Sell put Picks: Exxon Mobil's big order, signaling stabilization in crude prices through October

Strategy introduction:

Selling a put option is a common option trading strategy.

A put option, as its name suggests, represents the right to short a stock. A trader buying a put option usually indicates a bearish trend in the stock, while selling a put option indicates that the trader wants to buy the stock at a certain strike price, or believes that the stock price will not fall below a certain strike price for a certain period of time, thereby earning a premium.

Sell the put option to receive the right to profit, and assume the obligation to exercise the right to buy the stock at a future agreed time.

Strategy advantages: sell to get the right fee, when the option expires, when the stock price is higher than or equal to the exercise price, there is no need to accept the positive stock.

Strategy disadvantages: When the option expires, when the stock price trend is not as expected and falls below the exercise price, it is still necessary to buy the positive shares at the exercise price, that is, to buy the shares above the positive share price.

Example:

When the stock price of Coca-Cola was 40 in that year, Buffett sold 5 million shares with an exercise price of 35 put, and obtained a royalty of $1.50 per share (that is, $750). If the expiration stock price was not lower than 35, the put would be cancelled and Buffett would earn 7.5 million. If the expiration stock price reached 35, Buffett would buy 5 million shares of Coca-Cola according to 35. And since the first 1.5 earned, the equivalent of the cost per share is only 33.5.

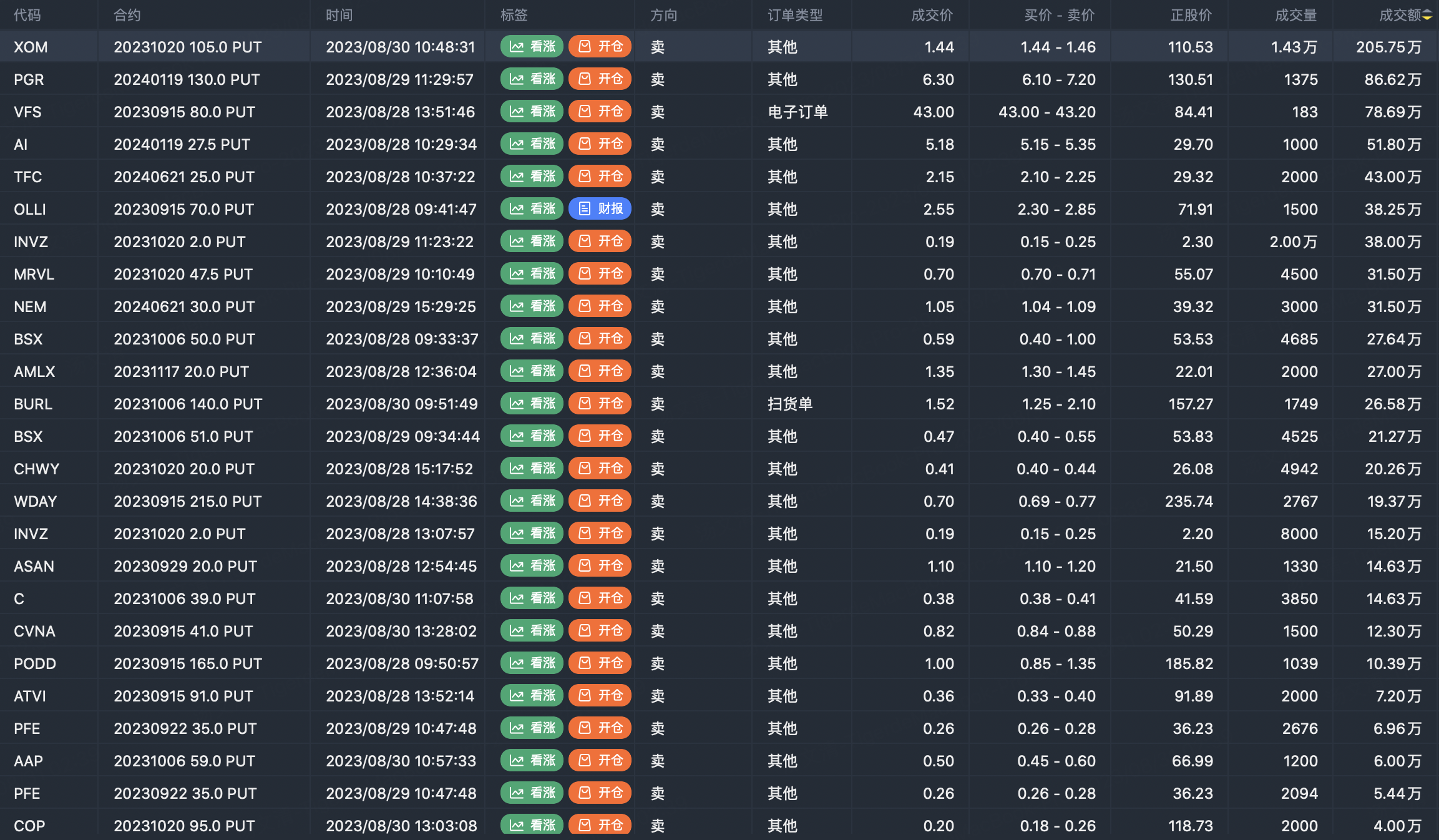

A selection of this week's sell put

1 $Exxon Mobil(XOM)$

Exercise price: 105; Expiration date: October 20, 2023; Volume: 14,300 lots; Total turnover: 2,057,500; Stock price at transaction: 110.53;

Annualized return: 8.3%

Company introduction: $Exxon Mobil(XOM)$ was founded in New Jersey in 1882. The company's segments and affiliates operate or sell products in the United States and most other countries of the world. Their principal activities are related to the exploration and production of crude oil and natural gas, as well as the manufacture, trade, transportation and sale of crude oil, natural gas, petroleum products, petrochemicals and various specialty products. The company's affiliates conduct extensive research programs to support these businesses.

