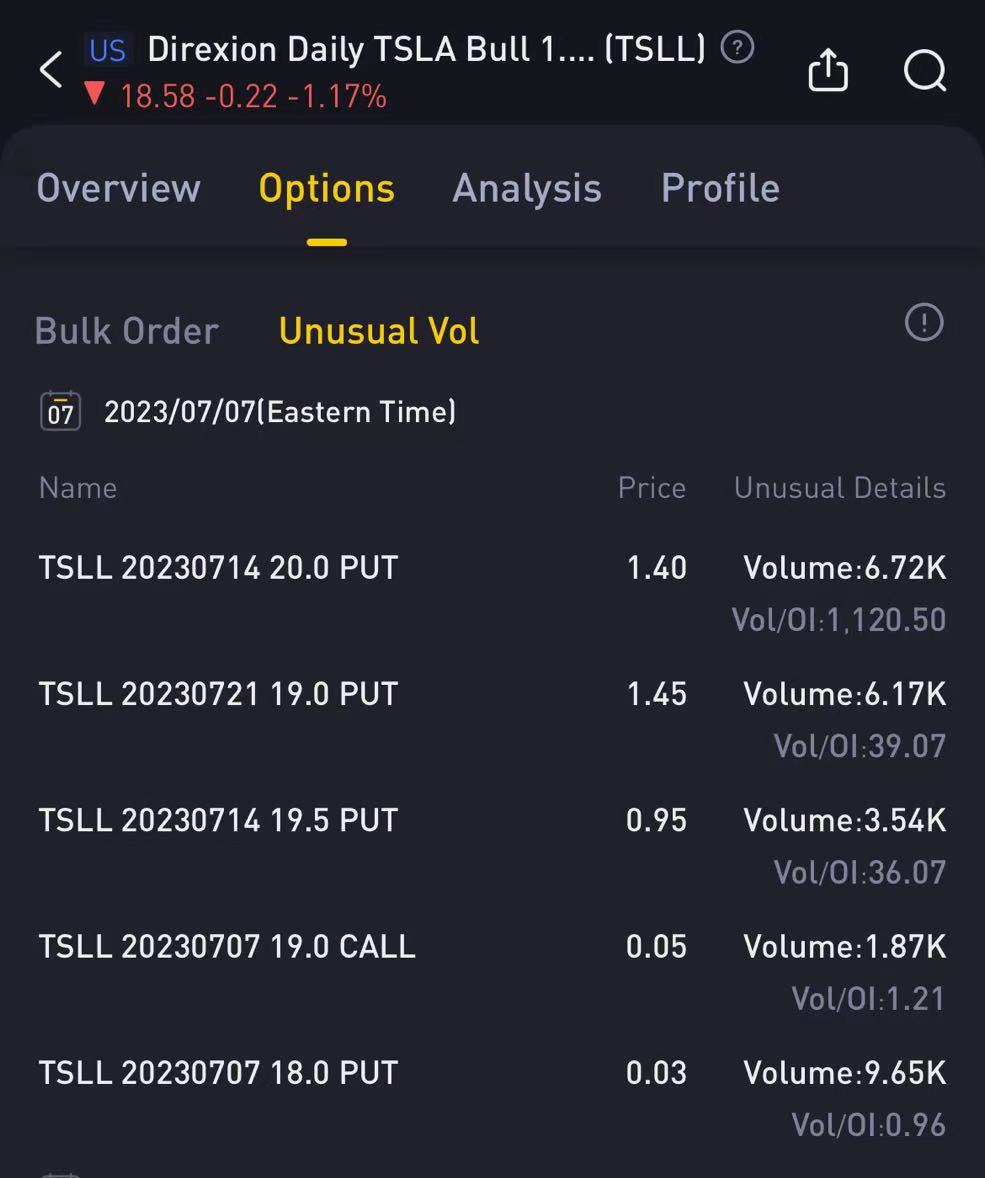

Tesla shares have been on a tear this year. However, high volatility and a stock price as high as 266 became a high threshold for option entry. So some players have taken a different path and turned to options on Tesla's 1.5x bullish leveraged ETF $Direxion Daily TSLA Bull 1.5X Shares(TSLL)$

On Friday, someone sold $TSLL 20230714 19.5 PUT$ and$TSLL 20230714 20.0 PUT$ . Very audacious, these traders are presumably assuming that Tesla will continue its steady upward trend this week. Even though TSLL is a leveraged product, they may feel that the stock price is cheap and therefore it is not painful to buy.

It should be reminded that leveraged ETFs have their own losses, and the share price of the underlying benchmark stock does not rise, and the share price of leveraged ETFs will fall. So selling ITM put a very aggressive strategy on leveraged ETFs.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

😊

aggressssive

aggressssive