Recent news: Barclays analysts cut their 2023 Brent crude price forecast by $3 per barrel to $84 per barrel, leaving their Q4 2023 forecast unchanged at $92 per barrel. Raised its 2024 Brent crude oil price forecast by $8 / BBL to $97 / BBL as the supply and demand balance is expected to tighten significantly.

2 $PROG Holdings, Inc.(PRG)$

Exercise price: 130; Expiry date: January 19, 2024; Volume: 1375; Total turnover: 866,000; Stock price at transaction: 130.51;

Annualized return: 10%

Company introduction: PROG Holdings,Inc. is a leading provider of omnichannel lease-purchase solutions for underserved, credit-challenged populations. Through its multiple business segments, the company primarily provides consumers with rental and purchase solutions for the products they need and want, including furniture, appliances, electronics, jewelry, and various other products. The company offers flexible options to help customers gain ownership, including early purchase options, low upfront payments, and flexible options.

Recent news.: No

3 $C3.ai, Inc.(AI)$

Exercise price: 27.5; Expiry date: January 19, 2024; Volume: 1000; Total turnover: 51.8; Stock price at transaction: 29.7;

Annualized return: 35%

Company introduction: C3.ai, Inc., incorporated in Delaware, is an enterprise AI software company that offers two primary families of software solutions: 1. C3 AI Suite, its core technology, is a comprehensive application development and runtime environment designed to allow customers to quickly design, develop and deploy any type of Enterprise AI application. C3 AI applications built with C3 AI Suite include a large and growing family of industry-specific and application-specific turnkey AI solutions that can be installed and deployed immediately.

Recent news: Nvidia shares rose 4.2 percent Tuesday to a record closing high, pushing the company's market value above $1.2 trillion. This comes after the chipmaker announced an expanded partnership with Google to accelerate the rollout of artificial intelligence (AI) technology. Led AI sector stocks rose collectively.

Exercise price: 47.5; Expiration date: October 20, 2023; Volume: 4500; Total turnover: 31.5; Stock price at transaction: 55.07;

Annualized return: 5.26%

Company introduction: Marvell Technology, Inc. was incorporated in Delaware on October 23, 2020. The company is one of the world's largest suppliers of Fabless mode semiconductors, offering products with high performance application standards.

Recent news: Marvell Technology reported adjusted second-quarter earnings on Aug. 26 that beat analysts' expectations, but its third-quarter outlook was in line with expectations and disappointed investors, sending the chipmaker's shares down 6.6%.

Exercise price: 47.5; Expiration date: October 20, 2023; Volume: 4500; Total turnover: 31.5; Stock price at transaction: 55.07;

Annualized return: 5.26%

Company introduction: Marvell Technology, Inc. was incorporated in Delaware on October 23, 2020. The company is one of the world's largest suppliers of Fabless mode semiconductors, offering products with high performance application standards. The company's core competency lies in the development of complex system single-chip components using its technology portfolio of intellectual property in analog, mixed-signal, digital signal processing and embedded and standalone ARM-based microprocessor integrated circuits. The company's broad product portfolio includes data storage devices, enterprise-class Ethernet data conversion, wireless networking, personal area networks, Ethernet-based PC connectivity, control surface communication controllers, video image processing, and power management solutions.

Recent news: Marvell Technology reported adjusted second-quarter earnings on Aug. 26 that beat analysts' expectations, but its third-quarter outlook was in line with expectations and disappointed investors, sending the chipmaker's shares down 6.6%.

sell $WDAY 20230915 215.0 PUT$

Exercise price: 215; Expiry date: September 15, 2023; Volume: 2767; Total turnover: 19.3; Stock price at transaction: 235.74;

Annualized return: 3%

Company introduction: Workday, Inc. was incorporated in Nevada in March 2005 and re-incorporated in Delaware in June 2012. The company is a leading provider of enterprise cloud applications for finance and human resources, helping customers adapt and evolve in a changing world. Workday provides software-as-a-service solutions to more than 8,000 companies to help solve some of today's most complex business challenges, including supporting and empowering employees, managing finances and expenses in a changing environment, and planning for the unexpected.

Recent news: Workday reported better-than-expected second-quarter results on August 26. Results showed that the company achieved revenue of $1.786.8 billion in the quarter, exceeding market expectations by 0.95%; Earnings per share were $1.43, beating consensus by 13.49%. Bernstein Research: Maintained Workday(WDAY.US) rating to outperform from Outperform, with price target revised to $284.00 from $275.00.

Exercise price: 39; Expiry date: October 6, 2023; Large single volume: 3850; Total turnover: 14.63; Stock price at transaction: 41.59;

Annualized return: 9.5%

Company introduction: Citigroup is a global diversified financial services holding company that provides consumers, businesses, governments and institutions with a broad range of financial products and services, including retail banking and credit, corporate and investment banking, securities brokerage, trading services and wealth management. Citi has approximately 200 million customer accounts in more than 160 countries and territories, and currently operates two business segments: Citibank and Citi Holdings.

Recent news: On August 21, according to the Financial Times, Citigroup CEO Jane Fraser is considering splitting the company's largest division, the Institutional Client Group, into three main business units: investment and corporate banking, global markets and transaction services. It would be the group's most significant corporate restructuring in nearly 15 years.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Buy buy